EquityMultiple

Strengths

- Begin investing with as little as $5,000

- Competitive fees

- Live customer support, including a dedicated investor relations team

- No capital call requirement

Weaknesses

- Limits participation to accredited investors

- No mobile app

- A multi-tier fee structure can make calculating investment returns a bit difficult

If you’ve been searching for a new asset class to add to your portfolio, commercial real estate is worth considering.

The good news is that commercial real estate is not as complicated or exclusive as it once was, and you can now get started with as little as a few thousand dollars through real estate crowdfunding platforms like EquityMultiple.

But even with the low investment minimums EquityMultiple offers, there is still a significant barrier to entry. In this EquityMultiple Review, I’ll let you know who this investment platform is best suited for, and share some pros and cons along with some EquityMultiple alternatives.

Table of Contents

What Is EquityMultiple?

EquityMultiple is a New York City-based real estate crowdfunding platform offering high-yield, professionally managed commercial real estate. Launching in 2015, they now manage deals with a total project value of more than $4.4 billion.

EquityMultiple combines real estate investing with technology. Its purpose is to provide investors with investment opportunities in professionally managed private real estate transactions. They focus on making commercial real estate investing simple, accessible, and transparent.

EquityMultiple provides in-house underwriting to assess potential investment deals. Only about 5% of those available make the cut and are offered to investors. The company’s staff brings decades of commercial real estate experience to their business.

Learn More About EquityMultiple

Key Features

- Accredited investors only, requiring a high income, high net worth, or a combination of both.

- Individual and joint taxable investment accounts, LLCs, trusts, or limited partnerships. You can also set up a special IRA account known as a self-directed IRA (SDIRA), which must be handled through a dedicated SDIRA trustee.

- Professionally managed portfolios of commercial real estate properties that provide interest income, steady income, or growth.

- Minimum investment of $5,000.

- Quarterly reporting

- Less liquid than standard market investments. Plan to hold until maturity

- No mobile app

- Phone and email support, Monday through Friday, 9:00 AM to 6:00 PM, Eastern time. Investor contact is through a dedicated investor relations team.

EquityMultiple Investor Services

EquityMultiple distinguishes itself from other real estate crowdfunding platforms in that it does not operate as an open online marketplace. Instead, the focus is on providing a more holistic, investor-centric experience. Here are some services you can expect to receive when you invest with EquityMultiple.

Full Cycle Asset Management

EquityMultiple is less of a pure do-it-yourself investment platform than most of its competitors. They have a dedicated asset management team that works each deal, from initial closing through investment exit. In addition to a rigorous vetting process, the EquityMultiple team works to maximize investor returns and minimize the risk of capital loss.

Dedicated Investor Relations Team

This is another service unique to EquityMultiple. Each investor on the platform has a dedicated representative. You’ll be able to talk to a live person about investment opportunities or even your personal portfolio.

Types of Investments

EquityMultiple investments fall under one of three categories: Keep, Earn, and Grow, which represent safety, income, and growth categories. Let’s take a closer look at how you can invest in each category:

