There’s something sexy about owning gold.

In times of turbulence, gold seems to be valued as a store of value. It’s never bad to get a little stability as fiat currencies rise and fall in value relative to one another. We recently spent some time in England over the summer and enjoyed how far the US Dollar goes relative to the pound sterling!

A lot of folks misunderstand the value of gold in a portfolio. It’s not meant to be an investment in the typical sense. You don’t own it because you think the value of it will go up. You own it because it offers stability. It’s the dollar that moves, not gold.

But owning gold isn’t easy. You can buy gold bullion online, get it shipped to your house, but then you have to store it in a safe place. If you need to sell it, that’s a whole other set of headaches.

Vaulted is a new company, backed by an old experienced company, looking to make gold more accessible.

Table of Contents

Who is Vaulted?

Vaulted is backed by McAlvany Financial Group and International Collectors Associates, LLC, known as McAlvany ICA, and headquartered in Durango, CO. They have an A+ rating from the Better Business Bureau.

McAlvany ICA was founded in 1972 by Don McAlvany. Back then, owning gold bullion was illegal due to Executive Order 6102, signed in 1933 by President Franklin D. Roosevelt. It forbid “the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” It wouldn’t be until 1974 that this order was lifted by President Gerald Ford. So for the first few years, McAlvany and his wife designed religious-themed gold medallions, which was still legal. You have to love a backstory like that!

Today, McAlvany ICA is a full-service precious metals provider and Vaulted is their latest foray into being able to help people buy and sell physical gold.

How Vaulted Works

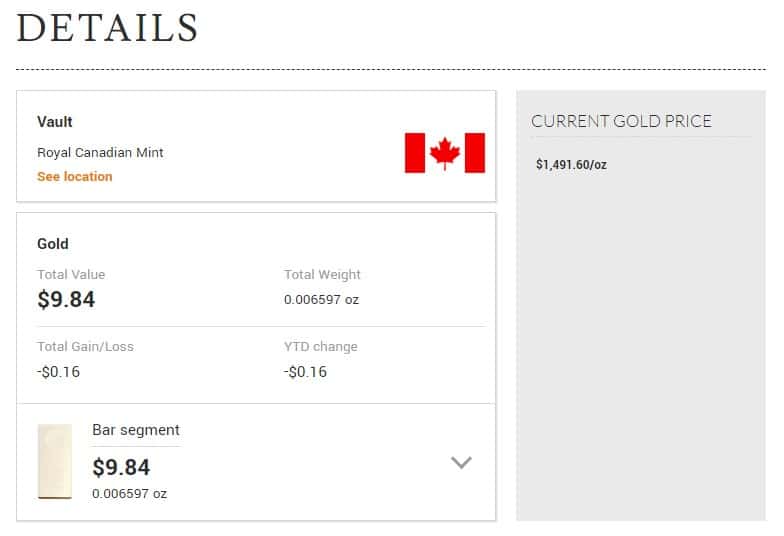

When you buy gold on Vaulted, you’re buying actual gold being stored at the Royal Canadian Mint. They are 99.99% fine gold kilo bars that have the hallmark of the Royal Canadian Mint as well as an imprint that certifies its weight and fineness. Each bar has a unique serial number and when you buy gold, you’re buying a piece of a specific bar or bars.

If you want, you can even visit the Royal Canadian Mint (for a fee) to see your bar(s). You can also request physical delivery of a bar once you’ve acquired a whole bar (for a fee, it’ll be shipped via FedEx).

As for taxes, you will be issued a tax form if you sell any or all of your gold. And best of all, you don’t need to report your account to the IRS or FinCEN (Financial Crimes Enforcement Network) as a foreign financial account because the account is maintained by a US company (they’re in Colorado). The gold may be in Canada but your account is technically within the United States.

Vaulted doesn’t have to report the purchase of gold on its platform. They only have to report gains after a sale to the IRS.

Vaulted Sign Up Process

When I met Vaulted at FinCon, they gave me a $10 gift card to test out their sign up process.

Creating an account was simple. You need to provide all the information you’d expect to give when opening any financial account – name, phone number, birthday, address, and email/password you want to log in with. They never asked for a social security number.

