Launched in 2011, Wealthfront is a robo-advisor with $25+ billion in assets under management as of July 2022. A robo-advisor is an investment advisory service that uses robots instead of people to help you invest – hence the name robo-advisor.

It’s a little more complicated than that, but for all practical purposes, it’s the robots. 🙂

Wealthfront bills itself as the “most tax-efficient, low-cost, hassle-free way to invest.” Their offering is compelling. For just 0.25%, they do all the heavy lifting using a computer’s memory.

I think robo-advisors are great because they offer professional advisory services, at least a vanilla version (or cosmopolitan, to keep the ice cream analogy as accurate as possible), to the masses by relying on algorithms rather than an advisor-heavy approach.

Many investment advisers won’t meet someone without at least six figures to invest since they get paid as a percentage of assets under management. Robo-advisors can do this because robots don’t need anything but hugs.

With a new feature, Wealthfront separates itself from the rest of the pack by offering a personalization aspect you won’t find elsewhere. You connect your accounts, and Path will give you an approach tailored to your information. As for the rest, who determines the algorithms behind the curtain?

Their investment team is impressive, featuring names like their Chief Investment Officer, Dr. Burton Malkiel (A Random Walk Down Wall Street), and Charles Ellis (Winning the Loser’s Game), founder of Greenwich Associates.

Table of Contents

What Wealthfront Offers

Simplicity and optimization.

All robo-advisors promise investment returns without as much maintenance. With an account minimum of just $500, Wealthfront offers an investment advisory service to the masses.

It took me many years to amass $5,000 in investable assets, and it sat in an index fund at Vanguard while it grew. I didn’t pay much in fees, but I also didn’t get tax loss harvest either (heck, I didn’t even learn about it until many years later!).

I saw my job as an investor as being two primary tasks:

- Determine and establish an asset allocation and,

- Rebalance their portfolio periodically.

Wealthfront does the first task by having you answer a questionnaire about your risk tolerance to establish your asset allocation. Then its robots do their magic to accumulate the right assets to get the allocation that best fits your risk tolerance.

As an ongoing service, they handle rebalancing, tax loss harvesting, dividend reinvestment, and all the other smaller tasks that can add to your returns but that we often forget to do. That’s where the optimization comes in.

About the “Robots”

Computers are only as good as the people who design and program them, so while I say “robots” a lot in this post (it is a “robo-advisor”), the folks who built the robots and give them the insight to do their automated magic – they’re not robots.

They’re PhDs led by Dr. Burton Malkiel. They hire only PhDs to work on the investment team.

Wealthfront Free Financial Planning

Wealthfront has begun separating itself from the robo-competition with a new free automated financial planning experience. Path is the name of the automated financial advice engine they built.

It is available to everyone.

Path is an automated financial advice engine that takes your individual data, like income, spending, and investing, to protect your financial assets and ability to meet future goals.

It considers life events, like buying a house and having children, and adjusts your “path” accordingly. And it does this regularly, rather than once a year or once a quarter as you would with a human advisor.

Here is their brief explainer video:

This is a huge value-add and something I haven’t seen with their peers.

Released in December of 2018, Wealthfront offers software-based financial planning for free to anyone. This isn’t a premium service where you schedule a call with a CFP, this is a robo-solution in that it’s software-driven.

You can get a snapshot of your finances, explore various scenarios, and then look at different tradeoffs. If you’ve never built a plan, they have an interactive Financial Health Guide that helps you get started.

College Planning

College Planning is a feature that applies Path toward the arduous financial task of planning for college.

The tool is simple – you pick a college, and it calculates the real-time expenses (tuition, room, board, books, etc.) projected to when your kiddo will start college. You can change the college, and it’ll update the data.

Then they use outside data to determine how much financial aid you might get, all based on your existing Wealthfront data. Then you just choose how much you’d like to save (like retirement), and you can play with the different numbers to see how they affect your plan.

How do they figure out financial aid? That’s the secret sauce – I asked Kate, my contact with Wealthfront, and she explained:

Path connects to the Integrated Postsecondary Education Data System (IPEDS) database, which is the official source of actual data provided by the colleges themselves.

