TurboTax is one of the most trusted tax prep software available. It’s priced based on how much assistance you need and how complicated your taxes are. They have a Do-It-Yourself plan, a Live Assistance plan (that lets you ask a tax pro questions), and a Life Full Support plan where a tax expert will do your taxes for you and file on your behalf.

How much you’ll pay for each plan depends on how complicated your taxes are. They also have a full suite of guarantees, such as an accuracy guarantee and a maximum refund guarantee.

Every return comes with audit assistance, which lets you ask questions if you get audited, but the tax expert will not represent you to the IRS. You can add on full audit assistance for an additional fee.

✅Special Offer: If you file before March 31, 2024, and qualify for the free plan you can add on Live Assist for free.

Table of Contents

How Much Does TurboTax Cost

TurboTax is one of the more expensive tax software available, but for good reason. It is the gold standard when it comes to online tax prep and has all the features you could need in an easy-to-use package.

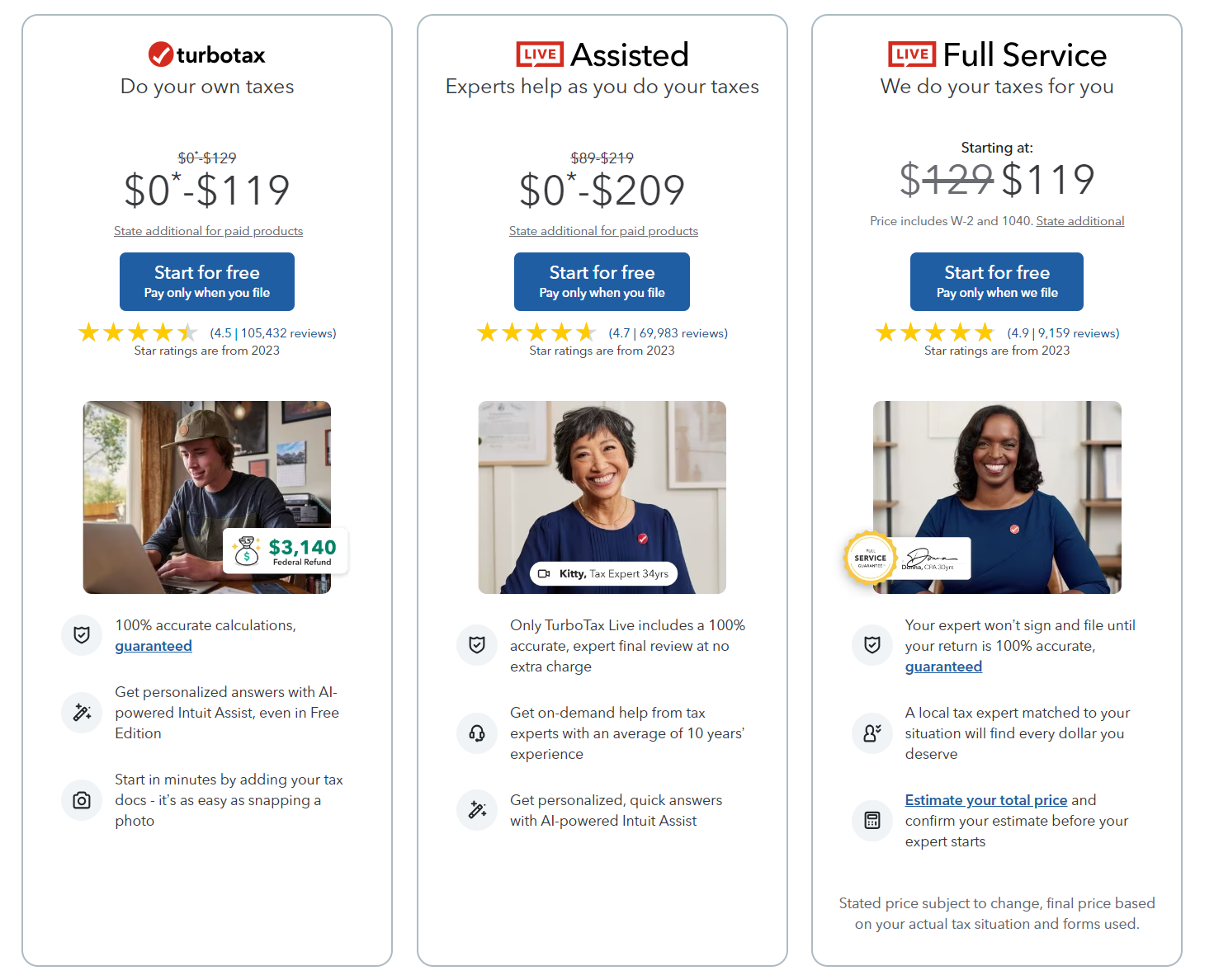

The TurboTax versions available are based on how much assistance you’ll receive. The Do It Yourself version doesn’t come with any tax assistance, Live Assisted allows you to ask tax questions to a tax expert, and Full Service lets you hand off the entire task to a tax pro who will file on your behalf.

How much you’ll pay for each version depends on how complicated your taxes are. You can start for free and upgrade as needed, you’ll only pay when you actually file your taxes.

Note: Did you know that if you rented your home out for 14 or fewer days, you can exclude that rental income from your tax return because of the Augusta Rule. If you would otherwise have a very simple tax situation, except for rental income of 14 or fewer days, you could still use the free editions.

TurboTax for Free Edition

Audit assistance included: Informational only | Accuracy guarantee: Yes | Maximum return guarantee: Yes

➕ Includes one state

➕ Easy to use

➖ Not everyone will qualify

➖ Doesn’t include unemployment income

Pricing 1: Free

File for free with TurboTax Free Edition. ~37% of taxpayers qualify and it includes Form 1040 + limited credits only. File for free with TurboTax Free Edition. For simple tax returns only. Not all taxpayers qualify.

