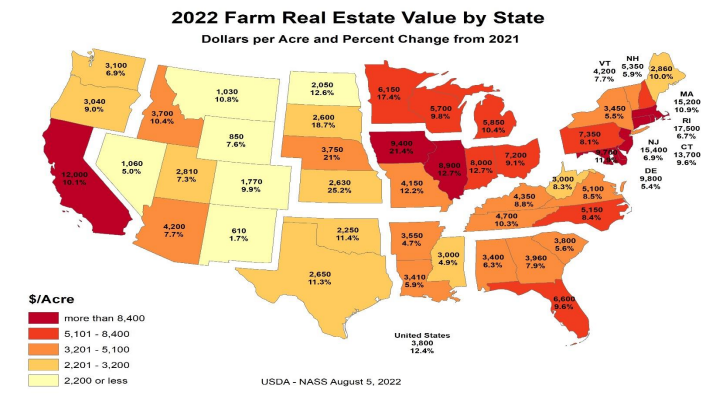

Do you know how much an acre of farmland is worth?

$3,800.

It varies from region to region but nationally, according to the United States Department of Agriculture, it is $3,800 per acre in 2022 (increase of $420 from 2021). The National Agricultural Statistics Service reported that statistic and more in their Land Values 2022 Summary published in August 2022.

As you’d expect, the land value increases based on where it is and what is able to grow there. California is so valuable because of what they produce – almonds, grapes (wine!), and other high dollar crops.

But owning a farm is not feasible (for most of us). Certainly for me.

And thanks to online platforms, you can invest in an acre of farmland and not farm it yourself.

That’s where AcreTrader comes in.

Table of Contents

- What is AcreTrader?

- Is Farmland a Good Investment?

- How AcreTrader Works

- Timber Investments

- AcreTrader Features and Benefits

- How to Sign Up with AcreTrader

- AcreTrader Sign Up Walkthrough

- How the AcreTrader Rating Works

- My Personal AcreTrader Experience

- AcreTrader Pros & Cons

- AcreTrader Alternatives

- Should You Invest in Farmland?

What is AcreTrader?

In 2018, AcreTrader opened its doors and allowed investors to buy parcels of farmland through their fund offerings. Based out of Fayetteville, Arkansas, the company was founded by Carter Malloy, who was working in financial services but grew up in a farm family.

When you invest with AcreTrader you’re not taking direct ownership of the farmland. Instead, you’re buying shares of various farm properties. Potential income is generated in the form of rent from the land or from any gains on the sale of the property.

AcreTrader, Inc. has a Better Business Bureau rating of “A+” on scale of A+ to F.

Before we get any deeper into this review, let’s first attempt to answer the most basic question:

Is Farmland a Good Investment?

Yes – because it is not correlated with the stock market, offers return opportunities, and is in limited supply. You may not get the highest rate of return but that’s not the goal, farmland has a place in a well-diversified portfolio.

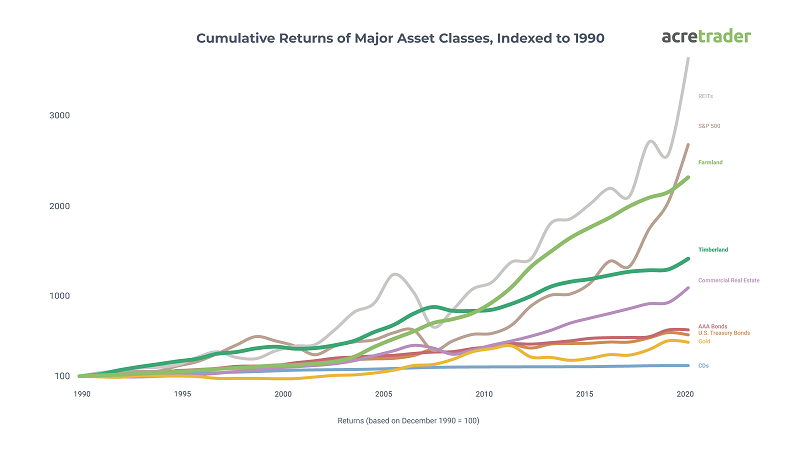

The idea of investing in farmland may seem like a radical concept, especially when more conventional forms of real estate investment involve commercial and residential properties. But according to research from AcreTrader, farmland has been a historically less volatile investment since 1990.

