I have a friend who enjoys horse racing. Well, to be precise, I have a friend who enjoys betting on horse races.

When we go to Las Vegas, we like to spend an afternoon at a sportsbook. We pool our money and he picks a few races. On any typical trip, we sit down with $100 and leave with $90 – $110… with a few close races to make it exciting. Not a bad way to spend an afternoon.

While I enjoy an afternoon hanging out with friends at a sportsbook, owning a race horse is one of the income producing assets I’m probably never going to own.

Like with owning a boat, it’s more fun knowing someone who owns a horse rather than actually owning one. (I don’t know anyone who owns a horse, but I can attest to the boat!)

That said, I have been keeping my eye out towards alternative investments.

It’s important to know what’s out there and I enjoy reading about weird alternative investments. Equities are good investments but they are also boring. How many articles about how low-cost Vanguard funds can you read? 🙂

Table of Contents

- What is an Alternative Investment?

- Do You Need Alternative Investments?

- How Much Should be in Alternative Investments?

- What are the Best (and Fun) Alternative Investments?

- Farmland

- Private Credit

- Art

- Wine

- Startups & Privately Held Companies

- Local & Small Businesses

- Real Estate

- Precious Metals

- Venture Capital/Angel Investing

- Cryptocurrency

- Non-Fungible Tokens

- Collectibles

- Mineral Rights

- Pop Culture Collectibles

- Private Mortgages

- Tax Liens

- Equipment Leasing

- Structured Settlements

- Equipment Leasing Funds

- Summary

What is an Alternative Investment?

What is an alternative investment? An alternative investment is anything you can’t buy in a standard 401(k). Stocks, bonds, and cash are not alternative investments.

Many of these are not regulated by the Securities and Exchange Commission (SEC). Some may file their offerings with the SEC but that’s because they are considered “exempt offerings.”

For most people, their biggest “alternative investment” is real estate. You can own real estate in a 401(k) through REITs and mutual funds, but you can’t own the deed to a property. You have to set up a special structure if you want to invest your retirement savings in property. You also can’t own gold bullion, art, or other collectibles.

Some types of alternative investments will require you to be an accredited investor. To qualify as one, you need to be able to satisfy a few conditions such as net worth and income. Some investment platforms will need to certify you as an accredited investor while others will take you at your word.

Do You Need Alternative Investments?

The key to investing is diversification.

You don’t want to be overexposed in any one area.

It’s why experts recommend you get an appropriate mix of stocks and bonds. It’s also why you need a good mix of domestic and international, so the woes of any one nation don’t sink your fortunes. It’s also why experts recommend some part of your portfolio to be in alternative investments.

In theory, alternatives aren’t supposed to be strongly correlated with the stock market or many external forces. They may be negatively correlated, as often is the case with gold and the stock market.

Alternative investments are often used as a hedge against the rest of your portfolio.

We reached out to Professor Kevin R. Mirabile, a Clinical Associate Professor of Finance at Fordham University, to get his thoughts on the role of alternative investments in a portfolio. He is the Director of the Alternative Investment Program at the Gabelli School of Business and well suited to give us his thoughts on alternative investments:

1. For the average retail investor, we think of investing as stocks and bonds. What’s the role of alternative investments in their portfolio?

Alternative investments help to diversify a portfolio. They make portfolios more efficient by including stocks and bonds plus an allocation to some alternative investments. This helps to reduce portfolio volatility and provide additional sources of return. Some types of alternative investments can also provide downside protection when markets fall. Diversification, downside protection, and enhanced returns are the primary benefits and roles of alternatives in portfolio construction.2. Many investors believe alternative investments are only for accredited investors – is that still the case? How has that changed over the years?

Traditionally, that is correct, but only if you are talking about private funds. Private funds such as hedge funds and venture capital funds are typically offered via private limited partnerships under a safe harbor exemption restricting their sales to certain high net worth individuals and institutions who meet accreditation criteria. Over the past several years a whole range of alternative investments are now available to the public in registered vehicles or via exchanges or crypto solutions that do not require any special accreditation.

