NerdWallet Budgeting App

Product Name: NerdWallet Budgeting App

Product Description: NerdWallet offers a free budgeting app that is available to anyone who registers for an account. It has all the basic features of a budgeting app but lacks a few niceties, like splitting transactions and notifications.

Summary

NerdWallet was founded in 2009 by Tim Chen and Jacob Gibson. They provide recommendations for various financial products and services.

Overall

Pros

Free tool without ads Has basic budgeting tools and reports 50/30/20 budgeting report

Cons

No custom notifications No custom expense categories Cannot split transactions Can’t delete transactions

Did you know that NerdWallet offers a budgeting app?

I didn’t until I saw someone mention it on Reddit. It’s part of a suite of tools they make available whenever you register for an account on their site. It’s a lesser advertised benefit.

In addition to budgeting and monitoring your net worth, you can also get your credit score based on your TransUnion credit report.

Is it worth getting?

📔 Quick Summary: If you register an account on NerdWallet, you can get free access to their basic budgeting and net worth tracking tool as well as a free credit score based on your TransUnion credit report. It’s not a very complex tool but if you just want to keep an eye on your transactions, spending categories, and bills – it might be a good option for those who don’t want to pay. It is our favorite of the completely free budgeting apps.

Table of Contents

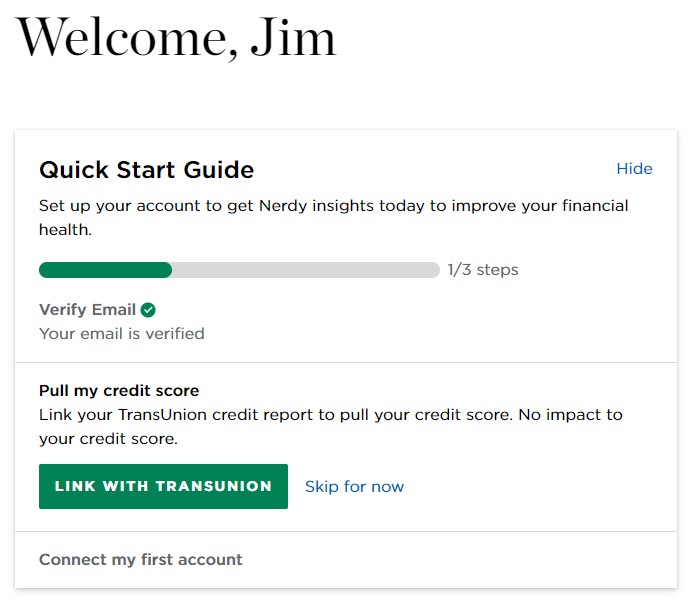

Signing up for NerdWallet

Once you register for an account, you’re prompted to finish two more steps:

- Pull your credit score

- Connect your first account

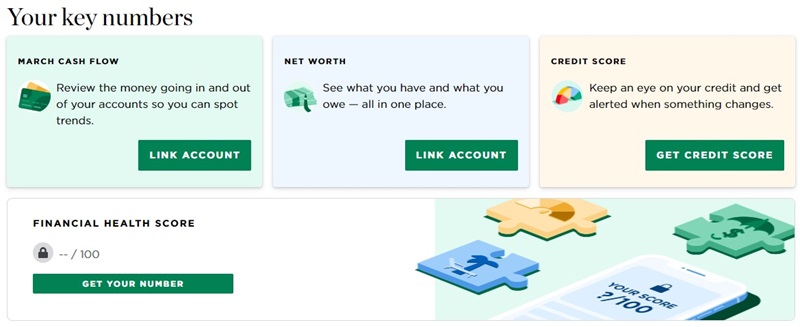

I don’t really care about my TransUnion credit score right now but right below that image is “Your key numbers” and two intriguing boxes:

Before you can use any of those features, they want more information so they can increase their security. They ask one security question and then want you to verify your phone number. This is probably a requirement for Plaid, what they use to link your accounts, and you always want two-factor authentication for stuff like this.

Cash Flow Tracking

Using Plaid, I connected our Chase credit cards to see what kind of budgeting features they would offer. NerdWallet wants your account numbers (Chase gives them “substitutes” that aren’t your actual numbers), account names, balances, transactions, rewards, and contact information.

