If your investment portfolio is filled with “paper assets” – stocks, bonds, funds, etc. – have you considered adding alternative assets to the mix?

If you have (and you should), an excellent choice may be art.

Yes, artwork.

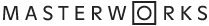

Don't dismiss this alternative lightly. High-quality artwork has been a staple investment among the wealthy for centuries. Because of its rarity, the value of artwork created by famous artists tends to increase over time, often outperforming more conventional assets.

While you once would've needed millions of dollars to invest in rare works of art, a platform known as Masterworks has brought priceless art investing down to the masses.

Now, you don't need millions – or even hundreds of thousands – to invest in rare art created by the masters. Masterworks enables you to invest in these treasures for as little as $1,000. What's more, you can even spread that minimum investment across several different pieces of art enabling you to diversify your holdings into a portfolio of blue-chip art.

About Masterworks

Launched in 2017, and based in New York City, Masterworks is on a mission to enable people at all financial levels to invest in rare art. They're doing this by allowing people to invest small amounts of money to own shares of famous paintings (similar to buying stock in blue-chip companies).

Some of the artists' work you can participate in includes that by Andy Warhol, Jean-Michel Basquiat, Keith Haring, Willem de Kooning, Banksy, Claude Monet, Yayoi Kusama, and Joan Mitchell.

The company was founded by Scott Lynn, Alberto Simon, and Hai Minh Tran, who have a combined 75+ years of art collecting experience.

The company has a Better Business Bureau rating of “A,” on a scale of A+ to F.

Is Art a Good Investment?

Art is an unconventional investment, and most likely, the average person doesn't even think of it in that way at all. But the wealthy know something that the average investor doesn't, and it's how rare paintings from artistic masters are often some of the best-performing assets they have.

This has to do with several factors –

- the widely recognized talent of the artist

- how each piece is unique, and,

- while morbid, once the artist is deceased, no more work will be produced from that source.

Over time, each piece of artwork becomes increasingly valuable.

This process has been aided and abetted by the explosion in both individual wealth and heavy monetary creation by central banks. As more money comes into existence – particularly in the hands of the wealthy – the value of rare artwork gets bid up to levels once considered unimaginable.

There are currently an estimated 47 million millionaires in the world. Not only do they hold an estimated 50% of the world's wealth, but they represent the primary market for rare art. The desire to own such pieces among the wealthy is considerable, and it's reflected in high and rising art value.

A famous example is the Mona Lisa by Leonardo da Vinci. Though it sits on display at the Louvre Museum in Paris, it was valued at $100 million in 1962 but was recently estimated to be worth $1 billion in 2017.

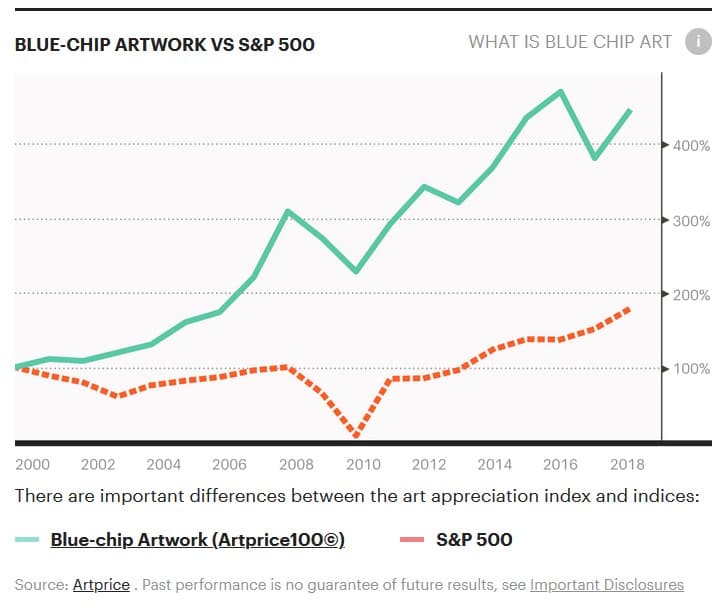

It's not surprising then that rare artwork has outperformed the S&P 500 in recent decades.