3. If someone is not yet accredited, what’s the best way for them to get exposure into these investment types?

Here are some examples. Mutual funds and listed business development funds that offer exposure to hedge fund strategies and credit strategies are available to anyone today. These products are more highly regulated and offer better liquidity than private funds. There are even some mutual funds being offered today that provide exposure to private equity deals and firms. In addition, exotic alternative investments like storage units or litigation funding can be purchased using ETFs that are listed on the NYSE. Some, even more exotic investments like trading cards, luxury handbags, and vintage sneakers as well as many NFTs can now be bought and sold peer to peer, on exchanges set up to match buyers and sellers, or using crypto assets that leverage blockchain technology.

How Much Should be in Alternative Investments?

This is a challenging question because alternative investments are so different. They are not perfect substitutes for one another.

Miscellaneous investments may be a better term! Real estate is nothing like art. Art is nothing like mineral rights.

That said, experts will say that you should be anywhere from 7-12% in alternative assets. Real estate is an alternative investment. For many, home equity is a huge percentage of their net worth… so many people already have huge exposure to real estate and not know it.

When I looked at my Personal Capital account, they said 10.5%.

My actual? Faaaaar less:

When it comes to investments, I’m a boring plain vanilla type of guy.

But it would be fun to see what’s out there. 🙂

What are the Best (and Fun) Alternative Investments?

Now to the fun stuff!

I’m going to present a list of fun alternative investments.

Some of these are a little odd… but that’s part of the fun. Remember, this is not an endorsement of any of them! 🙂

Farmland

I discuss general real estate in the next section but farmland is a special subclass that deserves special mention. It’s been traditionally very difficult to invest in farmland, especially farmland because there haven’t been many platforms that appeal to that market.

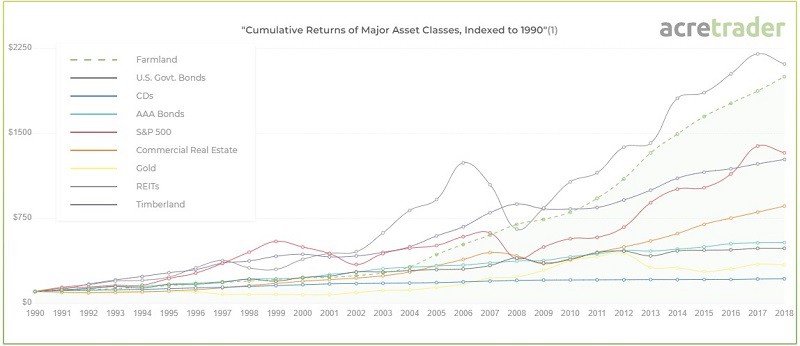

Farmland has had a very good run since 1990 and $10,000 invested in farmland in 1990 would be worth $199,700 today. The S&P 500 grew about 13X over that same period (including dividends).

There’s on new company that is hoping to change that – they are named AcreTrader.

What’s been most interesting is that farmland returns are relatively stable over that period. Whereas the stock market can jump up and crash pretty violently, farmland is a slow climb upward as an asset class. It’s boring but I really like boring as long as it goes up.

With AcreTrader, they research the farmland, select less than 5% of them, and create a legal entity into which you can invest your money. When you invest, you become an owner of that farm and this is all done 100% electronically. AcreTrader pays out excess income (3-5% for low-risk properties) and charges a flat 0.75% fee of the farm’s value, usually deducted from the income. Their target unlevered internal rate of return is 7-9%.

You can read a more detailed look at Acretrader in our review.

FarmTogether

I’ve invested on the AcreTrader platform but they’re not the only one offering farmland to investors.

FarmTogether is for accredited investors and gives you access to other farmland investments. Minimums for each deal are around $10,000 – $50,000 but it’s free to join and see the properties. If you’re interested in the category, I’d sign up for both so you can see what they have available. If you want to learn more about that platform, here is our detailed FarmTogether review.

Finally, if you want to know the difference, we share a comparison – AcreTrader vs. FarmTogether.

Private Credit

Private credit is a category of debt where you lend money towards privately negotiated loans and debt financing with non-bank lenders. These can be anything from personal and business loans to startups or litigation financing. It’s a short term, high yield asset with higher risks, as these are loans to people and businesses.

