Psychology was one of my favorite subjects in school.

It was like getting an instruction manual for how people worked.

A cheat sheet.

One of my favorite “theories” in psychology is Abraham Maslow’s Hierarchy of Needs.

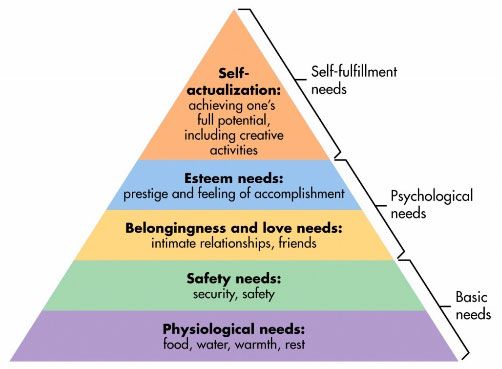

Here it is:

It’s a theory of human motivation.

We aim to satisfy the needs at the bottom before working our way up.

You don’t care about prestige when you don’t have food or water or shelter. Once you satisfy your basic needs, you start thinking about psychological needs.

(the levels aren’t this cut and dry and you don’t satisfy each level before moving up, but the framework is still a useful model)

Maslow’s Hierarchy of Needs is a framework that can help you understand how you spend your money and your life.

Table of Contents

How do I use the hierarchy of needs

The hierarchy can help explain the motivation behind why people behave a certain way.

Here’s how you can use the hierarchy to guide you and help you make better decisions —

Everyone is striving for the fulfillment of every level of their hierarchy of needs. The lower ones have higher priorities, but at our core we’re seeking to fulfill them all.

Before you commit that next dollar, think about the need it is fulfilling.

Are you looking to satisfy higher needs at the cost of lower ones?

Are there alternatives that might cost less or fulfill that specific need better?

Is it even fulfilling the need you think it is?

A purse isn’t just a purse.

Let’s take a very simple example – a purse is just a bag. Functionally, it holds stuff.

In reality – it does so much more.

You can buy a $20 one from Target or a $150 one from Coach or a $15,000 one from Louis Vuitton.

Why do some people buy the $15,000 version? Because it makes them feel good. It gives them prestige and it is the fruit of their labor.

There are people who can buy $15,000 handbags but buy the $20 one instead. It’s not because they’re cheap but because they don’t associate prestige with a handbag. They don’t get $15,000 of value out of the bag. It doesn’t make them feel $15,000 good.

The folks who spend that much have a reason too. Maybe they buy those handbags so they appear more appealing as they seek out friends and intimate relationships. Maybe they do it because they feel they deserve it – so it’s a reward for past behavior. Whatever the case, it’s not “stupid.” It merely is what it is.

This applies to everything – cars, houses, clothes, jewelry, … this list never ends.

The Prime Directive of Personal Finance is that you should “Avoid committing future funds to spending obligations; commit them to saving obligations.”

Before you commit your funds, consider the purpose and whether you’d be better off making a trade instead.

If a handbag is unrelatable, how about shelter?

A house is a prime example of how understanding the hierarchy is so important and how it intersects with the Prime Directive of Personal Finance.

A house hits every layer of the hierarchy of needs:

- Physiological needs: The most obvious, a home provides physical warmth and rest.

- Safety needs: Your home is your sanctuary, a place where you can lock the doors – you feel safe and secure.

- Belongingness and love needs: When you put down roots, it’s far easier to build lasting relationships.

- Esteem needs: Homeowners are seen as having more prestige than renters. Owning your home is a badge of honor. A nicer home is better than a less nice home.

- Self-actualization needs: A home may not check off this need but it enables you to pursue it, perhaps giving you a place within the home that you can be creative – a workshop, a studio, something of that nature.

And houses most certainly have luxury versions. You can buy a small house or you can buy a massive one. Or you can buy a cottage in the woods. Or live in a converted camper van!

They satisfy each of the levels to varying degrees but can have widely different costs.

Warren Buffett has lived in the same house since 1958. It’s a nice home in Omaha, NE that he purchased for $31,500. It has five bedrooms and 2.5 baths. He’s worth ~135 billion dollars. He could easily buy many many MANY lavish homes anywhere he wants and not even notice it.

But he doesn’t and there’s a good reason – it doesn’t matter to him.

He’s fine with the equivalent of a Coach handbag, he doesn’t need the Louis Vuitton. He doesn’t need or care about the prestige associated with it. He has it satisfied elsewhere in his life.

As you go to buy your house, are you buying that much house because you need that much space or are you trying to satisfy another need? Are you committing to 15/30 years of payments to get something you could get in a $1,000 handbag? 😆

How debt flips the hierarchy upside-down

When you introduce debt, things get ugly.

If you want to buy a $15,000 handbag and can pay cash, go for it!

There is nothing wrong with satisfying your need for prestige. It’s human. Anyone who says otherwise is simply signaling they don’t care about handbags, nothing more.

We all want prestige, whether we admit it or not.

