Betterment is a longstanding robo-advisor that offers low fees and more control over your portfolio than many other automated investment platforms.

Betterment offers expert-built portfolios, including socially responsible and crypto portfolios, a high-yield cash account, a no-fee checking account, and access to human advisors.

But with so many robo-advisors to choose from, is Betterment still worth it? Find out in this Betterment review.

Table of Contents

- Key Features

- Who Is Betterment?

- Getting Started with Betterment

- How Betterment Works

- Betterment Account Types

- Betterment Pricing

- Betterment Core Portfolios

- Other Betterment Portfolios

- Innovative Technology

- Broad Impact

- Climate Impact

- Social Impact

- Goldman Sachs Smart Beta

- Universe

- Sustainable

- Metaverse

- Decentralized Finance

- Betterment Premium

- Betterment Cash Reserve

- Betterment Checking

- Tax Efficient Investing

- Pros & Cons

- Betterment Alternatives

- FAQs

- Is Betterment Worth It?

Key Features

- The management fee is $4/month (up to $20k) or 0.25% annually

- $0 minimum initial investment

- $100,000 minimum required for Betterment Premium

- Individual and joint taxable accounts; retirement accounts

- High-yield cash account

- No-fee checking account

- Create customizable sub-accounts (goal accounts)

- Available on iOS and Android mobile app

- Accounts are SIPC protected up to $500,000 ($250,000 cash)

Who Is Betterment?

Betterment is an online, automated investment platform, a.k.a. a robo-advisor.

With over $40 billion in assets under management and more than 800,000 customers, Betterment is one of the largest independent robo-advisors on the market today. In fact, Betterment was the first independent online financial advisor to reach $10 billion in AUM in July of 2017.

With Betterment, your entire investment experience takes place online. An algorithm calculates your portfolio based on your preferences and goals.

Since everything runs through computers, they can offer investment management at a very low cost. This makes it cost-effective for any investor, regardless of investment size. Most financial advisors won’t even talk to you if you have less than half a million in assets, but you can invest with Betterment for as little as $1.

If you’re new to investing or you don’t have much money, Betterment may be the best solution to your investment needs. If you are a larger or more experienced investor, Betterment may be a good platform to have some of your portfolios professionally managed.

Getting Started with Betterment

Betterment is available to U.S. citizens 18 years old or older with a permanent U.S. address, a U.S. Social Security number or ITIN, and a checking account from a U.S. bank. Residents of Puerto Rico and the Virgin Islands (but not Guam) and U.S. military personnel residing abroad are also eligible.

You can open a Betterment account and start investing in a couple of steps:

- Open an account directly on the Betterment website. The first step is to complete your application, including a brief questionnaire. The questionnaire assesses your risk tolerance, investment goals, and time horizon. Your answers to those questions will determine the type of portfolio Betterment will create for you. That can be anything from conservative to aggressive.

- Choose the type of account you want. For example, you may want a taxable investment account for short-term savings goals, like saving money for the down payment on a house. Alternatively, you can select a tax-deferred account, like an IRA, for a long-term goal, like retirement.

Note: You can open an account with no money and then begin investing as you fund it. For that reason, you’ll need to connect a bank account to your Betterment account. But you can also set up direct deposits from your paycheck for funding purposes.

How Betterment Works

For a very low annual fee, Betterment will provide automated management of your account. That will include creating and rebalancing your portfolio, reinvesting dividends, and implementing tax efficiencies to minimize the tax liability your account will generate.

Betterment works using Modern Portfolio Theory, an investment theory that favors general asset allocation over individual security selection.

Your portfolio will consist of exchange-traded funds(ETFs), comprising a mix of both U.S. and foreign stocks and bonds in your asset allocation.

ETFs are low-cost, index-based funds that are designed to match the performance of an underlying index, like the S&P 500 Index. This is what’s known as passive investing because neither Betterment nor the funds themselves engage in active trading of the securities within the funds.