Not all private credit deals are the same though so you shouldn’t lump them into a single bucket in terms of risk and reward. For example, a common example of a business loan is a factored invoice. This is when you “buy” an invoice (accounts receivable) from a business at a discount. They get their cash up front, rather than waiting 30-90 days (Net30 – Net90 terms), but you get it based on the terms.

A platform that facilitates this is called Percent (see our review of Percent for more). They offer everything from merchant cash advances to short-term e-commerce financing. They even offer a cash bonus based on your first investment size, up to $500.

Art

I remember when I heard the story of Steve Wynn (of the casino empire fame) put his elbow into Picasso’s painting titled ‘Le Rêve.” He had planned to sell it to a hedge fund manager for $139 million in 2006 but the deal fell through after Wynn put a silver dollar-sized hole in the painting! It all worked out because a hedge fund manager bought it a few years later for $155 million. Elbow holes or not, fine art appreciates.

If you want a piece of fine art, one of the few ways to invest in this asset class is with a company called Masterworks. Much like crowdfunded real estate, Masterworks lets you buy small ownership stakes in pieces of art.

How it works is they buy “blue-chip art” and then sells shares at $20 a share. When they purchase a painting, they’ll also file an offering circular with the SEC so you’re protected by securities laws. They charge a 1.5% management fee plus 20% of any future profits. They look to exit each holding after 7 years and at most 10 years.

We recommend reading our complete review of Masterworks if this investment interests you and definitely read about how to invest in art so you have a better understanding of the space ahead of time.

Wine

In 2019, we spent a couple of weeks in the Tuscany region of Italy. We went to several wineries and were amazed at how good the wine was and how inexpensive it was. The vintners told us that the vast majority of Italian wines are consumed within the country – very little of it is exported abroad.

As we toured various vineyards and learned more of the history, it became obvious why wine collectors exist. Each year, a limited number of bottles are produced and when the winery is popular, or the vintage is excellent, the value of each bottle increases. As time passes, fewer and fewer of these bottles exist because people drink them, they break, whatever.

Scarcity + demand = value.

Art is, theoretically, forever because you don’t physically consume it to enjoy it… but wine is not. Every year, wine is consume, broken, lost, damaged, or otherwise “taken off the market.” This makes it a good candidate as an investment.

There are several companies looking to offer wine investing to regular (by this I mean non-wealthy) investors.

Vinovest

First, There’s a company, Vinovest, that looks to bring investing in wine to the masses. Through the platform, you can buy bottles, have them shipped to their storage facilities, and truly “invest” in wine without all the hassles and difficulties of storing the bottles yourself (which is expensive to do by yourself). These aren’t thousand dollars per bottle wines – they’re investment grade but not high priced. In many cases, we’re talking about buying 10 bottles priced at $100 vs. 1 bottle at $1,000.

And if you want your bottles, you can ask for them and Vinovest ships them to you. It’s a fascinating model.

Here is our Vinovest review for more detailed information.

There is a $1,000 minimum.

Startups & Privately Held Companies

If you want to invest in a startup, there aren’t very many options out there. If you want in at the Friends & Family round (pre-seed), chances are you have to be friends or family (or friends of family) with founders and that requires a fair amount of intentional networking. It’s certainly an alternative investment but a very risky one – you’re often betting on the person rather than the business. Even then, things can go badly very easily.

If you want to invest in startups further down the road, there are several options. The most well known is going through a platform like AngelList and their AngelList Syndicates platform. Many of the really good ones are invite only but within those there are ones with fairly flexible invitation polities (often accessible if you follow the lead investors).

Local & Small Businesses

When people think about investing in businesses, most people only think about publicly traded companies. Or they think about how their neighbor’s brother’s friend’s roommate wants to open up a brew pub and is looking for investors. Those are typically risky operations because you have to invest a lot into a single entity.

What if you can support small businesses while making small investments in a variety of businesses? That’s where a platform like Mainvest comes into the picture – you can invest in small businesses with as little as $100 and target returns from 10-25%.

When you make an investment, you participate in a revenue sharing agreement with the business. To qualify for the platform, businesses have to raise at least $10,000 from 10 people they know personally. This has helped lead to a 97% repayment rate – pretty stellar.

If this interests you, our comprehensive Mainvest review has more.

