For decades, companies have been giving away free stuff to get you to try their service.

Brokers, like E*Trade, would offer hundreds of free trades within a fixed window whenever you signed up. Their latest advertised offer seems to be 60 days of commission-free trades. It’s a nice offer, but what if I don’t want to trade like a madman? What if I just want to try them out and perhaps get a few free shares of stock?

That’s where the new crop of brokers comes in. Much like how online banks broke traditional banks, with high-interest rates and no fees, a new crop of brokers seeks to upend the traditional model.

Their first step? Free stock. (or cash to invest)

Here are some brokers who offer free shares of stock when you sign up:

Every company on this list is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). SIPC is the FDIC equivalent of deposit insurance with limits up to $500,000 ($250,000 for cash). Never use a broker that is not covered.

🔃 Updated September 2023 with updated details of these promotions and any additional offers we’ve seen.

Moomoo

Moomoo is a free trading app powered by Nasdaq-listed FinTech FUTU. Its parent company Moomoo Financial Inc. is an SEC and FINRA regulated brokerage with headquarters in Palo Alto, CA. You can look up their FINRA’s BrokerCheck records here (CRD#: 283078/SEC#: 8-69739).

Moomoo has a free stock offer that should excite you:

Deposit $100 to get up to 7 fractional shares ($35 total value).

There are no trading requirements but you must keep the cash in there for 60 days.

Webull

Webull is a commission free broker and is accessible by app only. The app itself, which I’ve had for a couple months, is more technical but the shares of stock they gift are just as real.

When you open and fund an account, you get up to 12 free stocks. The company will have a market cap of at least $2.5 billion and be traded on the NASDAQ or NYSE.

- Get 12 free fractional shares when you open an account and deposit any amount,

- That’s it!

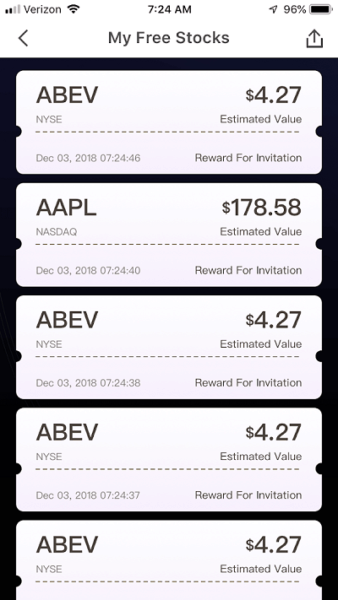

The stocks they give will most likely be a small share but from time to time you’ll get something wild and crazy. For example, I received many shares of ABEV before randomly one day getting a share of AAPL.

Webull Financial LLC is based out of New York City with CRD# 289063 and SEC# 69978.

Summary of the deal: Open and fund an account to get a free share of stock valued up to $1,600. There are no other requirements, no minimum deposit amount, and trades are free. One of the best alternatives to Robinhood.

Get your free share of stock from Webull

(or learn more about the Webull free stock offer)

Robinhood

Robinhood is the most well-known startup on this list. They were founded in 2013 by two veterans from the high-frequency stock trading world.

Robinhood is a broker that lets you buy and sell shares of stock and exchange-traded funds (ETFs) without paying a commission. They do not charge a maintenance fee either.

They were the first to aggressively market themselves by giving away free stock and you can still get yours if you act quickly. Robinhood Financial LLC is based out of California with CRD# 165998 and SEC# 69188.

Summary of the deal: You get free stock (valued $5 - $200), with the free stock valued between $5 and $150 (average around $10).

Get free stock (valued $5 - $200) from Robinhood

SoFi Invest

SoFi Invest is the brokerage arm of SoFi and I’ve been a fan of them because they offer free trades, you can invest in crypto (if you are into that), and they often run promotions where you can get rewarded for using their app.

When you sign up for a new account, you could get a random dollar amount of stock valued at around $25. All you have to do is open an account (free, no funding requirement) and play the game to get your free money.

The simplest promotion you’ll ever see. 🙂

Get $25 of free stock from SoFi Invest

Public

Public is one of the few zero commission brokerages that lets you buy stock with any amount of money. Yes, that means you can buy partial shares with as little as $5 invested with real-time settlement (not batched, like what they used to do back in the day). They’ve also integrated a social component where you can see what other people have invested in (when they make it public) and you can see what their strategies are. If you wish, you can also follow investment strategies like investing in Tech Giants (most influential tech companies), American Made (US Manufacturing), The Future is Female (S&P 500 companies with female CEOs), and many others. You can buy ETFs too.

They are SIPC insured up to $500,000 and they even pay interest on your uninvested cash (2.53% APY on up to $10,000 as of 1/30/2020)

When you sign up with our link (on your desktop), you can get $3-300 of stock from one of the following 9 companies – Alphabet (Google), J&J, Facebook, Apple, Visa, Chase, Microsoft, Amazon, or Alibaba. Once you click through, enter your phone number and they’ll send you a text message with the instructions.

(read our full review of Public)

Get $3-300 of free stock from Public

Tornado

Tornado offers a generous signup bonus of up to $1,000, and has a Learn & Earn feature that rewards users with up to $50 towards investing for completing learning modules on investment fundamentals There are a few conditions with these offers, such as you cannot withdraw the funds for 1 year and you must place a trade within the first month.

Unlike Webull and Robinhood, Tornado charges a $7.99/month membership which includes 40 commission-free trades, or $4.50 per trade without a membership, which is lower than some other brokers and on par with Ally Invest. There is a simulated portfolio feature so you can use their collaboration and optimization tools without putting real money on the line.

It was founded in 2015 by Bernard George and Patrick Aber. George has a hedge fund and engineering background with a Physics degree from Harvard. Aber designed investment strategies at Tower Research Capital and The Carlyle Group after studying Applied Math and Economics at Harvard. If you’re not familiar with them, read our Tornado review to learn more.

Tornado, also known as Nvstr Financial LLC, is based out of New York City with CRD# 269966 and SEC# 69642.

Summary of the deal: You actually get free cash between $20 and $500. There is no minimum deposit and you must hold the amount in your account for a year and make one trade within a year to keep the bonus. Trades are $4.50 each and there are no monthly fees, no membership fees, no account opening or closing fee, and no fund transfer fees.

You will get a Form 1099 for the value of the stock that you receive from any of these brokers. You’ll be responsible for including that on your tax return for next year and it’ll likely be taxed like bank interest. The moment you get the shares, the value is recorded and the broker will record that as miscellaneous income.

When you sell the shares, you’ll owe capital gains tax if you sold for a capital gain. You can deduct capital losses if you sell for a loss. The cost basis is the value of the share when you received it.

For example, you get a share of Wallet Hacks LLC valued at $100. The broker will issue you a Form 1099 at the end of the year for $100. If you sell the stock for $110 sometime during the year, you’ll owe taxes on $10 of capital gain. You’ll be taxed at ordinary income tax rates on the $100 and then capital gains tax rates on the extra $10.

If you sell the stock for $90 and take a loss of $10, then you’ll still owe ordinary income tax rates on the $100 but you can deduct $10 of capital loss from any capital gains you have. If you don’t, you can take that $10 off your ordinary income (up to the limit).

So, don’t forget to set aside cash for taxes!

Thanks for this info. I will be looking into these. I am liking Robinhood.

Either way you look at it, eventhough it is free money (somewhat), Uncle Sam makes sure that he crashes your “money party,” by ensuring he gets his cut of the $ gUaP $. Sad truth, but true.

I love this app.