From real estate investment trusts (REITs) to real estate crowdfunding platforms, it’s never been easier to invest in passive real estate. In the past, investing in commercial real estate has been challenging. Commercial real estate can be very expensive, making it hard for the average investor to enter the market.

Enter Fundrise.

Fundrise is a private market real estate investing platform that allows you to invest in eREITs (electronic REITs) that aren’t traded on public stock exchanges.

But Fundrise offers more than just commercial real estate. You can also invest in high-interest-yielding private credit deals, and the stock of rising technology companies before their shares are made available to the general public. With as little as $10, investors have the ability to participate in some of the most sought-after stock investments on Wall Street.

When you combine private credit and pre-IPO stock in innovative technology companies with the many commercial real estate opportunities Fundrise offers, the end result is one of the best online investment platforms available to regular investors.

In fact, Fundrise provides a level of investment diversification to small investors that was once available only through hedge funds.

We earn a commission from Fundrise partner links on WalletHacks.com. We are not a client of Fundrise. All opinions are my own.

Table of Contents

- What Is Fundrise?

- How Fundrise Works

- Operating Technology

- Account Types

- Real Estate Portfolio

- Venture Portfolio – Innovation Fund

- Private Credit Portfolio

- eREITs and eFunds

- What Is Goal-Based Investing?

- Four Fundrise Portfolio Options

- Fundrise Pro

- Who Can Invest and How?

- What are Fundrise Returns?

- What are the Pros and Cons?

- Fundrise Alternatives

- Fundrise FAQs

- Final Thoughts

What Is Fundrise?

Fundrise is a crowdfunded real estate investing platform that was founded in 2012 by two brothers (Ben and Dan Miller) in Washington, D.C. Fundrise’s first project was a $325,000 raise from 175 investors (minimum of just $100) in the H Street NE Corridor in D.C.

They’ve come a long way since then – as of 9/30/2022, Fundrise has over 371,000 active investors with $7 billion total asset transaction value and over $226 million in net dividends earned by those investors.

Today, you don’t invest directly in real estate property – you purchase eREITs or eFunds – private real estate portfolios across the United States in accordance with your investment goals. Some Fundrise investment funds are designed for income, others for equity growth.

Some prefer this approach over investing directly in real estate because you avoid the problem of taxable events. When you directly own physical real estate, like a vacation rental property, you’ll realize a capital gain when you sell. You don’t have that with a fund approach.

Additionally, crowdfunded real estate allows you to diversify your risk across multiple properties.

Fundrise differs from other crowdfunded real estate marketplaces because you invest in funds, not directly into properties. This is also why you don’t need to be an accredited investor since you’re investing in a fund and not in a private placement.

As Fundrise has continued to grow and evolve, it’s added totally new asset classes in the form of private credit and pre-IPO technology company stocks. As mentioned, these opportunities are available to small investors for an investment of as little as $10. With a few hundred dollars, you can spread your portfolio across multiple investment classes.

Fundrise is one of the few real estate crowdfunding options for non-accredited investors. Very few companies offer the same investment opportunities in a single platform.

How Fundrise Works

Fundrise has evolved its platform while simultaneously expanding the investment options available, all within a few years.

Operating Technology

Fundrise has redesigned the investment management process, using software-enabled automated systems to replace high-cost manual workflows.

The process involves a combination of three systems:

- Cornice is the Fundrise internal investor servicing and management software system. It streamlines the process of managing more than 500,000 individual investors as though the platform were managing just one single account.

- Basis is the software that manages real estate operations. It’s a next-generation asset management system built on top of a modern data warehouse, designed to provide real-time, automated reporting across hundreds of individual assets.

- Equitize is a system providing faster, fairer, and more flexible funding solutions.

The combination of these systems has enabled Fundrise to manage hundreds of thousands of investor accounts spread across hundreds of asset classes with greater speed, accuracy, and efficiency. The result is a streamlined investor platform that’s proven to be more user-friendly.