Real Estate

Real estate is the most common alternative investment (farmland is technically a subcategory of real estate, though it’s a more interesting one).

Owning a home is part of the American Dream. Your home is where you live, but it is also an investment. If you sell your home for a gain, you owe taxes on it (after the home gain exclusion).

As the saying goes, they aren’t making any more land. So, many investors think of real estate when considering expanding their portfolio.

If you don’t want to buy property, either to hold or to flip, there are other ways to get involved in this asset class. You can invest in property through a crowdfunded real estate platform.

Fundrise

Fundrise is one of the more popular platforms and is available for all investors. Its a crowdfunding platform that lets you invest in electronic REITs that aren’t traded on the public exchanges. You can get started for as little as $10.

They have $7 billion worth of real estate and you can choose from apartment buildings, commercial real estate, and single-family rentals.

Here’s our full review of Fundrise.

Equity Multiple

Equity Multiple is a real estate crowdfunding platform that gives accredited investors access to commercial real estate. The minimum investment is $5,000.

It has a team of professionals that vet each investment opportunity, and they break the investment opportunities into three areas — safety, income, and growth. This makes it easy to understand exactly how the investment fits into your overall portfolio and goals.

Here’s our full review of Equity Multiple.

Burial Plots? Yes.

Another unconventional “real estate” asset is to buy and sell burial plots. Yep. Those rectangles of land in a cemetery.

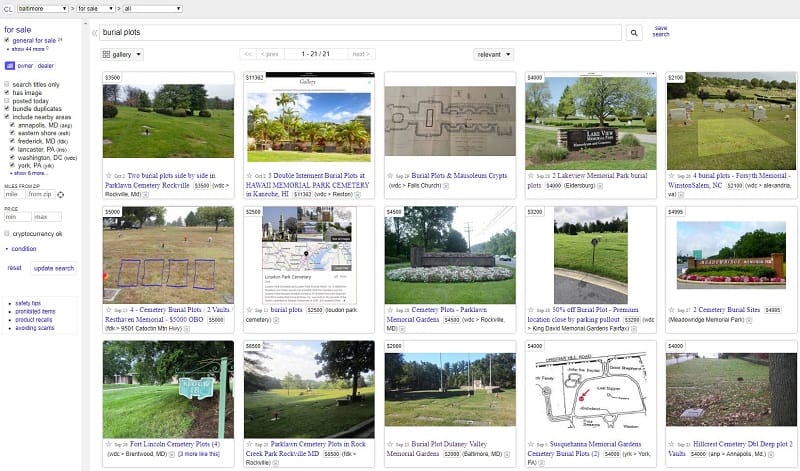

If you can get past how morbid this sounds, it’s no different than any other kind of land – it’s just smaller parcels. There isn’t a Redfin for burial plots, so the data gathering is a bit harder, but you can buy and sell burial plots like any other piece of property. One of the best places to look happens to be Craigslist.

Here’s a look at what was available near Baltimore, Maryland:

Prices will vary based on the area. They run anywhere from a few hundred bucks for a plot to a few thousand, based on location. When you buy or sell, it’s coordinated with the cemetery’s representative.

Oh, and here’s a little bit of morbid humor. Sometimes a listing will say that the plot is “used” or “pre-owned.” Yikes.

That’s usually an error on the part of the seller. A cemetery won’t bury someone in a plot that’s already being used. 🙂

I’m not sure what the returns are on this type of investment but it’s fascinating that it’s even a possibility.

Precious Metals

After real property, precious metals are the next most common alternative investments. They’re often seen as a store of value, which like having a little insurance policy.

You can invest in precious metals through ETFs and mutual funds or buying bullion. If you’re hoping to use it as a store of value, bullion is the way to go. If you don’t want to store it yourself, you can buy bullion through a service like Vaulted, which stores it in the Royal Canadian Mint. (full review of Vaulted)

If you simply want it as a hedge investment, you can invest in ETFs or you can invest in mining companies.

If you want bullion, you can buy that close to the cost of the precious metal from a dealer online. Or, there is a class of precious metals known as “junk silver,” which refers to the silver content of common coins. The value is in the silver content and it is often not pure silver. These are often older coins, think pre-1960’s, when coins had more silver.

