Are you looking for a financial app that can track your banking accounts, help you budget, and suggest ways to improve your finances?

Monarch Money is a popular budgeting app that can monitor your financial progress and make it easier to plan for the future.

For example, the app syncs to most bank accounts, lets you create unlimited budgets, and tracks your investments and net worth.

This Monarch Money review covers the various financial tools available to you.

Table of Contents

- What Is Monarch Money?

- How Monarch Money Works

- Monarch Money Pricing

- Best Monarch Money Features

- Budget

- Financial Goals

- Investment Tracking

- Net Worth Tracker

- Joint Finances

- Personalized Advice

- Customized Charts

- Monarch Money Pros and Cons

- Alternatives to Monarch Money

- Money Monarch FAQs

- Monarch Money Review: Final Thoughts

What Is Monarch Money?

Monarch Money is a budgeting app and net worth tracker. You can use the free version or upgrade to a premium plan to unlock more benefits.

Some of the intriguing features include:

- A monthly budget

- Savings goals

- Net worth tracking

- Personalized financial advice

Individuals and couples can budget together. You can also add a financial advisor as a collaborator to provide additional insights.

How Monarch Money Works

You can access Monarch Money by a mobile app (Android or iOS) and the online website.

The service will sync with your bank and investment accounts (over 11,200 available institutions) upon joining. The free version will allow you to connect up to two bank accounts, and investment tracking is only for paid subscribers.

Once your accounts are connected, the app walks you through the various functions like budgeting and goal setting. Monarch will pull transactions from your linked accounts, and you can assign a specific income or expense category to make an accurate budget.

As the months roll on, you can log contributions for savings goals and act on the advice for other financial topics like retirement planning and getting necessary insurance.

Monarch Money Pricing

There is a free and paid version of Monarch Money. The free version of Monarch Money is best for budgeting and bank account monitoring. You might consider the free edition at first to test the platform, although a free 7-day premium trial is also available.

Free

The free plan includes these unlimited features:

- Collaborators (i.e., spouse, financial advisor)

- Cash flow statement

- Budgets

- Savings goals

Keep in mind that there are several limitations. Most notably, you can only sync two bank accounts and cannot track investments.

Premium

The Premium plan costs $9.99 month-to-month without a contract. Purchasing an annual subscription costs $89.99 upfront and lowers the monthly rate to $7.50. You can choose a no obligation, 7-day free trial to decide if upgrading is worth it.

Here are some of the best reasons to upgrade:

- Unlimited bank connections

- Customized budget categories

- Investment and cryptocurrency tracking

- Track Apple Card and Venmo transactions

- Priority customer support

Best Monarch Money Features

Monarch Money is packed with tools to help you track your spending and plan for future goals. Let’s take a closer look at some of its best features:

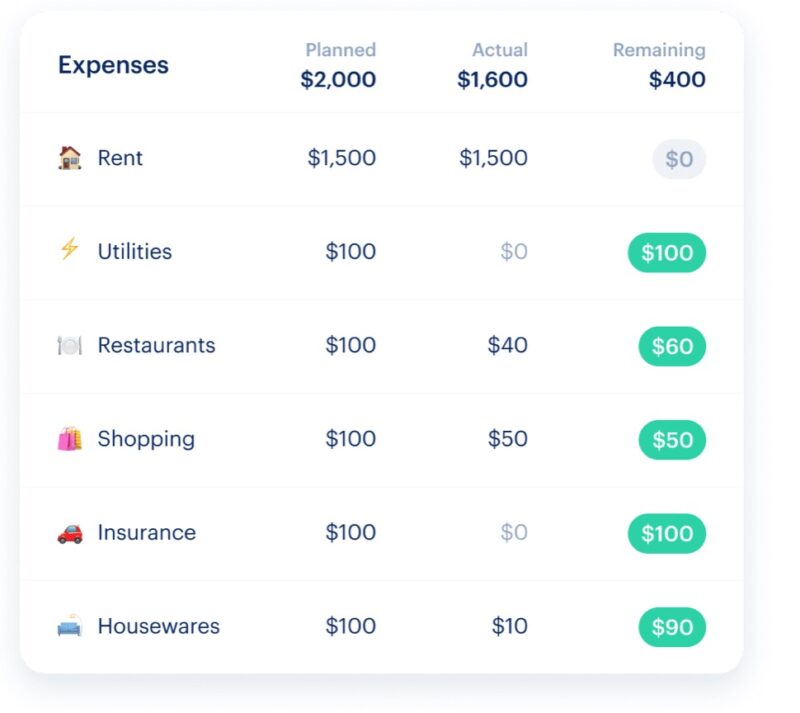

Budget

The free or premium budgets are both impressive with Monarch Money. This feature rivals most free budgeting apps as you get an in-depth look, and it’s easy to set up.