Betterment Account Types

You can open the following account types with Betterment:

- Individual and joint taxable accounts

- Traditional IRA

- Roth IRA

- SEP IRA

- Rollovers

- Employer-sponsored 401(k) plans (Betterment 401(k))

- High-Yield Cash account

- No-fee Checking account

- Trusts

Betterment Pricing

Here’s how Betterment’s pricing breaks down:

Investing: $4 monthly fee or 0.25% annual fee*

Crypto Investing: 1% annual fee + trading expenses

High-Yield Cash Reserve Account: No fee

Checking Account: No fee

Betterment Premium: A 0.15% add-on fee applies to Investing and Crypto investing fees but does not apply to Cash Reserve.**

*You’ll start out with a flat fee of $4 per month, but you’ll automatically switch to 0.25% when you either a) set up recurring deposits of $250 or more or b) reach an account balance of $20,000 or more across all accounts held with Betterment. That includes the checking, Cash Reserve, and Crypto portfolios in addition to your Core portfolio.

**Betterment Premium gives you unlimited access to financial planning advice from a Betterment CFP. There is a $100k minimum balance requirement for this service.

Betterment Core Portfolios

Betterment Core portfolios are constructed from six stock ETFs and six bond ETFs. The specific allocation in each of the 12 funds will be determined by your individual risk tolerance, goals, and time horizon.

Here are the ETFs currently being used by Betterment as of February 2024 (I list primary ETFs only, as they also have a secondary ETF when tax-loss harvesting):

Stocks/Equities

- U.S. Total Stock Market – Vanguard U.S. Total Stock Market Index ETF (VTI)

- U.S. Large-Cap Value Stocks – Vanguard US Large-Cap Value Index ETF (VTV)

- U.S. Mid-Cap Value Stocks – Vanguard US Mid-Cap Value Index ETF (VOE)

- U.S. Small-Cap Value Stocks – Vanguard US Small-Cap Value Index ETF (VBR)

- International Developed Stocks – Vanguard FTSE Developed Market Index ETF (VEA)

- International Emerging Market Stocks – Vanguard FTSE Emerging Index ETF (VWO)

Bonds/ Fixed Income

- U.S. High-Quality Bonds (IRA and 401(k) accounts) – iShares Barclays Aggregate Bond Fund (AGG)

- U.S. Municipal Bonds – iShares National Muni Bond ETF (MUB)

- U.S. Short-Term Treasury Bonds – Goldman Sachs Access 0-1 Year ETF (GBIL)

- U.S. Short-Term Investment-Grade Bonds – J.P. Morgan Ultra-Short Income ETF (JPST)

- U.S. Inflation-Protected Bonds – Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)

- International Developed Bonds – Vanguard Total International Bond Index ETF (BNDX)

- International Emerging Market Bonds – iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB)

Betterment will rebalance your portfolio as needed as funds change in value.

Other Betterment Portfolios

In addition to its core portfolios, Betterment offers more targeted portfolios that cover a range of industries and investments, including socially responsible investing (SRI) and crypto.

Here’s a brief description of some of those portfolios.

Innovative Technology

Betterment invests in “pioneer companies” through its Innovative Technology portfolio. The companies in this portfolio are involved with clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology.

The portfolio mix is 70% stocks and 30% bonds. Includes many of the funds in the Core portfolio but adds SPDR S&P Kensho New Economies Composite ETF (KOMP).

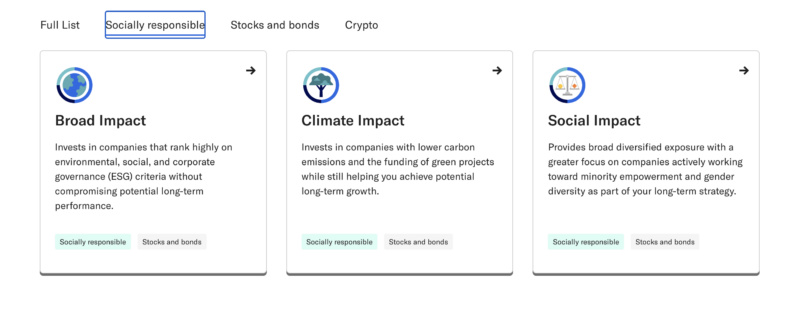

Broad Impact

This is a socially responsible investing (SRI) portfolio providing greater exposure to lower carbon emissions, ethical labor management, or greater board diversity. Except for a few bond ETFs in the Core portfolio, this portfolio includes parallel stock funds with a greater emphasis on SRI.