The screenshot below provides a visual of the performance of farmland compared to other types of popular investments.

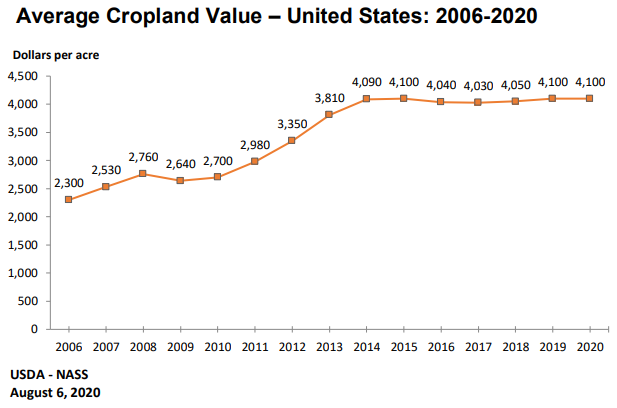

This is from the USDA NASS (chart goes back to 2006):

There are abundant reasons to believe the future holds more of the same. The world’s population, already fast closing in on 8 billion, is expected to reach 10 billion in the next 30 years. And as Will Rogers once famously said, Buy land, they ain’t making any more of the stuff. Technology has played a role in increasing crop yields, but it takes land to grow food in the first place.

There are several other reasons why farmland may be a desirable investment:

- It’s an investment that’s outside the publicly traded markets.

- Farmland produces a real, necessary commodity – food. Food will always be in demand.

- It has low historical volatility.

- Farmland is a true alternative investment, because its price levels are not tied to movements in other assets.

This doesn’t imply you should sell your other investments and move all your money into farmland. But it does show that farmland may have a place in a well-balanced portfolio. Land, after all, and farmland, in particular, is the most basic of all commodities. Nothing is produced without it.

With that information in mind, let’s get back to AcreTrader, and how it will enable you to invest in farmland.

How AcreTrader Works

Since AcreTrader is an online investing platform, investors can come to make investments in farmland.

In the case of each investment, the property is owned by an LLC created by AcreTrader. The company will lease the farmland to reputable local farmers who pay a predetermined cash rent, which is common in the farming industry. To decrease the risk of nonpayment, rents are collected in advance of the planting season. If a farmer doesn’t pay, a new farmer will be located to rent the property.

To be eligible to invest with AcreTrader you must be an accredited investor. This is the case with many real estate investment platforms. Requirements to be an accredited investor include at least one of the following:

Requirements to be an accredited investor include at least one of the following:

- You must have an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years, with a reasonable expectation of reaching the same income level in the current year, OR

- An individual net worth, or joint net worth with that person’s spouse, in excess of $1 million not including your primary residence.

As an investor on the platform, you can select among investments that have been fully vetted by AcreTrader. You don’t even need to have any knowledge of farming. AcreTrader conducts thorough due diligence on each parcel and will exclude any properties that don’t meet their standards. Approximately 5% of farm properties reviewed are accepted for investment purposes.

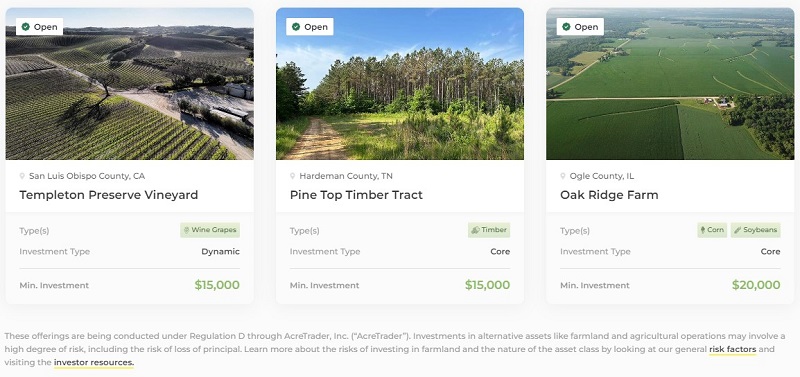

You can review the open investment opportunities online:

Each listing will display the minimum required investment, location, crops produced, investment type, and Private Placement Memorandum with financial information. . You can click on each listing to get more information. There you’ll find a general overview of the property, location maps, financial information on the farm, and ownership documents.

