When it comes to investing, the two most popular options are the stock market and real estate.

Within each, there are different asset classes. In the stock market, you have small companies and big companies. You have domestic and international. With each type, the companies within them are quite different as well. You can avoid a lot of headaches by simply buying an ETF or mutual fund made up of a single class or of the entire market.

With real estate, it’s not nearly as simple. There are publicly traded real estate investment trusts (REITs) and they offer a good option if you want exposure to real estate but don’t want to own any property.

But one asset class that has fascinated me is farmland.

Table of Contents

Why Invest in Farmland?

I’m interested in farmland because it offers equity appreciation as well as cashflow. When you invest in farmland, the land itself can appreciate as the value of farmland increases but you can also get cash from the sale of crops and/or rental payments.

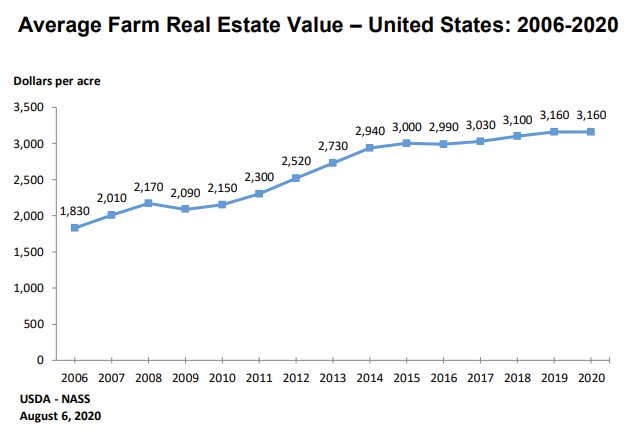

The USDA publishes land value reports on a regular basis and the latest one I saw, from August 2020, shows that an acre of farmland (the entire property) is worth approximately $3,160 in 2020 (no change from 2019):

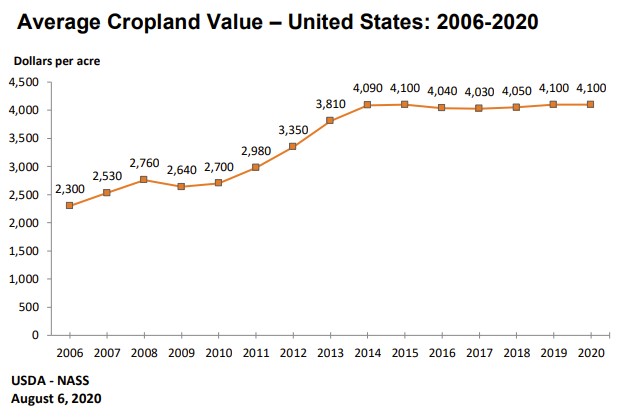

The value of cropland, which is the land on which the crops are grown, is slightly higher at $4,100 per acre:

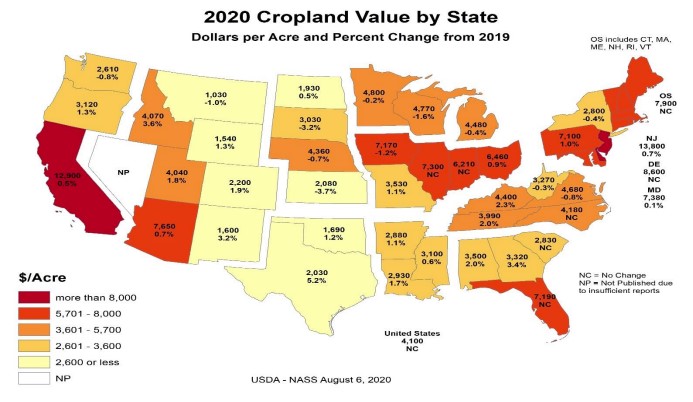

These values are nationwide and you’ll see a huge variance in values based on the state:

Some areas are worth more than others, such as California and the Corn Belt (Iowa, Missouri, Illinois, Indiana, and Ohio), but overall it’s a relatively stable asset class as it experiences a lot lower volatility compared to the stock market (which is to be expected).

Another reason why it interests me is that it has a low correlation with the stock market. People always need food, in good times and in bad, and so the value of farmland doesn’t seem to move much with the stock market. It’s had positive returns even during bad stock market years.

Lastly, since farmland makes food, it benefits from inflation.

(Also another hidden perk from farmland, sometimes they install cell phone towers or wind turbines and the farm can get rent payments for those units.)

How to Invest in Farmland

There are a few ways to invest in farmland without buying the land myself (I would not make a good farmer, I wouldn’t even make a bad farmer… I’d be a HORRIBLE one).

Specialty REITs

The easiest way is to invest in specialty REITs that invest in farmland. The two biggest are Farmland Partners (FPI) and Gladstone Land Corporation (LAND).

Farmland Partners is a Denver, CO based company founded in 2013 that owns about 156,600 across 16 states in North America. They own farms in Alabama, Arkansas, California, Colorado, Florida, Georgia, Illinois, Kansas, Louisiana, Michigan, Mississippi, Nebraska, North Carolina, South Carolina, South Dakota, and Virginia.

Gladstone Land Corporation is based out of Virginia and has been around since 1997. They own 115 farms comprised of 89,128 acres in 10 states (Arizona, California, Colorado, Florida, Maryland, Michigan, Nebraska, North Carolina, Oregon, Texas, and Washington).

Specialty REITs are a convenient way to invest in farmland because:

- Anyone can invest – you don’t need to be an accredited investor;

- The shares are liquid – since you can buy and sell them on the market;

- You get instant diversification – across states, farms, operators, crop types, etc;

- Simple tax preparation – since it’s publicly traded REITs, it’s like trading any other security

The big downside is that you have market risk. If the market sours and people start liquidating, the stock price can go down through no fault of the REIT or its operators. As I write this, Farmland Partners is trading at a discount to its book value. On 12/17/2020, Yahoo Finance has its book value per share at $9.57 while the stock trades at around $8.73.

Farmland Crowdfunding Platforms

If you are an accredited investor (net worth over $1,000,000 or $200,000 in annual income each of the last two years), you could take a look at crowdfunding platforms. Through these platforms you can buy ownership in a piece of a farm without buying the whole thing.

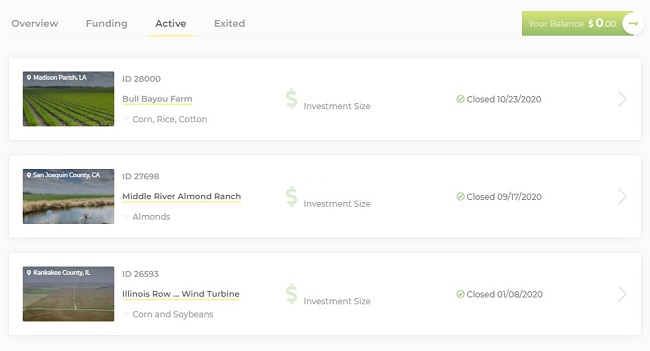

AcreTrader is the platform I’m most familiar with, having invested in parts of three farms, and they allow you buy acres of farmland with relatively low minimums. My first investment was in an Illinois Row Crop Farm with a Wind Turbine – the minimum investment was 5 shares ($4,750.50) with a 9.2% net annual return (what they call net internal rate of return, IRR). One actually failed; you can read about how that worked here.

With each investment, they offer a lot of research so you can dig a little deeper if you want and all of it is available without requiring you to register. I reviewed AcreTrader if you want more information.

FarmTogether is another platform that allows you to invest in individual farms. I have not invested with them yet but their offerings have a minimum of $10,000 and they may use leverage.

FarmTogether offers a sole ownership option . You can buy a whole farm yourself if you’re willing to commit over $1,000,000. One downside of the site is they require you to register before seeing more information (but it’s free).

More reading – FarmTogether review

Farmland crowdfunding platforms are great because:

- Invest in specific farms – You get to take an active role in picking your investments

- Fees are reasonable – AcreTrader’s standard 0.75% fee structure feels fair

- You pick your mix of equity growth and cash flow – Different deals offer different structures, so you can pick what works best for you

There are drawbacks though:

- The cashflow is mostly ordinary income – When you get distributions, it’s not going to be long term capital gains or return of capital. REITs can sometimes play tax accounting games where part of the distribution is returning your money, but you don’t get that here.

- You’ll have to file more tax forms – Just like a baseball player has to file taxes in each state they play, you will now need to file a state tax return for each state in which you own a farm. That’s because you’re getting income in the state.

- Highly illiquid – These investments have 5 and 10 year hold periods with no way to get your money out.

Curious about how they compare to one other? Check out our AcreTrader vs. FarmTogether post.

I see this asset class as a nice hedge against the market. It’s also fun to invest in something different.

Get Free Farmland

Did you know that you can get free land in the United States? This is more prevalent in the midwest where they will offer you free land incentives with the hopes you will develop it into something more economically viable. In many areas, the primary industry is farming and ranching so you could continue the trend and develop the land for use that way.

For example, Flagler, Colorado is two hours east of Denver and is giving away tracts of land for individuals and businesses. The land has no infrastructure but it is free and you will be expected to develop it. It’s not for the faint of heart but if you’re eager, it represents a good opportunity for free farmland.

What do you think?