Simplifi by Quicken $47.99 per year or $5.99 per month

Product Name: Simplifi by Quicken

Product Description: Simplifi by Quicken is a budgeting app that costs just $2 a month and offers all the features you'd expect from a paid service - including the ability to import transactions from apps like Mint (JSON or CSV). You can track your spending and establish a budget, set savings goals, and share your data with up to six family members.

Overall

Pros

Powerful budgeting tools

Very affordable ($2/mo)

No ads, highly customizable

Data sharable with 6 other people

Cons

Is not free

When you think about budgeting and money management, Quicken has been at the top of many people’s lists for decades. And with Mint shutting down, you might be looking for an alternative.

But Quicken is software you download to your Mac or Windows machine. What if you want a mobile app that has powerful budgeting and planning features that you can use when you’re out and about?

That’s where Simplifi fits in. Simplifi by Quicken aggregates all your personal finances into one tool that you can access away from a computer.

It allows you to set up a spending plan, view upcoming bills, set goals, and see all your bank account and loan balances. And since it’s a paid service, you’ll get an ad-free experience.

It’s a newer service and is still working out some of the kinks. But we suspect that as it does, it’ll do what all Quicken products do and become one of the leaders in the space.

💲 For a limited time, Simplifi by Quicken has a massive 50% off for Mint users who switch to Quicken Simplifi.

Mint was shut down in March of 2024 and they only gave you a few months to decide what to do. Fortunately, Simplifi by Quicken can be one of those options and it makes sense to lock in a discount price while you can.

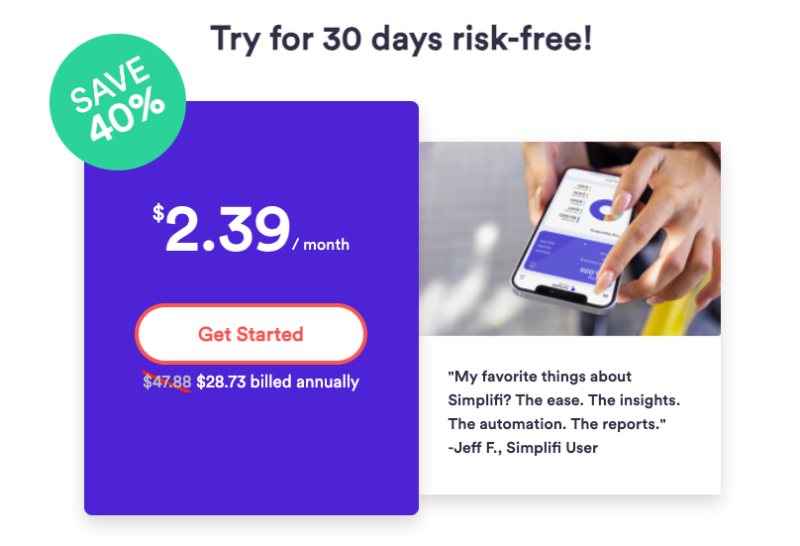

Simplifi offers a 30-day money back guarantee so you have a month to try it out and see if it’s a good solution for you.

Table of Contents

- What Is Simplifi by Quicken?

- How Simplifi by Quicken Works

- Simplifi by Quicken Features

- Simplifi Customer Support

- Simplifi by Quicken Pricing and Fees

- How to Sign Up with Simplifi by Quicken

- Simplifi vs. Quicken

- Simplifi by Quicken Pros & Cons

- Simplifi by Quicken Alternatives

- FAQs

- Should You Sign Up for Simplifi by Quicken?

What Is Simplifi by Quicken?

Simplifi is a mobile and web app serving as a financial aggregator and money management platform. If you’re familiar with apps like Mint and Empower, you already know what Simplifi does. It assembles all your financial accounts on the app, giving you a 360° view of your entire financial picture in one place.

It might be tempting to dismiss Simplifi as just another financial aggregator but it’s important to recognize it’s a Quicken product.

