If you earn over $200,000 per year, you may be subject to the net investment income tax (NIIT), an additional tax levied on the investment income of taxpayers considered to be high income.

In some parts of the country, particularly the big coastal cities, an individual requires a $200,000 income just to achieve a middle-class lifestyle. But even if you consider yourself “only middle-class,” you may be subject to this tax — if not now, soon.

This article will explain how the NIIT works, and give you some tips on how to reduce the potential expense of this tax liability.

Table of Contents

What Is the Net Investment Income Tax?

The net investment income tax (NIIT) was created to help fund the Affordable Care Act (ACA) and went into effect in 2013. Essentially, it’s an expansion of the Medicare portion of the FICA tax; an additional 3.8% on investment income earned by high-income taxpayers.

The tax only applies to investment income, including interest, dividends, capital gains, rental income, royalty income, and nonqualified annuities.

One conspicuous exclusion is the gain on the sale of your principal residence, as long as you exclude the gain from your regular taxable income. (Presumably, any portion of the gain subject to tax will also be subject to the NIIT.)

Fortunately, the tax does not apply to other forms of income, including wages and income from self-employment, unemployment compensation, Social Security benefits, or alimony.

Modified Adjusted Gross Income Threshold

The income thresholds for having the NIIT tax liability imposed are determined using your modified adjusted gross income (MAGI). That’s your adjusted gross income, which is then modified for certain adjustments determined to be “preferential.”

The MAGI thresholds the tax applies to are as follows (for 2024):

- Married filing jointly: $250,000.

- Married filing separately: $125,000.

- Single: $200,000.

- Head of household: $200,000.

- Qualifying widow(er) with dependent child: $250,000.

The NIIT is not to be confused with the Additional Medicare Tax, which also went into effect in 2013. That tax imposes a 0.9% additional Medicare tax on earned income above certain income levels. But it does not extend to net investment income.

How to Calculate Net Investment Income Tax

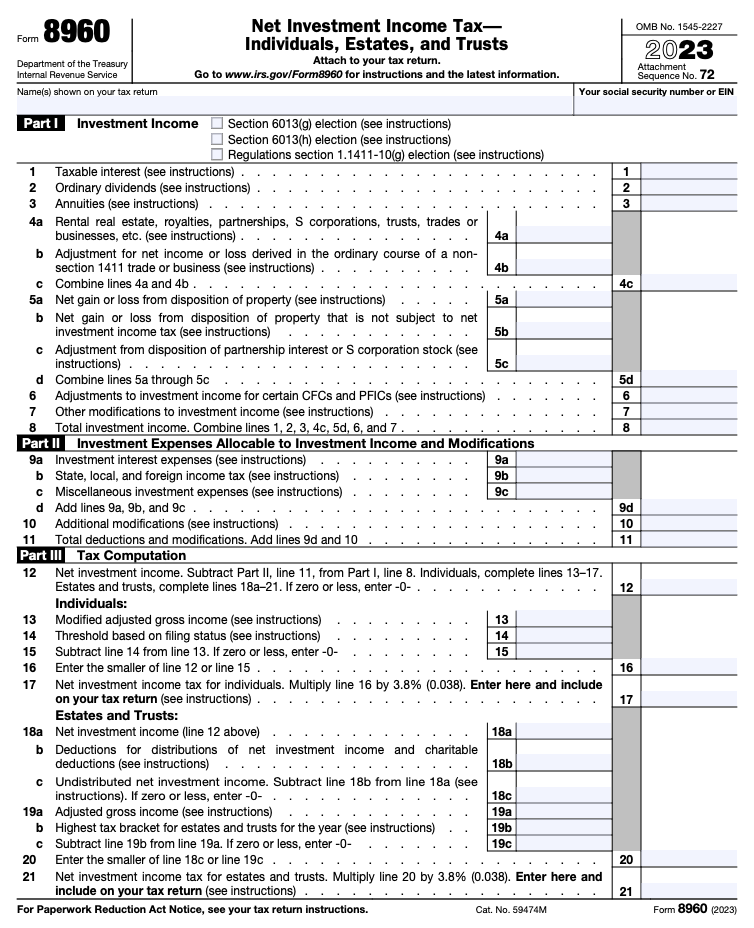

You can use Form 8960 to calculate your net investment income tax; however, computing the NIIT can be challenging. Fortunately, the best tax software programs, like TurboTax, can easily accommodate this tax if it applies to your situation. The NIIT is reported on Form 1040 for individuals (Form 1041 for estates and trusts).