Climate Impact

This portfolio invests in companies funding green projects and lower carbon emissions, as well as those that divest from fossil fuel reserves. It is another SRI portfolio. Like Broad Impact, it includes a few bond funds from the Core portfolio but holds stocks in the funds that favor low carbon emissions.

Social Impact

Another SRI portfolio, but one that emphasizes companies supporting social equality and minority empowerment. It adds funds with these specializations alongside Core bond positions.

Goldman Sachs Smart Beta

This portfolio invests in companies with the potential to outperform the broader market over the long term. It favors value stocks with sustainable profits, low volatility, and strong upward price momentum. These are the factors that make up Smart Beta investing.

Most of the funds in this portfolio are from Goldman Sachs. They parallel the funds in the Core portfolio but meet Smart Beta characteristics.

Universe

This portfolio includes a diversified group of cryptocurrencies, as well as exposure to decentralized finance, the meta-verse, and more. The Universe fund invests primarily in crypto, with about 50% concentrated in Bitcoin and Ethereum.

Sustainable

This is another crypto portfolio, but one that favors currencies focused on reducing energy consumption and lowering carbon emissions in their usage. Includes a somewhat different mix of cryptos from the Universe portfolio, including a nearly 42% allocation in Ethereum.

Metaverse

A crypto portfolio that focuses on currencies that are helping to build a network of immersive digital experiences. That’s where both crypto and non-fungible tokens (NFTs) re-create aspects of daily life in real time. The metaverse is attempting to create new forms of digital commerce.

Decentralized Finance

Still another crypto portfolio, but one that focuses on cryptos offering financial services without banks or other centralized institutions. This is what has come to be known as decentralized finance, or simply DeFi. They’re assets that leverage blockchain technology in support of peer-to-peer lending and borrowing, as well as trading and other financial transactions.

Betterment Premium

In addition to the Digital plan, Betterment offers their Premium plan. With a minimum portfolio balance of $100,000, you’ll have access to unlimited financial guidance from a certified financial planner. That planner will help you with everything from retirement to crypto investing. It includes professional one-on-one advice to help you establish your goals and create a roadmap to reach them.

The portfolio minimum balance includes investment accounts and crypto accounts, whether taxable or retirement. It does not include cash accounts, HSAs, or an employer 401(k) account managed by Betterment.

Betterment Cash Reserve

Betterment offers a high-yield cash account currently paying a variable rate of 4.75% APY. That makes it a nice option for you to hold cash balances on the same platform where you invest your money. You can open an account with as little as $10, and there are no monthly maintenance fees. Meanwhile, the account features unlimited withdrawals.

(Annual percentage yield (variable) is as of 02/16/2024. Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities.)

Because Cash Reserve is provided by multiple banking partners, FDIC insurance applies on balances up to $1 million. That’s four times higher than the $250,000 in coverage offered by your friendly neighborhood bank. And if you open a joint account, the FDIC coverage rises to $2 million.

✨ Related: Betterment Checking and Savings Review: Cash Reserve

Betterment Checking

This is a mobile checking account that comes with a Visa debit card. There are no monthly or overdraft fees. Meanwhile, Betterment reimburses you for ATM fees and foreign transaction fees. The account even comes with paper checks, which is fairly unusual with online banks. And when you make purchases using your debit card, you can earn cash back rewards from thousands of your favorite brands.

Tax Efficient Investing

Betterment has built automated tax-efficient strategies into its portfolios to help you lower your taxes. This includes Tax Coordination, which automates a complex strategy known as asset location for your retirement goals. Asset location has the ability to improve your after-tax returns without increasing your portfolio’s risk level.