On my desk I have a silver quarter, made in 1957, that is worth around five bucks. It’s a collectible, valued for its materials, and I found it in a field. It stood out to me because it was a quarter in a field but it looked really dull. The dullness was because of the metal composition, 90% silver, and now it’s my little foray into numismatics (and a reminder to be observant!).

Venture Capital/Angel Investing

I’m not a fan of angel investing.

I’m bad at it. If I was early on Facebook, Uber, Airbnb, or some other unicorn- I’d be singing a different tune.

For angel investing, it’s quite simple – you have to find a business to invest in. You can sign up for websites that look to connect angel investors with companies. You can also go the old-fashioned route and network with entrepreneurs.

If there are business development or technology groups in your area, join them. New companies often go to those groups to find funding, mentors, and other support. If there is a tech hub or any kind of startup accelerator, give them a call to find out if they have events you can attend.

With venture capital, you give your money to a venture capitalist and they find the deals for you. You pay for this through a management fee (usually a percentage of assets and a percentage of gains), but you get access to their deal flow rather than building your own.

Cryptocurrency

Now we’re getting a little more exotic.

Cryptocurrency has gotten a lot of attention the last years, rightfully so as it’s one of the most interesting innovations in finance in recent memory. While I don’t care that bitcoin is hot (despite it’s massive fall in the first half of 2022), many do care.

Money is a store of value and a means of exchange. Your dollars only have value because the US Government supports it and because you can spend it. Cryptocurrency has no central bank to prop it up but it is being accepted more and more, which contributes to its volatility. A dollar and a bitcoin and a gold coin all have value because you can spend them.

Like any new commodity, no one knows how to price it and no one knows what it’s “really” worth. This creates some volatility and traders LOVE volatility.

So, if you want in, here’s how to buy cryptocurrencies. Here are also a few fintech startups that will give you crypto to start using their platform.

If you like crypto but don’t necessarily like the volatility that might come with it, you can always invest in real estate that leverages blockchain technology rather than cryptocurrency itself (at least directly). You can invest in real estate with crypto on a platform like HoneyBricks.

Non-Fungible Tokens

A sub-category of cryptocurrency, in a way, are non-fungible tokens (NFTs). These are cryptographic tokens that represent something unique. Whereas bitcoins are interchangeable, NFTs are not. They’re unique tokens.

If you’re having trouble wrapping your head around it, look at NBA Top Shot. They’ve basically taken NFTs and made each one a video clip. It’s not that dissimilar to sports trading cards except these are video clips. Each NFT represents a clip and each one as a different value, all based on market demand.

You might think to yourself – “Jim, this is crazy! It’s not real!”

You might also think it’s crazy to spend millions on a piece of cardboard (how real is the value there?) – but people do it.

Wild right?

Collectibles

Art. Hummel dolls. Beanie Babies. Whisk(e)y. Coins.

The list goes on.

These all fall into a category known as collectibles.

When I was younger, I loved comic books. My favorites were Spider-Man, X-Men, and the Fantastic Four.

I would tell my mom that those comics would be worth something one day. My mom would always tell me they’re only worth what someone will pay for them. They’re sitting in a box in the basement now … BUT ONE DAY MOM! 🙂

Most collectibles are too mass-produced to be valuable. Many of the toys that are valuable today are only valuable because they survived. I used to play with my toys and that usually doesn’t help them stay valuable. Or in one piece!

The most valuable baseball card in the world was once the T206 Honus Wagner baseball card made by the American Tobacco Company. You can watch documentaries about this card, worth over three million bucks, but very few collectibles ever reach this point. (it was recently eclipsed by a signed 2009 Bowman Mike Trout rookie card)

The most valuable stamp in the world is the Treskilling Yellow. It’s a Swedish postage stamp with a color error and it is one-of-a-kind. It’s estimated value is $2.3 million!

It’s hard to look at different types of collectibles and try to come up with a blanket rate of appreciation. All we know is that they often lag the stock market.

Sometimes even inflation.

But the fun of collectibles isn’t in the rate of return. It’s in owning a rare item as well as how it may appreciate.

It’s like a Powerball ticket you can admire and less like a share of stock.

