I love Vanguard.

The bulk of my investments are there, minus a few dividend growth stocks I hold in an Ally Invest account.

I'm not the only one.

Of the top 25 largest mutual funds by assets, thirteen are from Vanguard (source, 2/16/2021, special note).

When I say “best Vanguard funds,” that's not to say that there are good ones and bad ones. Every fund has its place and Vanguard's funds are generally very good because they do the job and they have low fees. When it comes to something like an index fund, which tracks a specific thing, one of the biggest factors is the expense ratio (its cost).

The best index fund is the low-cost index fund. 🙂

Another important factor with index funds is tracking error, which is how much the fund deviates from the index itself. Indices change and funds have to adjust to match them, but Vanguard's funds have some of the lowest tracking errors. They're very efficient.

These are the ones I like the most (no particular order).

| Fund | Ticker | Expense Ratio | Morningstar Rating |

|---|---|---|---|

| 1. Total Stock Market ETF | VTI | 0.03% | ⭐⭐⭐⭐ |

| 2. Total International Stock ETF | VXUS | 0.08% | ⭐⭐⭐⭐ |

| 3. S&P 500 ETF | VOO | 0.03% | ⭐⭐⭐⭐ |

| 4. Target Retirement 2050 | VFIFX | 0.08% | ⭐⭐⭐⭐ |

| 5. REIT ETF | VNQ | 0.12% | ⭐⭐⭐⭐ |

| 6. Total Bond ETF | BND | 0.03% | ⭐⭐⭐⭐ |

| 7. Wellington | VWELX | 0.24%/0.16% | ⭐⭐⭐⭐⭐ |

| 8. High-Yield Tax-Exempt Fund | VWAHX | 0.17%/0.09% | ⭐⭐⭐⭐⭐ |

| 9. STAR Fund | VGSTX | 0.31% | ⭐⭐⭐⭐ |

| 10. Windsor Fund | VWNDX | 0.30%/0.20% | ⭐⭐⭐ |

I include Morningstar ratings but remember to take into account your own financial situation and not rely strictly on ratings. Also, Morningstar has a premium product that is worth a look if you're considering a deeper dive into each.

Want to work with a Vanguard Financial Advisor?

Vanguard has recently started offering the ability for you to work with a financial advisor through their Personal Advisor Services. It's a 1-on-1 service with a fiduciary that has your interests in mind.

The initial consultation is complimentary and includes a custom plan.

🔃 UPDATED: We updated this post on 3/14/2024 with updated details about each of the funds. In most cases, this only resulted in a change of their holdings (percentages shifted slightly) as well as some of the expense ratios. The funds are largely the same, with the same target allocations, and many of the changes are the result of market fluctuations.

Vanguard Total Stock Market ETF (VTI)

Quick Fund Stats:

- Ticker: VTI

- Expense Ratio: 0.03%

- Asset Class: Domestic Stock – General

- Category: Large Blend

- Minimum Investment: No Minimum

The Vanguard Total Stock Market is exactly what it sounds like, the entire market including large, mid and small-cap companies in the United States. VTI is the bomb dot com (does anyone still say that?). The expense ratio, as of March 2024, is a mere 0.04%.

When Vanguard says Total Market, they're trying to track the CRSP US Total Market Index. CRSP stands for the Center for Research in Security Prices and its index includes 4,000 companies.

Vanguard Total International Stock ETF (VXUS)

Quick Fund Stats:

- Ticker: VXUS

- Expense Ratio: 0.08%

- Asset Class: International/Global Stock

- Category: Foreign Large Blend

- Minimum Investment: No Minimum

The Vanguard Total International Stock ETF is like the VTI except we're going international. It is also an index fund and seeks to track the FTSE Global All Cap ex US Index, which includes all publicly traded companies located outside the United States. The expense ratio of 0.11% puts it, like its many other index fund friends, in the “very low” category compared to its peers.

Vanguard S&P 500 ETF (VOO)

Quick Fund Stats:

- Ticker: VOO

- Expense Ratio: 0.03%

- Asset Class: Domestic Stock – General

- Category: Large Blend

- Minimum Investment: No Minimum

The Vanguard S&P 500 ETF is an index fund that mirrors the S&P 500 index. With a 0.03% expense ratio, it's one of the cheapest S&P 500 index funds.