If you put that purchase on a credit card (and carry a balance), it becomes a big financial problem.

Functionally, debt allows you to borrow money from your future self. But your future self doesn’t get interest payments, he or she just gets to use whatever you’re buying a little bit earlier.

With debt, people can spend beyond their means. This is great when you want to make invest in yourself and your financial system. A mortgage gives you access to a more predictable living situation. A car loan gives you access to a car. A student loan gives you access to higher education and skill building.

But debt introduces problems. Debt can be used on “needs” as easily as they can be used on investments.

People often live beyond their means because they are looking to satisfy one of their higher needs. The engine of their financial life, their ability to earn, hasn’t increased but they’ve already borrowed against their future self.

Debt is dangerous when you use it on satisfying a higher need because it’s very expensive. If your earning ability doesn’t also increase, debt means you’ve bumped up the incline on the treadmill of life.

When you use it for an investment in your earning potential, like education, you borrow against the future but you also increase your earning potential. In that situation, debt can be a valuable tool.

In either case, the question you have to answer is – “what need am I satisfying?”

It’s your money, spend it however you want

Before you think this is a “spend only on function!” post – it’s not.

Take me for example – I really enjoy vacations. I enjoy visiting new places, having new experiences, and living a life that isn’t mine if only for a short time. (the new places thing is why a timeshare isn’t for me)

Vacations are hard to defend financially because they create nothing tangible. They create memories (memories appreciate!) but it’s not like a bag. They don’t do anything… but I love them nonetheless.

It is your money and you can spend it however you want. Some people spend more on food. Some people spend more on security. Some people spend more on relationships, prestige, whatever!

You made that money and you don’t need anyone else’s permission. (certainly not mine!)

You need permission from your future self.

You must be honest to the true motivation. Companies spend billions a year on advertising to appeal to these needs, educate yourself so you can adequately defend yourself.

If you are honest with yourself, spend without guilt. You earned it.

The real challenge after you have “enough”

Spending is just part one of using the hierarchy – earning is part two.

When you are making just enough to satisfy the basic needs, you don’t have extra time and mental space to think about the work. You’re too busy trying to make enough money to pay for rent, food, gas, and other basic needs.

As your income grows, as your investments accrue, and you escape financial gravity, you will start looking at your work and thinking about whether it satisfies self-fulfillment and psychological needs.

New retirees face these challenges. Whether they’re retired after decades of work or they’re athletes who retire from professional sports in their thirties or forties – this is a difficult transition.

This is why so many people have encore careers or enter into philanthropy – they still want to be productive, they don’t need more money, but they need to satisfy these higher needs.

If this describes you, be aware that what you want isn’t more money but something else.

Check the hierarchy, the answer may be there.

Wow it’s amazing you liked Psychology. I still remember people talking about the long lab hours for their Psychology classes. I didn’t take it, but I could see how it might come in handy. I’ve always thought of our wants and needs as a pyramid of priorities too. At the moment, Mr. FAF and I spend most of our money on the bottom ranks. But in terms of intellect and careers, we’ve always been aiming for the top. I don’t need a Coach bag to feel important. Likewise, Mr. FAF doesn’t need a super expensive suit to look nice. But… Read more »

We all need different things at different times. 🙂 Psychology has become even more important now that I have kids. Understanding what they’re capable of (and not capable of) is important because sometimes they behave in irrational ways, but their brains haven’t fully developed yet. Knowing that helps me understand their behavior and I can attribute things to their age rather than their “personality” – they’re not jerks by choice sometimes. 🙂 I don’t need a super expensive suit (though that may be conflating quality with price) to look nice but a tailored suit does look and feel great, vs.… Read more »

hahaha i do love my designer purses. this is something i reward myself with. I can be frugal everywhere else, but when it comes to a purse, i just favor the designer brands more. They are made of the best materials and they do last a long time. Because of the amt of $ you put in, you take care of it better. I also buy classic styles so they don’t go out of season… even if they do, i don’t care, i still love it and wear it.

It would be awesome if there was a recommendation on how much you should spend on each level. From my perspective the two lower levels should account for ~70% of your spending. This would be 50% for basic living expenses and 20% savings for the future. The next two psychological levels might take up 20-25% of your spending. Things like entertainment, restaurants, hobbies etc. Then the highest level, self-fulfillment might be 5-10%.

What do you think Jim? Great post by the way. Very much enjoyed it.

Amen! The big emphasis right now is travel, experience, etc. I have to say I get more of my money’s worth with key pieces/items than I do with some vacations. It really us up to you what is worth your money (and time). I value cheap/free/inexpensive experiences over ones that cost more and enjoy saving up for big purchases (shoes, handbags, etc.). The key is to not purchase these things with credit. You are dead on!

We try to keep our buying of things to a minimum, only buy what we need and the things we do buy tend to have greater value to us (since it has to pass a higher bar).

It’s something we’ve learned a lot since having kids. They fall in and out of love with things so quickly it’s really a microcosm of how we behave, whether we like it or not.