I offered up the main credit card we use, the Chase Sapphire Preferred card. Incidentally, if you have multiple logins to a single institution, you can only use one. For example, if you have a login for your bank and your partner does too (to a separate account), you can’t log into both accounts.

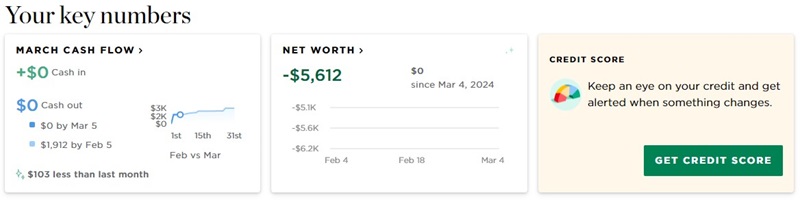

Those three boxes updated to show this:

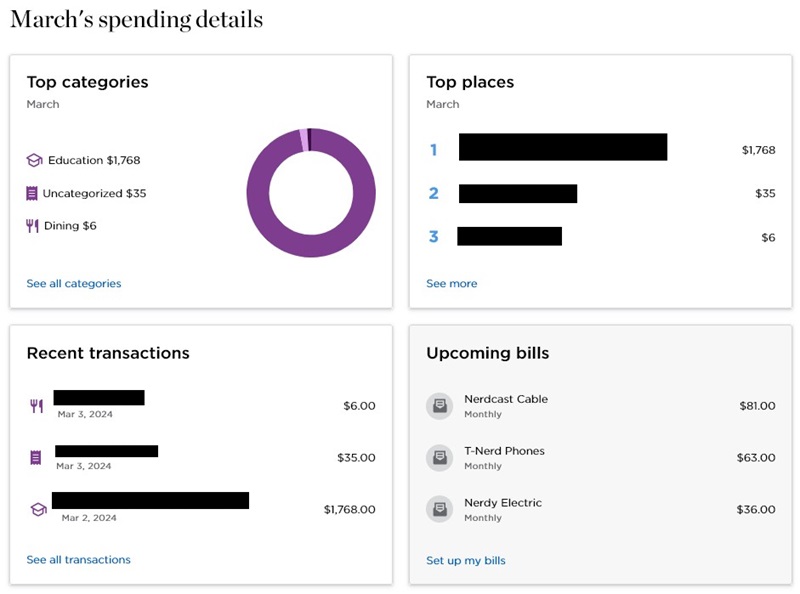

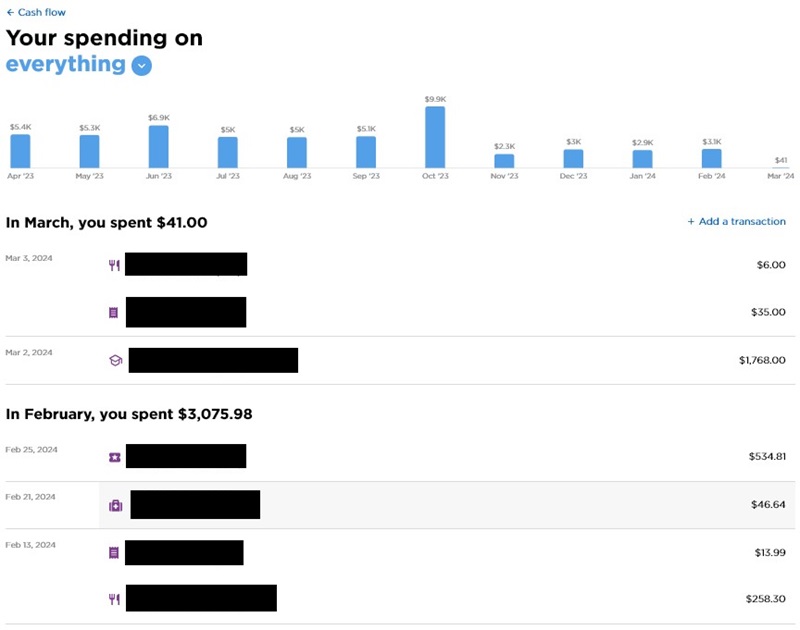

If you click through, you get the types of things you’d expect:

The interesting data is in the Recent Transactions:

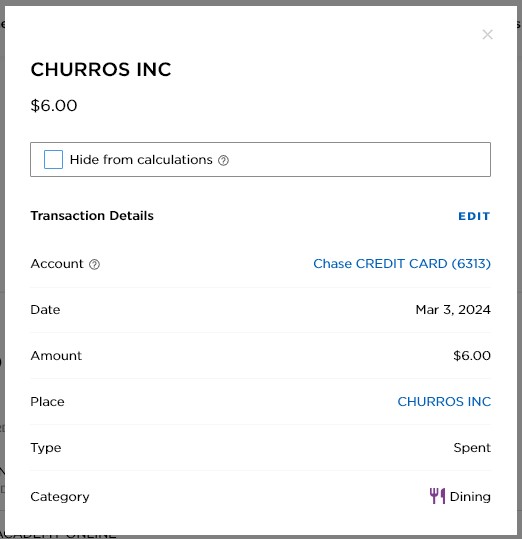

If you click on a transaction, you can edit a lot of the details (you can also hide the transaction).

The budgeting features are relatively basic, with a few minor concerns.

You cannot split a transaction into multiple categories. You can edit the value lower and then add another transaction, which is a few extra steps.

If you got paid back for a shared expense, you can add a transaction for that, but there’s no way to link it to the original expense.

If you edit a transaction’s category, it doesn’t know to edit the other transactions from that same vendor to the new category. For the most part, it gets most of the categories right.

Depending on how particular you like your categories, they can be a little broad. And you can’t add custom categories. What you see is what you get.

Finally, you can’t manually add a transaction for the future, it’ll default to the current date.

Upcoming Bills

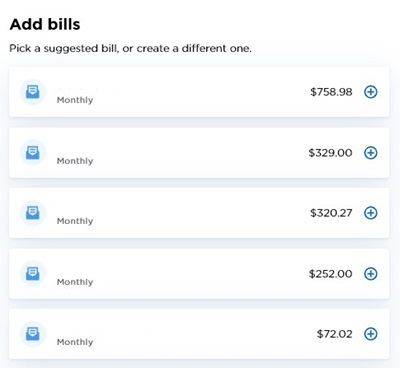

To use the upcoming bills feature, you have to add each bill yourself. NerdWallet will check for recurring charges and suggest ones that might be recurring but it always suggests that it’s a Monthly cadence.

If you click the Plus sign, you can add it after editing the details. You can change the name, amount, next due date, frequency, bill category, and subcategory. For frequency, you can pick weekly, every other week, monthly, every other month, every 3 months, every 6 months, yearly, or one-time.

When you’re done, scroll down to the “Add X Bills” button to save it. If you X out the window, it won’t save.