Account Types

Fundrise can accommodate both private investment accounts and IRAs. Private investment accounts are designed specifically for regular, taxable investment accounts. They can be opened with an investment as little as $10.

IRA accounts are available for both traditional and Roth IRAs. They require a minimum initial investment of $1,000. IRAs have an annual account fee of $125, which is waived in any year in which you contribute at least $3,000 or for any IRA account with a balance of greater than $25,000.

IRA accounts are held with Millennium Trust Company, LLC, as the custodian of assets in each retirement account opened through Fundrise.

Real Estate Portfolio

Fundrise is known, first and foremost, as a real estate investment platform. The company has a real estate portfolio greater than $7 billion spread across hundreds of industrial properties, multifamily apartments, and even single-family rental homes.

The real estate portfolio includes 294 active and 141 completed projects, which have produced the following investor returns in recent years:

Real estate returns result from four different portfolio options, which will be covered in some detail below. These include Fixed Income, Core-Plus, Value-Add, and Opportunistic. Any real estate portfolio you invest in will include at least a small part of each of the four. However, the portfolio options favored in your investment mix will be determined by your own investment preferences or your risk tolerance.

But this is where Fundrise has taken a departure from its traditional emphasis entirely on real estate investing. They now offer two investing options that go beyond real estate and promise to roll out even more investing options in the future.

Venture Portfolio – Innovation Fund

Venture Portfolio offers the opportunity to “invest in tomorrow’s great tech companies today.” The objective is to allow investors to invest in top-tier technology companies during the pre-IPO (“initial public offering”) phase.

This strategy requires some explanation. Fundrise maintains that the vast majority of investment returns from IPOs occur during the time when the issuing companies are still privately owned. That is partly due to the fact that pre-IPO companies are staying in the pre-IPO phase longer than in the past, often for many years.

The Venture Portfolio uses the Fundrise Innovation Fund to capitalize on this market. The fund focuses on the following five investment sectors:

- Artificial intelligence and machine learning

- Modern data infrastructure

- Development operations (“DevOps”)

- Financial technology (“FinTech”), and

- Real estate and property technology (“PropTech”)

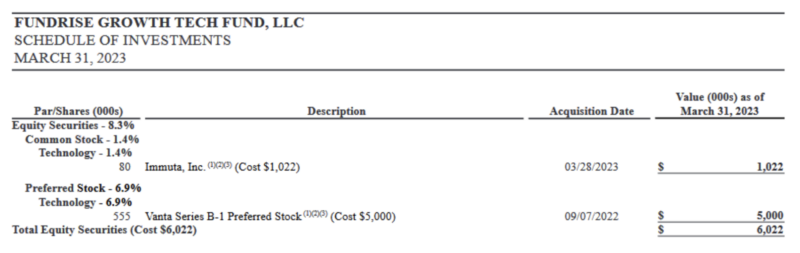

However, since the Innovation Fund is a new venture, it currently holds an equity position in a single company known as Vanta. The position in the company was taken in November 2022 in the amount of $5 million. Vanta is a high-growth tech company “with a solution at the intersection of the cyber security and compliance industries.” (As of March 31, 2023, the Innovation Fund has also taken a $1 million position in the stock of Immuta, Inc.)

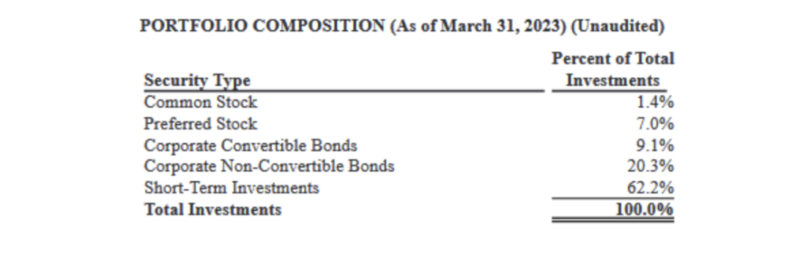

As you can see from the Portfolio Composition statement below, provided by the Innovation Fund, only 8.4% of the fund is currently sitting in the stock of pre-IPO companies. As such, the fund is primarily invested in corporate convertible bonds, corporate non-convertible bonds, and short-term investments.