“Blue-chip artwork” not only outperformed the S&P 500 in 2018 but also more than doubled its performance since 2000. According to the Artprice100 Index, rare art turned in a 450% return between 2000 and 2018, compared to 200% for the S&P 500.

Investing in Rare Art through Masterworks

Even if you know nothing at all about artwork, you can invest in it through Masterworks. There is no minimum investment across the platform but it is based on each investment. This helps put the opportunity well within reach of investors at nearly all levels. Since you buy shares in each piece of artwork – generally at $20 each – it's possible to spread your investment across 50 different pieces. It will allow you to create a portfolio of rare art with a relatively small investment.

(you may wish to read this primer on how to invest in art)

Investment selection and management will be handled by Masterworks. This is much the same model as mutual funds, exchange-traded funds, and robo-advisors, where you invest your money in the fund and have it professionally managed for you.

The experts at Masterworks are well aware of the difference between ordinary commercial art – which is commonly available – and “investment-grade art.” The latter is the type of rare art created by recognized masters and, typically, commanding millions of dollars per piece.

The Masterworks Art Selection and Investment Process

The company has a staff of 17 professionals who put each piece through a rigorous vetting process. It involves the following steps:

- Masterworks culls through a database of more than 1 million auction records, selecting only paintings created by top performing artists.

- The artwork itself is evaluated. Consideration includes: Does the artist have a global collector base? What is the individual artist's appreciation rate? Is there sufficient demand for the artist's work? And an understanding of the risk of the market for that artist's work.

- Once a piece is purchased, Masterworks files an offering circular with the Securities and Exchange Commission, enabling them to offer the piece publicly.

- Investors can invest in the piece at $20 per share.

- The artwork will be displayed at the Masterworks gallery until it is sold to a collector. It's generally assumed the piece will be held for three to five years before being sold, and the proceeds distributed to shareholders.

Features and Benefits of Investing with Masterworks

Minimum investment. None. You can diversify your investment across several different art pieces.

Investment holding period. Masterworks makes no guarantee as to when a piece of artwork will be sold. However, they generally estimate a holding period of between three and 10 years.

Artwork selection. Since Masterworks holds several art pieces in their gallery at all times, you'll be able to select the specific investments you want to make.

Fee structure. Masterworks charges an annual fee of 1% of your investment value to cover the storage, insurance, and transfer of the artwork. When they sell a piece of art, they collect a 20% commission on the profit.

Investor contact. Available by email [email protected] or by phone at 203-518-5172, 9 AM to 6 PM Eastern. No contact days provided, so presume it's available only during regular business days.

How to Sign Up with Masterworks

Since it is a specialized investment, to join Masterworks you must “request an invitation.” You'll do that by completing a brief online application that will request the following information:

- Your name

- Email address

- Phone number

- Account type – individual investor, investment advisor, existing art collector, art dealer/advisor, or other

- The size of your investment portfolio, which includes stocks, bonds, and other assets

- An answer to the question “How much would you consider investing in blue-chip art over the next 12 months?

You must be at least 18 years old to participate, and you'll be required to create a password for your account.

You must also link a bank account to your Masterworks account. Two test deposits will be run through Plaid to verify your account. Next, a Dwolla account is required to hold and manage your deposited funds.

Should I sign up before I see a piece of art I want to invest in? Yes. If you're at all interested in Masterworks, go through the sign up process because they make investments available to existing accounts first. This can be as many as five days before they open it up to others and if the offering is subscribed in that time frame, newer investors don't get a shot at it.

What Happens When You Sign Up?