Keep

- Savings account alternatives

- Competitive short-term interest rates

- Typical yield is superior to a CD

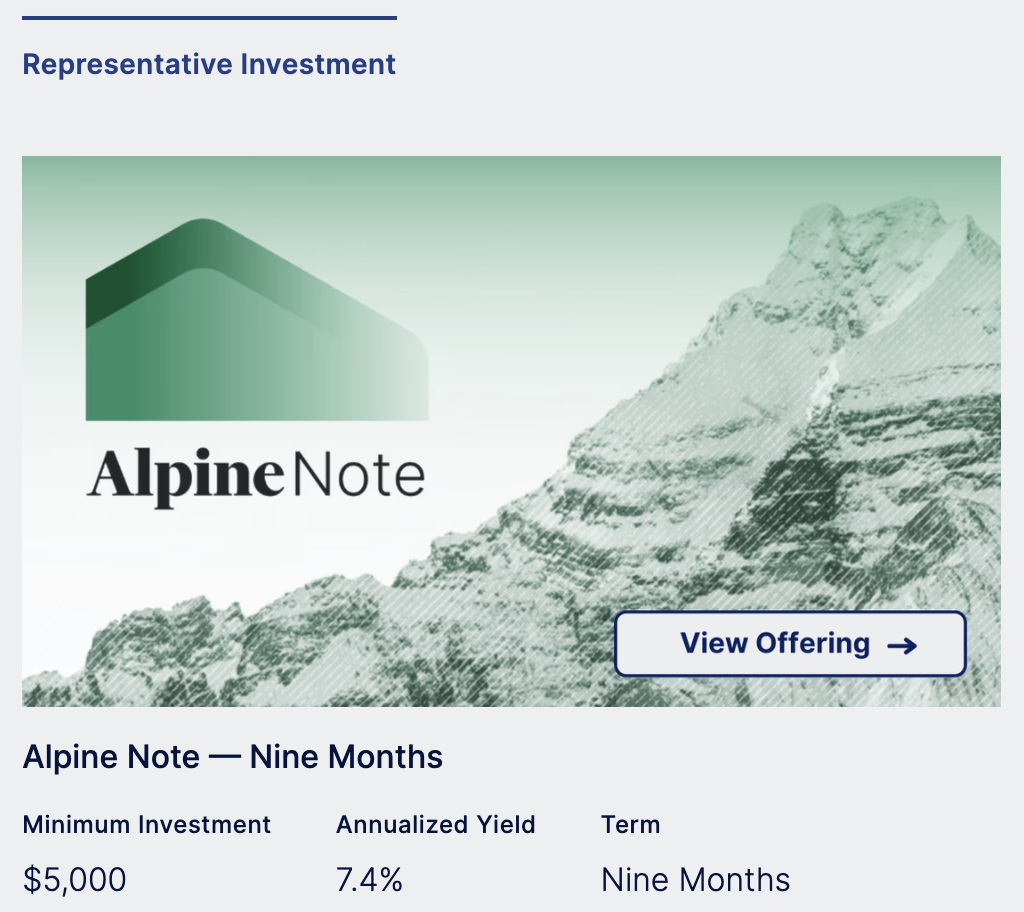

Real estate investing can often tie up your money for years, as you wait for the property to sell. For investors who are concerned about this, EquityMultiple offers the Alpine Note, a fee-free savings account alternative with interest rates well above the average on certificates of deposit (CDs).

It’s available in terms of three months, six months, and nine months. Proceeds from Alpine Notes can be rolled into the subsequent series of another security or other EquityMultiple investments. As well, Alpine Note holders can redeem early (after 30 days) penalty-free to invest in another EquityMultiple offering.

With Alpine Notes, you can get your principal back quickly, which may be appealing during periods of low interest rates.

Earn

- Senior debt – targets returns of 8% to 12%

- Preferred equity – targets returns of 10% to 14%

- Yield-focused funds

EquityMultiple’s ‘Earn’ pillar provides commercial real estate investments offering current yield, payment priority, and short terms, with redemption options kicking in after one year.

