FreeTaxUSA Tax Preparation

Product Name: FreeTaxUSA Tax Preparation

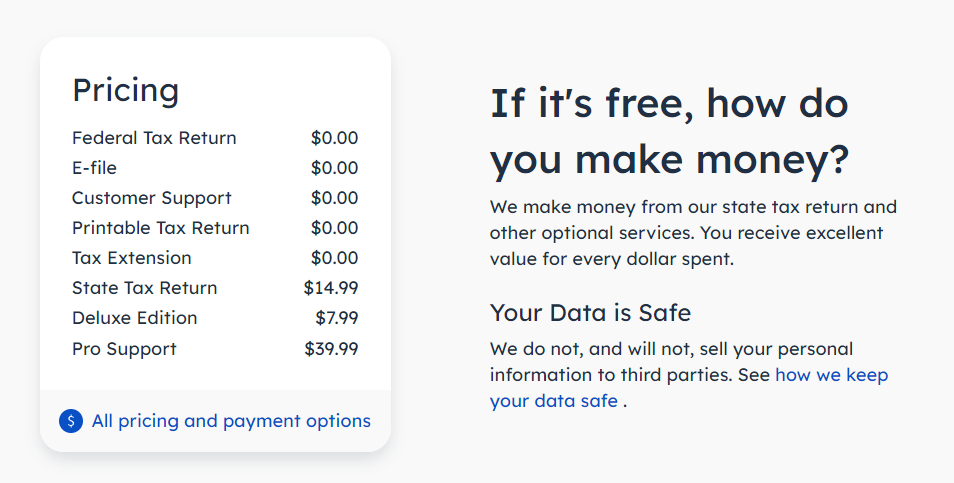

Product Description: FreeTaxUSA is a free tax federal preparation software package that anyone can use, regardless of income. Federal returns are always free. State filings are $14.99 and you can pay extra for support and other services, like audit protection.

Summary

FreeTaxUSA was founded in 2001 and owned by TaxHawk, Inc. They have 150+ employees and one of the original members of the IRS Free File Alliance.

Overall

Pros

Free Federal Returns (Always)

Cheap State Returns ($14.99)

Auditing Assistance

Access to a tax pro

Cons

Limited Customer Service (for free)

Limited Data Importing (for free)

FreeTaxUSA is a tax preparation software program that is exactly what the name implies – free.

It’s free to file your federal income tax return. Like many other free tax prep services, they do charge for filing a state income tax return, but the fee is very reasonable.

With FreeTaxUSA you can prepare your tax returns for free, even if they are more complicated. Many free tax prep software programs only allow you to file for free under certain very limited conditions. It is free only if you have only W2 income, minimal interest and dividend income, and take the standard deduction. If you have anything more complicated than that, free goes out the window, and you’re directed to a premium plan.

That’s not the case with FreeTaxUSA, and that’s why this software is well worth a close look.

Table of Contents

FreeTaxUSA Free Version

The Free Version allows for free federal returns and covers all tax situations, which is very unusual for a free plan. State returns aren’t free, but they are inexpensive, just $14.99 per state.

This is considerably cheaper than how much it costs to get taxes professionally prepared. Accountants will charge $263-$368 to prepare a Form 1040.

Once again, one of the major advantages of using FreeTaxUSA is that it supports virtually any type of income tax return. That’s a very unusual benefit of using this program.

For the free version, customer support is available by email, but not by live chat.

Returns are stored in PDF format. There’s no limit on how many returns you can store, and no charge for doing so. You can also download and either store or print your returns on your own computer.

FreeTaxUSA Deluxe Version

The FreeTaxUSA Deluxe Version has all of the functionality of the free version, but it adds several important premium features that are well worth the price. The paid version costs $7.99 for your federal income tax return and $14.99 for each state return filed.

Those added features include:

Access to a tax pro. For just $7.99 you will be able to ask a tax professional questions via live chat. Note that they can only answer generic tax questions, and will not be able to address your specific situation. However, you can add-on tax assistance if you’d like.

Unlimited amendments. You can file amended federal income tax returns for free when you filed using the Deluxe version.

Priority Support. This feature enables you to get a priority on your inquiries. That means that your email or chat questions will be moved to the front of the line. That will put you ahead of users who are working only with the free version.

Add-ons

There are a few additional services you can add on if you wish.

Pro Support. If you have tax questions that are specific to your situation you can speak to a tax professional for $39.99. You’ll be able to share your screen with them and they can walk you through any questions you have.

Audit Defense. For just $19.99 you can get audit defense. If you are audited, FreeTaxUSA will communicate with the IRS on your behalf and provide up to $1 million in services. They will help you with both federal and state audits.

FreeTaxUSA Features and Tools

FreeTaxUSA offers many of the features and benefits that you typically find with paid tax software programs or those that charge much higher fees.

FreeTaxUSA accommodates filing more complicated returns. This includes self-employed taxpayers, rental income, K-1 income from an LLC, partnership, or S corporation, or a home office deduction. You can do any and all of these with FreeTaxUSA, even with the free version.

FreeTaxUSA Refund Maximizer. This tool double-checks your work on a return filed with another tax prep software program. You enter the information from that return, and the maximizer will analyze it to determine if you could have gotten a bigger refund with FreeTaxUSA.

Also, you can import prior year’s tax returns from TurboTax, H&R Block, and TaxAct.