Betterment also supports Tax Loss Harvesting, which involves offsetting capital gains and income by selling a security that has experienced a loss. Betterment’s Tax Loss Harvesting+ feature is fully automated and is available to investors at no additional cost.

Pros & Cons

If you’re looking for a straightforward robo-advisor that also offers banking services (savings & checking), Betterment should be on your shortlist. However, it is missing some key features found on other platforms. Here are some Betterment pros and cons:

Pros:

- Low-fee automated investing

- $0 is required to open an account

- A high-yield cash account offers a competitive APY

- Supports fractional shares

- Tax-loss harvesting available on all taxable investment accounts

- Financial planning services are available

Cons:

- Not the cheapest robo-advisor on the market

- No self-directed investing option

- Not available to non-U.S. citizens/residents or U.S. citizens living abroad

- Doesn’t offer custodial accounts or 529 plans

Betterment Alternatives

If you’re looking for a robo-advisor platform that supports your passive investing strategy, you may want to explore the following options before you sign up with Betterment.

Wealthfront

Wealthfront may be Betterment’s biggest competitor. Both companies launched around the same time, and they’ve closely paralleled one another since. Like Betterment, Wealthfront provides you with a diversified portfolio of stocks and bonds.

But Wealthfront offers a broader diversification, spreading your portfolio among 239 investments in 17 different asset classes. That includes sectors like cryptocurrency trusts, commodity funds, and funds that specialize in technology. They also offer a single flat fee pricing level of 0.25% on all account balances. And like Betterment, Wealthfront also offers a high-yield Cash account, with a slightly higher APY (5.00% vs. 4.75%) as of February 2024. Learn more in our Wealthfront review.

M1 Finance

If you like the robo-advisor concept but want more control over what you invest in, M1 Finance is an excellent alternative to Betterment. With M1 Finance, you can choose the stocks and ETFs that you hold in your M1 Finance portfolios (called “pies”) and have M1 Finance manage and rebalance them automatically. In addition, M1 Finance charges no commissions for buying and selling stocks and funds in your pies, nor do they charge an advisory fee. Learn more in our M1 Finance review.

SoFi Automated Investing

SoFi Invest is a robo-advisor that is similar to Betterment. It uses a goals-based system that allows you to invest for both short-term needs, like saving for the down payment on a home, or long-term goals, like retirement.

But unlike Betterment, SoFi doesn’t charge any fees for its automated investing. And it has a self-directed option, which Betterment doesn’t. You can invest on your own through SoFi Active Investing, with no commission fees, when you buy and sell individual stocks and funds. Like Betterment, SoFi offers a high-yield savings account and an online checking account.

FAQs

At its core, Betterment is a robo-advisor. And until a few years ago, that was basically all it was. But Betterment has been steadily expanding its product offering and now provides a variety of portfolio options, including banking services and financial planning.

Probably the biggest knock against Betterment is that it doesn’t have a self-directed investing option. It’s designed specifically for investors looking for low-cost, professional investment management. In that regard, it’s a perfect hands-off investment service, enabling you to save money for investing without actually needing to get involved in the process.

Betterment is a trustworthy investment platform. First, accounts held with the company are covered under SIPC insurance, which provides protection against broker failure for up to $500,000 in cash and securities, including up to $250,000 in cash. Second, it’s a fiduciary company that’s registered with the Securities and Exchange Commission (SEC) and is also a registered member of FINRA.

Yes. Most Betterment investors will pay a $4 monthly fee (for balances up to $20,000) or 0.25% annually on assets under management. While it’s not the lowest-priced robo-advisor on the market, it is much more affordable than dealing with a human advisor.

Is Betterment Worth It?

If you’re looking for a robo-advisor and don’t need to be hands-on with investment decisions, Betterment is a solid choice. It’s ideal for beginner investors or anyone who follows a passive investing approach. We also like the automated tax-efficient strategies that Betterment employs, the fact that clients with larger portfolios can access financial planning advice, and the High-Yield Cash Reserve account.