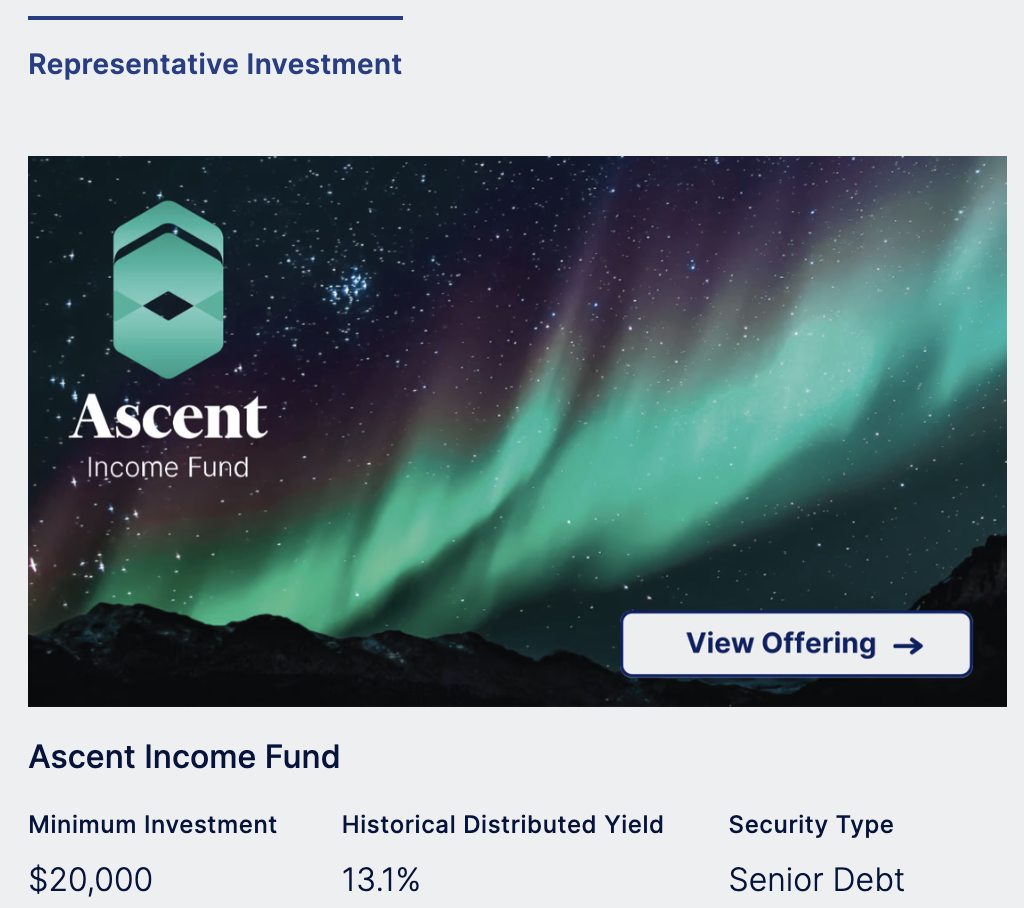

Investments include senior debt with targeted returns of between 8% and 12%, preferred equity with targeted returns of between 10% and 14%, and yield-focused bonds. For example, the Ascent Income Fund has a historical distribution yield of 13.1%.

With the Ascent Income Fund, distributions are paid every quarter or can be automatically reinvested. While the minimum investment is normally $20,000 for the Ascent, EquityMultiple is currently offering first-time investors a heavily reduced minimum investment of $5,000.

Grow

- Value add and opportunistic equity – target net IRRs of 18%+

- Upside-focused funds

- Growth-focused portfolios

- Target hold five years

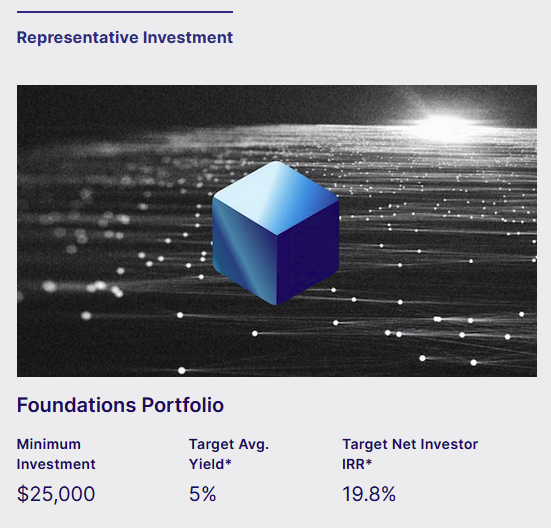

The ‘Grow’ pillar of EquityMultiple offers commercial real estate investments with significant upside potential. As the name implies, growth is incorporated into the investment objective.

The focus is on value-added and opportunistic equity, with a targeted net internal rate of return (IRR) of 18% or more.

It also emphasizes upside-focused funds and growth-focused portfolios.

Learn More About EquityMultiple

EquityMultiple Fees

EquityMultiple fees depend on the type of investment you’ll be making:

If you’re investing in debt or preferred equity, there is a servicing fee of 1% of your investment, but that can be either more or less. (Where “Preferred Return” is indicated, it is net of the servicing fee.)

Common equity investments have an annual monitoring and reporting fee equal to between 0.5% and 1.5% of your investment capital. In addition, once you have received the full return of your investment principal and the IRR objective has been achieved, EquityMultiple will also collect a percentage of the overage for profit participation.

For EquityMultiple funds, fees vary but typically include an origination fee, as well as an annual administrative expense fee of $30-$70 per investor.

Is EquityMultiple Safe?

Yes, EquityMultiple is safe to use. Their physical infrastructure is hosted and managed as a Heroku application within Amazon’s secure data centers. It utilizes Amazon Web Service (AWS) technology. All sensitive data is encrypted and stored within databases to meet security requirements.

Data encryption is employed using industry-standard encryption and best practices for the EquityMultiple technology stack. Funds held on deposit awaiting investment are held in a separate FDIC-insured bank account, covering up to $250,000 per depositor.

How to Sign Up with EquityMultiple

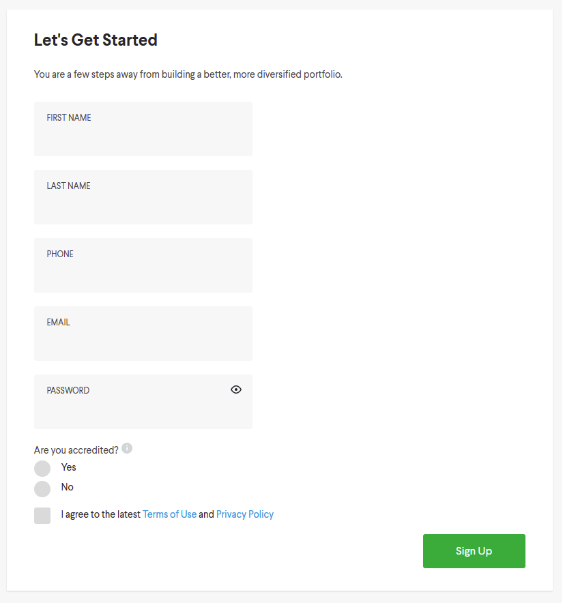

You can sign up with EquityMultiple right from their website homepage. The application only takes a few minutes to complete, and there is no cost to join.