The monthly spending plan lets you forecast upcoming monthly expenses by category. Taking it further, you can quickly compare your actual budget figures to your planned expenses. You can adjust your planned category spending for each month to account for one-off events like a vacation or an expensive car repair.

The various budget categories are expansive and cover the most common household expenses, business income, taxes, health and wellness, and more. Premium members can add customized categories for income and expenses to get a more realistic household budget.

Monarch Money automatically categorizes your transactions, but you must adjust several category assignments. You will probably need to modify the monthly budget’s planned and actual spending amounts – the same goes for most budget software.

Premium Budget Tools

Customizable budget categories are just a start for premium members. Some of the other nifty features include:

- Rollover budgets: Roll your monthly savings into next month’s budget. This capability makes tracking your disposable income for life’s variable expenses easier.

- Unlimited transaction rules: Free members can only create up to 10 transaction rules to categorize transactions automatically. In addition, automating the budgeting process lets you spend less time performing maintenance and more time focusing on your spending habits. A high-maintenance budget can be frustrating to follow.

- Venmo syncing: The platform can connect to your Venmo account to track spending and friend payments. Unfortunately, this is the only linkable digital wallet which means PayPal, Cash App, and other services can be difficult to record in real-time.

- Apple Card tracking: The Apple Card is currently the only credit card the app can track directly. Even then, you need to use the iOS mobile app.

Financial Goals

Instead of creating savings goals in your savings account, you can build them within this platform to see your entire financial picture in one place.

This feature is similar to other financial platforms as you assign a savings goal and deadline. Then, as you set aside new funds for the purpose, you can update your progress which displays with an interactive graph.

Investment Tracking

Premium members can sync unlimited investment accounts to track the performance of individual stocks and funds. You can also compare your portfolio performance to the major indexes (i.e., S&P 500 or Nasdaq).

The service can track a few crypto exchanges, including Coinbase, Kraken, and Gemini, though a dedicated crypto portfolio tracker would be more effective if that’s important to you.

Net Worth Tracker

The platform can track your cash and investment balances to calculate your liquid net worth. Premium members can estimate their home value through Zillow. You can also add manual accounts that won’t sync to track the value of more assets.

While this tool is helpful, it doesn’t track every net worth metric. Other services specializing in tracking net worth can be better if this task is more important than budgeting.

Joint Finances

You can add unlimited collaborators, including your spouse, financial advisor, adult children, etc. This hands-on access is available to free and paid members.

Being able to have multiple collaborators can make it easier to build a household budget. If you’re seeking professional financial advice, your advisor can get their own Monarch login, and Multi-factor Authentication (MFA), to (securely) help you make a long-term plan. Other budgeting apps may charge extra for multiple users, but that’s not the case with Monarch Money.