Quicken has been in business for over 30 years and is one of the most well-recognized names in the financial services industry. While the Quicken product has been around for that long, it was sold to H.I.G. Capital in 2016. Intuit no longer operates Quicken and Simplifi by Quicken is not affiliated with Intuit.

The app lets you set up your own spending categories, financial limits, watch lists, and spending plan, all in customized formats. And since it’s a paid service, you won’t have to deal with annoying ads and “recommendations” while you’re trying to managing your money.

Simplifi has a rating of 2.9 stars out of five by nearly 1.15K users on Google Play, and 4.1 out of five stars by ~2K users on The App Store. And The New York Times’ Wirecutter named them the best budgeting app of 2023.

👉 Learn more about Simplifi by Quicken

How Simplifi by Quicken Works

Simplifi is available in both the web version and mobile app. It offers the following capabilities:

Organize your money: You can automatically connect with financial accounts at more than 14,000 institutions.

By adding those accounts on the platform, you’ll be able to know exactly what your financial situation is at any point in time. This will help you to identify patterns in income, spending, and net worth.

This is a must have feature for any budgeting app.

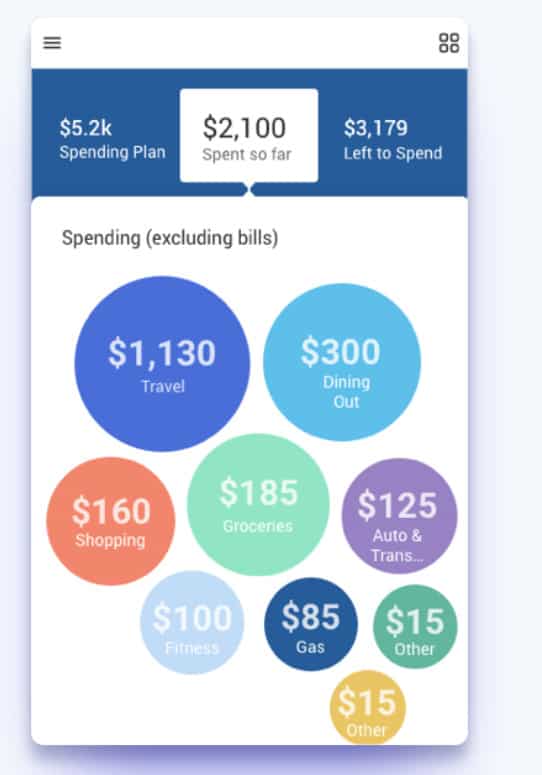

Track spending and budgeting: You can create a simple budget to better manage your income and your expenses and to make sure you’re not spending more than you earn. The service also enables you to categorize your spending and to monitor it on an ongoing basis. Similar to envelope budgeting, your categories will show you how much is left in each “envelope” so you are less likely to overspend.

Set and accomplish personal savings goals: You can set custom savings goals for specific purposes, like retirement, saving for the down payment on a house, saving for an upcoming vacation, or even saving for your wedding. You can set your goal, and Simplifi will help you accomplish it by keeping you informed on your progress.

Get insights on spending and savings. By having all your cash flows – income and expenses – assembled on one platform, you’ll be able to determine where your money’s going. With that information, you’ll be able to make changes that will help you to redirect funds to finance your goals.

Family Sharing. The mobile app can be used by up to six family members when Family Sharing is set up. You can set up separate logins so they can get access and they don’t need to buy their own subscription.

Simplifi by Quicken Features

Here is a list of key Simplifi features:

Simplifi Dashboard

You can customize your dashboard to meet your own personal preferences. But you’ll start out with a default titles that will help you to organize your finances:

- Account List (Net Worth)

- Spending Plan – breaks down spendable income, bills, and subscriptions, with money available for discretionary spending.

- You Have Sent (in the last few days)

- Upcoming

- Top Spending Categories in the Last 30 Days

- Spending Watchlists (you can create multiple spending watch lists, and all are accessible from the Dashboard view)

- Spending Over Time

- Income by Month

Other Simplifi Features

Real-Time Quotes and Investment Balance Chart: View your holdings, real-time quotes, and balances over time.

