Worthy

Strengths

- Earn 5.65% APY on your Worthy Bonds investments

- Invest with as little as $10.

- There are no fees of any kind

- Worthy Bonds are liquid, and you can withdraw funds at any time

Weaknesses

- Worthy Bonds can be defaulted on, causing you to lose some or all your investment.

- No FDIC or SIPC insurance is offered with the bonds.

- Maximum investment is limited to $50,000 for accredited investors, and no more than 10% of the annual income of nonaccredited investors.

For many years, while banks were offering low rates in a low interest rate environment, an alternative appeared that proved fairly attractive.

As rates have risen, Worthy Property Bonds appear a bit less attractive but may still be worth consideration.

If you’re not happy with your savings rate, a company called Worthy Property Bonds gives you an opportunity to earn slightly higher returns through the use of bonds.

If you are interested, here are the details:

Table of Contents

- What is Worthy Property Bonds?

- How Does Worthy Property Bonds Work?

- Worthy Property Bonds Round-ups

- Worthy Property Bonds Referral Program

- Worthy Property Bonds Features

- How to Sign Up with Worthy Property Bonds

- Who Should – And Shouldn’t – Invest with Worthy Property Bonds

- Worthy Property Bonds Pros & Cons

- FAQs

- Bottom Line

What is Worthy Property Bonds?

Worthy Property Bonds is a service that provides loans to US-based businesses by selling bonds to investors that pay an incredible 5.65% APY. Based in Boca Raton, Florida, the company has already sold more than $170 million in bonds to over 100,000 investors.

Not only will you be earning a high rate of return on your investment, but you can know that you’re doing your part to help small businesses grow.

The bonds you’ll invest in are “demand” bonds with no maturity date. You can hold them for as long or as short as you wish.

You can also be secure in the knowledge that Worthy Property Bonds is registered with the Securities and Exchange Commission (SEC), and that the bonds issued are SEC-qualified bonds. That means they’re privately issued corporate bonds that don’t trade on public exchanges.

You can think of Worthy Property Bonds as a peer-to-peer lender, connecting investors searching for higher yields, with local entrepreneurs looking to grow their businesses.

How Does Worthy Property Bonds Work?

Worthy Property Bonds sells $10, 5.65% APY interest-earning bonds to the public and then aggregates the capital and loans to real estate developers. That’s roughly the same as the 5.04% average return on US corporate bonds, or the 1.63% being paid on ten-year U.S. Treasury notes as of January 2023.

Interest is compounded annually and credited to your account once accrued interest reaches at least $0.01.

While most of the proceeds of the bonds are invested in asset-backed loans to small businesses, up to 40% are invested in a mix of real estate, U.S. Treasury securities, and certificates of deposit. The purpose of the additional asset investments is to provide a higher degree of diversification for your bonds.

Interest rates are fixed since your money is invested in private bonds. Rates will not go down because of policy changes by the Federal Reserve.

Given that the loans are made to small businesses, there is always the risk of loss. However, Worthy Property Bonds states that they have never missed a principal or interest payment up to this time.

Worthy Property Bonds accommodates both accredited investors and nonaccredited investors. The main difference is accredited investors are eligible to invest a larger amount of money in the bonds. An accredited investor can invest up to $50,000 in Worthy Property Bonds, while a nonaccredited investor is limited to no more than 10% of their annual income. If that income is $50,000, the most you can invest is $5,000.

You can withdraw principal or interest earned on the bonds from your account at any time. But there is a restriction that you can only withdraw interest amounts of less than $10 twice in any 30-day period.

Learn more about Worthy Property Bonds

Worthy Property Bonds Round-ups

While you can fund your account with transfers from a connected bank account (and even automatic purchases), Worthy Property Bonds also offers their round-up feature to help you build your account passively.

You’ll choose a spending account to connect to your Worthy Property Bonds account, which can be a checking account or credit card. Worthy Property Bonds will monitor that account the track spare change from ordinary purchases. That change will be moved into your Worthy Property Bonds account when the total reaches the $10 bonds purchase requirement.

For example, if you make a purchase for $5.25, Worthy Property Bonds will allocate an additional $.75 of the purchase for bond investing. If you make 50 purchases per month through the credit card or checking account you’ve connected, that may result in something like $25 per month going into your Worthy Property Bonds account.

Worthy Property Bonds Referral Program

If you refer someone to Worthy Property Bonds, and that person opens an account using your personal referral invitation link, both you and your referral will earn $10 in bonds. You can earn up to $500 per year through the referral program.

Worthy Property Bonds Features

Minimum investment required: $10

Accredited investor requirement: Worthy Property Bonds accepts both accredited and nonaccredited investors. Accredited investors can invest up to $50,000, while nonaccredited investors are limited to not more than 10% of their annual income.