The majority of college institutions use a form of the federal method which we can get from IPEDS database while many of the Ivy League universities abide by the institutional method. The equation used to calculate financial aid for the institutional method isn’t public, but we spent time talking to the top institutions to figure this out for you.

What that means is you’ll get a financial aid estimate that is customized based on the school you select, the financial aid formula for that school, and the forward-projected income and assets for your household up to the year in which your child will start college.

Portfolio Line of Credit

If you have an individual or joint account valued at $100,000+, a Portfolio Line of Credit lets you request cash up to 30% of the current value of your account, and they’ll send it over as quickly as one business day.

Your portfolio becomes a line of credit. (hence the name!)

The interest rate depends on the value of your account (rate schedule & definitions):

| Greater of the aggregate net deposits and market values of your taxable Wealthfront accounts | Annual Interest Rate Rounded Down to the Nearest 0.05% in Your Favor |

|---|---|

| $25,000 – $499,999 | Effective federal funds rate +3.60% |

| $500,000 – $999,999 | Effective federal funds rate +2.85% |

| $1,000,000+ | Effective federal funds rate +2.35% |

Their interest rate could beat a home equity line of credit (since it’s technically a margin lending product and not a traditional loan), and since there are no fees, it’s even cheaper. And unlike a regular loan product, there is no credit check, no minimum monthly payments, and the loan is secured by the assets in your portfolio.

How Wealthfront Invests

Wealthfront invests your money through exchange-traded funds, or ETFs, and offers a variety of account types, including IRAs and trusts. The type of account determines the assets you get access to.

All accounts will access US Stocks, Foreign Stocks, Emerging Stocks, Dividend Stocks, US Government Bonds, and Treasury Inflation-Protected Securities (TIPS). Retirement accounts also access Corporate Bonds, Emerging Bonds, and Real Estate. Taxable accounts get access to Natural Resources and Municipal Bonds.

On top of these assets, they have a suite of tax-efficient products collectively known as PassivePlus. These include tax-loss harvesting, stock-level tax-loss harvesting, Smart Beta and Risk Parity.

Their “daily” Tax-Loss Harvesting feature is a game changer. Tax loss harvesting is the strategy of selling losers to capture the capital losses, reinvesting in a similar but not substantially similar investment for 30+ days, then reinvesting it in the original loser at a lower tax basis.

When they offered this, they were among the first to do so by a solid year. (they are often at the forefront of innovation… you’ll often see them roll out features far ahead of others)

Their “Stock-Level Tax-Loss Harvesting” service is a clever name for their own index funds – they’ve created a WF500 (Wealthfront 500), and they buy the S&P 500 stocks directly.

This, combined with an ETF of smaller non-S&P 500 companies, gets you index investing without the transaction commissions and work of keeping up with index changes. Traditional advisors usually won’t even consider this until you have $5,000,000.

The Investment Company Act of 1940 prohibits index funds and ETFs from passing realized losses to investors. The losses can be used to offset gains internally, but to help reduce taxes, Wealthfront uses this service to offer direct investing in index companies. Taxes can eat into your returns more than fees, so this feature works to counter that.

They’ve turned your investment account into a mutual fund for just 0.25% of AUM.

They offer Smart Beta, which is their improvement on existing Smart Beta ETFs. They implemented a multi-factor investment strategy combined with Stock-Level Tax-Loss Harvesting, which adds more tax efficiency you don’t find in existing Smart Beta ETFs. This is offered to those with $500,000 or more but at no incremental cost above the 0.25% fee.

Risk Parity is available to accounts over $100,000 and is an asset allocation methodology that uses risk to determine asset allocations. Smart Beta is available to accounts with over $500,000 in taxable investments and is expected to increase returns by weighting the securities within the US stock index of your portfolio more intelligently.