Once you verify your email, your account is open.

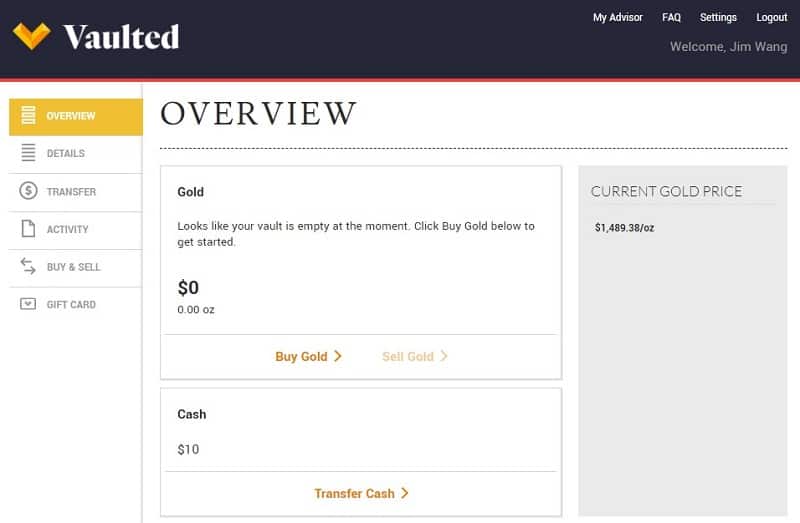

This is what I saw when I first logged in:

To buy gold, you need to transfer money into the account. There are two ways to do this – wire transfer or ACH.

You can link your checking account by getting your routing number and account number. The account must be a personal checking account, they can’t link up any other accounts.

Buying Gold

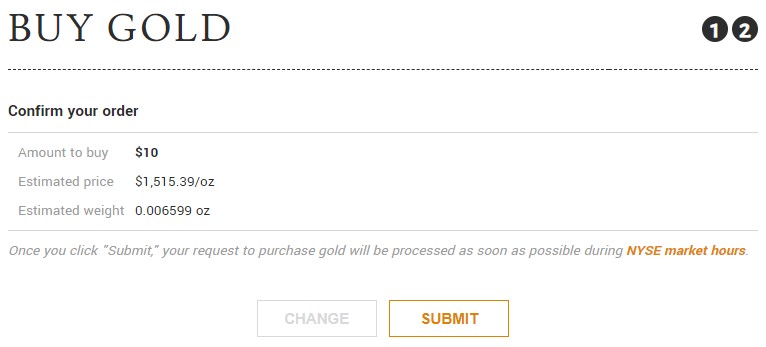

Buying gold is pretty simple, click on Buy Gold and you’re shown this screen:

My $10 will get me 0.006599 oz at $1,515.39/oz. The price listed is the buy price, which is the wholesale gold price plus the 1.8% transaction fee.

Click Next to reach the confirmation screen:

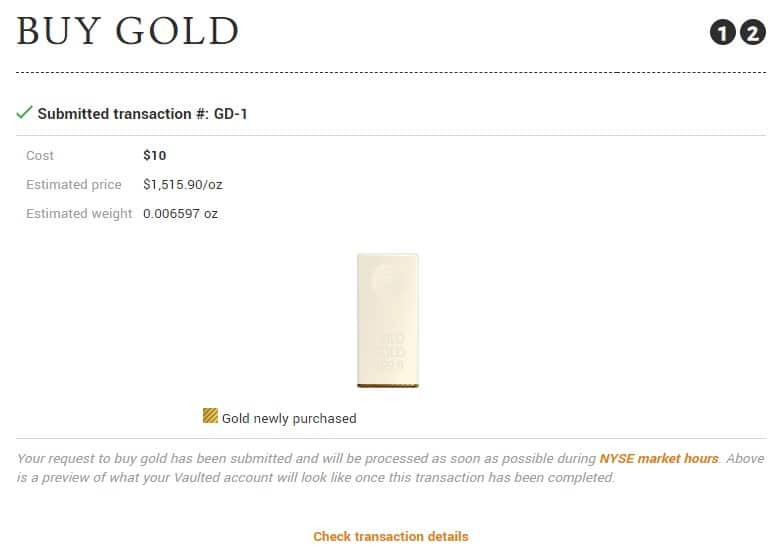

The transaction happens during NYSE market hours (9:30am to 4:00pm, excluding holidays):