For comparison, Fidelity's 500 Index Fund has a a 0.015% expense ratio with no minimum. Here's a comparison of VOO vs. VXIAX, they're very similar.

The S&P 500 index consists of 500+ large-cap U.S. companies and considered the best gauge of large-cap US companies – it consists of approximately 80% of the available market capitalization.

If you're considering this fund or the Total Market version, here's our breakdown of VOO vs. VTI. Also, if you're wondering how it compares with another popular S&P 500 fund, SPDR S&P 500 ETF Trust (SPY), here's our comparison of VOO vs. SPY.

Vanguard Target Retirement 2050 Fund (VFIFX)

Quick Fund Stats:

- Ticker: VFIFX

- Expense Ratio: 0.08%

- Asset Class: Life-Cycle

- Category: Target-Date 2046-2050

- Minimum Investment: $1,000

Target date retirement funds are popular options because they offer a diversified portfolio without all of the work. The idea is that they will adjust their allocations to meet the needs of someone looking to retire at the retirement date. The 2050 Fund is meant for people retiring between 2048 and 2052.

The expense ratio of 0.08% (as of March 2024) is quite modest for a fund that adjusts like this.

The 2050 target fund invests in other Vanguard funds, as of March 2024, this was the mix:

- Vanguard Total Stock Market Index Fund Institutional Plus Shares – 54.60%

- Vanguard Total International Stock Index Fund (Investor Shares) – 35.70%

- Vanguard Total Bond Market II Index Fund (Investor Shares) – 6.80%

- Vanguard Total International Bond II Index Fund (Investor Shares) – 2.90%

The minimum investment in the target funds is just $1,000 – compared to $3,000 for most other mutual funds at Vanguard.

Vanguard has a lot of these life-cycle funds – everything from a target date of 2010 (already retired) to 2060 (oh you kids).

Vanguard REIT ETF (VNQ)

Quick Fund Stats:

- Ticker: VNQ

- Expense Ratio: 0.12%

- Asset Class: Stock – Sector-Specific

- Category: Real Estate

- Minimum Investment: No Minimum

Who doesn't like a little real estate diversification in their life? If you don't feel like getting involved in crowdsourced real estate investing, REITs are a good way to go.

Vanguard's REIT ETF is a fund of other REITs, which are publicly traded holding companies for real estate. VNQ has an expense ratio of 0.12% and its holdings consist of big companies you've probably heard of if you've looked into this space – Simon Property Group, Public Storage, etc.

This is a solid way for non-accredited investors to get involved in real estate too (accredited investors is a designation for high net worth or high income individuals). Alternatively, there are sites like Fundrise (our full Fundrise review) that run their own eREITs that give you a little more specificity in options.

Vanguard Total Bond ETF (BND)

Quick Fund Stats:

- Ticker: BND

- Expense Ratio: 0.03%

- Asset Class: Intermediate-Term Bond

- Category: Intermediate-Term Bond

- Minimum Investment: No Minimum

What a great ticker – BND – for a solid bond market ETF.

As of March 2024, the Total Bond ETF holds U.S. investment-grade bonds with an average effective maturity of 8.7 years. The bonds themselves have a smattering of all issuer types of are heavily weighted with Treasury/Agency (46.50%), Government Mortgage-Backed (20.50%), and Industrial (15.50%). There is a small slice of Foreign bonds (3.10%) so this is not a wholly domestic bond ETF.

Vanguard has over a dozen bond ETFs, with varying maturities, bond quality, etc. This fund checks all the boxes and runs about average in all characteristics while having a very low, Vanguardian, expense ratio.

Vanguard Wellington Fund (VWELX)

Quick Fund Stats:

- Ticker: VWELX

- Expense Ratio: 0.25% Investor, 0.17% Admiral

- Asset Class: Balanced

- Category: Moderate Allocation

- Minimum Investment: $3,000 ($50,000 for Admiral)

I was torn adding this to the list because it's one of Vanguard's more expensive funds at 0.25% for the Investor Shares and 0.17% for the Admiral Shares (with a $50,000 minimum!).