Private Credit Portfolio

Private Credit includes high-yield loans and other fixed-income investments. These include primarily debt-related instruments rather than equity. Because of the shorter duration of private credit loans, they typically provide higher returns because they are private agreements rather than publicly traded securities, like bonds.

For example, in today’s rising rate environment, short-term debt provides higher rates of return than long-term securities.

Private Credit provides investors with the ability to invest in these kinds of debt obligations. Fundrise uses its experience in financing real estate investors to enter this highly profitable asset class. Private credit consists of real estate-related loans, mezzanine financing (including preferred equity), financing residential construction and development, and acquiring subordinate notes and high-yield investments in the asset-backed securities market.

Fundrise’s Private Credit portfolio will invest in specific projects in the form of high-yield preferred equity. These investments offer low fees, flexible minimum investments, and even an opportunity for quarterly liquidity.

eREITs and eFunds

eREITs and eFunds are the foundation of real estate investing through Fundrise. An eREIT is a real estate investment trust but a privately traded one, available only on Fundrise. They comprise either equity or debt investments in commercial property, including retail space, apartment complexes, office buildings, and other developments.

eFunds are much like eREITs in that they’re only available through Fundrise. But rather than investing in large-scale projects, they invest in the acquisition and/or development of individual properties, like single-family homes, townhomes, and condominiums. By investing in an eFund you can invest in a portfolio of such properties.

What Is Goal-Based Investing?

Fundrise lets you, as an investor, pick one of three goals:

Supplemental Income: Designed for investors who want to earn additional passive income, have a moderate-term investment horizon, and may be planning for retirement shortly. Income-focused assets represent 70% to 80%, and growth-focused assets are the remaining 20% to 30%.

Balanced Investing: For investors who want maximum diversification, have a moderate to long-term investment horizon, and may be newer to investing outside the stock market. Income-focused assets represent 40% to 60%, and growth-focused assets are the remaining 40% to 60%.

Long-Term Growth: For those who want to maximize returns over the life of the investment, have a long-term investment horizon, and are comfortable with more potential variability year to year. Income-focused assets represent 20% to 30%, and growth-focused assets are the remaining 70% to 80%.

(There is a questionnaire if you aren’t sure which type of investor you are.)

You pick one type for these plans, open an account, and deposit money. Fundrise handles the rest.

The Long-Term Growth Plan projects annual returns of 9.7% to 11.6% (about half as income, half as appreciation) and would put you in 12 active projects in a mixture of risk categories (they tell you exactly how much of your portfolio would be going where).

Four Fundrise Portfolio Options

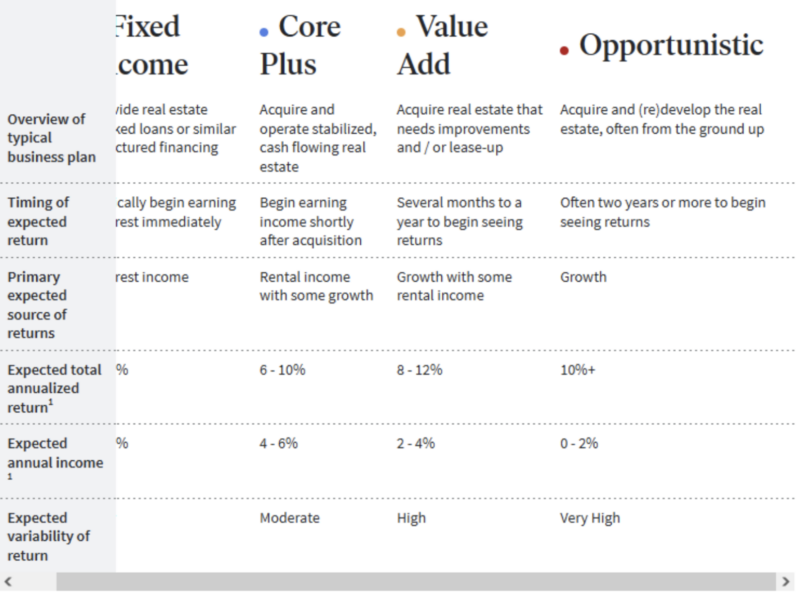

Fundrise uses four different portfolio options for the real estate investments it offers. The screenshot below provides a summary of the four options and the basic functions of each (we apologize for the Fixed Income section being truncated, as that is how it is presented on the website):

