Few of us enjoy filing taxes. Maybe you’re fearing a big tax bill due to a prosperous year. Or you can think of a hundred better ways to spend your cash than mailing a check to the IRS.

You may already know that you can be audited if you lie on your tax return (for example, if you don’t report all of your income or claim inappropriate deductions). But what happens when you don’t file your tax return at all? Will the IRS realize one measly missing tax return of the 160 million individual tax returns filed each year?

The answer is yes.

And while it’s possible (but nearly impossible) to sneak below the radar, there can be stiff financial and legal penalties for not filing, filing late, or failing to pay.

Table of Contents

- Legitimate Reasons You Don’t Need to File a Federal Income Tax Return

- IRS Statute of Limitations

- Severe Consequences of Unpaid Taxes

- Tax Filing Penalty with Interest

- Wage Garnishment

- Tax Liens

- Tax Evasion Charges

- Substitute Tax Return

- No Tax Refund

- No Social Security or Disability Credits

- Cannot Qualify for Loans

- How to Pay Back Taxes

- Summary

Legitimate Reasons You Don’t Need to File a Federal Income Tax Return

Just because you earn an income doesn’t necessarily mean you must file a tax return. Here are some instances when you can legally not file a return:

- You only earn non-taxable Social Security benefits.

- You earn less than the standard deduction and don’t owe a tax liability.

- You earn less than $400 in self-employment income.

- You don’t receive advance payments for the healthcare marketplace Premium Tax Credits (Form 1095-A).

However, it might be worth your time to file taxes so you can get any extra money you qualify for under the tax code — for example, the Earned Income Credit and Child Tax Credit. You may also appreciate filing taxes for peace of mind.

IRS Statute of Limitations

The IRS can only pursue you for a limited time if you owe taxes. Statutes of limitations mean that after a set timeframe, your tax debt is written off.

However, waiting out the IRS isn’t a good financial strategy, as your debt will go into collections before the timeframe is up. Plus, many factors could temporarily pause the clock and extend the statute of limitations—for example, if you declare bankruptcy or leave the country for more than six months.

The following two IRS deadlines can affect you if you don’t pay taxes on time.

Collection Deadline

The IRS has a 10-year statute of limitations for collecting unpaid taxes. This countdown usually starts on April 15, assuming you’ve filed your taxes before the filing deadline. However, if you delay filing your return, the timer may not begin until years later.

As mentioned above, significant events like declaring personal bankruptcy or moving out of the country may suspend the collection period but won’t cancel the affected months.

Audit Deadline

The IRS must initiate a tax audit within three years of filing a federal income tax return—the same window within which to file a return and claim a refund. You can also file an amended return during this time to fix errors. However, if you originally underpaid, you might pay penalties and interest.

Like most legal matters, there can be exceptions to these deadlines, and a tax lawyer can help you navigate the process.

Severe Consequences of Unpaid Taxes

If you don’t submit a return, underpay, or make accuracy errors, there are various potential consequences. For example, the IRS will charge interest on any outstanding taxes. You could also face even more severe penalties, such as a lien on your property or criminal charges.

The severity primarily depends on the amount of tax owed and when you filed your return.

Tax Filing Penalty with Interest

Two of the most common income tax penalties are:

- Failure to File: You don’t file before the tax filing deadline. The due date is usually April 15.

- Failure to Pay: You don’t pay your total income tax due before the federal tax deadline.

Neither penalty applies if you’re due a refund.

Requesting a tax extension can avoid the failure-to-file penalty. However, you must still pay the total due by the annual filing deadline. Even if you don’t have all of your tax documents by April 15, your interest penalties begin on the federal filing deadline, not when you finally file your return.

IRS interest rates are updated quarterly and compound daily. The interest rate for individuals is 8% for the first quarter of 2024.

Failure-to-File Penalty

If you file taxes late or fail to file, your monthly penalty is 5% of your unpaid tax liability and won’t exceed 25% of your total amount due. The combined penalty percentage is 5% if you also have a failure-to-pay penalty.

The minimum penalty is $485 or 100% of the tax required (whichever is less) if you file at least 60 days late.

Failure-to-Pay Penalty

If you owe taxes and fail to pay, the penalty is 0.5% of your unpaid balance each month, up to 25% of your total amount due. Your combined monthly penalty rate won’t exceed 5% if you’re also paying a failure-to-file penalty.

Your penalty rate can be different if you file in time but don’t pay the correct amount. For example, if you enroll in a payment plan, your monthly rate drops to 0.25%. Or if you don’t pay your income tax due within 10 days of receiving an IRS intent to levy, the monthly rate is 1%.

Wage Garnishment

You might receive an IRS levy garnishing your wages to repay overdue taxes. Usually, you won’t receive a levy until meeting these four conditions:

- The IRS sends you a Notice and Demand for Payment.

- You neglect or refuse to pay a tax notice.

- The IRS sends you a Final Notice of Intent to Levy and Notice of Your Right to a Hearing at least 30 days before the levy goes into effect.

- The IRS sends you an advance notice that third parties may start collecting your tax liability.

Wage garnishment happens if you don’t pay the initial penalties or negotiate a payment plan. When the IRS implements a levy, you will receive Form 1494 listing your garnishment amount. The withholding can come from your paychecks or bank account.

