Recent Federal Trade Commission data shows consumers reported losing nearly $9 billion to identity fraud in 2022. This is an increase of over 30% from 2021.

While the sharp increase in financial fraud can be alarming, there are steps that you can take to minimize your risk of becoming a victim. This includes knowing how to freeze (and unfreeze) your credit report.

Here’s how credit freezes work, how to place one, and what it can (and can’t) do to help you protect your credit rating.

Table of Contents

- What Is a Credit Freeze?

- How Does a Credit Freeze Work?

- How to Freeze Your Credit Report

- How to Freeze Your Credit Report with Experian

- How to Freeze Your Credit Report with Equifax

- How to Freeze Your Credit Report with TransUnion

- How to Unfreeze Your Credit Report

- Unfreezing Your Credit Report Online or By Phone

- Unfreezing Your Credit Report by Mail

- Credit Freeze vs. Fraud Alert

- FAQs

- Final Thoughts

What Is a Credit Freeze?

Put simply, a credit freeze (sometimes called a security freeze) is a block placed by the credit bureau (at your request), limiting who can access your credit report. This can help to prevent unscrupulous parties from applying for credit in your name, which can compromise your credit history.

Whether you’re just beginning to build or rebuild your credit or you already have plenty of credit files along with a good credit score, the last thing you want is for fraudsters to be able to ruin your hard work.

Several credit score apps can help you monitor your credit. But sometimes, that’s not enough, and you need to place a freeze on your report.

How Does a Credit Freeze Work?

A credit freeze restricts companies or individuals from accessing your credit file, preventing them from pulling a hard credit check and approving credit in your name. This includes both legitimate and fraudulent attempts.

While a credit freeze will restrict hard credit checks, it doesn’t restrict soft credit checks.

Hard credit checks are used by lenders to assess your creditworthiness and can affect your credit score. Soft credit checks don’t impact your score and are commonly used when you are applying to rent an apartment or when a company wants to pre-approve you for a credit card.

More specifically, freezing your credit report should not impact the following entities from access to your credit report:

- Current lenders you have previously authorized

- Landlords and rental companies

- Employers

- Debt collection agencies working to collect a debt

- Child support agencies

- Credit card companies offering prescreened offers

✨ Related: What Is a 609 Letter and How to File a Credit Report Dispute

How to Freeze Your Credit Report

If you’re interested in freezing your credit report, you’ll need to contact each of the three credit bureaus: Experian, Equifax, and Transunion. If you request a freeze online or by phone, it is required that the agencies freeze your credit within one business day. If you request it by mail, it must be frozen within three business days.

Freezing your credit reports with the three major credit bureaus is free. Below are directions for each bureau.

How to Freeze Your Credit Report with Experian

You can freeze your Experian credit report using one of three different methods:

- Online: Open a free Experian account online. Visit the Experian Help Center. Click on the Manage Security Freeze box. Click the Frozen button. Or you can start by visiting this link.

- By Phone: Call Experian at 888-397-3742 and request a security freeze.

- By Mail: Mail a security freeze request to the following address:

Experian Security Freeze

P.O. Box 9554

Allen, TX 75013

Any written requests to freeze your credit should contain the following information:

- Your Social Security number

- Addresses for the past two years

- Birthdate

- Full name

- A copy of a government-issued ID

- A copy of a utility bill or bank statement verifying your address

How to Freeze Your Credit Report with Equifax

Equifax allows you to request a credit report freeze using one of the following methods:

- Online: Register for a free Equifax account here. Then, once you log in, you will see an option in the left sidebar underneath the “Your Identity” section for “Freeze.” Follow the steps to freeze your Equifax credit report (it’s fast, takes just a few minutes).

- By Phone: Call Equifax at 800-685-1111 and request a security freeze.

- By Mail: Use Equifax’s Security Freeze form to request a security freeze by mail.

How to Freeze Your Credit Report with TransUnion

TransUnion also offers three ways to freeze your credit report.

- Online: Open a free account with TransUnion, sign into your account, and follow the steps for a security freeze.

- By Phone: Call TransUnion at 888-909-8872 and request a credit report freeze.

- By Mail: Send a written request including your name, address, and Social Security number to:

TransUnion

P.O. Box 160

Woodlyn, PA 19094

See TransUnion’s credit freeze FAQs for more information on requesting a credit freeze for your TransUnion credit report.