TurboTax Free Edition is technically part of the Do It Yourself version, but it’s good to break it out of the list so we can discuss it in full.

Simple tax returns can qualify for free services. This includes:

- W-2 income

- Interest income

- Dividend income

- Standard deduction

- Earned income tax credit

- Child tax credit

- Student loan interest deduction.

It’s important to note that the free plan includes your federal return and one free state.

This plan doesn’t come with any tax assistance. However, if you file before March 31, 2024, you can add on Live Assisted for free. This makes the TurboTax free plan the best in the industry. You will not get tax assistance for free anywhere else.

Do It Yourself

Best For: Access to a tax professional

Audit assistance included: Informational only | Accuracy guarantee: Yes | Maximum return guarantee: Yes

➕ Includes all tax returns

➖ Doesn’t include any tax assistance

Simple returns: $0 for federal and one state

Moderate returns: $59 for federal and $59 per state

Complex returns: $119 for federal and $59 per state

The Do It Yourself plan does not come with any live tax assistance. There is tech support if you have questions about the software, but you will not have access to a tax pro.

Simple returns: This plan may be free, if you have a simple return. For example, only having W-2 income and taking the standard deduction.

Moderate returns: If you have a slightly more complicated return, such as having unemployment income or wanting to itemize, you’ll pay $39 for your federal return and $39 for each state you need to file in.

Complicated returns: The most complicated returns include sold investments, rental income, and business or freelance income. If you fall into this category you’ll pay $89 for your federal return and $39 for each state.

Live Assisted

Best For: Speaking with a tax expert

Audit assistance included: Informational only | Accuracy guarantee: Yes | Maximum return guarantee: Yes

➕Gives you unlimited access to a tax pro

➕Can share your screen with the tax expert

➖Expensive

Simple returns: Free if you file before March 31, 2024

Moderate returns: $89 for federal and $64 per state

Complex returns: starts at $119 for federal and $64 per state

The Live Assisted version gives you access to a tax professional who can answer tax questions specific to your situation.