An Example of the Net Investment Income Tax

For this example, let’s assume you’re a single taxpayer with a modified adjusted gross income of $220,000 per year. Your marginal federal income tax rate is 32%.

You have a significant amount of investment income that includes the following:

- Interest Income: $1,000

- Dividends: $3,000

- Short-term Capital Gains: $10,000

- Short-term Capital Losses: ($4,000)

- Net Investment Income: $10,000

The net investment income will be subject to your marginal federal tax rate of 32%, plus the additional 3.8% for the NIIT.

That will produce an effective tax rate on investment income of 35.8%.

Note: I’ve included capital gains as short-term to simplify the calculation.

Long-term capital gains will be subject to lower taxes and the NIIT. Either way, the NIIT will increase your tax liability by 3.8% of the net investment income above your regular income tax rate or capital gain tax rate if you exceed the statutory threshold amounts for the tax.

The NIIT applies only to your net investment income. It does not apply to the amount by which your income exceeds the MAGI threshold.

Though this example doesn’t reflect it, the tax will only apply to the amount of net investment income that exceeds the MAGI threshold for your filing status. For example, if your modified adjusted gross income, including the investment income, was just $205,000, only $5,000 would be subject to the NIIT, not the entire $10,000 investment income you’ve earned.

How to Avoid Net Investment Income Tax

There are two basic strategies you can employ to minimize the impact of the net investment income tax:

- Increase your retirement contributions; and

- Lower your net taxable investment income.

You can reduce your income by maximizing deductions that figure into your adjusted gross income. A good example would be maximizing your retirement contributions.

Increase Contributions to Qualified Retirement Plans

For 2024, a 401(k), 403(b), or similar program will allow you to contribute up to $23,000, or $30,500 if you’re 50 or older. Unfortunately, IRA contributions are still limited to just $7,000 per year, or $8,000 if you are 50 or older (in 2024). But that may be sufficient to lower your modified adjusted gross income to below the net investment income tax threshold.

You may also be able to participate in a deferred compensation arrangement if your employer offers one.

If you have self-employment income, you may be able to lower your income by an even larger amount through retirement plan contributions because self-employed individuals make contributions as the employee and employer.

For 2024, the maximum contribution to a solo 401(k) is $69,000, or $76,500 if you’re 50 or older. The maximum contribution for a SEP IRA, another popular self-employed retirement plan, is $69,000 for 2024 (there is no catch-up contribution on this plan for taxpayers 50 and older).

How to Lower Your Investment Income

You can lower the income subject to the NIIT simply by reducing your investment income.

One strategy is to take advantage of tax-loss harvesting — selling losing positions to offset capital gains. The strategy is used at year-end to lower capital gains for that year. But similar investment positions can be added during the new year, as long as they occur at least 31 days after the tax-loss harvesting sale. (This is to avoid IRS wash sale rules.)

Robo-advisors like Betterment and Wealthfront commonly employ tax-loss harvesting to minimize taxes in client portfolios. But perhaps an even more effective strategy is rearranging investment asset location in your portfolio.

The basic idea is that you hold investments likely to generate steady income in tax-sheltered accounts where they will escape immediate income tax. This can be especially effective in avoiding the NIIT, since investment gains within tax-sheltered plans are tax-deferred and not subject to the extra tax.

For example, let’s say you hold mutual funds or exchange-traded funds that regularly generate dividends and capital gains distributions. If you hold them in a taxable brokerage account, their income will be subject to the net investment income tax. But if you keep the same funds in a tax-sheltered retirement plan, they’ll escape the NIIT and ordinary income tax.

You can use this strategy to allocate your most productive investments to tax-sheltered plans while holding low-income generating assets, like certificates of deposit (CDs), in taxable accounts. With that arrangement, only the interest earned on the CDs will be subject to the NIIT.

It’s also worth noting that investment expenses are deductible when calculating your gross investment income. Eligible expenses include brokerage fees, fiduciary expenses, tax preparation fees, investment interest expenses, and state and local income taxes.

✨Related: Year-End Tax Moves You Must Be Doing

Final Thoughts on Net Investment Income Tax

The net investment income tax can be a rude awakening for those already dealing with a high marginal tax rate. It can be an even bigger surprise the first time you cross the income threshold level.

But you’re not defenseless against this tax. By using a combination of income minimization strategies and investment income reductions — such as doing your most aggressive investing within tax-sheltered retirement accounts — you can minimize the impact of the tax or eliminate it entirely.

It’s also important to understand that protecting your income from the NIIT is ongoing. You’ll need to be aware of your income situation each year and whether or not it will trigger the tax. And if it will, you’ll need to make as many adjustments as possible.