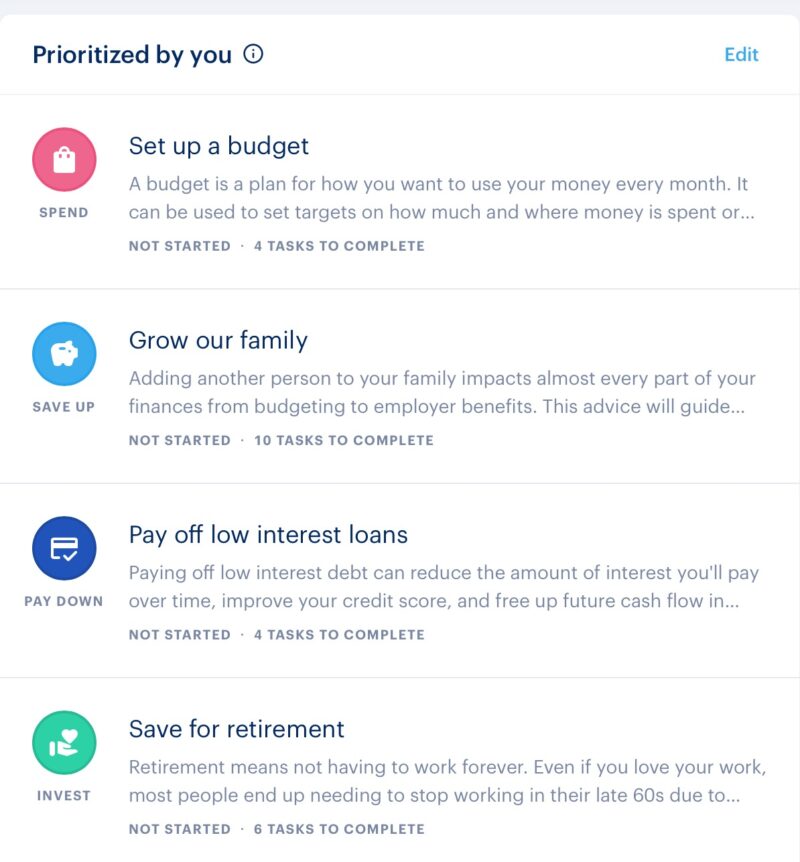

Personalized Advice

Monarch can help you prioritize various financial and life goals if you complete a short financial quiz. In addition, the service can provide basic suggestions for various topics.

Some of the goals you can receive insights on include:

- Paying off high-interest debt

- Paying off low-interest debt or a mortgage

- Expanding your family

- Saving enough for retirement

- Improving your credit score

- Buying a car

- Buying a home

The next step is ranking your priorities in order of importance. Then, there will be task checklists you can complete for each objective.

For example, if you’d like guidance in retirement savings, the tasks can include opening a Roth IRA, getting an employer’s 401k matching contribution, and investing at least 10% of your income.

The recommended tasks can depend on what details Monarch Money retrieves from your synced accounts. This robo-advisor adheres to the fiduciary duty to provide conflict-free advice instead of recommending tasks and services that may not be in your best interest.

You won’t have access to a human advisor, but these recommendations can help you gain a sound footing to become financially independent.

Customized Charts

You can also view colorful, detailed charts for these topics:

- Cash flow

- Investment performance

- Monthly spending

- Net worth

Mobile users can receive a monthly report highlighting the various topics. You can also view the charts on your customizable dashboard each time you log into your account.

Monarch Money Pros and Cons

Pros

- The free budgeting tools are impressive

- Personalized financial planning suggestions

- View brokerage account positions alongside banking balances (premium plan)

- Ad-free

Cons

- No credit score monitoring

- Doesn’t sync with non-traditional financial accounts

Alternatives to Monarch Money

There’s a lot of competition in the budgeting app space, and Monarch Money has several competitors – names like Mint and YNAB. Here are some free and paid Monarch Money alternatives for you to consider, if none of these are good fit check out list of the best budgeting apps for couples.

YNAB

Consider YNAB (You Need a Budget) if you’re serious about budgeting. You can have more budgeting categories, and the charts can also be different. This app syncs with multiple devices, including computers, phones, and wearables.

This program practices zero-based budgeting to assign a purpose to every dollar you earn. The ultimate goal is to pay this month’s bills with last month’s income instead of living paycheck to paycheck.

After a 34-day free trial, you pay $14.99 per month or $98.99 annually with a one-time payment.

While YNAB costs more than Monarch Money, it has more in-depth budgeting features. In addition, it can be compatible with more devices, making budgeting easier. Learn more in our full YNAB review.

Empower (formerly Personal Capital)

Empower is better if you mostly want to track your net worth and investment performance. It’s also free to use. The service also has a basic budgeting tool which can be helpful if you have a firm grasp on living within your means and are ready to increase your disposable income to save for long-term goals. Read our full Empower review to discover all of the financial tools.

Kubera

Kubera is a premium net worth tracker that follows the investment performance of your stocks, cryptocurrency, and alternative investments. A virtual safe deposit box can also store your vital documents like a last will and testament, insurance documents, and secret codes.

Kubera doesn’t offer budgeting tools. After a 15-day free trial, the monthly fee is $15 or an upfront annual cost of $150. Read our Kubera review for more information.

Money Monarch FAQs

Yes, an iOS and Android app are available. The app may display exclusive reports that web browser users cannot access. Additionally, the iOS app can track Apple Card purchases.

Yes. Monarch Money uses bank-level security to protect your financial data. The service won’t collect sensitive information such as your Social Security number. Additionally, the app uses Finicity, a third-party service, to connect to your financial accounts to avoid storing your banking credentials on the Monarch server.

Email support is the only way to receive hands-on help. Paid subscribers receive priority support. An online FAQ library or interactive feature walkthroughs can help you navigate the easy-to-use platform.

Monarch Money Review: Final Thoughts

In the world of budgeting apps, Monarch Money is a solid choice. For many users, the free version will be enough to help you manage your money and track your spending. In my opinion, Springing for the premium plan is worth it if you want to track your investments and sync unlimited accounts. Personal Capital is an excellent alternative if you don’t need in-depth budgeting tools.