I included it because it's Vanguard's oldest mutual fund having been founded in 1929. It's two-thirds stocks and one-third bonds, broad diversification, and it recently was re-opened for new investors. For a while, it was closed to new investors and there was something alluring about not being to invest in a fund, especially when you consider so many of Vanguard's funds are for everyone.

That said, there a reason why funds close – they get too much capital and the pressure to deploy it is immense. Mo' money, mo' problems, right?

Vanguard High-Yield Tax-Exempt Fund Admiral Shares (VWAHX)

Quick Fund Stats:

- Ticker: VWAHX

- Expense Ratio: 0.17% Investor, 0.09% Admiral

- Asset Class: Long-Term Bond

- Category: High Yield Muni

- Minimum Investment: $3,000 ($50,000 for Admiral)

This last one represents a very specific type of investment that fulfills a small need – if you want a low cost municipal bond fund with a bit of risk then the Vanguard High-Yield Tax-Exempt Fund Admiral Shares (VWALX) is a fine one. It's volatile because it's higher risk due to lower credit quality, so it's not your typical “safe” bond fund, but it's also federal tax-exempt interest.

As of March 2024, the bulk of the credit quality is AA (18.60%), A (35.20%) and BBB (15.40%) with maturities in the 5-10 Years (13.10%), 10-20 Years (28.10%) and 20-30 Years (35.20%) range. You'd expect it to be impacted by interest rates pretty significantly. The average stated maturity is 17.2 years, which has come down from around 18 years last year around this time.

Vanguard STAR (VGSTX)

Quick Fund Stats:

- Ticker: VGSTX

- Expense Ratio: 0.31% Investor

- Asset Class: Balanced

- Category: Moderate Allocation

- Minimum Investment: $1,000

The Vanguard STAR Fund has a special place in my heart because when I started investing, ETFs did not exist. If you wanted to invest in a Vanguard fund and did not have $3,000 – the Vanguard STAR Fund and its $1,000 minimum was the only game in town. It became the best Vanguard fund for me because it was the only one I could invest in!

The investment itself is OK, it's a mix of other Vanguard funds which explains the higher 0.31% expense ratio – some of the underlying funds have higher fees.

Here are the underlying funds as of March 2024 (all Investor Shares):

- Vanguard Windsor II Fund – 14.60%

- Vanguard U.S. Growth Fund – 12.30

- Vanguard Long-Term Investment-Grade Fund – 12.10%

- Vanguard Short-Term Investment-Grade Fund – 12.00%

- Vanguard GNMA Fund – 12.00%

- Vanguard International Growth Fund – 9.70%

- Vanguard International Value Fund – 9.50%

- Vanguard Windsor Fund – 7.70%

- Vanguard PRIMECAP Fund – 6.20%

- Vanguard Explorer Fund – 3.90%

Vanguard Windsor Fund (VWNDX)

Quick Fund Stats:

- Ticker: VWNDX

- Expense Ratio: 0.42% Investor, 0.32% Admiral

- Asset Class: Domestic Stock – General

- Category: Large Value

- Minimum Investment: $3,000 ($50,000 for Admiral)

This is one of the few actively managed funds on this list and it's Vanguard's oldest mutual fund. It looks to give you exposure to stocks (2/3rds of the portfolio) and bonds (1/3rd) while not letting one or two companies dominate the fund.

It's top holdings as of March 2024 are what'd you expect to see – Microsoft, Alphabet/Google, Apple, Amazon, Facebook – but the market value is distributed relatively evenly.

For an actively managed fund, it's 0.42% expense ratio is affordable but higher than other passive Vanguard fund. There are no other fees or loads (commissions).

✨ Related: Vanguard vs Betterment: Which Is Best for You

Frequently Asked Questions

How much money do you need to start a Vanguard account?

$1,000. That's the minimum amount you need for Vanguard's Target Retirement Funds and their Vanguard STAR Fund. If you have $3,000, that's the minimum for almost every other Vanguard Fund. If you are interested in Vanguard's ETFs, then the minimum is the price of a single share (~$50).

What are the fees for a Vanguard account?

They vary but Vanguard charges a $20 annual fee on brokerage accounts but you can avoid this account service fees by opting for electronic statements.

If you have over $10,000 in assets, they will also waive this fee.