Fixed Income

As the name implies, the Fixed Income option is designed primarily to provide steady income. This is provided through interest income generated by real estate loans and other types of financing.

The advantage of the Fixed Income option is that it generates income immediately and throughout the term of the underlying investments. Fundrise relies on a portfolio of debt-related investments so that loans that are paid off are replaced by new ones to continue the interest-generating process.

Core-Plus

Core-Plus relies on a combination of stable income and potential for capital growth. It’s done by acquiring stabilized cash flow-generating real estate, which will eventually be sold at hopefully higher prices to produce capital gains in the future.

Expected annual income is between 4% and 6%, while expected total annualized return – which includes potential future capital gains – is estimated at between 6% and 10% per year.

Value-Add

This may be the area of real estate investing Fundrise is best known for. Value-Add is a process that involves the acquisition of real estate that needs to either be improved or leased up. The completion of either activity can result in increased property values.

The primary objective of Value-Add is growth with net rental income, somewhat like a growth-income mutual fund in stock. Though there is high return variability, the expected total annualized return is between 8% and 12% per year, with expected annual net income in the 2% to 4% range.

Opportunistic

Opportunistic involves the acquisition and development of real estate from the ground up. The entire objective of this option is long-term growth, and it is expected to produce annualized returns in excess of 10%.

This is, however, a very long-term process, return-wise. Expected annual returns are estimated at between 0% and 2%, and the expected variability of returns is very high. When you invest with this option, expect no return in the short run and a holding period of two years or longer before capital gains on your investments are realized.

Fundrise Pro

Fundrise Pro is a feature that enables you to invest in customized portfolio allocations in investment funds offered by Fundrise. Investment decisions can be made through either the web version or Android and iOS mobile devices. That includes some of the more than 5,000 residential assets currently being offered on the platform. You’ll also have access to financial content offered by the Wall Street Journal and WSJ Pro, but without the required fees those publications require.

Through Fundrise Pro, you can invest in any fund offered by Fundrise for as little as $10. That small minimum investment will enable you to spread a small amount of money across many different funds. You can even set asset allocation percentages across the different funds.

Fundrise Pro is currently being offered for a fee of $10 per month.

Alternatively, you can pay a flat annual fee of $99, saving you $21 annually. You can sign up for Fundrise Pro as an existing Fundrise customer. In addition, Fundrise Pro comes with a 30-day free trial, and you can cancel your membership anytime.

Who Can Invest and How?

Any US resident over the age of 18 can become an investor on Fundrise. You do not have to be an accredited investor. (International investors cannot invest directly through Fundrise).

Fundrise currently supports personal and joint investment accounts, Trusts, LLCs, LPs, and C and S corporations. If you want to invest with your IRA, you must set up an agreement with the Millennium Trust Company, but it’s possible.

What are Fundrise Returns?