You’ll be able to track information and developments about your investments on the AcreTrader Dashboard, though you may also be notified by email particularly when distributions will be made.

Income distributions on investments take place on an annual basis, usually in December.

Limited Number of Deals

Deals are made publicly available and close fairly quickly, often in a matter of days depending on how attractive they are. If this is something that interests you, sign up for a free account so you get notifications whenever deals are available.

AcreTrader is very particular about which offerings they bring to the table and after being a user for several years, you tend to see about an offer or two each month. They send out emails giving you a heads up that a deal is about to come through, you have a few days to review it and then it’s typically fully subscribed by then.

If you’re interested in farmland investments, there’s no cost to sign up and they don’t spam you (I’ve only only received emails about deals – they don’t pitch anything else)

Timber Investments

One of the latest additions to the AcreTrader offering is the ability to invest in farm land where the product is timber and not a more traditional agricultural product you might find at the grocery store.

Years ago, I looked into the investment potential of black walnut trees on our personal property. We have several acres but our lot is mostly wooded – so for us it didn’t make sense. Clearing the land and then planting trees would’ve significantly reduced any potential returns (plus we like the woods!). I still did the research and learned that timber markets are enormous (several hundred billion) and well established.

AcreTrader will from time to time bring farmland that has a timber investment component. This is interesting because timber isn’t seasonal and offers the holder the ability to be judicious in harvesting. If markets are strong, you can harvest the timber. If they aren’t, just let them grow a bit longer.

It’s a fascinating addition and one of the reasons I’m a big fan of AcreTrader – they’re constantly innovating.

AcreTrader Features and Benefits

Minimum investment. When you make an investment, you’re not technically buying a piece of the farm. You get an ownership stake in the LLC that legally owns the property. A minor distinction that makes the transaction easier. The minimum initial investment is 10 shares, which is the equivalent of 1 acre of farmland. That would make the minimum initial investment typically around $20,000 – $30,000, depending on the particular parcel of farmland.

Investment term. Once you make an investment in a parcel of farmland, the expected term will range anywhere from five years to 20 years. The company is “exploring a secondary marketplace” allowing the sale of shares within that timeframe, but this is not guaranteed at this time. It may be possible to sell your shares to another investor in the same property through a private transaction though.

Tax considerations. At year-end, income distribution information will be disclosed using IRS Form K-1. This is the same form you’d get from any real estate crowdfunding platform that allowed you to invest in specific properties. (this is also what you’d get if you were doing this yourself through a partnership) Rent distributions, net of expenses, will be taxable in the year earned. Capital gains will be taxed in the year the property is sold, subject to lower capital gains tax rates. You should always consult with your tax consultant regarding the tax implications of any investment.

AcreTrader Fees. AcreTrader is free to sign up and there are no fees for using the platform. When you make an investment, there are closing fees, typically 2% of your investment amount. There is then an annual servicing fee of 0.75% of the value of the investment. AcreTrader also charges a 5% fee when the underlying property is sold, but that’s paid by the selling farm owner. PPM includes more complete information about fees and expenses of the investment.

Customer support. Available by toll-free phone and by email, though no specific days or hours of customer support availability are provided.

How to Sign Up with AcreTrader

To reiterate, you must be an accredited investor to invest with AcreTrader. You must also be a US citizen or a legal resident of the US. To sign up, you’ll need to provide your full name, email address, and create a password. You can also sign up using your Facebook, LinkedIn, or Google credentials.

Next up is personal information, including bank account numbers for funding purposes and accreditation documents. Your bank information is not retained by AcreTrader, they use a third-party provider, Plaid. Plaid provides similar services for other investment platforms too. The situation is similar with your accreditation documents, which are held by another third-party service, North Capital Investment Technology.

All necessary documentation is both signed and sent electronically through the website. Your investment account will be funded by ACH transfers from a linked bank account.