As long as the market is open, you’ll get allocated the gold. Here’s what the “Details” page shows:

Vaulted Fees

The fees are simple:

- Transaction fees – 1.8% fee included on all buy and sell transactions. This fee is included in the “buy/sell price” listed. So the “buy/sell price” will always be 1.8% higher (or lower) than the spot price of gold because it includes the fee. They also show you the wholesale price, or spot price, on transaction pages for reference.

- Annual maintenance fees – 0.40% (40 basis points) on the average value of the net cumulative gold purchases in your account, charged semi-annually. The fee is billed each July and January. This is typically taken from cash, if possible, but also from gold if cash isn’t available within 30 days of the invoice.

- Physical delivery – If you want to get your gold, Vaulted doesn’t charge a fee but passes on the Mint and FedEx’s fees to you. You can request delivery in increments of a whole bar. The Mint charges $50 per delivery plus $2 per bar. FedEx charges Next-Day or Second-Day shipping based on the weight and distance but Vaulted estimates it’s usually around $100. It is fully insured.

Vaulted Is Not SIPC Insured

When you invest in something like stocks or mutual funds, the brokerage is SIPC insured. This means that your investments are protected in the event your brokerage goes bankrupt or something bad happens. The value of your investments isn’t protected (they can go down in value) but the shares themselves are.

With Vaulted, you don’t get similar protections. What you do get is assurances that they are backed by a company that’s been around nearly 50 years and the gold is stored in the Royal Canadian Mint. Canada is a stable nation with a AAA rating from S&P – there are no worries that the gold will be seized.

That said, nothing is for sure and this is certainly a risk, however small it may be.

Is Vaulted Worth It?

If you want to own physical gold, there are two options – buy a fund that owns gold or buy physical gold bullion.

Gold ETFs

You want to make sure the gold ETF you’re buying owns physical gold and nothing else. Some “gold funds” invest in gold miners, producers, etc. You want the ones that just own gold. The benefit of this is that it’s easy and cheap to buy and sell shares of an ETF. The downside is that you can never get any gold. You can’t redeem your shares for physical gold.

The three most popular funds are:

- SPDR Gold Trust ETF (GLD)

- iShares COMEX Gold Trust ETF (IAU)

- Invesco DB Gold ETF (DGL)

These ETFs have annual fees too. SPDR Gold Trust ETF, for example, has a 0.40% fee similar to what Vaulted charges.

Physical Gold Bullion

With physical gold bullion, to get the best price you need to buy in 1 oz. increments.

At JM Bullion, if you buy a 1 Gram Valcambi Gold Bar, you’re paying $57.12 when buying more than 25. There are 28.3495 grams in an ounce so you’re paying $1619.32 (assuming you can buy a .3495 gram!) when the spot price is only $1,496.91. (JM Bullion updates their sitewide prices according to the spot price) That’s a huge premium and not worth it.

If you think buying by the ounce is cheaper, it’s not because you only get the best price when you buy 40+ units. That’s 40+ ounces of gold!

A 1 oz bar will run you only $1516.44 when the spot price is $1502.48, a premium of 0.9%. If you can only buy 1-9 ounces, the price is $1526.44 – or $23.96 premium. That’s about a 1.6% premium. Shipping is free.

If you can afford to and want to own physical gold, it’s slightly cheaper to buy it from a dealer. Selling it will be a little harder since you have the gold in your possession.

But if you can’t afford to spend big bucks on a bar of gold, Vaulted may be a good way to build a position in gold if you’re willing to pay a 1.8% premium.

GhostRider2001 says

If I buy the ETF, I save the 1.8% fee assuming my brokerage doesn’t charge commissions on ETFs. The yearly expenses will be about the same. Unless the world goes to hell and I’m hoarding guns, gold and groceries in survivalist mode, I’d rather not have physical possession, but prefer the flexibility of holding or trading on the exchange as I see fit.