Percent

Strengths

- Low minimum investment of $500

- Potential for high returns

- Opportunity to diversify your investment across several different notes

- Purchase private notes, blended notes, or venture investing

- up to $250,000 in FDIC coverage on funds held on deposit

Weaknesses

- Must be an accredited investor

- Cash held with Percent doesn't earn interest

- IRAs require a special type of trustee, referred to as a self-directed IRA (SDIRA)

More and more investors are looking for alternative assets not correlated to stocks or bonds. One of the ways you can diversify is through peer-to-peer lending. In this article, we’re taking a close look at one such platform, called Percent.

But how does Percent compare to other alternative investment apps like Lending Club, Fundrise, and Worthy? In this Percent review, I’ll let you know how the platform works and cover everything from pricing to pros and cons. I’ll let you know what type of investor will want to consider dealing with Percent.

Table of Contents

About Percent

If you’re familiar with platforms like Lending Club and Prosper, you’ll have a basic idea of what Percent is all about. It functions as a peer-to-peer lending platform where investors invest in loans requested by borrowers on the site. It’s a form of crowdfunding that is becoming increasingly popular as both an investment vehicle and a source of capital for business.

Based in New York City, Percent launched in 2018 and is fast becoming a leader in asset-backed and corporate lending. The company has funded over $1 billion in loan transactions thus far, with plenty of room to grow in the multi-trillion-dollar private credit industry.

As an investor, Percent will provide you with an opportunity to participate in private credit deals. These represent an alternative investment once available only to large institutions and wealthy individuals.

Private credit is becoming an increasingly important asset class because it’s a true alternative investment. That means it is not correlated with the stock or bond markets. You can earn solid returns, even if the financial markets are in a serious downturn. It offers diversification within a portfolio otherwise filled with stock market investments.

With Percent, you can choose from a large selection of high-yield, short-duration private credit investments. Because there are multiple deals to choose from, you can select the ones that will work best for you.

Percent At-A-Glance

- Investments offered: Short-term debt instruments and funds that invest in them.

- Eligible investors: Percent is open to accredited investors only. That status requires a high income, assets, or a combination. You may also qualify if you have certain professional designations related to investing.

- Available account types: Taxable investment accounts and special IRA accounts known as self-directed IRAs (SDIRAs), which must be handled through a dedicated SDIRA trustee.

- The minimum investment required: As low as $500, but some investments may require a larger initial investment.

- Mobile app availability: Android and iOS devices.

- Customer service: Phone and email support, Monday through Friday, 9:30 AM to 6:30 PM, Eastern time.

- Account security: Percent employs commercially reasonable safeguards to protect and secure your personal information. For example, personal information is not retained any longer than necessary. It’s periodically reviewed and will either be erased or anonymized when it is no longer needed.

Percent cash deposits are insured by the FDIC for up to $250,000 per depositor. Investors have the option to use two-factor authentication to add an extra layer of protection to their accounts.

What Investments Does Percent Offer?

Percent offers investors a choice of private notes, blended notes, and venture investing. I explain each in more detail below:

Private Notes

Percent offers private credit investment opportunities, such as privately negotiated loans and debt financing. As an investor on the platform, you’ll be making loans directly to borrowers, which are largely small businesses.

The concept is attractive to small businesses that cannot obtain financing from banks. They’re also too small to float bond issues in the bond market, leaving them with limited options for financing. As an investor on the Percent platform, you’ll provide funding in exchange for a higher rate than you can get in conventional fixed-rate investments.

Private credit has the advantage of providing higher returns than you can earn on conventional investments, like Certificates of Deposit (CDs) and bonds. And since they’re not correlated with the financial markets, you may earn positive returns, even when markets are down.

A loan portfolio can be diversified to include small business lending in Latin America, Canadian mortgages, US merchant cash advances, and corporate debt.

Loans can include any of the following:

- Consumer loans

- Trade receivables

- Mid-sized business (SMB) loans

- SMB cash advances

- SMB leases

- Corporate loans

With Percent, you can participate in private debt deals for as little as $500. Terms range from nine months to three years. Returns have been as high as 20% but more commonly fall in the 15% range.

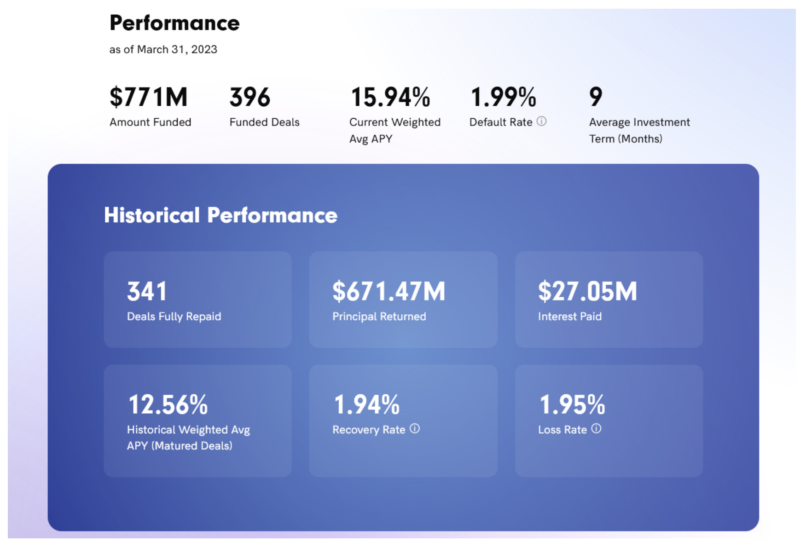

Percent reports the following performance result of their private notes:

Blended Notes

Percent also offers blended notes which offer exposure to multiple notes across different asset classes and geographic locations. You can choose an investment amount, and Percent will use an algorithm designed to prioritize both diversification and investment returns.