Jim signed up and this is what he had to say about the process back in 2019:

After you sign up, you are put on a waitlist to get access to the platform to invest. To get access, you need to schedule a phone call where you talk to one of their representatives about your investment objectives. You can schedule a phone call as soon as thirty minutes after you sign up. For what it was worth, it was not a sales pitch at all (which surprised me honestly!).

We had a casual fifteen-minute conversation in which the rep discussed what they did and answered any questions they had. He told me they aim to get about ten investments a year, or about one every six weeks, and that the $1,000,000 valuation deals often close in about a week. They can hold shares if you want, so you can do additional research without feeling pressure to buy right then and there, but I declined. It was probably the most casual low-pressure “sales” call I've ever been on and I appreciated that.

Process of Buying Artwork

More recently, Jim invested in two pieces of art and here he is to talk about it:

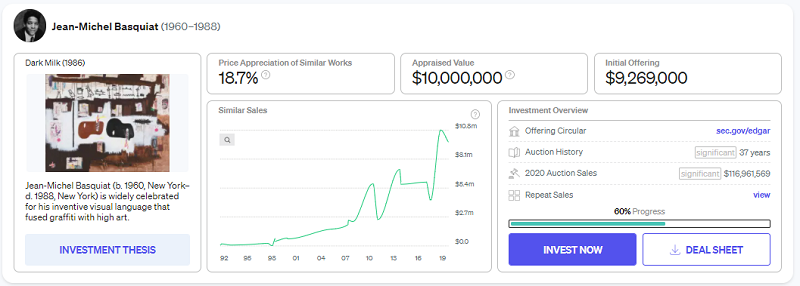

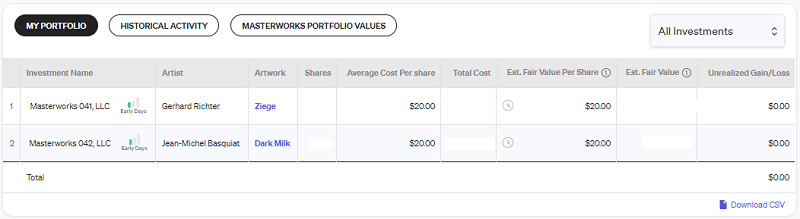

The process for investment was really simple. Since I was on the platform already, I've periodically received emails about new works of art and two recent pieces caught my eye. The first was Ziege by Gerhard Richter, a highly-regarded contemporary German artist, and the second was Dark milk by Jean-Michel Basquiat, an American artist whose name I already knew. Basquiat passed in 1988 at the age of 27 and was considered one of the most influential artists in the 20th century.

Some offerings are subscribed in minutes, others take a little more time. For example, I invested in Dark Milk a week or so ago but, as of 4/21/2021, it was only 60% subscribed:

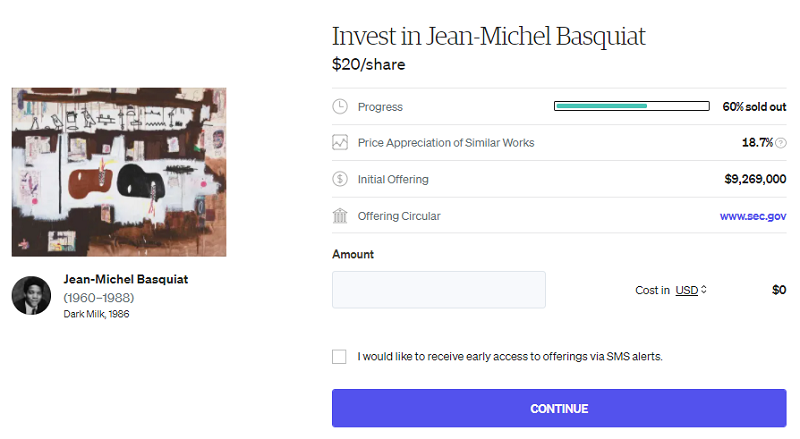

To invest, you just click on the blue-ish Invest Now button and then you'll see this screen:

There is a minimum order on each investment and sometimes it's as low as $100. I believe they start with a higher limit and gradually lower as time goes on.