Simple returns: If you qualify for the free version you can upgrade to Live Assisted for free, if you file before March 31, 2024.

File for free with TurboTax Free Edition. ~37% of taxpayers qualify and it includes Form 1040 + limited credits only. File for free with TurboTax Free Edition. For simple tax returns only. Not all taxpayers qualify.

Moderate returns: If you want to itemize or have income that isn’t business income or W-2 income, such as unemployment income you’ll pay $89 for your federal and $64 for each state.

Complicated returns: If you sold investments, have a rental property, or have business income (including 1099 income) then you’ll need the highest plan which is $209 for your federal return and $64 for each state.

Live Full Service

Best For: Having your taxes done for you

Audit assistance included: Informational only | Accuracy guarantee: Yes | Maximum return guarantee: Yes

➕ You don’t have to do your own taxes

➖Pricing is not transparent

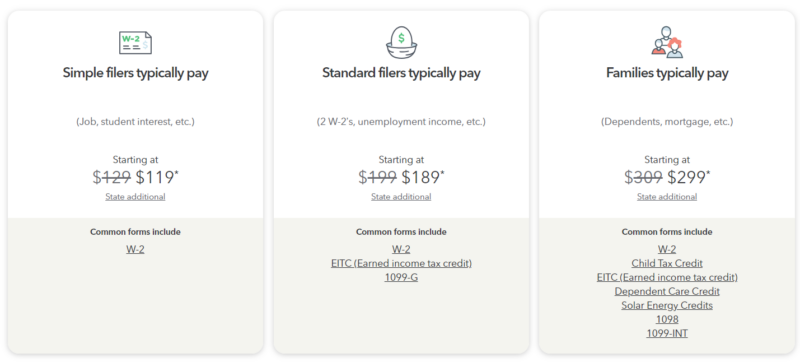

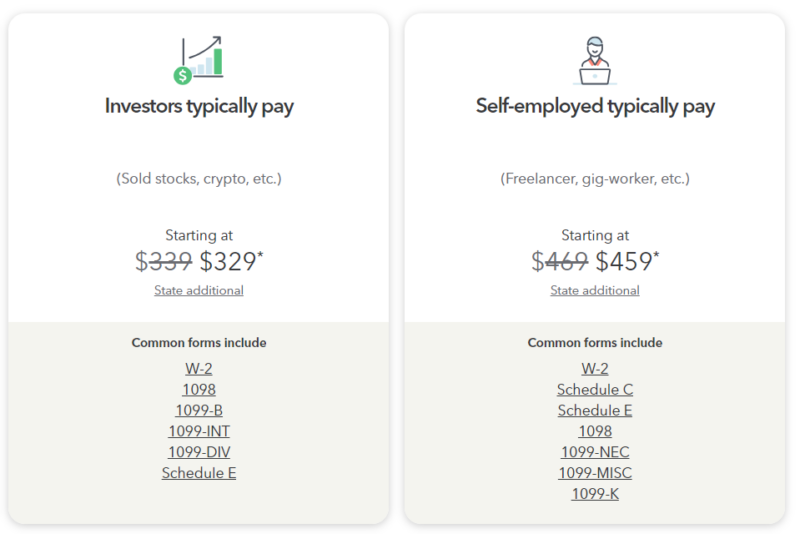

Simple returns: starts at $119 for federal and $64 per state

Moderate returns: starts at $299 for federal and $64 per state

Complex returns: starts at $459 for federal and $64 per state

With this version, you will just hand your taxes over to a tax expert, and they will file your return for you. This plan starts at $119 for federal returns for the simplest of returns and goes up from there, depending on the complexity.

Audit Support

Informational audit support is in every individual plan, and Live Assisted Business and Full Service Business. In other words, you get audit support unless you did a business return without assistance.