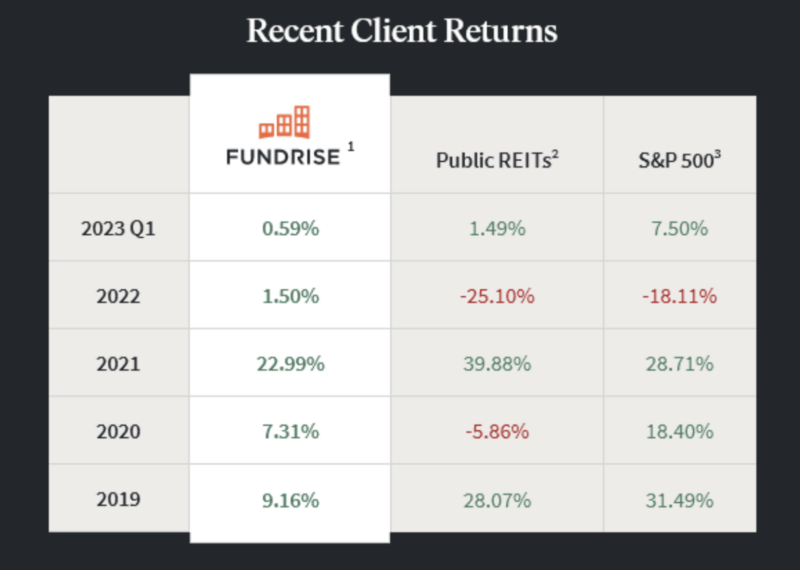

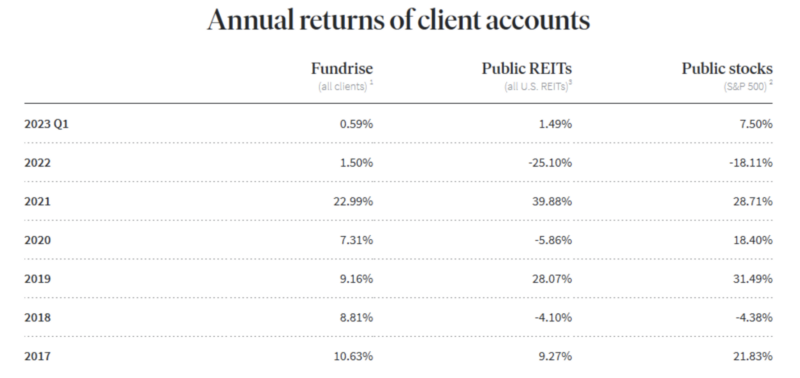

Fundrise has provided the following returns from 2017 through the first quarter of 2023:

What is perhaps most noteworthy about these returns is that their performance tends to be strongest in the years when other asset classes are weakest.

For example, notice that in 2022, when the S&P 500 was down by more than 18% and public REITs lost more than 25%, Fundrise produced a 1.50% return. That may not be impressive on the surface, but it offered a return during the year when both stocks and publicly traded REITs took a serious dive.

The situation was similar in 2018, when Fundrise returned nearly 9%, while both public REITs and stocks lost money.

Perhaps more than anything else, Fundrise might be seen as a true alternative investment, performing well when other asset classes are weak.

What are the Pros and Cons?

Pros:

- You do not have to be an accredited investor

- Begin investing with as little as $500

- Low investment management fees of up to 1% per year

- Three different investment goals – Supplemental Income, Balanced Investing, and Long-term Growth – are designed to meet your own investment goals and risk tolerance

- A solid track record of investment growth, ranging from 8.76% to 12.42% since 2014

- Opportunity to redeem your investment after just 90 days, which is extremely unusual in the crowdfunding industry

- Fundrise pays distributions quarterly

- Now offers portfolios invested in high-tech growth companies and private credit in addition to real estate

Cons:

- Given that it’s a real estate investment, expect to hold investments for at least five years.

- Innovation Fund started only late in 2022 and currently holds equity positions in just two companies

Fundrise Alternatives

Fundrise has a lot to offer, but if you’re looking for something else, here are some solid Fundrise alternatives.

Streitwise

Streitwise is similar to Fundrise in that it’s a real estate investment trust. That also makes it less of a true real estate crowdfunding platform and more of a traditional REIT, though it isn’t publicly traded. You can begin investing with as little as $5,000, and you can be either an accredited investor or non-accredited, subject to certain limitations.

The benefit of investing with Streitwise is in their investment methodology. They look for properties located in “non-gateway markets,” which means they’re lower priced than properties in high-cost coastal markets. Properties must also have high-quality construction and a record of sustained high occupancy with high-quality tenants. They also limit leverage to reduce risk.