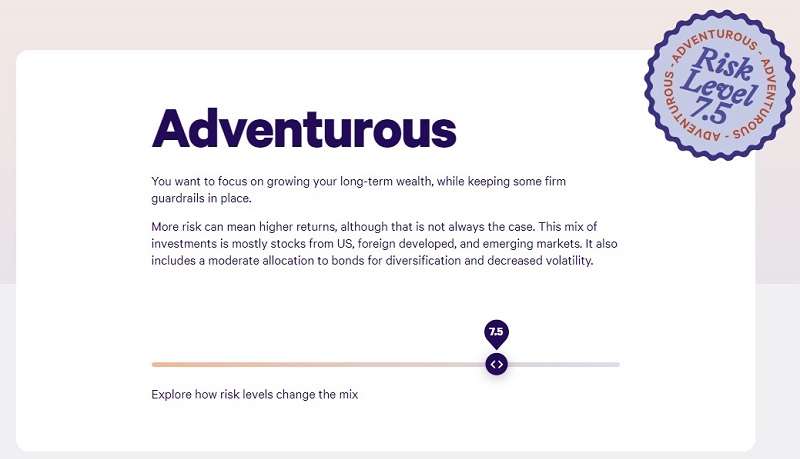

Risk Tolerance & Asset Allocation Tool

It’s pretty simple. It takes a few seconds to answer Wealthfront’s Risk Tolerance questionnaire to get your recommended investment plan: (you can do this yourself without putting any personal information, they don’t ask for or require an email to play with this tool)

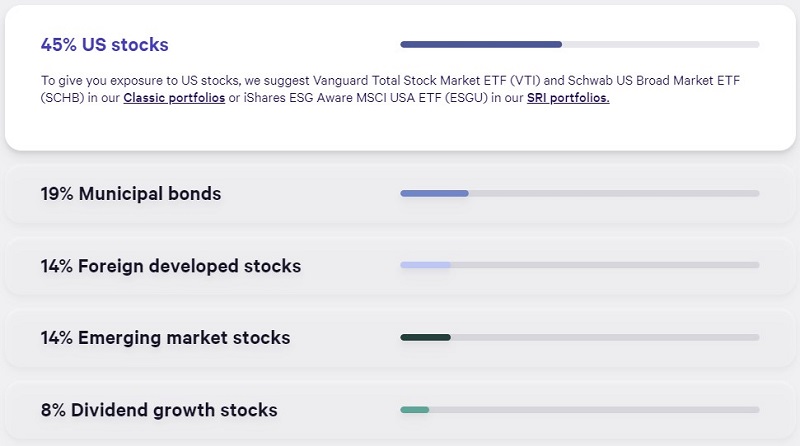

Scroll down to see the breakdown:

Under each category, they list the three leading ETFs. In theory, you could go and buy these allocations directly. If you click on each of the bars, you’ll see a breakdown.

You can play around with the Risk Tolerance slider to see how the allocations change (max is 10), plus see the difference between a Taxable Investment Mix and a Retirement Investment Mix. I like that the Projected Performance is a spread versus a single line as it’s often depicted because it more accurately reflects the data.

As you can see, the investment options for the taxable account consist of mostly Vanguard funds (VTI ETF, VEA ETF, VWO ETF, and VIG ETF) plus a State Street XLE ETF for “natural resources” and iShares MUB ETF for municipal bonds. If you hover over the choice, they explain why they chose the fund.

For example, for the State Street XLE, they explain their choice over the two alternatives:

The three leading choices in this category are:

- XLE (State Street Energy Select Sector ETF)

- DJP (iPath Dow Jones-UBS Commodity Index Total Return ETN)

- VDE (Vanguard Energy ETF)

XLE vs. DJP

While both XLE and DJP provide investment exposure to natural resources, XLE has a substantially lower expense ratio. XLE also has much higher trading volume than DJP, making it easier to transition in and out of (as part of a tax-loss harvesting transaction, for example). Lastly, because of the way DJP uses futures contracts, it is vulnerable to an effect known as contango, which can be destructive for long-term investors.XLE vs. VDE

Both XLE and VDE provide investment exposure to natural resources, with a primary focus on energy. The expense ratios for XLE and VDE are also roughly the same. However, XLE has a significant advantage in trading volume, making it the better default choice for Wealthfront portfolios.