Upload W-2 from a PDF. If you have a PDF of your W-2 you can upload it. This saves time and limits typos.

Pay fees with your tax refund. If you want, you can pay the fee with your tax return instead of with a credit card. However, this costs an extra $24.99 on top of the normal fee. There’s no added cost if you pay with a credit card. If you have a card, I would recommend using it instead.

Printed return: You will get a PDF copy of your return that you can print for free. However, if you’d rather have FreeTaxUSA print it, they will mail you a paper copy of your return for $7.97, shipping included. You can also get a copy that is professionally bound for $15.99.

Accuracy Checker. FreeTaxUSA uses a real-time accuracy Checker to check your work throughout the preparation process. If the program determines that you may have made a mistake or an omission, you’ll be alerted. This will help to keep you on track throughout the process.

Accuracy guarantee. FreeTaxUSA guarantees the accuracy of your return as filed. You will be reimbursed for IRS-imposed penalties and interest for any errors, omissions or other misinformation resulting from the program software. (Penalties and interest on state income tax returns is not covered under this guarantee.)

Customer support. Email technical support, included with all services, is 8:00 AM – 11:00 PM Eastern Standard Time every day (including weekends). They report answering most emails in under 20 minutes. Particularly complex questions might take up to 24 hours.

Prior years. If you need to file taxes for prior years, you can file your federal returns for free and $17.99 for each state.

Unlimited amendments. You purchase a package that allows for unlimited amendments for just $15.98. If you filed using the Deluxe plan amendments are free.

Prior year amendments. If you need to amend a prior return it will cost $17.97 for each amendment.

FreeTaxUSA Drawbacks

It’s free, so it can’t be 100% roses, right? There are some (reasonable) drawbacks to FreeTaxUSA:

Limited hours for customer support. Customer support is available daily until 11:00 PM Eastern time, which means it cuts off at 10 PM central time, 9 PM Mountain time, and 8 PM Pacific time. This is important to remember since you’re probably doing your taxes during these “after-hours” times.

Data importing limitations. The program cannot import basic data from popular payment processors, including information from W-2s and 1099s.

It’s not completely free. There are completely free options available for those who qualify. So, even though FreeTaxUSA is reasonably priced, you’ll pay more than if you qualify for a free return elsewhere.

FreeTaxUSA Alternatives

FreeTaxUSA vs Cash App Taxes

Cash App Taxes is a totally free way to do your taxes. It completes both federal and state returns for free and covers almost all tax situations. Audit defense is included, but there is no option to speak to a tax professional, even for a fee.

You also can’t file multiple state returns, so if you earned income in more than one state, you won’t be able to use Cash App Taxes.

Here’s our full review of Cash App Taxes.

FreeTaxUSA vs. TurboTax

If you qualify for TurboTax‘s free plan, you can file both your federal and one state return for free. However, only simple returns qualify. You are limited to W-2 income, unemployment income, and a limited amount of interest income. You also must claim the standard deduction, but can also claim the earned income tax credit and child tax credits.

If you don’t qualify for the free plan, then you’ll pay up to $119 for the federal return and $59 per state. You also have the option to add on live assistance from a tax professional. You can also get your entire return done for you with their Full Service plan.

Here’s our full review of TurboTax.

FreeTaxUSA vs. TaxSlayer

TaxSlayer is another software that offers a completely free version. You can file both your federal and one state return for free if you qualify.

To qualify you’ll need to have under $100,000 in taxable income. You also can only have W-2, unemployment income, and limited interest income. You must take the standard deduction and cannot claim any dependents. You can deduct student loan interest and education expenses.

If you don’t qualify for the free version, you will likely qualify for the Classic version, which costs $22.95 for federal and $39.95 for each state return.

Here’s our full review of TaxSlayer.

Will FreeTaxUSA Work for You?

Despite a few program limitations, FreeTaxUSA is well worth using. It has far greater functionality than many other free tax preparation software programs, and even the Deluxe version costs just a fraction of what it does with other popular paid programs.

Due to the lack of importing capability, you must expect to spend more preparation time with this program then you will with TurboTax, but you will also be saving a considerable amount of money on the program fee.

The ability of FreeTaxUSA to accommodate even the most complicated tax returns is virtually a built-in advantage. Most competing free tax software programs can only do the most basic returns. If you have anything more complicated, you’ll have to move up to a premium version.

Even the popular paid programs use a graduated service level. For example, you may pay $50 for a program that does basic returns, but then be required to pay $100 if you operate a small business. There are no such up-charges with FreeTaxUSA.

If you want more information, or if you want to sign up for the program, check out the FreeTaxUSA website.

Kevin, I had signed up for FreeTaxUSA last year and planned to use it this year. I have a VERY simple return. When I finished both returns online, I was told that nothing could be sent out yet due to changes in the tax laws. In addition, I would have to send the returns myself rather than their efiling for me. For my purposes and for these reasons, I did not see any reason to spend $12.95 when other programs are completely free, like TurboTax and ones that some of the more popular credit websites are starting to offer. I… Read more »

I didn’t have any problem sending my returns last year. It filed for me – free for Federal and about $10 for state.

This is exactly what I used last year to file my kids’ taxes. They only have part-time income with the simplest return and I found this FreeTaxUSA website very easy to use. Will definitely use this again for their taxes this year.

That seems like a perfect use case!