Why Fees Matter

Many of the Vanguard passive index funds have tiny expense ratios and no loads, which is a commission on the buying and selling of the funds.

Intuitively, we look at these fees of 1%, 0.5%, of whatever – we think it's small.

It's not.

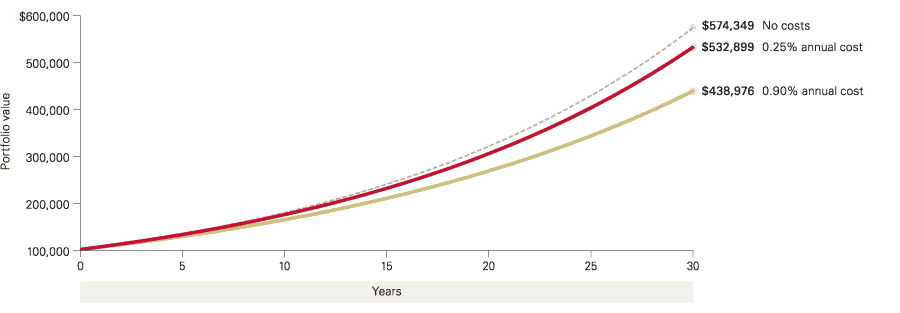

I looked at the most important number in investing and was amazed at how a small fee difference impacted your savings. Over 30 years, a 0.65% difference in fees has a huge impact:

It makes sense, it's just that we don't think about the magnitude when we see a small 0.95% fee.

Vanguard ETFs versus Mutual Funds?

I had a lot of misconceptions about ETFs.

What's the difference between the Vanguard ETF and the equivalent mutual fund?

First, mutual funds and exchange-traded funds are fundamentally different creatures. When you buy and sell (redeem) a mutual fund, you deal directly with the fund itself. When you buy and sell shares of an ETF, you're doing so on the open market.

Functionally, the biggest difference is that an ETF can be bought and sold when the market is open because it's traded just like a stock. A mutual fund is transacted just once a day when the market closes.

Expense ratios are similar: With Vanguard's Mutual Funds and ETF equivalents, the expense ratios are similar. Vanguard funds have two classes – Investor and Admiral shares. The Admiral shares have a lower fee but may require a higher minimum investment.

The ETF expense ratio mirrors the Admiral shares but has no minimum investment.

Here's a comparison of expense ratios for the Vanguard Total Stock Market Fund/ETF:

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) – 0.04%, $10,000 minimum

- Vanguard Total Stock Market ETF (VTI) = 0.03%, no minimum

Here's a comparison of VTSAX vs. VTI.

Transaction fees waived in a Vanguard account: When you buy and sell shares of an ETF, you pay a transaction fee just as you would any other stock. If you buy and sell shares of Vanguard ETFs within your Vanguard brokerage account, you do not pay a fee. If you buy and sell shares of Vanguard ETFs through another brokerage firm, you'll pay a transaction fee.

For all practical purposes, a Vanguard ETF is more flexible than the equivalent mutual fund.

What are Vanguard Admiral funds?

Vanguard mutual funds have two classes – Investor Shares (regular) and Admiral Shares. Investor Shares usually have minimum investments of $3,000 whereas Admiral Shares have higher minimums of $10,000. The Admiral Shares also come with a lower expense ratio, usually matching the expense ratio of the corresponding ETF.

You can start with Investor Shares and when the balance exceeds $10,000, request they be converted to Admiral shares (it is a non-taxable event).

Wise Money Tips says

True that many investors see a small difference in expense ratio and think it’s not a big deal. But over time it can result in a very significant variation in portfolio value.

JoeHx says

These are all good ones. Personally I invest mostly in the total stock market, although I do the index fund one (VTSAX), plus a little in the total bond market fund. I might put some in the REIT at a later date. The total international fund sounds interesting, as well.

Matt says

Thanks for putting this list together Jim! I love Vanguard as well and would be a Boglehead if I didn’t invest in individual growth stocks myself. My 401k is through them and I hold their S&P 500 index fund through it. The funny thing is I still see advertisements all over the web for Vanguard. I guess when you’re king of the hill, you still have to fight to stay on top. Great fund company and great founder!

Wealthy Content says

Good summary, I am a Vanguard fan myself.