You will be asked to select whether you are an accredited investor. It is based on a self-certification process, but you will need to let EquityMultiple know how you qualify. You’ll be asked to confirm your status each time you invest.

Funding Your Account

You can fund your account by linking your bank account to EquityMultiple. You can then move funds into your investment account through ACH transfers. Other funding options include a check or wire transfer. Note that all cash is held in a separate account at an FDIC-insured national bank, with coverage of up to $250,000 per depositor.

Who Is Eligible?

EquityMultiple accepts any accredited investor who has a US tax ID number. That can be either a Social Security number or an employer identification number (EIN). Participants can be either US citizens, legal US residents, or foreign nationals who own an investing entity incorporated in the United States.

Tax Reporting

For income tax purposes, year-end investment and expense results will be provided by IRS Form K-1.

Learn More About EquityMultiple

Pros & Cons

There’s a lot to like about EquityMultiple, but it won’t be the right tool for every investor. Here’s my list of EquityMultiple pros and cons:

Pros:

- Begin investing with as little as $5,000.

- Competitive fees

- Live customer support, including a dedicated investor relations team.

- No capital call requirement

Cons:

- Limits participation to accredited investors

- No mobile app

- A multi-tier fee structure can make calculating investment returns a bit difficult

EquityMultiple Alternatives

If EquityMultiple isn’t the right real estate investment platform for you, take a close look at some of the alternatives:

Fundrise

Fundrise is a great alternative to EquityMultiple for smaller investors. The minimum initial investment required is just $10, compared to $5,000 with EquityMultiple. In addition, where EquityMultiple requires you to be an accredited investor, Fundrise can accommodate accredited and non-accredited investors.

Fundrise investments are primarily held in private investment funds, known as eREITs and eFunds. These are something like mutual funds that invest in multiple real estate investment opportunities. Fundrise offers five different investment plans – based on the size of your portfolio – and three different investment scenarios, including long-term growth, income, or balanced investing, which is a combination of the two. For more information, check out our Fundrise review.

RealtyMogul

RealtyMogul is open to accredited and non-accredited investors. And similar to EquityMultiple, you can open an account with as little as $5,000 (to invest in an Income REIT). The platform also offers a wider range of investment opportunities, including investments in residential and multi-family properties. And like CrowdStreet, RealtyMogul gives you an opportunity to participate in individual property deals.

Unfortunately, RealtyMogul’s fee structure is higher than EquityMultiple’s. With RealtyMogul, fee structures are tied to each individual deal, and in some cases, the front-end fees are pretty high. There may also be an annual management fee, as well as additional fees based on a percentage of the gross income generated by the property. Individual RealtyMogul deals are better suited to more experienced investors. Read our RealtyMogul review for more details.

FAQs

In addition to the revenue generated from fees charged to investors on the platform (as described above under “EquityMultiple Fees”), EquityMultiple also charges a fee of 3% to deal sponsors. This is charged at the successful closing of funding on each deal.

The minimum investment required is $5,000. However, there may be higher minimums for other investment types. For example, the minimum initial investment on Earn and Grow investments is typically $25,000.

EquityMultiple serves as a platform where deal sponsors seek to obtain funding for property acquisitions and improvements. The projects are funded by EquityMultiple investors. Investments are developed from a nationwide network of contacts in real estate development and investing. Investors then put up funds for a specific timeframe at a predetermined rate of return. This can be anywhere from a few months to a couple of years, with returns typically in double digits.

There’s always an element of risk with any individual investment, and that’s true of EquityMultiple as well. As an alternative asset class, investments made through EquityMultiple are not covered by FDIC or SIPC.

However, EquityMultiple does take numerous steps to protect investors’ cash and information. As mentioned above, they utilize Amazon Web Service (AWS) technology, in which all sensitive data is encrypted and stored within secure databases.

Meanwhile, industry-standard encryption and best practices are used in connection with data encryption for the transfer of information.

Learn More About EquityMultiple

Should You Invest with EquityMultiple?

If you’re looking for an alternative investment, EquityMultiple should be on your shortlist. With the relatively modest initial investment requirement and the long-term return potential offered by the commercial real estate asset class, EquityMultiple may, at times, outperform more conventional investments, like stocks and bonds.

It’s also an excellent way to diversify by adding a “hard investment” to a portfolio that may be comprised mostly of paper investments.