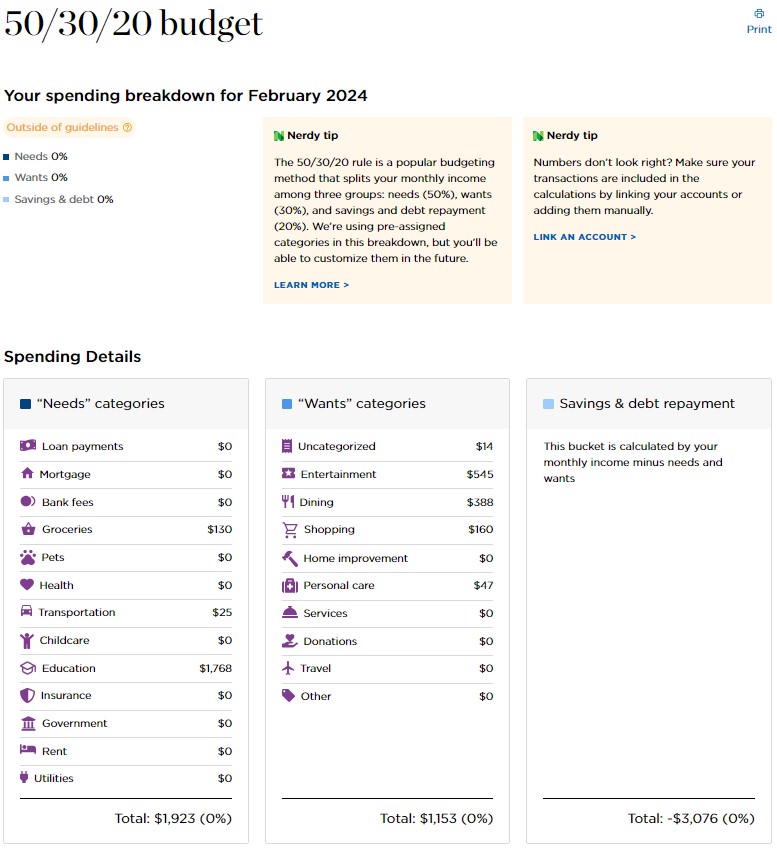

50/30/20 Budget Tracker

Do you follow the 50/30/20 budget?

That’s where you spend 50% on needs, 30% on wants, and 20% on savings and debt repayment?

If so, that’s built into the tool. You can get a report each month to see how close you matched those percentages.

It’s still in beta but eventually they will let you move things around the columns:

The only philosophical gripe you can have with this is that the principle behind the 50-30-20 budget is that you set aside 20% for savings and debt repayment first.

They calculate it as what is left over after all the other expenses. This is because savings and debt repayment aren’t linked to specific transaction categories. This could be fixed if they made a special category for it, so that you could “pay yourself first.”

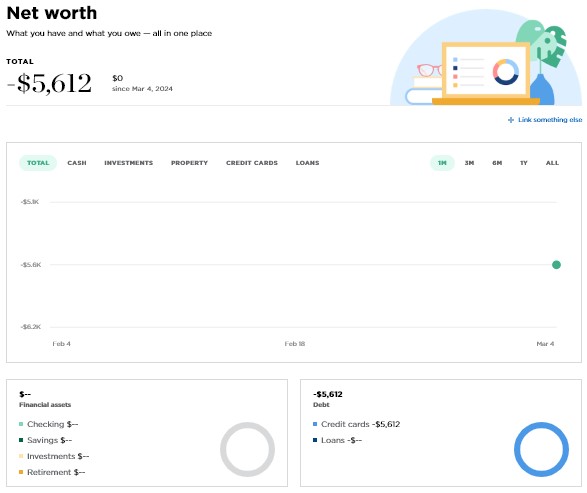

Net Worth Tracking

Since I was mostly interested in the budgeting features, I didn’t go through the effort of adding any investment accounts so the Net Worth page looks barren:

I suspect this part of the tool isn’t going to be super sophisticated and even after adding a few manual accounts, with dummy information, what you see is what you get. It collects data and tracks it, similar to what you might get from Empower Personal Dashboard, but not much in the way of breakdowns and analysis beyond what categorization.

They may expand this later but right now it’s rudimentary.

NerdWallet Mobile App

At this point, I’ve just been playing with everything on my desktop. They do have an app too.

The app is just a convenient way to access your account from your phone, without having to go to the website to do it. The only major difference is the addition of a Marketplace, which is where you can find different products (and sign up for NerdWallet+)

Having the app also gives you the option to opt into push notifications.

You can get push notifications for cash flow – such as “spending updates for large transactions, fees, deposits, and more.” I couldn’t find a way to set up notifications

Is It Worth It?

Considering it’s free, they do offer a lot of the basic features you were getting with Mint (but you cannot import transactions).

The inability to split transactions is one big difference but there’s also no way to force a sync of your accounts. They are going to be synched once a day at whatever cadence NerdWallet has worked out with Plaid. I suspect this is to help keep costs low, which is completely reasonable.

If you look at reviews online, you’ll heard that some people have had difficulty linking up different accounts but that’s likely a Plaid issue and not a NerdWallet one. If you’ve had issues with Plaid and your institutions in the past, you’ll have those same issues here.

Bottom Line

If you want a basic budgeting app, NerdWallet has a good product at a great price. If you want a little more, there are a few paid budgeting apps that currently offer a lot more features and reporting capabilities. A lot of folks were looking for alternatives to Mint, as it shut down in March of 2024, and NerdWallet might be a good option though you cannot import your data.

If you do have a budgeting to pay for a service, the paid services that seem to get the most praise are Simplifi by Quicken and Monarch Money.

If budgeting is important but not the primary purpose you’re after, I’d recommend looking at Empower Personal Dashboard. It’s budgeting capabilities are similar but the net worth tracking and retirement planning is stronger.