Liquidity is more limited, however. You cannot redeem your investment for the first year. After that, you’ll be subject to a redemption fee of up to 10%, which will decline to zero after five years. The company charges a 2% annual management fee. For more details, see our Streitwise review.

RealtyMogul

RealtyMogul is another real estate crowdfunding platform for accredited and non-accredited investors. And you can similarly invest with as little as $1,000. They also provide an opportunity to invest in various real estate asset classes, including commercial, retail, residential, multi-family, and other property types.

For non-accredited investors, they have the Income REIT fund. It’s a mix of both equity and debt investments in commercial property, with an annual distribution target of 8%.

But for accredited investors, RealtyMogul offers direct investments in individual properties. These investments require a minimum of $25,000 and have more substantial long-term projected returns, though they also come with high fees. Read our RealtyMogul review for more information.

Yieldstreet

In its current form, the closest alternative to Fundrise is Yieldstreet. Much like Fundrise, it offers a wide selection of asset classes, in addition to real estate. Yieldstreet similarly functions as an alternative investment platform and includes asset classes like private credit, structured notes, art, legal, finance, and transportation – in addition to real estate investments.

More than $3.2 billion has been invested in the platform since it began, with current net annualized returns averaging 9.7% since 2015. For more information, check out our full Yieldstreet review.

Fundrise FAQs

There may be penalties if you liquidate shares early with Fundrise. For example, if you withdraw funds from your eREIT or eFund before 5 years, you will pay a penalty of approximately 1%. After 5 years, there is no penalty. When you invest with Fundrise, you should have a long-term mindset and expect to hold your investment for at least 5 years.

Not necessarily. However, you must be over the age of 18, be a permanent U.S. resident, have a U.S. tax ID, and file your taxes in the U.S. If so, you should be able to invest with Fundrise. Note that Fundrise is not available in Canada.

While you can achieve diversification within the real estate asset class by investing in a Fundrise eREIT, your investment is not guaranteed, nor is it FDIC-insured. In other words, there is a risk that you could lose money with Fundrise. To minimize potential losses, only invest money that you can afford to lose, and plan to hold your Fundrise investment for five years or more. Your Fundrise investment should not be considered a core holding in your investment portfolio.

Final Thoughts

The real estate crowdfunding space has become crowded in the last few years. But Fundrise stands out as one of the leaders in the field because they offer small investors an opportunity to invest in one of the best real estate investments there is, commercial real estate.

And they don’t stop there. Fundrise also enables small investors to participate in private credit investments and pre-IPO purchases of innovative technology companies – before those stocks are available to the general public.

Best of all, you can do so with as little as $10 and no requirement to be an accredited investor. You’ll not only benefit from a fully diversified real estate portfolio, but Fundrise provides the ability to liquidate your investment early – though with certain limitations and a penalty fee.

But that stands out because very few real estate crowdfunding platforms offer any opportunity for early redemption at all.

If you’re new to real estate crowdfunding investing, or you only want to commit a small amount of money to a diversified portfolio, Fundrise is one of the best options in the industry. You’ll also like Fundrise if you’re looking to invest in a true alternative investment platform that mixes real estate with private credit and pre-IPO technology company stocks.

VNQ does not have a $3000 dollar minimum. It is an ETF. You can buy one share if you’d like. You are thinking of a mutual fund.

Yes! You’re right, thanks and I’ll update the post.

Jim,

I think the average annual returns are a bit tricky to assess. I have been on the platform for 18 months, have about $20k invested I have only seen about 4% annual return. Also, the return depends on the type of investment…balanced, income or growth. Even though the returns are less than stellar at this point, it is a long-term investment I plan on holding for many years. What I like about the platform is the well thought out website, the IPhone app and the flexibility of making your minimum investment which is $100.

I think you’re right, especially during a time like this when rents are less likely to be paid and everyone accepts that is the new normal for the time being.