Blended Notes are available for a minimum initial investment of $5,000 and require a 1% management fee.

Venture Investing

Percent allows you to invest in debt focused on high-growth, venture-backed companies. This includes short-term debt investments with higher yields. They provide financing to companies between fundraising rounds. Once that fundraising has been obtained, the notes are paid off. Venture investing offers fast-growing businesses access to capital in the form of debt rather than equity positions, which is typical with venture capital firms.

Described on the website as “The Alternatives’ Alternative,” you can invest in venture investing for as little as $500. Unlike private notes, venture investing deals are collateralized by all of the assets of the borrowing entity, sometimes even including intellectual property.

How Do You Sign-up with Percent?

There is no fee to open a Percent account. Once you sign up on their website, you’ll have access to the investment opportunities on the platform. Percent requires you to take the following steps to start:

- Sign up. Percent will ask you for your state ID or passport to verify your identity. You’ll also need to indicate you qualify as an accredited investor. To qualify, you must be high-income, high-net-worth, or both.

- Fund your account. Once Percent has approved your account, you’ll need to fund it. You can do this by wire transfer or ACH from your bank account. Wire transfers will clear on the same or the following day, while ACH transfers can take up to five calendar days. You can begin investing once your funds have cleared your account.

- Sign-up bonus: Percent currently pays a cash bonus of up to $500 when you open a new account and make your first investment. The bonus payout schedule is as follows:

Percent Fees

There are no fees to invest in private notes with Percent. Instead, Percent collects fees from borrowers on the platform. However, Percent is expected to change that arrangement in the future. Percent plans to switch to collecting an amount equal to 10% of the interest paid by a borrower on a note.

That means if a note pays 15%, Percent will collect 1.5%, and the investor will receive 13.5%. For blended notes, Percent charges a 1% annual management fee.

Percent Pros and Cons

Pros:

- Low minimum investment of $500

- Potential for high returns

- Opportunity to diversify your investment across several different notes

- Purchase private notes, blended notes, or venture investing

- up to $250,000 in FDIC coverage on funds held on deposit

Cons:

- Must be an accredited investor

- IRAs require a special type of trustee, referred to as a self-directed IRA (SDIRA)

- Cash held on the platform does not earn interest

Percent Alternatives

If Percent isn’t the right alternative investment platform for you, you do have other choices. The following Percent alternatives are worth considering.

Yieldstreet

Yieldstreet is another investment crowdfunding platform offering to invest in alternative asset classes. They provide a wide variety of asset options, including single and multifamily real estate, commercial finance, legal offerings, marine offerings, and even investments in blue-chip art deals. They even offer an aviation fund so you can earn profits from commercial aircraft leasing.

Similar to Percent, Yieldstreet does require you to be an accredited investor. You can also invest in short-term notes, with higher yields than certificates of deposit and high-interest savings accounts.

If you prefer to invest in a diversified fund that offers all the above asset classes, Yieldstreet offers its Prism Fund. The minimum required investment is $2,500. Learn more in our Yieldstreet review.

Fundrise

Fundrise is an excellent choice if you are especially interested in real estate investing. It has the advantage of enabling you to participate in real estate deals without the need to purchase properties outright. You can participate in commercial real estate deals for as little as $10. There is no requirement for you to be an accredited investor.

Fundrise enables you to invest in eREITs and eFunds – private investments available only on the Fundrise platform – through which you will hold your real estate investments. Fundrise offers five different plans, each with its own minimum initial investment, investment, composition, and expected returns.

They also offer goal-based investing, where you can choose a supplemental income, long-term growth, or balanced investing. It’s one of the top real estate crowdfunding platforms in the industry. Check out our Fundrise review for more details.

Worthy

Worthy may be the investment platform most closely related to Percent. That’s because they also provide investments in debt-related securities. Worthy offers investments in private bonds, which they refer to as Worthy Bonds. At the time of this writing, those bonds pay 5.73% APY, and you can purchase them in denominations of as little as $10.

One of the advantages of Worthy is that they secure their bonds. They are asset-backed loans to small businesses, but Worthy holds up to 40% of your investment in a mix of real estate, US Treasury securities, and certificates of deposit.

Accredited investors can invest up to $50,000 in the bonds, but if you are a non-accredited investor, you will be limited to investing no more than 10% of your annual income. Learn more in our Worthy Property Bonds review.

Should You Sign up with Percent?

If you’re an accredited investor in search of another alternative asset to add to your portfolio, the small business notes Percent offers can be a good fit.

Even as an accredited investor, you should maintain only a small percentage of your portfolio with Percent. Like most alternative investments, the notes offered by Percent carry additional risk, which is the tradeoff for the higher return potential.

FAQs

Most investments carry some level of risk, and Percent is no different. Percent investments are speculative in nature, and Percent does not guarantee your principal. There is a chance that you could lose money. It’s one of the reasons that Percent is only open to accredited investors who have the ability to diversify their investments and manage the risks sufficiently.

Yes. To qualify as an accredited investor, you must meet the following guidelines:

– Net worth over $1 million, excluding the primary residence (individually or with spouse or partner)

– Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years,

and reasonably expects the same for the current year, or

– You must qualify based on certain professional criteria.

You will be required to certify yourself as an accredited investor on the Percent platform.

Once you sign up for the platform, certify yourself as an accredited investor, and fund your account, you can begin investing. You will invest in private notes to small businesses for a minimum of $500 each. But you can also invest in a portfolio of private notes through Percent’s Blended Notes program.

And if you are looking for even more unique investment opportunities, you can also invest through Venture Investing, providing financing to high-growth venture-backed companies.