Mineral Rights

Have you ever seen There Will Be Blood with Daniel Day-Lewis? If you have, then you know about mineral rights.

If you own property that sits on valuable natural resources, you can sell the mineral rights to a company who will extract those minerals. While the term is minerals, it can be anything from rocks to oil to gas to some other precious resource. The most valuable minerals are the ones you expect – oil, gas, gold, copper, diamonds, and coal.

People who own mineral rights may be looking to turn their stream of income into a lump sum payout. You can potentially buy their rights, collect the payments, and earn a lucrative return.

It can be a very competitive world so do your due diligence before you buy or sell mineral rights.

In addition to what’s underground, what’s above ground may also be of value. Your land may double as a timberland investment that a Timber Investment Management Organization (TIMO) can log.

Pop Culture Collectibles

When I was a kid, I played a lot of Magic: The Gathering. I started around the Revised Edition period (1994) and still have a box of cards in my basement that spans the Revised to Ice Age period, with a few earlier cards mixed in. As you would expect, these cards now have a little bit of value.

One of the valuable cards, due to its rarity, was Black Lotus. Collectibles are always a sexy alternative investment but pop culture collectibles are even more so because of the close emotional connection. I know how coveted the Black Lotus was even back then – so it comes as no shock that you can buy shares of an Alpha edition Black Lotus currently valued at $90,000 on Mythic Markets. (in mid-2021, Mythic Markets shut down)

Another similar company is Otis, which lets you invest in sneakers, collectibles, and contemporary art.

Private Mortgages

Another way to invest in real estate without buying the property is by investing in private mortgages. As the investor, you are acting as the bank and lending money to a homeowner as a mortgage.

With this alternative investment, your investment cost is the debt amount for the mortgage and you collect interest payments for profit. The property serves as collateral that you can take possession of if the owner stops making payments.

As there’s a possibility of foreclosing on the property, you should only invest in notes of properties that you’re comfortable buying.

Paperstac is an online marketplace that lets individual investors trade mortgage notes. You can browse listings from across the United States.

During your research, it’s important to see if the mortgage note owner is current on payments and whether the note is has a first or second lien position.

The least risky mortgage note is usually one where the homeowner is current on payments and has a first lien position. Having the first lien position entitles you to claim the first portion of the sale proceeds if you must repossess the property.

Non-performing (meaning the homeowner has missed payments) and second lien position loans can sell at a lower premium as the owner is behind on payments and is more likely to default. You might prefer these riskier note options if you have intentions of acquiring an investment property at a discount.

You can also use mortgage notes in a rent-to-own scheme to sell a rental property that you own. It’s possible to reduce your taxable capital gains but be sure to use a licensed mortgage loan originator to draft the contract and avoid potential legal troubles.

Tax Liens

When someone is unable to pay their property taxes, the local governments auction the unpaid property taxes to collect revenue. It’s basically buying the debt from the government and the property owner now owes you the back taxes, rather than the city.

As an investor, you can earn interest payments as you assume the tax lien from the property owner.

The bidder offering the lowest interest rate has the winning bid. As the winning investor, you spot the outstanding property tax balance and the property owner pays you back taxes plus your interest rate.

Like investing in private mortgages, you must be ready to foreclose on the property if the owner defaults on their tax payments. Local laws determine the repayment schedule and when you can start the foreclosure process.

As unpaid property taxes are generally smaller than private mortgage debt, you might consider this alternative investment if you want to invest a smaller amount of cash.

Read more about tax lien investing to see how this investing idea works.

Equipment Leasing

Businesses from a variety of industries need to lease equipment to generate revenue. You can help these companies grow and earn a profit in the process.

You might be able to earn income by leasing heavy construction or farming machinery, medical equipment, office furniture or other pricey devices.

You can earn monthly lease income for several years until the equipment depreciates and is sold off. Your earnings can be tax-deferred until the equipment leasing program sells off the equipment at a depreciated value.

Equipment leasing investing usually requires you to join a group of investors to create an equipment leasing fund (ELF). In most cases, the investment period is between seven and ten years.

A fund manager manages the equipment fund by acquiring the equipment and finding a renter. You receive a monthly lease payment until the lease ends or the fund sells off the equipment.