Similar to other online platforms, your investment doesn’t become final until the fundraising target is met for a particular investment. A property will be offered for between 30 and 90 days. If it isn’t fully subscribed, it’ll be removed and any funds you’ve invested will be refunded. (Funds are held in escrow by North Capital, pending closing.)

AcreTrader Sign Up Walkthrough

Signing up is pretty quick – first, you register with your name, email, and setting up a password.

Then you have to declare your accreditation status:

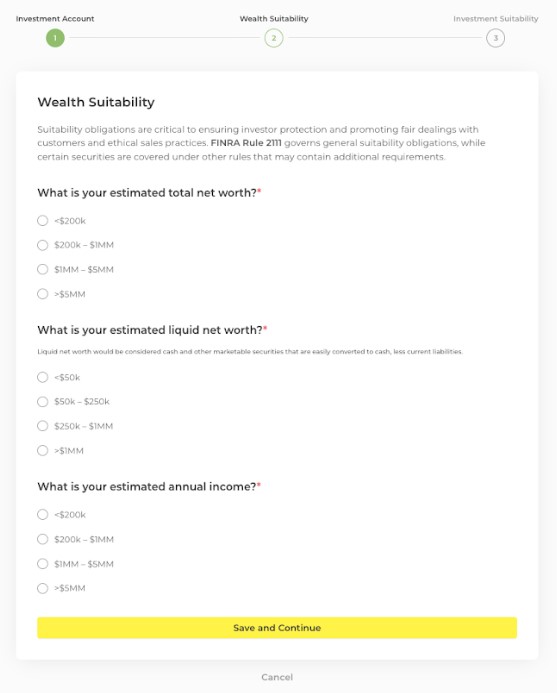

After that, you’ll fill out pages with your personal information, and your wealth and investment suitability. It’s to satisfy the Know Your Customer requirements of FinCEN.

You can skip these for now if you just want to look at the properties.

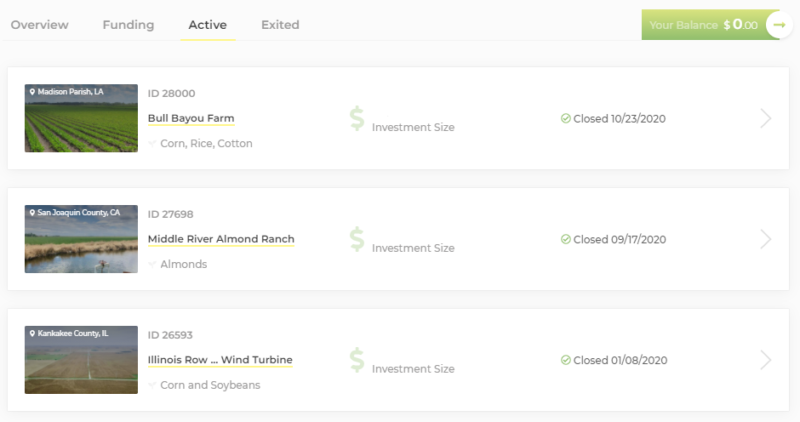

At the time I signed up (back in early October 2019), there were three Live properties.

The first one in Will, Illinois was fully subscribed. The second, a farm in IL that includes a wind turbine, was at 29% and the third, an almond ranch in California, was still being raised.

Different farms in different states with different crops will have different valuations.

For example, the almond ranch was $34,267 an acre! No wonder almonds are so expensive! 🙂

The two other farms were listed at a far lower price per acre. The Cottage Grove Row Crop Farm in Will, IL had a $4,461 price per acre.

How the AcreTrader Rating Works

Each property is given a rating of Core, Core Plus and Opportunistic.The categorization of Core, Core Plus, and Opportunistic investment strategies are a way of providing investors with information about the risk/return profile of their potential investment

The broad considerations AcreTrader evaluates when assigning a category to a particular investment include the following:

Regional:

- Is the property located in a prime growing region for the given crop/tree type?

- Is there a significant presence of operators such as farmer or tenant density or institutional capital?

- Is there sufficient infrastructure to get the crop to market such as hullers, packinghouses, grain storage, reasonable crop basis, roads, sawmills, etc.?

- Is there a potential for extreme weather risk such as hurricanes or flooding that could create an impairment?

- Is the soil well suited to the given crop?