Once you click through, you have to select who is doing the investing (entity or individual) and then you pass along bank information using Plaid. You can also invest with a credit/debit card, wire, or transfer from an IRA.

After some processing, you're the brand new owner of a (very) small piece of art!

How Jim's Holdings Have Performed

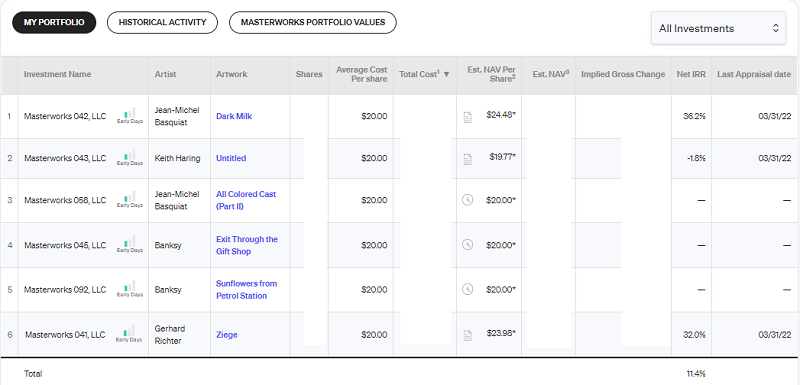

Jim has invested in a few pieces of art and after several months of seeing Masterworks report that they were “Early Days” with no change in value, some of the pieces were re-appraised:

Half the pieces were not re-appraised so they have no change in value, two pieces appraised for a higher value while one piece appraised for a lower value. While I wouldn't make any grand predictions based on these movements, it is another data point to help you think about the platform.

How Have Masterworks Funds Performed

One fun area you can look at is Masterworks Portfolio Values, it lists every investment they've made and the estimated fair value per share. There are currently 55 funds, Masterworks 001, LLC through masterworks 055, LLC, and only 18 of them have an estimated fair value per share that differs from the IPO price of $20 (this is as of June 22nd, 2021:

| Investment Name | Artist | Artwork | IPO Price | Est. Fair Value Per Share | Offering Amount | Implied Gross Change | |

|---|---|---|---|---|---|---|---|

| 1 | Masterworks 001, LLC | Andy Warhol | 1 Colored Marilyn (Reversal Series) | $20.00 | $17.63 | $1,996,500.00 | -11.9% |

| 2 | Masterworks 002, LLC | Claude Monet | Coup de vent | $20.00 | $21.40 | $6,846,500.00 | 7.0% |

| 3 | Masterworks 003, LLC | Banksy | Mona Lisa | $20.00 | $26.67 | $1,039,000.00 | 33.4% |

| 4 | Masterworks 004, LLC | Jonas Wood | Hammer 5 | $20.00 | $18.05 | $1,089,000.00 | -9.8% |

| 5 | Masterworks 005, LLC | Alex Katz | Maxine | $20.00 | $21.23 | $1,188,760.00 | 6.2% |

| 6 | Masterworks 006, LLC | Jean-Michel Basquiat | The Mosque | $20.00 | $19.15 | $5,688,400.00 | -4.3% |

| 7 | Masterworks 007, LLC | Cecily Brown | Girl Trouble | $20.00 | $29.86 | $2,144,000.00 | 49.3% |

| 8 | Masterworks 008, LLC | Kaws | Far Away Friends | $20.00 | $21.21 | $1,284,900.00 | 6.1% |

| 9 | Masterworks 009, LLC | Günther Förg | Untitled | $20.00 | $23.20 | $660,000.00 | 16.0% |

| 10 | Masterworks 010, LLC | Sam Gilliam | Tracing | $20.00 | $23.50 | $770,000.00 | 17.5% |