The audit support that is included allows you to call TurboTax and speak to a tax professional who will answer questions about any letters you received or the audit process. They will not write letters or speak to the IRS on your behalf.

If you want full audit defense, you’ll have to upgrade for $39.99. This service is provided through a third party, called TaxAudit. In the event you are audited, they will handle every aspect of your audit for you – including representing you with the IRS – at no additional cost. Think of it like audit insurance.

Accuracy Guarantee

TurboTax’s calculations are guaranteed accurate. If you are charged a penalty or interest due to a calculation error (ie, you put in the right information but the software made a mistake) TurboTax will pay the penalties and interest.

They will not pay the extra taxes that you legitimately owe.

Maximum Refund Guarantee

If you file your individual return with TurboTax and then redo your taxes with another company and get a bigger return (or smaller tax liability), you can get a refund of the fees you paid to TurboTax.

This does not apply to business taxes.

Free Refund Advance

If you can’t wait for your refund to show up you can get a refund advance up to $4,000, for free.

It won’t cost you any fees or interest but you do have to open a checking account with Credit Karma Money, however. Your advance will be deposited into the Credit Karma Money checking account within a few minutes.

Who should use TurboTax

Anyone who qualifies for the free version of TurboTax should go ahead. If you file before March 31, 2024, you can add on tax assistance for free.

Also, if you are nervous about doing your taxes yourself, TurboTax is a great place to begin filing because you can upgrade to tax assistance, and if you still want more help, you can upgrade again to the full-service plan. TurboTax is the only tax software that has all three options.

Most tax software will allow you to add on the ability to speak to a tax expert and ask questions, but few have the option to just hand them over completely and have the expert file on your behalf.

Who shouldn’t use TurboTax

If you are confident in your ability to do your own taxes, you may not need all the support that TurboTax offers. If this is the case, you are paying for features you probably don’t need, and you would be just fine using a less expensive service.

Also, if you have very complicated business taxes, you might be better off having your taxes done by an accountant and skipping tax software altogether.

How TurboTax Works

TurboTax will walk you through the process of doing your taxes by asking simple, plain English, questions that will guide the software to understand what forms and information you’ll need to submit.

For example, it will ask you if you have dependents. If you say yes, you’ll be guided to enter their information. If you say no, the software will skip all things related to dependents.

If it asks for information that you need to track down, or haven’t received yet, you can skip the question and come back to it later. It’s very easy to navigate around to different sections and add in forms and documents as they come in.

TurboTax Download

TurboTax does have downloadable software if you don’t want to file online. It is a bit more expensive if you are only doing one return, but the real benefit is that you can file multiple federal returns with the download version.

For example, the basic version is $40, but you can e-file five federal returns and state returns are $20 each. So, if you are doing taxes for several people, this could save some money.

TurboTax Alternatives

TurboTax isn’t the only place to get your taxes done.

H&R Block

H&R Block is a strong competitor to TurboTax. They’ve been doing taxes since 1955, and you probably have a local office near you.

The main difference is that with H&R Block, you don’t have the option to ask questions to a tax pro on any plan. Tax questions are answered by an AI chatbot and if you want to speak to a human you have to upgrade all the way to a full service plan, where they file on your behalf.

However, the free version of their online software is more comprehensive than TurboTax’s version. So if you don’t qualify for the free version on TurboTax, check out H&R Block

Here’s our full review of H&R Block.

TaxSlayer

TaxSlayer’s free version is fairly comprehensive and includes one state return, but you have to have under $100,000 in taxable income to qualify.

But the next level up, the Classic plan, is reasonably priced and covers almost all individual tax situations. If you want to add on tax assistance, you’ll need to upgrade to the Premium plan, but it’s only an additional $20. Which is not a bad price for tax assistance.

Here’s our full review of TaxSlayer.

FreeTaxUSA

FreeTaxUSA includes just about every tax situation in their free plan. It doesn’t include a state, bu the state returns are only $14.99. You can add on tax assistance for $39.99 and full audit defense for $19.99.