Water:

- Is there sufficient and dependable/sustainable supply of water on a cost effective basis?

Commodity:

- What is the marketability of the crop type and the quality of the income stream based on the crop produced?

Operational:

- What is the volatility of the income stream? Is income earned via cash lease arrangement, crop share, or pure operational exposure?

- Are large amounts of working capital needed?

- Is there input cost exposure?

Financial Leverage:

- Are the equity holder’s rights subordinated by debt? If so, to what degree?

Improvements:

- Is there potential liability from improvements on the land that could drive a capital impairment?

Development:

- Is capital being deployed to repair or add improvements such irrigation, tiling, permanent crops, grain bins, etc.?

Non-Farm Income:

- Is there a risk of income loss associated with non-farm operations?

My Personal AcreTrader Experience

I’ve made three investments through the AcreTrader platform:

They’ve all performed according to expectations and the updates have been regular and detailed.

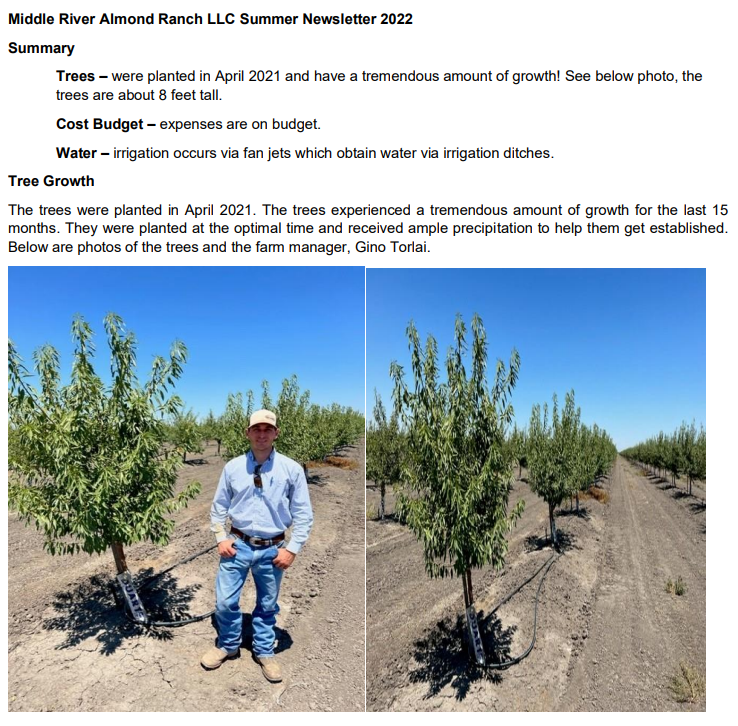

For example, we own a share of the Middle River Almond Ranch and this was one of the updates (well, part of it) – nothing in mind-blowing but it is fun to keep up to date on the farm itself:

In years past, they sent you little vials of dirt from your farms!

And sometimes you also get some of the products the farms make. Each year, we get a box from one of the almond farms. It’s a mix of lightly roasted almonds and chocolate covered almonds, quite delicious!

As it turns out, the almond farm ended up going bankrupt in March 2024. Here’s how AcreTrader handled it and how that worked.

AcreTrader Pros & Cons

Pros:

- AcreTrader is an opportunity to invest in farmland, which is one of the most basic kinds of “hard assets.”

- I believe farmland is an excellent alternative investment, since it tends to move independently of swings in the general financial markets.

- Investments provide potential for income and growth through a mix of ongoing annual rent income, as well as capital gains on the sale of the property.

- Given the long-term nature of AcreTrader investments, profits on the sale of the underlying property will be taxable at more favorable long-term capital gains tax rates.

- AcreTrader investments can be held in a self-directed individual retirement account (SDIRA).

Cons:

- You must be an accredited investor.

- Your investment is illiquid with no secondary market to sell your shares. The holding period on a farm parcel can be from three to 20 years.

- Income distributions take place once each year, typically in December.

- Neither income distributions nor their timing are guaranteed.

Finally, this is neither a pro nor a con but worth mentioning – because AcreTrader is very discerning and detailed in their analysis, the platform does not have a lot of investment opportunities. You won’t be able to sign up and see a dozen different farms in the fundraising phase. The investments that are offered will be subscribed in a very short period of time.