Depending on the investing setup, you will not have much influence in what type of equipment you invest in or who the leasing company is. The fund manager with leasing experience usually makes these decisions.

Your leasing fund might be set up as a “blind-pool.” This agreement means the fund manager might lease different types of equipment as business trends and market demands change to avoid idle periods.

Before joining a leasing program, you should review the past investment records to determine which industries they invest in and your potential annual returns. Damaged or idle equipment can hinder your long-term income potential.

An indirect way to invest in equipment leasing is using Worthy Bonds. Small businesses can use their loan proceeds for obtaining equipment and inventory as you earn a 5% annual yield.

Structured Settlements

When I hear the term structured settlements, I can’t help but think of those terrible daytime commercials from companies that buy structured settlements. Those companies give the recipient a lump sum in return for all the future payments from the settlement.

You can do the same thing. by investing in structured settlements, you provide a lump sum payment to the beneficiary that’s smaller than the settlement amount. You then start receiving the monthly settlement payment.

Your profit is the difference between your lump-sum investment and the remaining structured settlement payment.

It may also be possible to invest in structured settlements for lottery winners or annuity payments.

If you’re comfortable with “end of life investments,” you can invest in life insurance settlements too by providing lump-sum payments to those who need the cash now and you collect your payment after they pass.

CrowFly is an online platform that lets you buy pre-existing settlements. If you find a settlement you like, a judge will approve the final agreement so you can start earning passive income.

As it can take decades to recoup your investment, you must decide if the income potential is worth the long-term commitment. Rising inflation can erode your returns as your potential yield might only be as high as 5%.

Besides the legal agreement to receive structured payments, this alternative asset doesn’t have any collateral. A default from the insurer or party paying you the settlement money can put your investment at risk.

If you need to sell early to raise cash, you will need to sell at a discount and potential loss. As many short term investments have low yields, these settlements can be a unique alternative to 20- or 30-year bonds

Other alternative assets may have similar returns but with a smaller holding period and better liquidity.

Equipment Leasing Funds

There are a lot of industries and businesses where the equipment is extremely expensive. We rarely buy cars with cash so it’s understandable that you wouldn’t want to, or even be able to, purchase a tractor outright. Even in industries where the equipment is expensive but not six-figures, it’s better for the business to borrow to fund the purchase rather than make a huge capital outlay at the start. For many of these types of purchases or leases, business owners rely on equipment leasing funds.

An equipment leasing fund is a limited partnership that engages in these types of loans. The benefit of this, over a regular loan, is that a portion of the distributions may be non-taxable or tax-deferred due to depreciation, expenses, and return of capital.

An ideal scenario is the leasing of low-tech equipment to investment-grade companies – low tech requires less maintenance and investment-grade companies reduce your credit risk.

Two companies that are big in this field are ATEL Capital Group and ICON Investments.

Summary

This is only a sprinkling of some common and some offbeat alternative investments. There are a ton of wild ideas out there. You might be able to find a fun little investment that yields big dividends in an area you never considered!

But no matter what fun things you find, be sure they fit into your overall plan and you don’t invest more than you can afford to lose.

Hi Jim –

I disagree with your premise on Forever Stamps, at least at this time. We know that the USPS already has plans to raise the price of first class postage by 10% in January. In terms of “taking your profits”, for anyone who uses a lot of stamps for mailouts for their small business, not to mention greeting cards and holiday cards, it can be a useful proposition, albeit a small one in terms of total investment size.

One of the important cards, because of its irregularity, was Black Lotus. Collectibles are constantly a hot elective venture however popular culture collectibles are much more so on account of the nearby passionate association. I realize how desired the Black Lotus was even in those days – so it comes as no stun that you can purchase portions of an Alpha version Black Lotus as of now esteemed at $90,000 on Mythic Markets.

I remember the Black Lotus!

I love that the first thing on this list was farmland. It’s completely an undervalued market and with the price of farming real estate increasing it is definitely worth investing in. I use FarmTogether and it’s very easy for a bit more casual investments since it is crowdfunding farmland.

I haven’t used FarmTogether but I did invest in farmland through AcreTrader. It’s a small farm in Kankakee County, IL, and I’m eager to see how it performs.