Wealthfront Cash Account

Finally, sometimes you’ll have cash not invested in the markets, and Wealthfront has a cash account that currently pays 4.80% with FDIC insurance up to $5,000,000. This account integrates with their free planning service, so you don’t lose visibility in your planning.

How much does Wealthfront cost?

Wealthfront doesn’t charge a commission or account maintenance fees, they instead rely on an account management fee. The account management fee is 0.25% of assets. This is on top of the fees charged by the underlying ETFs, which average 0.12%.

Wealthfront Alternatives

There’s a lot to like about Wealthfront, but it’s always a good idea to comparison shop before signing on to any investment account. It is your hard-earned money, after all. Here are a few Wealthfront alternatives to consider.

Betterment

Betterment has many similarities to Wealthfront. For one, the company’s automated robo advisor (called the Digital plan) offers a 0.25% asset management fee and tax loss harvesting.

However, Wealthfront has a $500 minimum balance to start investing, while Betterment’s minimum investment amount is $0. Betterment also has a Premium investment plan with a minimum balance of $100,000 in your portfolio.

The Premium plan costs 0.40% per year to manage and includes additional benefits such as:

- Unlimited calls and emails with Betterment’s (live) CFP professionals

- In-depth advice on investments held outside of Betterment with Betterment’s CFP professionals

- Fee-free Checking account and Cash Reserve account

Premium and Digital plan investors get free checking and cash reserve accounts. However, the live advice at Betterment’s stated price is very attractive.

SoFi Automated Investing

Loan giant SoFi also offers robo advisor services, and so far, they’ve gotten high reviews from users.

With a $1 minimum investment and zero annual asset management fees, SoFi is an attractive choice for investors concerned about fees, and who want to start investing with a small minimum investment.

Remember that SoFi doesn’t offer tax loss harvesting and is newer to the robo advisor game and investing.

Vanguard Digital

Vanguard Digital is another Wealthfront alternative. With the Vanguard name behind it, this choice for a robo advisor may make you feel more comfortable than investing with a newer service like SoFi would.

Vanguard has a low 0.20% annual asset management fee. However, the investment minimum with this plan is $3,000, which may keep many investors away.

There’s no tax loss harvesting with Vanguard either. That downside might make you want to stay with Wealthfront.

Wealthfront Review: Final Thoughts

Sure, anyone can do anything themselves. But self-directed investing takes time and expertise. Wealthfront has top-notch software and automation, a stunning Ph.D. investment team led by one of the greats, and is low-cost.

If you’re entirely invested in Vanguard funds (or similar), you can re-balance them at no cost since all fund and ETF trades are free. You still have to remember to rebalance and tax loss harvest.

As I tried to think of drawbacks to their service, only I could think of a few. First, you can’t own fractional shares, so there will be a small amount of uninvested cash in your account. They also keep the projected annual fees as cash in your account.

You may not be 100% invested because you can’t buy partial shares. Most ETFs trade in increments of $30 to $100, so you’ll have some smaller portion of that uninvested. This is a minor drawback and one that you’d face anyway. As the investments pay dividends, Wealthfront will monitor your cash and put you into the market when you reach the minimum share price.

They also don’t give a discount on the fees for large balances. Whether you invest $10,000 or $1,000,000, the 0.25% fee applies, though you get access to more services at higher balances.

The last one was whether you agreed with their asset allocation. Seven questions to reach my ideal allocation seemed short. Then again, it’s based on modern portfolio theory, Wealthfront has a top-notch board, and investing shouldn’t be complicated – so what am I complaining about? 🙂

If you’re using Wealthfront, I’d love to hear about your experience!

Vic @ Dad Is Cheap says

I use Betterment and I’m overall happy with that. I’ve gotten most of my assets in their and it’s north of 100k so I’m at the lowest expense ratio of 0.15%. They do tax loss harvesting as well.

Mike Thans says

After reading many articles on robo investors and how they stack vs Vanguard, or the Wealthfront vs Betterment vs Schwab IP, the nuances don’t really matter to an investor who will invest 1k to 20k. It’s just about going with one that you’re comfortable and not to let money sit in savings/checking accounts. I’ve chosen Wealthfront since the initial $15k is freely managed with a referral.