On one hand, it’s a “con” that there aren’t a lot of investment opportunities but the reality is that it’s a pro – they only pick strong investments to offer their users.

AcreTrader Alternatives

Do you want to invest in farmland but don’t see any opportunities on AcreTrader?

FarmTogether is another real estate investment platform that focuses on farmland. They are only for accredited investors at the moment with a minimum that varies from $10,000 to $50,000 based on the investment. Cash yields are paid out on a quarterly, semi-annual, or annual basis while the appreciation of the farmland is paid out at the end of the hold period.

It’s set up very similarly to AcreTrader but, as you’d imagine, they offer different deals. If you’re interested in this category, I suggest signing up for FarmTogether too because then you get to review all the deals that go through. It’s free to sign up – here is a deeper review of FarmTogether.

To learn the key differences between the two platforms, check out our AcreTrader vs. FarmTogether post.

Finally, you could get free land through land grant programs and farm it yourself. Many areas, especially in the midwest, have land that they will give you to develop yourself.

Should You Invest in Farmland?

AcreTrader investments are limited to accredited investors.

This is because investing in farmland is a non-typical investment, considered suitable for high net worth individuals who have the financial strength to withstand potential losses. It’s important to understand that while each investment is expected to provide positive cash flow and sell at a higher price, the potential to lose money on any particular farm parcel is always possible.

However, if you’re interested in investing in “hard assets,” adding farmland to your portfolio can be a welcome addition. It’s not subject to the cycles and swings of the financial markets, and can be an excellent countercyclical investment.

And much like all real estate, it’s a true long-term investment. Though you may be down on the investment at any point in the investment cycle, the long-term prospects are in your favor. As the global population continues to rise, demand for food will increase with it. That will only increase the value of farmland over the long-term. And with inflation being virtually a matter of public policy in every major nation in the world, farmland is one of the very best hedges to protect your portfolio.

That said, what happens if things go south? What if they can’t find a farmer to work the land or climate change impacts the profitability of the farm? These are all huge question marks that could impact your investments. I don’t know enough to be able to provide any guidance on that front.

But if this does interest you, I suggest visiting the AcreTrader website and checking out what they have to offer. It’s free to join and peruse the platform.

This is a sponsored promotion for the AcreTrader platform. Jim Wang Enterprises, LLC may have investments in companies represented on the AcreTrader platform. This informational post is by no means a promotion, solicitation, or recommendation of any specific investment.

Past performance is not a guarantee of future results and is not indicative of future results. The experience and/or returns of the author are uniquely his and are not provided as indications of future performance. Statements related to the tax implications of investing in farmland should not be relied upon as tax advice or advice of any kind. Please consult with your tax advisor.

Thanks for this write up, Jim. I wasn’t familiar with Acre Trader, and I do believe U.S. farmland is a unique asset with a great medium-term future. That said, I generally steer clear of these types of online investment aggregation platforms due to the opaque, multi-layered management fees baked into the deals–and because these types of investments can be tax-inefficient compared to stocks. That said, I’ll check them out. Cheers!

That is true – a lot of times they say no fees but they take a spread. RealtyShares used to (these are rough examples, not exactly the right numbers but it illustrated the point) collect 11% in interest and pass along 10% as part of the fee (not including everything they collected in setting up the loans). 1% sounds like not a lot but it’s technically at 9% fee since it’s 1% of 11%. That said, the 10% justified the investment so I was OK with it. There are farmland REITs too like Farmland Partners (FPI) – it sports a… Read more »

Yes. What’s more, in addition to the online aggregators taking their fees, you also have the individuals/firms managing the underlying assets getting ongoing management fees. Of course, everyone deserves fair payment for the work they put in, but the fees can really add up.

Thanks for the article. I’m going to give it a try..

I’m 77 & sitting on some cash. I may need the cash for a personal situation in the next few years. As the cash earns almost nothing, is this a good alternative? I noticed the comment regarding 5 – 20 year payout.

Hi Phil – I suggest speaking with a financial adviser before making any investments.

I love the approach you took in this review Jim. That was a great data-driven overview.

Thanks Seth!