Tax preparation is one of those services where prices can vary a lot.

As a general rule, the more you do, the less it will cost. The more an accountant does, the more it will cost. It’s not unreasonable for a professionally prepared tax return to cost several hundred dollars or more.

How much this costs will depend on the cost of living in your area (tax returns in Manhattan are more expensive than in Mississippi, the lowest cost of living state in the U.S.), how busy the tax preparer is, and other similar factors.

📓 Quick Summary: Based on the National Society of Accountants survey from 2020, the average cost to prepare a Form 1040 tax return (standard deduction) is $263, when adjusted to December 2023 dollars. If you itemize deductions, the average cost to prepare a Form 1040 tax return with Schedule A increases to $368. (also adjusted to December 2023 dollars)

Table of Contents

Cost for Professional Tax Preparer

The National Society of Accountants (NSA) conducted a survey back in 2020 and produced an Income and Fees of Accountants and Tax Preparers in public Practice Survey Report that outlines how much accountants were charging for various tax returns. It’s a massive report, clocking in at 400+ pages, with detailed breakdowns by region.

We used the BLS’ CPI inflation calculator to adjust the figures for 2024 (we assumed the NSA’s report was April 2020 figures and adjusted them to December 2023 dollars, rounded to the nearest dollar).

National Cost to Prepare Various Tax Forms

- Form 1040, not itemized – $263

- Form 1040, itemized – $368

- Form 709 (Gift Tax) – $504

- Form 1041 (Fiduciary) – $689

- Form 1065 (Partnership) – $877

- Form 1120S (S Corporation) – $1,080

- Form 1120 (Corporation) – $1,092

- Form 706 (Estates) – $1,542

- File an Extension – $56

They also break it out based on the Schedules:

- Schedule B (Interest and Ordinary Dividends) – $50

- Schedule C (Business) – $230

- Schedule E/Form 8949 (Gains & Losses) – $141

- Schedule E (Rental) – $173

- Schedule EIC (Earned Income Credit) – $78

- Schedule F (Farm) – $239

- Schedule H (Household Employment Taxes) – $79

- Schedule SE (Self Employment Tax) – $49

The report also shares the hourly rates for preparing various forms but I don’t feel like that’s a reflection of cost and more a reflection of the area’s cost of living. I’d expect, on average, the forms to take the same amount of time so an hourly rate doesn’t make much sense.

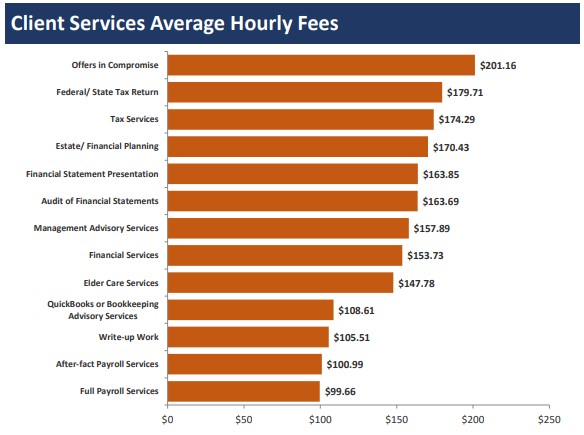

Also, if you look at the report, the hourly rate is about $150 an hour across all forms anyway. They also go into hourly rates for other tax related items and those can run more than preparing the forms (which are typically straightforward anyway):

If you are reviewing accounting costs, this can give you an idea of what everything costs.

State Cost to Prepare Various Forms

They surveyed enough accountants in various states to get the same above values for each state. The simplest way to see that is to use their NSA Tax Preparation Fee calculator. If you use the tool, remember it is using 2020 dollars and you have to add about 20% to account for inflation.

For example, in Maryland, the average cost to file a Form 1040 (Not Itemized & state return) is $548 (the tool says $307). If you itemize (adds a Schedule A), the cost goes up to $989! (tools says $552). These are higher than national averages because Maryland is a higher cost of living state (approximately 22% higher than average).

You can also view how much they cost in various U.S. Census Regions but given state level data, I’m not sure regional data is all that useful.

Cost for Tax Software

As you can see, the cost to hire an accountant to do your taxes is quite high. The best way to save money is to do as much of it yourself and for most tax situations, you can prepare it yourself.

How much you’ll pay depends on how complicated your taxes are. It typically breaks down to simple, moderate, and business owner.

- Simple taxes are those returns that only have W-2 income and don’t itemize.

- Moderate returns include anything more than just a W-2 and the standard deduction but are less complicated than having a business. This could include investment income, a rental property, etc, and any complications, such as itemizing.

- Lastly, business returns are the most complicated and will cost the most.

If you have a simple tax return, there is a good chance you can get your return done for free. Here’s a list of free tax software.

If your taxes are more complicated but your income is below $79,000, check out the IRS Free File program. They’ve partnered with several tax preparation services so that you don’t need to pay to file your federal returns. There may be a cost for state returns, but some preparers won’t charge you for that either.

If you have moderately complicated taxes, you can expect to pay around $70 for both federal and state. And if you own a business, you can expect to be charged around $100.

If doing your taxes yourself seems a bit scary, don’t worry. Most tax software will give you access to a live tax professional for an additional fee.

The least expensive way to access a tax pro is with FreeTaxUSA. With FreeTaxUSA all federal returns are free and state returns are $14.99. Then, you can add on live tax assistance for $39.99. That means even business owners could do their taxes with the help of a tax expert for $55, assuming one state return.

If you qualify for a free return with TurboTax you can actually add on live tax assistance for free until March 31, 2024.

✨ Related: How to File Back Taxes for Free

Conclusion

Tax preparation is expensive, and accountants are famously swamped during this time of year. If you were to call up an accountant right now and inquire about services, chances are they’re too busy to take you on as a new client. They’d ask for your paperwork, do a quick estimate of your taxes due, and then request an extension.

If you’re getting tax preparation quotes and balking at the price (it’s natural to be hesitant when you see quotes in the many hundreds of dollars!), try doing it yourself.

The best-case scenario is that you file your taxes and save hundreds of dollars. The worst case is that you learned you need a professional and spent a few hours learning more about your situation (and now you know you need someone).

If you want to save money, you want to do as much as you can yourself.

It does not seem to be well known, but Cash App Taxes is 100% free for federal and state. There are very few scenarios that it cannot handle, most prominently multi-state returns. I’m a CPA and have been using it for my own returns for years.

That’s a big vote of confidence for Cash App Taxes! I think they’re less well known because they used to be Credit Karma Taxes and were acquired/re-branded.

They aren’t on my radar because there are a few situations they can’t cover and, since they have no paid option, if you happen to have those situations then you have to go elsewhere.