Performance: You can view your portfolio’s performance on a detailed graph, showing the performance of your investments over time.

News Feed: Receive news that’s related to the companies in your portfolio.

Cryptocurrency Tracking: Add and track cryptocurrencies and connect your accounts to top financial institutions that track cryptocurrencies.

Investment Transactions: View and edit your investment transactions directly from the app.

Projected Balances Tool: One of the most valuable tools offered by the platform, it provides you with a visual representation of your estimated balance over the next 30 days. Projected Balances are estimated using your recurring transactions and will allow you to know what your account balances will be ahead of time.

Mobile app: The Simplifi Mobile App is available on Google Play for Android devices 5.0 and up, where it has already been installed by more than 10,000 users. It’s also available at The App Store for iOS devices, 9.0 or later, and is compatible with iPhone, iPad, and iPod touch.

Account security: This is always a concern when you are aggregating all of your financial accounts on one platform. Using the Quicken system, data is securely transmitted from your bank servers using 256-bit encryption. The information is downloaded from your bank accounts and kept completely confidential. It is used only to update your accounts.

👉 Learn more about Simplifi by Quicken

Simplifi Customer Support

The Simplifi website offers a comprehensive Help Center with articles and resources to address your concerns. If you still need help, Simplifi by Quicken offers Chat, Phone, and Community Support, seven days a week, from 5 AM – 5 PM PST.

Unfortunately, Simplifi doesn’t accept incoming phone calls. To speak with a customer service representative, you must enter your phone number in the Help Center widget and select “Call Me”, and they will contact you during business hours.

Simplifi by Quicken Pricing and Fees

First, you can try Simplifi completely free for the first 30 days. Take a trial run, and if you like it, you can sign up for the service. As of writing, Simplifi is offering annual plans for $28.73, which is 40% off the regular price.

“Regular” Simplifi pricing is $47.88 annually or $5.99/month – but I’ve seen the 40% off sale happening off and on forever. If you visit the site and don’t see a discount, you can just wait until it returns!

Please be aware that Simplifi is a separate Quicken product, and subscribing to it does not provide the services of Quicken itself or any other product the company offers.

Similarly, membership in Quicken doesn’t automatically give you to a Simplifi subscription. In fact, the two services aren’t even compatible!

How to Sign Up with Simplifi by Quicken

To sign up for Simplifi, you must be a US citizen or resident and be willing to put your credit card on file. The service is currently unavailable to non-US residents. As a financial aggregator, you will also be limited to US-based financial institutions.

You can sign up for the service using the following steps:

- Sign up at simplifimoney.com, then click “Start Free Trial”.

- Select your preferred plan.

- If you have previously created a Quicken ID, you can sign in using that ID and password. If you haven’t, you can create one by entering your email address, mobile phone number, and a unique password, then click “Create.”

- Enter your billing details and click “Subscribe.”

- After your order has been processed, click “Let’s Get Started”.

If you don’t put a credit card on file, Quicken won’t let you use the 30-day free trial.

👉 Learn more about Simplifi by Quicken

Simplifi vs. Quicken

Are you wondering what’s the difference between Simplifi by Quicken and Quicken itself? You’re not alone.

The key difference is that Simplifi by Quicken is meant to be an app for “basic” financial tracking and budgeting, whereas Quicken is meant to be a more comprehensive software tool. Quicken is a full-featured desktop software package – which is best designed for folks with more complex financial situations.

If you are managing an investment portfolio on top of balancing a budget and setting savings goals, Quicken may be the better of the two (I’d argue that it may be better to consider a Quicken alternative if you want more planning and investing features). If you have a complex tax situation or you want help with bill pay, Quicken may be better at handling that too (Simplifi can’t do bill pay).

If you are looking for a budgeting app with extra bells and whistles, Simplifi is a better fit. This is reflected in the cost, too – Simplifi is a bit cheaper than Quicken. Fortunately, you can play with the free trial to get a sense of whether Simplify works for you.