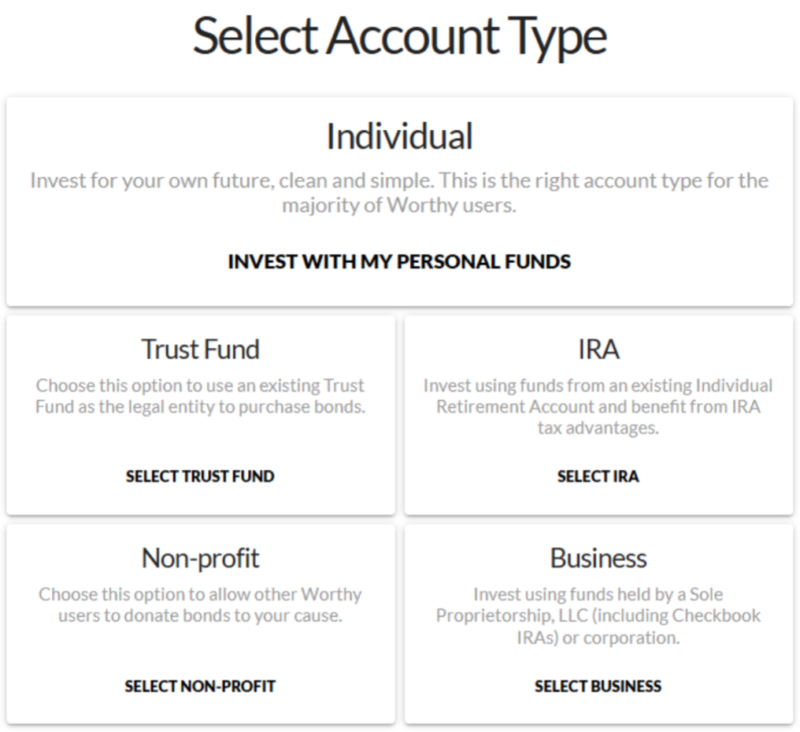

Available account types: Individual taxable accounts, IRAs, trust funds, business accounts, and nonprofit accounts.

Investments offered: Private bonds invested in loans made to small US-based businesses.

Worthy Property Bonds fees: None.

Customer service: Phone, live chat, and email.

Mobile App: Available on Google Play for Android devices, 7.0 and up, and on The App Store for iOS devices, 10.0 and later. Mac devices require macOS 11.0 or later, and a Mac with Apple M1 chip.

Liquidity: Worthy Property Bonds can be liquidated at any time, including accrued interest. There are no early withdrawal penalties either. You can withdraw funds just by clicking on the “Withdrawal” button.

Account security: Accounts are not protected by either FDIC or SIPC. But bonds are secured by borrowers’ assets, and a portion of each bond is invested in other asset classes, including certificates of deposit, U.S. Treasury securities, and real estate.

How to Sign Up with Worthy Property Bonds

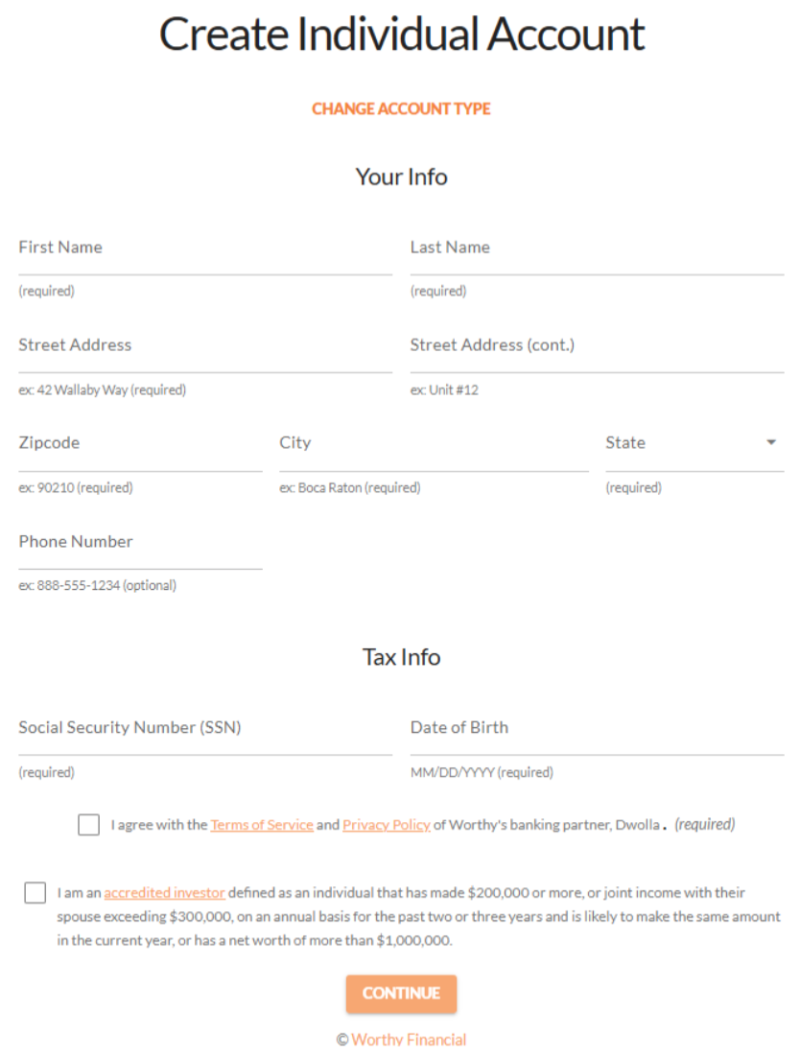

To be eligible to open an account with Worthy Property Bonds, you must be at least 18 years old, have a Social Security number, a US bank account, and a US address.