| 11 | Masterworks 011, LLC | Pierre Soulages | Peinture 102 × 130 cm, 11 Juin 2007 | $20.00 | $23.20 | $990,000.00 | 16.0% |

| 12 | Masterworks 012, LLC | Yayoi Kusama | Infinity Nets T.I.T. | $20.00 | $19.64 | $1,210,000.00 | -1.8% |

| 13 | Masterworks 013, LLC | Kaws | Companion (Detail of Crowd Shot) | $20.00 | $18.30 | $1,518,000.00 | -8.5% |

| 14 | Masterworks 014, LLC | Joan Mitchell | Rhubarb | $20.00 | $22.33 | $5,000,000.00 | 11.7% |

| 15 | Masterworks 015, LLC | Banksy | Monkey Poison | $20.00 | $21.99 | $2,206,000.00 | 10.0% |

| 16 | Masterworks 016, LLC | George Condo | Staring into Space | $20.00 | $23.84 | $1,760,000.00 | 19.2% |

| 17 | Masterworks 017, LLC | Andy Warhol | Little Electric Chair | $20.00 | $20.00 | $3,850,000.00 | — |

| 18 | Masterworks 018, LLC | Keith Haring | Untitled | $20.00 | $19.93 | $2,662,000.00 | -0.4% |

| 19 | Masterworks 019, LLC | Zao Wou-Ki | 15.6.64 | $20.00 | $19.87 | $1,980,000.00 | -0.7% |

All of my investments are too new to have any estimated difference in value.

Pros & Cons of Investing with Masterworks

Pros:

- You can open an account with no minimum and purchase a share of any piece of rare art available for just $20.

- There is a secondary market on the platform so you have liquidity in case you need it.

- Masterworks makes investing in rare art – previously available only to the very wealthy – available to the ordinary investor.

- The return on blue-chip art has been more than twice that of the S&P 500 since 2000.

- Fine art is a true diversification away from traditional assets because its price levels don't depend on the performance of the financial markets.

- Blue-chip art can function as an inflation hedge. That's because the value of each piece tends to increase as the money supply grows.

Cons:

- Since very few people know much about fine art, you'll be relying entirely on their management expertise.

- Fine art is a long-term investment; it may take up to a decade for an investment in a single piece to pay out.

- You'll be paying an annual management fee of 1% on investments that will be producing no investment income; then, there's the 20% commission on the sale of the artwork.

Should You Invest in Art with Masterworks?

First, decide if investing in fine art will work with your portfolio mix. It's an excellent choice if you're looking to diversify your portfolio with a true “hard asset”. Because fine art is rare, it will always have value, and the potential for it to rise in value out of proportion to the financial markets is very real. After all, even during times of financial turmoil, the wealthy often turn to alternative assets as a way to grow their investments. Fine art is one of those assets.

It's best to commit with only a small percentage of your portfolio. After all, despite the high value of blue-chip art, it doesn't pay interest or dividends.

You should have most of your portfolio invested in conventional assets, like stocks and fixed income securities. The art position is mainly a countercyclical alternative.

Still, another reason to maintain a very small investment is that fine art represents uncharted waters to the average investor. You'll be relying on the judgment of management, as there's no way to evaluate the intrinsic or future value of any given piece of art from published sources.

Finally, be keenly aware that artwork is a long-term investment. Not only is there a long payback period, but your investment is illiquid. You'll, generally, be required to hold your position until the specific pieces of art you've invested in are sold by Masterworks.

With those caveats in mind, if you're interested in investing in blue-chip art, Masterworks is your opportunity to do it. Just open an account and then you can choose which pieces you want to invest in. You won't be responsible for any of the details of management since that will be handled for you by the company.

As overall wealth in the world continues to increase, it should take blue-chip art off with it. This is an opportunity to take advantage of that trend.

If you'd like more information, visit the Masterworks website.