The two are similar, but there are some edge cases where one shines over the other.

Simplifi by Quicken Pros & Cons

Pros:

- Quicken is one of the most respected companies in the financial services industry.

- Keep track of all of your financial accounts on one platform.

- Ad-free experience.

- The app is highly customizable. Create your own categories, spending limits, goals, and watch lists.

- Encourages you along the way and celebrates your successes. 🥳🥳🥳

Cons:

- No free plan is available.

- Only to US residents.

- You can’t import Quicken data to Simplifi.

- No live customer support.

Much like Quicken, Simplifi by Quicken is not free. If you don’t want to spend money on a budgeting app, check out these free budgeting apps for more ideas.

Simplifi by Quicken Alternatives

Simplifi is not without competitors, and some well-established ones at that. Before you sign up with Simplifi, consider the following alternatives. If none of these are a good fit, you can also check out our list for the best budgeting apps for couples.

You Need A Budget

If you’re looking for budgeting software, one of the best alternatives to Simplifi is You Need a Budget. Much like Simplifi, You Need a Budget is a paid service ($8.25 a month when paid annually, after a 34-day trial) and it’s solely focused on helping you budget using a zero-based budget.

What I love about YNAB is that it’s laser focused on that task. The philosophy behind YNAB is beautiful – starting with their four rules and ending with software that has helped thousands of people saving money and pay off debt.

With zero-based budgeting, every dollar is accounted for (“give every dollar a job”) so you have a plan for what’s happening next month. It’s all about preparation, rather than reaction.

👉 Learn more about You Need a Budget

Empower (formerly Personal Capital)

A somewhat more advanced alternative is Empower.

If you know anything about Empower, it has a strong orientation toward investing – which is exactly what its users are looking for. The company provides a premium Wealth Management service for those with investment portfolios of at least $100,000 to manage. But they offer a free version that provides aggregating your financial accounts, as well as investment tools.

For example, they have a 401(k) fee analyzer to help you find unnecessary fees in your employer-sponsored retirement plan. However, if you’re looking primarily for an app that will help you better manage your finances, Simplifi does provide more tools and resources to help.

Empower works best for those who are looking for a financial aggregator and at least limited investment assistance or the ability to get professional investment management for larger portfolios.

Here’s our full Empower review.

FAQs

No. Simplifi is a separate product from Quicken. Also, Simplifi cannot read your Quicken data, so if you are already using Quicken, Simplifi will be of little use to you.

Simplifi is good for budgeting, but it is one of many excellent budgeting tools available. Other budgeting apps include Mint, YNAB, and EveryDollar, from Ramsey Solutions.

Unfortunately, Simplifi is not available to users outside of the U.S. In addition, you can only connect U.S. bank accounts to your Simplifi by Quicken app. No Canadian bank accounts can be added.

Should You Sign Up for Simplifi by Quicken?

What we like about Simplifi is that it’s more than a simple financial aggregator or even a budgeting tool. It’s a full-on financial management platform, that gives you a complete picture of your financial life in one place. Armed with that information, you can analyze your income and spending patterns, then make allocations to meet chosen financial goals.

It’s the perfect app if you’re looking to get total control of your finances from every direction.

What Simplifi won’t do – at least not yet – is provide investment guidance, or some of the other bells and whistles that come with other financial applications, like free credit score monitoring. But then you can always connect your investment accounts, like Betterment or Ally Invest to Simplifi, and use the app to track those balances and activity.

In that way, Simplifi concentrates on doing one thing well – financial management – while you rely on others to provide more specialized services, like investing. As well, it’s generally true that apps that attempt to be an all-in-one service end up instead of being an all-in-one. Specialization does have its virtues!

But it has to be remembered that Simplifi is a newer product and one provided by Quicken. We’re already seeing more features as the years pass, I expect them to add more… especially with Mint closing down.

Kris says

I used it recently and Simplifi does have live chat with customer service. It’s been very helpful to me!