I have VIG and VXUS in my portfolio outside of the normal S&P 500.

One of my newer editions not mentioned here is MGK, which I believe should always have good returns over the long term, over the past few years it has been a flyer.

Bernard says

As of late my broker, eTrade, offers a multitude of Vanguard ETFs without any load, and without any transaction fees.

So I can buy VTI (and Voo) at an 0.04 expense ratio, or open a Vanguard account and buy VTSAX with the same 0.04 (Admiral) expense ratio instead.

Can you please make an argument for going the latter route?

There is no reason to go with Vanguard if ETrade gives you access to those ETFs without a fee.

Matt Davis says

Jim, good write-up. Thanks for calling attention to the silent killer of investor performance–fees. Also, while there are several top-tier companies, Vanguard is certainly in the upper-echelon for retail investors for not only low fees, but for avoiding some of the weapons of mass destruction like 3x levered ETFs or other dangerous products like “inverse-ETFs”. A lot of times unsophisticated investors see “ETF” after the name and automatically assume it’s along the lines of an equally weighted S&P 500 ETF, when in reality it’s a terrible product.

Speaks to how ubiquitous index funds are when people confuse ETF with a specific index ETF but you’re right, there are a lot of terrible (and dangerous) ETFs.

Anthony Wren says

Appreciated the graph of the “fees” over time. I have a question: Should I be paying a fee of 1% to a CFP to manage my IRA that is built on a Vanguard passive account?

Here is my current situation.

I currently have a Vanguard passive account with investments distributed in VXUS, VOO, VXF, BND, BNDX. I am 68 years old. My CFP with Cambridge Investment Research transferred funds from a 403b to an IRA (with the Vanguard portfolio) when I retired in 2016 (I started my 403b with an IVY fund and paid in $82,000 total over 13 years). Over the last three years i have been paying on average about $1700 in fees. My current portfolio grew from $100,000 to $129,000, (2019 year) then quickly fell to $88,000 in mid March 2020.

My investment portfolio now shows a 1.52% growth. Seems unbelievably poor return over the years and it is costly. I am barely ahead of the CPI for the time period.

How do I take advantage of the Vanguard low expense costs? Who do I contact?

1% seems like a very high amount to allocate your assets unless you’re getting more from the CFP than asset allocation. I’d speak to someone at Vanguard about transferring your assets there directly if you want to manage it yourself.

DEE RUBIN says

Hi Jim,

Thank you for the Vanguard information. I have found your insights in different areas of finance to very helpful and I have applied some of your recommendations. I am a Vanguard client and they have done an impressive job managing my account. I plan to access some of the information you shared today to suggest adjustments to my current portfolio.

I’m appreciative

Dee Rubin

That’s fantastic Dee!

John E Doane Jr says

I haven’t invested in mutual funds in a along time. Use to be that I would look for no-load funds with a $10,000 minimum investment. These were thought to be the best and safest. I now have $50,000 to invest and I was thinking that 5 funds with those parameters would be my best bet. Now I’m wondering what would be the best way to go, as I don’t see these $10,000 minimum funds. Should I diversify into smaller minimum funds or go straight to, say, one single $50,000 minimum fund?

I think looking at minimum investment values is the wrong way to approach investing, you should be reviewing your goals and investing in funds that will help you reach those goals. The minimum investment amount is largely irrelevant.

Richard Chang says

Hi, Jim,

This is regarding automatic monthly investment in an IRA account – mutual fund vs. ETF.

I’m not an active investor and have been investing in Charles Schwab SWPPX S&P 500 mutual fund for my IRA account with automatic investment setup (twice a month).

For 2021, my wife would like to open a Vanguard IRA account.

Can she set up automatic monthly investment if she invests in Vanguard’s S&P 500 ETF?

I’m looking forward to hearing from you soon. Thank you.

Happy New Year!

Richard

I believe so – automatic contributions are supported by Vanguard.

Alan Strudas says

I am interested in investing in the Vanguard Federal Money Market as was recommended by a CPA in order to protect my money in these uncertain times and have some return on my money investment. How do I locate the Federal Money Market Fund and is the VMFXX the correct symbol? Thank you, Alan

That is the correct ticker for the Vanguard Federal Money Market fund.