How to Unfreeze Your Credit Report

If you are applying for credit, you’ll need to unfreeze your credit report so your new lender can view it. You can request that your credit reports be unfrozen at any time, and there are no time limits for freezing or unfreezing them.

However, it’s important to know that, depending on your contact method, freezing or unfreezing your credit report may not happen instantly.

Unfreezing Your Credit Report Online or By Phone

If you contact Experian, Equifax, or TransUnion online or by phone and request a credit unfreeze, it will take place immediately. This is the fastest way to complete either action. A credit freeze is recommended if you suspect the possibility of credit fraud in the near future, e.g., if you’ve had your wallet containing your ID and credit cards stolen.

Generally, when unfreezing your credit online your credit must be unfrozen within the hour. You’ll also be able to set a time frame for when your credit will be automatically re-frozen.

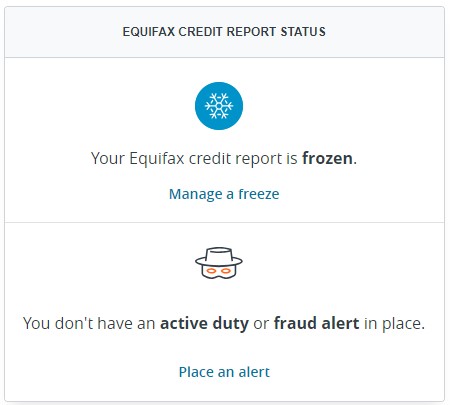

For the online option, just log back into your account and you should see a way to Manage your freeze. This is what it looks like for Equifax:

Click on “Manage a freeze” and you can temporarily lift a security freeze or permanently remove a security freeze. If you select temporarily lift, you can set a time frame (pick two days) for which the freeze is lifted. Permanently removing it is also an option.

Unfreezing Your Credit Report by Mail

You can also request a credit unfreeze by mail with all three major credit bureaus using the same addresses you did for mailing in a credit freeze request.

However, requesting a credit report “thaw” by mail can take quite some time. Once the credit bureau receives your letter, processing can take up to three days. In other words, this is not the method to use if you’re in a rush to have your credit report unfrozen.

Looking for more ways to keep your credit report safe? Check out this DIY Identity Theft Protection System. It offers great ideas on how to prevent thieves from accessing your personal information.

✨ Related: 12 Ways to Check Your Credit Score for Free

Credit Freeze vs. Fraud Alert

People often confuse Fraud alerts with credit freezes. While fraud alerts offer some protection against identity theft, it’s different from a credit freeze in two ways:

- Unlike a credit freeze, you place a fraud alert for a specified period (typically one year).

- Fraud alerts don’t “lock” your credit bureau the way a credit freeze will

A fraud alert is helpful if you have been the victim of fraud or identity theft in the past, which may increase the risk of reoccurrence. A fraud alert warns creditors to take extra precautions to verify your identity when they receive a credit application in your name.

Most fraud alerts will remain on your credit report for one year, but you can request an extended fraud alert to be placed on your credit report. See the FTC website for more information on extended fraud alerts and other credit freeze information.

FAQs

Anyone can freeze their credit. It’s becoming a popular identity theft prevention tactic as long as you don’t mind the occasional headache of unfreezing your reports to apply for credit.

You may consider freezing your credit report if you’re concerned about the possibility of identity theft or fraudulent credit applications.

You should not freeze your credit if you plan to apply for a mortgage, loan, or credit card in the near future.

A credit report freeze is open-ended – it lasts until you unfreeze it. And you can have it last as long as you want. You can freeze or unfreeze your credit with the three major credit bureaus at any time.

You can freeze your minor child’s credit report, although you may not be able to do so after the child turns 16.

Final Thoughts

A credit freeze can protect you from credit fraud by allowing you to limit who can access your credit report. It can be placed at any time and is open-ended, so you can remove a credit freeze whenever you want. A credit freeze prevents parties from performing a hard credit check on your file, but soft credit checks can still be pulled for things like lease applications and credit card pre-approvals.

To request a credit freeze (or unfreeze), you need to contact each of the three major credit bureaus directly, but you can do so online, by phone, or by regular mail.

Lastly, we don’t recommend that you freeze your credit report if you plan to apply for a loan or credit card in the near future.