You can sign up with Worthy Property Bonds on the website. You’ll start by entering your email address and creating a unique password.

Next, you’ll select an account type. You’ll be given five options:

Once you’ve chosen the account type you want to open, the next input screen will ask for general information. That will include your name, address, phone number, Social Security number, and date of birth.

At the very bottom of the screen, you’ll need to check the box acknowledging agreement with the terms of service and privacy policy (of Worthy Property Bonds banking partner, Dwolla). Equally important, you’ll need to indicate if you are an accredited investor.

The next step will be to add a funding source, typically a bank account. You can enter a checking or savings account, which will include your account number and your bank routing number.

Like most financial platforms, Worthy Property Bonds will verify your funding source with micro-deposits. Two very small (less than $1) deposits will be transferred to your bank account, after which you will confirm receipt.

But Worthy Property Bonds also offers their Instant Verification service. If your bank is a supported institution, your account can be instantly verified. The service can accommodate more than 2,800 US-based institutions. You can check to see if yours is one before going the micro deposit route.

Once your bank account is connected to your Worthy Property Bonds account, you can transfer funds and begin investing in bonds.

Who Should – And Shouldn’t – Invest with Worthy Property Bonds

Worthy Property Bonds is an option for anyone who is looking for a stable source of high interest on their savings.

While Worthy Property Bonds is a way to increase the overall rate of return on your savings, they shouldn’t be used to replace other savings vehicles. After all, there is significant risk involved with these bonds, and no FDIC insurance to cover you.

But by allocating a small percentage of your savings to Worthy Property Bonds, you can achieve a serious increase in your overall return.

For example, let’s say you have $10,000 in savings, currently earning 0.50%, or $50 per year.

By allocating $2,000 of your savings to Worthy Property Bonds, paying 5.65% APY you’ll increase the overall interest on your savings.

Learn more about Worthy Property Bonds

Worthy Property Bonds Pros & Cons

Pros:

- Earn 5.65% APY on your Worthy Property Bonds investments.

- Interest rates won’t be affected by changes in policy by the Federal Reserve or by shifts in the financial markets.

- You’ll be investing in small businesses, helping them to grow, provide jobs, and strengthen the economy.

- Invest with as little as $10.

- There are no fees of any kind when you invest with Worthy Property Bonds.

- Worthy Property Bonds are completely liquid, and you can withdraw funds at any time, including interest, without paying a prepayment penalty.

- You can use the Worthy Property Bonds roundups feature to accumulate funds for bond investing, in addition to making direct transfers from your bank account.

- Bonds are largely secured by business assets, with up to 40% invested in real estate, certificates of deposit, and U.S. Treasury securities.

Cons:

- Worthy Property Bonds can be defaulted on, causing you to lose some or all your investment.

- No FDIC or SIPC insurance is offered with the bonds.

- Maximum investment is limited to $50,000 for accredited investors, and no more than 10% of the annual income of nonaccredited investors.

- Worthy Property Bonds are not available to non-US residents.

FAQs

Worthy Property Bonds is a Securities and Exchange Commission registered company, which means it’s a legitimate company as far as the US government is concerned.

There’s always the possibility the borrower will default on the bonds you hold. It’s possible to lose part or even all of your investment. In the case of borrower default, SIPC does not apply

That said, part of your investment in Worthy Property Bonds is held in other asset classes, beyond loans to borrowers. Those asset classes include certificates of deposit, U.S. Treasury securities, and real estate. Depending on the percentage of your investments held in these assets, it’s unlikely you’ll lose 100% of your investment.

Worthy Property Bonds makes money on the “spread” between the interest they charge the borrower and the 5.65% APY return they provide to their investors. For example, if the borrower pays 7.5% on the bonds, and Worthy Property Bonds investors are paid 5.65% APY, Worthy Property Bonds earns the difference.

Bottom Line

🚨In April 2023, with no-penalty CDs rates at close to 5% APY – it’s hard to justify going with private bonds for just 0.65% APY more. Worthy was offering these same rates when high yield savings rates were half a percent and back then, this was more attractive. Our rating is for the platform itself and not necessarily the attractiveness of its rates relative to alternatives.

Worthy Property Bonds offers a unique combination of high interest, no fees, and liquidity that’s difficult to find in many other types of investment.

Though it’s not suitable to hold all your savings, you can increase your overall interest rate return by investing in Worthy Property Bonds.

If that’s a strategy you believe will work well for you, consider Worthy Property Bonds. You can begin funding your account with as little as $10, then build it with a combination of automatic or occasional bank transfers, or even through their round-up program.