I’ll cut to the chase (eek sorry) — If you are looking for a great travel credit card with a hefty bonus and easy-to-reach spending requirements, I can’t think of a better card than the card_name right now.

I just got it and it’s the first new credit I’ve gotten in several years.

As for the why – read on.

A few years ago, I got the Chase Ink Business Preferred card and have since amassed quite a few Chase Travel points from our business spending. The Chase Ink Business Preferred card is great but it lacks one thing that the card_name has – a 25% bonus when you spend those points on travel.

We’re planning on a fall trip and because of getting this card, we get an instant 25% discount. It requires a few more steps (you have to link the cards and then transfer the points from the Chase Ink Business Preferred card to the Chase Sapphire Preferred card before you use it, I explain below).

With the bonus and the 25% bump in our existing points, it became an easy choice.

Here are all the reasons why I liked the Chase Sapphire Preferred card in the first place.

Table of Contents

60,000 Ultimate Rewards points Welcome Bonus

For me, the welcome bonus is reason enough to get this card.

The card_name has a bonus that is one of the best – bonus_miles_full

When you consider that the card also gives you a bump up of 25% in value on those points, making each worth 1.25 cents when you book on the Chase Travel portal, the value is enormous.

But the card has several other benefits that I found appealing, which will likely make it one of our primary credit cards going forward.

A Simple Rewards Structure

I like credit cards with a simple rewards structure – I don’t really like trying to remember a spreadsheet of differing cashback rates when I’m waiting to pay for my order. I like my systems simple and this card is simple.

The rewards structure is as follows:

- Earn 3X points per dollar on dining (includes delivery services), take out, and dining out

- Earn 5X points on travel purchased through Chase Travel

- Earn 2X points on all other travel

- Earn 3X points on select streaming services and online grocery purchases (excluding Target®, Walmart® and wholesale clubs)

- Earn 1X points per dollar on everything else

There is an overlap with my current setup of a Costco Anywhere Visa Card and a Southwest Rapid Rewards credit card. The Costco card gives me 3% on restaurants and eligible travel in cashback (paid out once a year), so it lags there a little bit, but the 25% bump when you use the points in Chase’s Travel portal will help offset that.

Extra Perks We Can Actually Use

We have the rewards structure, which is fine, but we also have a few other nice side perks with the card that helps offset the annual fee of annual_fees:

- $50 Chase Travel Hotel Credit

- Complimentary DashPass from DoorDash for 12 months, activate by 12/31/2024 – We don’t use DashPass as much but from time to time we will send food to people as a gift and sometimes even get it ourselves, especially when we’re out of town, so I wouldn’t say we get the full $9.99 per month of value. (one of several cards with free DashPass)

Travel Insurance Protections

We canceled quite a few trips last year because of the pandemic and so I’d become acquainted with the travel insurance protections of our various credit cards.

The Chase Sapphire Preferred has the following travel insurance related benefits (among other benefits):

- Auto Rental Collision Damage Waiver – This is coverage for when you rent a car, you can decline the rental company’s insurance and this coverage will protect you. It’s primary and covers actual cash value of the car for theft and collision damage.

- Trip Cancellation / Trip Interruption Insurance – This is for if you have to cancel a trip or cancel a trip mid-way (sickness, weather, other covered situations) and will be reimbursed up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses.

- Baggage Delay Insurance – If your bags are delayed by more than 6 hours, this coverage will reimburse you for essential purchases (toiletries and clothing) of up to $100 a day for 5 days

- Trip Delay Reimbursement – If you are delayed by more than 12 hours or require an overnight stay, you’re covered for unreimbursed expenses up to $500 per ticket.

- Lost Luggage Reimbursement – If your luggage is damaged or lost, you’re covered up to $3,000 per passenger.

- Travel Accident Insurance – Accidental death and dismemberment coverage of up to $500,000.

If this is important to you, it’s important to read these insurance protections very carefully because, as is the case with all insurance, quite specific.

This is why “cancel for any reason” travel insurance is as popular as it is right now. It reimburses you regardless of reason.

Chase Points Are Worth 25% More

Chase Travel points are great because of how flexible the program is. With the card, I also get 25% more value when I redeem them for travel on the Chase Travel site. Normally, each point is worth a penny but with the 25% bump, each is now worth 1.25 cents.