Tax Liens

The IRS may also place a lien on your physical property, such as real estate or vehicles. This doesn’t mean the tax agency will seize your property, although it’s a possibility. A federal tax lien can have these adverse effects:

- It can appear on your credit report.

- You may not be able to sell your physical property until satisfying the lien requirements.

- It can be attached to your business property.

This lien can still apply even after you file for bankruptcy. If you need help paying your tax debt, following up on any correspondence from the IRS can help you avoid this action.

Tax Evasion Charges

If you still don’t file your taxes or pay the amount due, the IRS may pursue criminal penalties. Al Capone committed many heinous crimes during his day, but tax evasion put him in federal prison.

Capone owed $215,000 in back taxes at his sentencing in 1931. That’s approximately $4.1 million in today’s dollars. While most delinquent taxpayers won’t face criminal prosecution, the possibility still exists today.

Substitute Tax Return

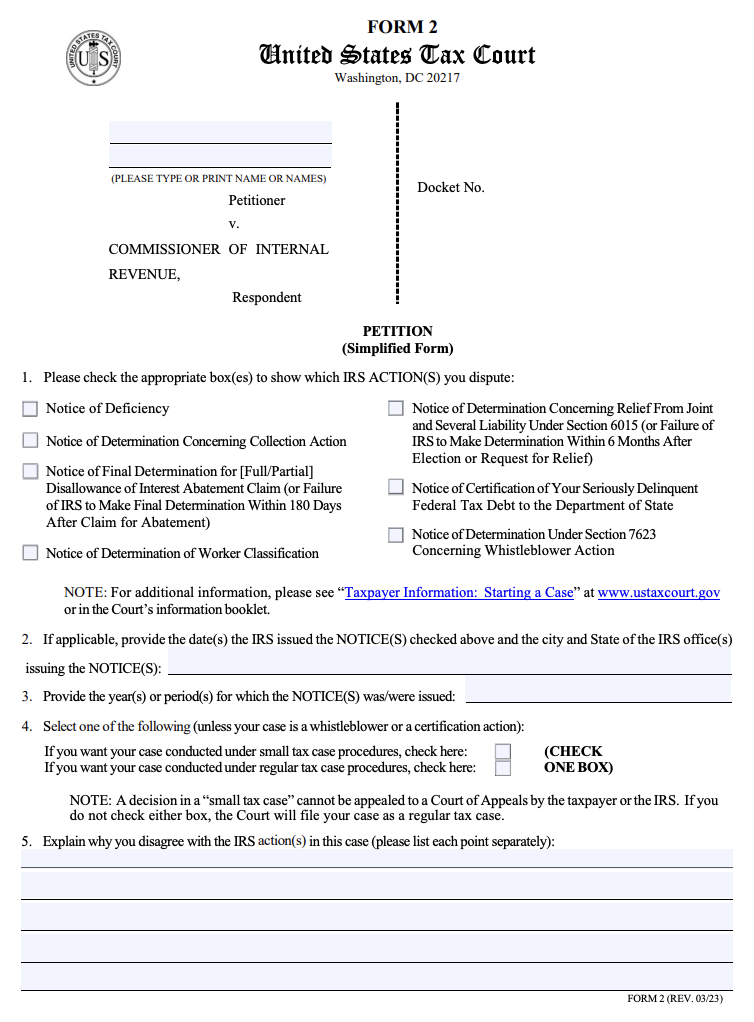

The IRS may file a substitute tax return on your behalf using tax forms provided by your employer, banks, and investment brokerages. You will receive a Notice of Deficiency (CP3219N), which generates a substitute return to estimate your tax owed.

You then have 90 days (150 days if you live out of the country) to file a petition to challenge the proposed tax. While this step can potentially keep you out of tax trouble, you will most likely miss out on valuable tax deductions and tax credits.

No Tax Refund

You cannot claim a tax refund if you don’t file a return within three years of the filing deadline.

For example, if you qualified for a refund during tax year 2021 with a filing deadline of April 18, 2022, you have until April 15, 2025, to file your return. Missing the deadline means you forfeit your refund amount.

No Social Security or Disability Credits

Your future Social Security and disability insurance benefits can be smaller as you won’t receive credit for the years you don’t file.

This consequence primarily affects the self-employed as W-2 employees have payroll taxes withheld from each paycheck.

Cannot Qualify for Loans

Lenders require a copy of your recent tax returns for new home loans and mortgage refinances. If you fail to file, you likely won’t qualify for any financing.

How to Pay Back Taxes

It’s your responsibility to pay any unpaid taxes to the IRS to avoid penalties and interest. There are several ways to settle your tax bill.

- Lump sum payment: If you owe a small amount, this is the quickest way to get back into good graces with the IRS and avoid future financial charges.

- Installment plan: Sometimes, you can’t afford to pay your tax bill in full all at once. A monthly payment plan will keep you in good standing. You may also be able to contact the IRS to set up a repayment plan, file an appeal, and demonstrate financial hardship.

- Hire a tax attorney: Some tax situations are too complex to navigate alone. Seeking counsel from a tax attorney can be the best option if you need to go to court or sue a tax agency.

✨ Related: How to File Back Taxes for Free

Summary

As you can see, not paying your income taxes can have several financial and legal ramifications. Therefore, do everything you can to file your taxes and pay your tax liability promptly.

As uncomfortable as paying a penalty can be, addressing an adverse tax situation sooner rather than later can give you more time and money to focus on other financial priorities.