In the past 8 years, I have used both Turbo Tax free file on the IRS website and Credit Karma free file. This year, I started with Credit Karma and discontinued, going with Turbo Tax free file. Here’s why: > Was found not eligible for the CA Renters Credit of $60. I’ve been eligible for every year since 2003 when I moved back to CA. No explanation as to why I wasn’t eligible. I had answered the questions in the CA Tax Form 540 instructions already (more questions than Credit Karma’s 3, including landlord’s name and contact information) and was… Read more »

It depends on how much money you make as to whether Turbo Tax will charge you. You left out that question between being free and being charged!!

Jim is wrong unless he’s only talking about online versions. The CD/download versions contain all the tax forms you need. TT Deluxe CD/download does have Schedule D and anything else you need for handling your investments. If you stick with the CD/download version you get more features and can switch to another tax software that can still import your previous year TT data.

The CD Basic has done my Schedule A deductions for years! I believe Jim is wrong. Intuit IMPLIES lots of things to get you to spend more, like “Deduction Maximizer” which is not the same as being able to do itemized deductions. Just a little more hand holding.

Gotcha, thanks for letting us know Ron!

I purchased 2019 TurboTax Deluxe. It does contain Schedule C which I have used in the past (small sidehustle). I am just wondering if it handles the new QBI calculation correctly, since it’s asking me for manual entries upon federal review.

I have used TurboTax Deluxe for many consecutive years now, and while the instructions online and here always say if you have stock sales, you need the Premier Edition, I have had stock sales virtually every year and the Deluxe version has been quite adequate! I can import my Ameritrade Consolidated Form 1099 easily and have never needed a higher version than the Deluxe one. Perhaps one would need the Premier version if one sold stock options … I cannot comment on that, but with just common stock sales, I’ve always been fine with Deluxe! So why the “You will… Read more »

Harry, I also wonder about the need for higher-level versions, because many posts I’ve read say that all of the desktop versions contain all of the tax forms. I began using TurboTax back in the 1990s, when it was only available on CD, and it worked fine. Eventually they added different versions and then the totally online option. Totally online seemed logical because you start for free and then are told which version you need to pay for, given the forms you used. But that is crazy if a downloaded basic desktop version contains all of the forms. A second… Read more »

I’ve always used turbotax for at least 15 years.

Jim, With the other suggested tax programs. Do they allow import data from turbotax?

And that’s why I use turbotax every year to be able to import all the data.

A lot of them will import from TurboTax – just see which one you like and double check. For example, H&R Block will import from TurboTax. Some will import from a PDF too.

What turbo tax version will cover 1095A(Obama care)? Thanks!

I believe it is the Premium version.

Jim you forgot to mention intuits “ITS DEDUCTIBLE “ program!! This is probably the main reason I still use TurboTax! You need to add the benefits of this program with TT! We track all our cash and material items, as well as all charitable donations in this program throughout the year. . It flows flawlessly into TT at tax time filling out all the correct forms. It gives you immediate feedback on how your contributions will reduce your taxes. I love it!

You have a great website. Thank you for the information you give us. I have used Turbo Tax Deluxe for years, but for the 2021 tax year, I inherited an out of state (I live in CA, my brother lived in AZ) pension plan monthly benefit that will last for 6 years. I assumed the pension plan he had been getting. They will issue a 1099 to me, and I have been paying Federal Income Tax on it. I was the beneficiary, and it was not through a trust. Do I need Turbo Tax Deluxe or Turbo Tax Premier for… Read more »

If you look at their list of tax forms, it’ll tell you which is covered by which version. If you have a fairly simple tax situation otherwise than you may be able to use the Free Edition. Free Edition (every edition actually) covers a Form 1099-R, Distributions From Pensions, Annuities, Retirement, etc.

I don’t know what other things you need but the pension won’t push you into a more expensive package.