That said, if you’re looking for the lowest possible price and more portfolio customization, M1 Finance might be a better choice. And if you’re a self-directed investor, you’ll want to deal with a discount brokerage that will allow you to select your own investments and place your own trades.

I invested with them early in the year, watching the stock market approach record highs this summer. So you think my Betterment account would be doing as well. Nope, YTD they have LOST 6% of my money. Pathetic…

I have had my Betterment account for the better part of 4 years. Today, with yet another stock market decline, I have learned this one very important fact: Betterment is not a Robo Advisor as we’d like to think. Here’s what the actually do: They invest your money in a few ETFs, collect the dividends, and then sit on their hands and ride the waves of the stock market. They do absolutely nothing to protect what gains you may have earned. That is not a robo advisor. That’s just a basic hedge fund. You and I can both do that…… Read more »

I can see why you’re upset but no advisor, robo or otherwise, can protect your gains. They simply cannot predict the future and buy and hold is a strategy that has worked since the beginning of time, it simply relies on you having a long enough time horizon. Even if you were in a relatively aggressive 100% S&P500 index, which started at 2058 points in 2015 and will start at ~2485 in 2019 (4 years), you should still be up even after factoring the fees. It’s a robo advisor and it is NOT a hedge fund, which would be more… Read more »

Interesting comments especially because after reading several reviews on Betterment I began searching for “Performance” and have had a difficult time finding how they’ve actually performed with your $$. It all sounds great in the detailed descriptions but where’ s the performance data? After reading the comments here I have some cold feet.

Hi Paulette, the reason we don’t have any performance data is that it’s all based on the mix of investments they put you in. I don’t have an account with them so my review is a look at the service itself, without looking at performance. The Performance will also be relative to how the market performs and so it’d be hard to give that type of information.

I’ve held a minor portion of my investments in Betterment since 2015 and Betterment has returned a subpar ~6% since they use a heavy concentration of international funds (45%) which underperformed the U.S. market. Betterment’s high international exposure should better emphasized by those who review it.

I personally would not have such a heavy exposure to global market as I’m with Warren Buffet and John Bogle on U.S. markets and is the main reason I’ve stopped adding to Betterment.

I’m about to close my account. I had Betterment since 2012. Their exposure to the international funds is what holds my investment down. They should let investors have a say how much of their investments are exposed to the international market like we have a choice of how much of our money is invested in stocks v bonds. My FKTFX account which grows 4% the most yearly has a better return than VWO or VEA or probably even combined. I don’t recommend FKTFX either. I kept it because my mom opened it when I was a minor and kept it… Read more »

The real nightmare of Betterment is trying to leave. I was unhappy with the lack of transparency (can’t tell what the heck my unrealized gains are!) and lack of control (can’t time a backdoor Roth because they don’t let you keep it in cash), so I set out to move back to Vanguard, thinking it would be simple. Not at all! They don’t do electronic outbound transfers at all, and they’re asking for a Medallion Signature Guarantee, which requires you to go into a physical bank with which you have a long-standing relationship and meet with a manager to have… Read more »

I have some cash sitting in my HSA account. To get better return, I transferred the fund to Betterment investment account. I select it because it is the only choice that HSA administrator specifies. I regret of my decision, and now I stuck in the hand of a swindler. Today is first day that my fund has been transferred into my Betterment account. Although the market is up big today, NASDAQ is up 3.69% and S&P 500 Index is up 1.42%. However, my account value is down on its first day with Betterment. Upon further scrutiny, I found that Betterment… Read more »

I’ve about had it. Betterment seems good, and in fact several of my friends in professional finance like them, but the truth is, in four and a half years, my returns with annualized returns have been 0.1% – yes, you read that right, one-tenth of one percent. That’s with a portfolio that is always between 70%-80% stocks vs bonds. Part of it was my mistake. In March 2020 I panicked and put my money in their safe ~3% APY portfolio. I didn’t move it back until Feb 2021. So I catch about a 10% loss and miss out on a… Read more »