To get the 25% bonus, you have to transfer the points to the Chase card with the bonus, then spend them via that card. It’s an extra step but something that’s easily done on the site.

Another small perk of using the travel portal is that to the airlines and hotels, the bookings are as if they were made in cash. This means you can also earn miles and points towards status.

Another way to maximize value is through their transfer partners. You can transfer it to ten airline programs (British Airways, Flying Blue, Jet Blue, Emirates, Singapore Airlines, Southwest, United, Virgin Atlantic, Aer Lingus and Iberia) and three hotel programs (Hyatt, IHG, and Marriott). The transfer is always 1-to-1 and in 1,000 point blocks.

So if you find a booking that’s cheaper on the partner’s site, you can transfer and still take advantage of the lower price. Oftentimes the transfer is quick but can take up to a few business days.

How to Transfer Chase Travel Points Between Your Accounts

One of the key reasons we got the card was because our existing points all got a 25% boost. To take advantage of this, we would have to transfer points from our business card to the personal one.

The first step in that process is to link up your accounts.

If you are combining a Business and a Personal account, you must start the process with the Business account. You can’t add a Business to Personal so you have to start in the Business account.

If you are combining two Personal accounts, you just log into the one you want to keep and click the three lines at the top left of the screen to access the menu. Click on Secure Messages, it’s in the “Connect with Chase” group of menu items.

Then click on the blue “+ New Message” to at the top right to start a new message. In the “What is this about?” drop-down, select “Link another username to this one.” Read the instructions carefully and then fill out the Link username form.

You’ll have to enter the other account’s username and confirm some details. The process takes a business day or two to link them together.

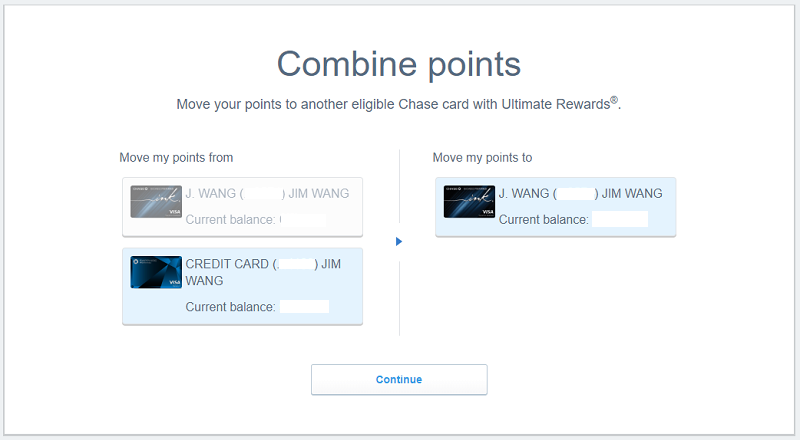

Next, to make the transfer, you want to log into your Chase Travel account. Then click on the three lines again to open the menu, at the very bottom you should see Combine Points. You’ll see a way to move your points pretty easily and that process is near instant.

Are There Any Drawbacks?

There is an annual fee, which can be seen as a drawback but it’s standard in travel reward credit cards, especially one with a 60,000 Ultimate Rewards points welcome bonus.

Another “drawback” is that the card is metal. It’s heavy, it’s thick, and if there comes a time you have to dispose of it… I’m not sure how you cut this thing. I’ve read online that you can request a postage-paid mailer to send the card back but I haven’t checked this out myself. Is it a drawback? Eh, I suppose.

Why We Got This Card

I suspect you probably know why I ended up getting this card but just to put a bow on it, here we go:

Getting a 60,000 Ultimate Rewards points welcome bonus is a no-brainer and that alone was enough for me to get my first new personal credit card in several years. The last time I got a new credit card was when Costco transitioned from American Express to Citi… and that was several years ago.

As I mentioned earlier, for my business I already have a Chase Ink Business Preferred card and am a firm believer in the Chase Travel program. After amassing quite a bit of points, I can now transfer all the points I earned on the Chase Ink Business Preferred card and get an immediate 25% bump because I’ll be spending it with this card. If you’re in this position as well, enjoy the raise. 🙂

In the end, the bonus is solid right now (not as big as before but still strong), we get a boost on existing Chase Travel points, and the other benefits made it attractive for us.

Leave a Comment: