If you’ve ever “linked” your bank account to a fintech platform, chances are you did so with Plaid.

Many finance and investing apps such as Empower Personal Dashboard, Acorns, and Vyzer use Plaid to connect your bank account to their platform without storing your sensitive credentials on their servers.

In addition to the added security, using a third-party service like Plaid reduces the potential for technology glitches or integration problems.

Because it’s often a required service for using a particular app, it’s fair to wonder whether Plaid is safe.

After all, when you use Plaid, you are providing them with your personal and account details. I’ll closely examine how Plaid works and let you know of any potential downsides.

Table of Contents

What Is Plaid?

Plaid is a technology service that helps you securely connect your bank accounts with finance-related apps that can assist with the following tasks, among others:

- Budgeting

- Digital wallets

- Investing

- Neobanks

- Getting a loan

- Sending money to family members

Which Apps Use Plaid?

Over 7,000 companies and fintechs use Plaid, so the chances are high that you will inevitably use this service to link to your banking account when you sign up for a new financial service.

Plaid is free for individuals to use as they make their money from the apps that they partner with. Businesses that use Plaid’s services include:

- Ally Invest (Investing)

- Chime (Banking and building credit)

- Copilot (Budgeting)

- Empower Personal Dashboard (financial dashboard)

- Kubera (Net worth tracker)

- NewRetirement (Retirement planner)

- Venmo (Digital wallet)

- YNAB (Budgeting)

- Vyzer (financial dashboard)

How Plaid Works

With Plaid, you don’t have to download software to your computer or mobile device, as the entire data transfer process occurs online using an application programming interface (API).

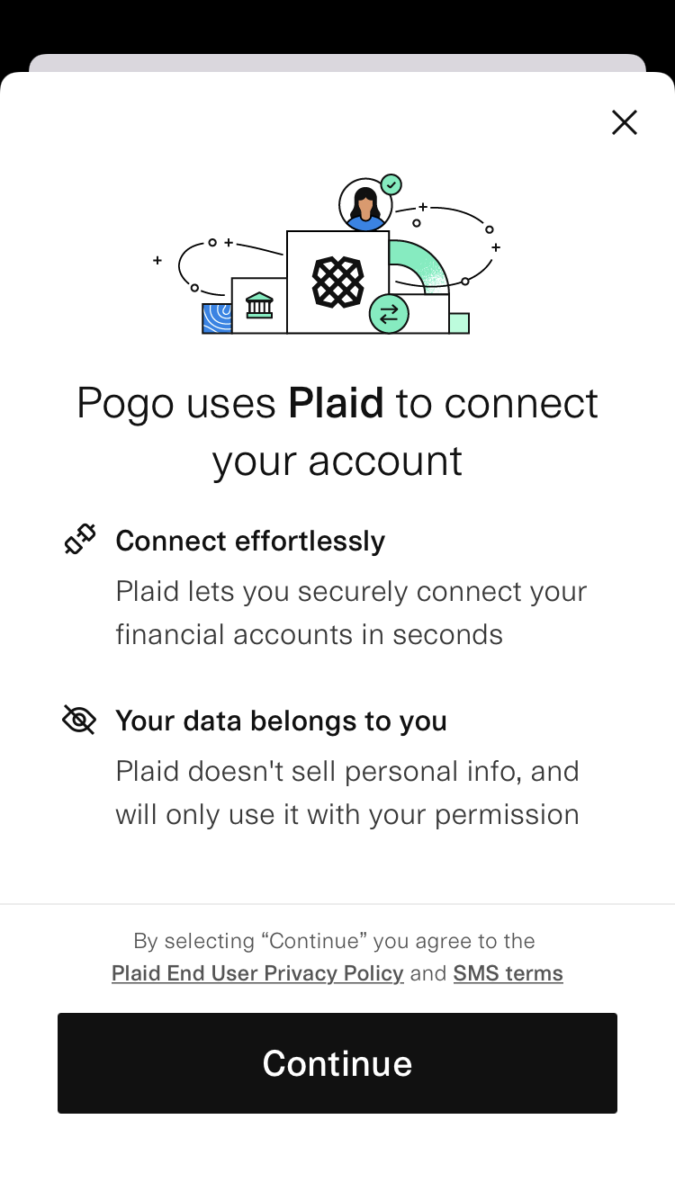

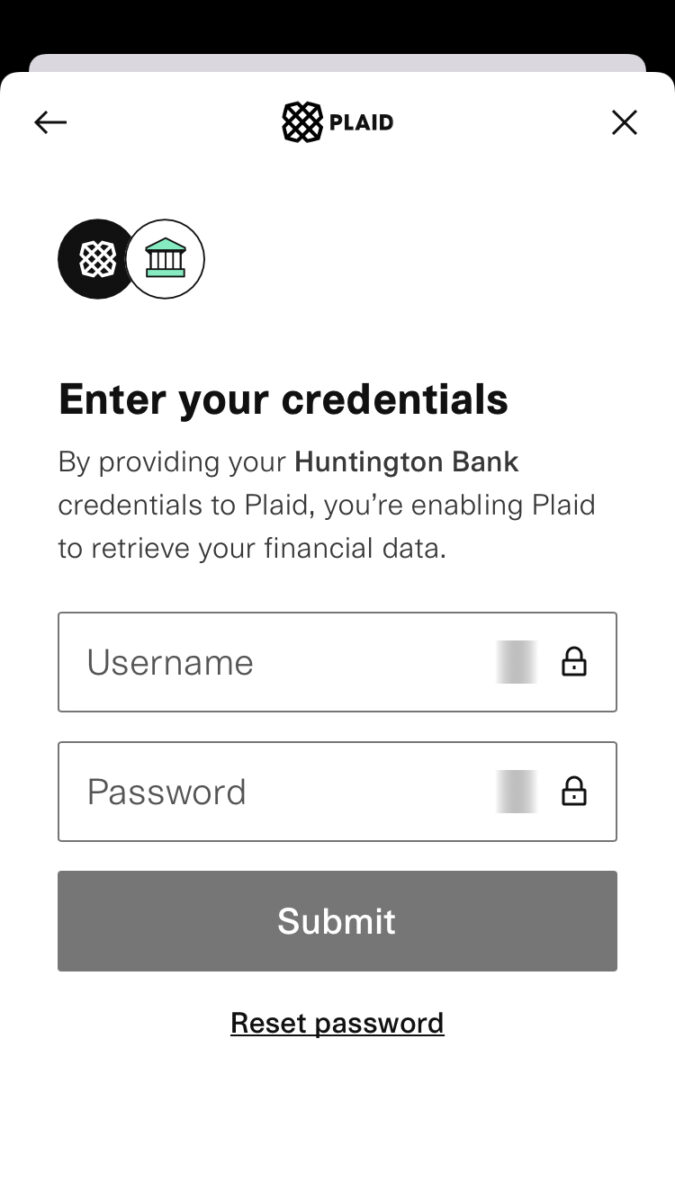

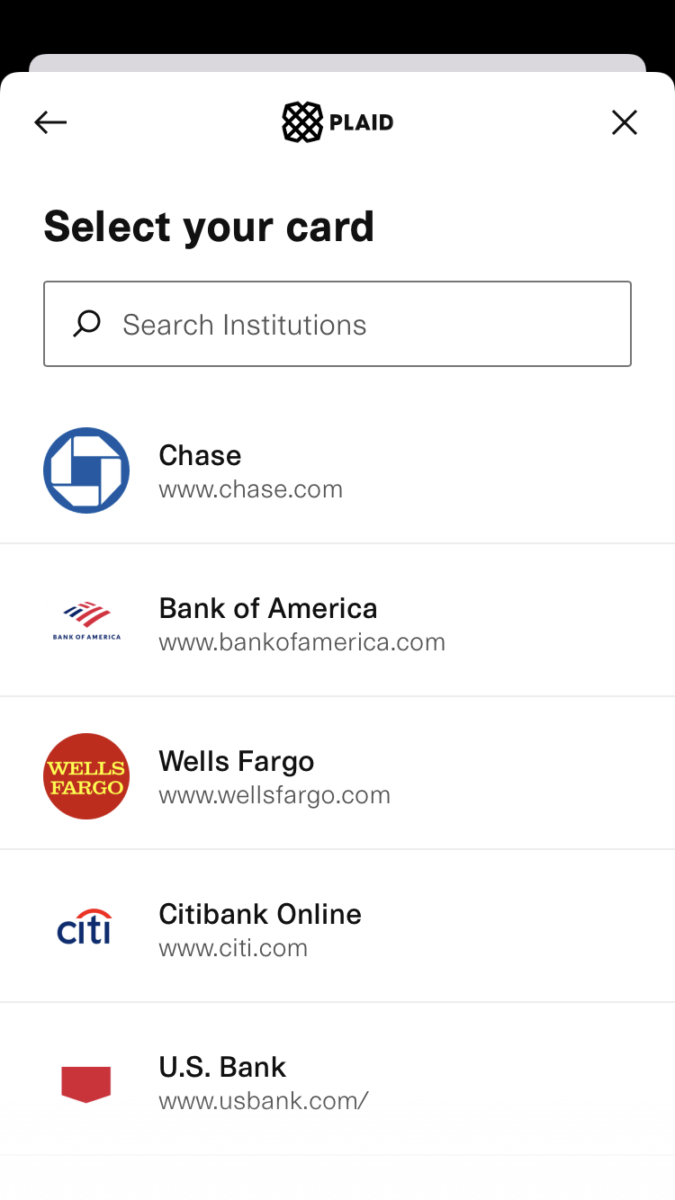

The screenshot below illustrates how you would provide your online banking credentials to Plaid so they can retrieve your data.

Choose Your Bank

In most cases, when you join a new service and get to the step where you need to connect a bank account, a screen displaying the Plaid logo appears with a searchable list of banks and credit unions.

Most financial institutions partner with this Plaid; however, some banks and credit unions have tight security controls which can prevent account syncing. If that’s the case, you must link a different bank or see if you can manually connect by directly providing your routing and account number to the app you’re joining.

Enter Login Details

After selecting your bank, you will enter your username and password. Many platforms utilize two-factor authentication (2FA) to prevent unauthorized access. Therefore, you will likely need to enter a time-sensitive code from a linked email address or phone number to proceed.

Agree to Terms and Conditions

After entering the code, you can choose which accounts you want Plaid to share with this particular platform. For example, you may only select your checking account but not your savings account or brokerage account if you have multiple account types.

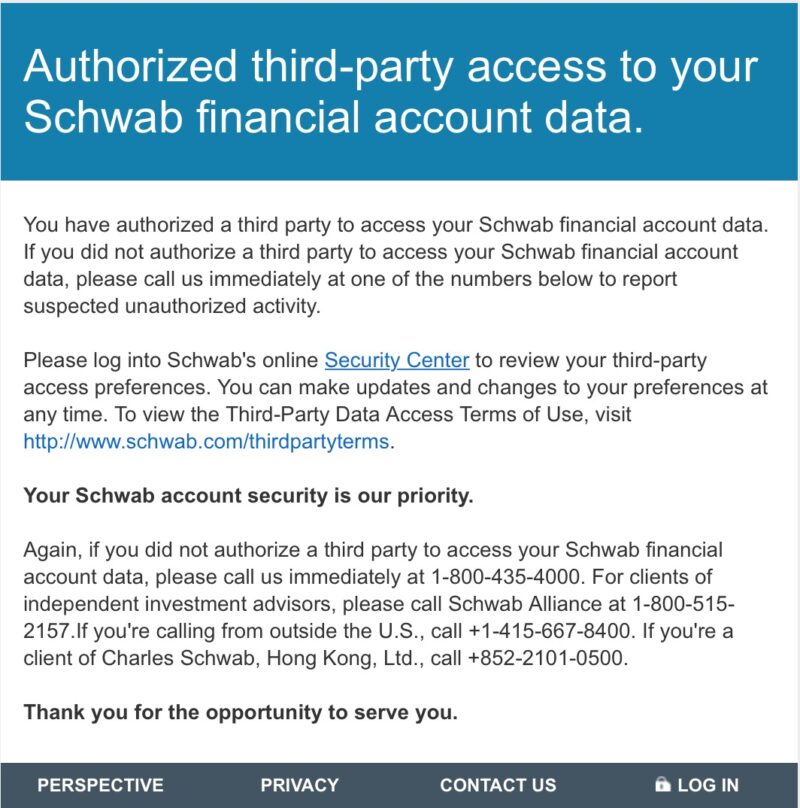

Further, you will read the terms and conditions from Plaid to finish the account syncing. After agreeing, your bank will send a notice letter to your email to verify there’s no fraudulent activity.

Is Plaid Safe?

Yes, Plaid is safe to use, although there is always a chance that your personal information and banking details are at risk when you join a service and expand your online footprint.

Plaid has only read-only access to your linked financial accounts. Therefore, they cannot initiate transactions or alter your account settings. To an extent, you can select which information you want to share and disconnect accounts at any time.

Additionally, independent investigators continually audit Plaid to look for security flaws and ways to improve its data protection practices.

If you’re hesitant, you may decide not to create an account for a particular service. But, if a data breach occurs, the information that Plaid collects should be safe as it isn’t stored on the servers of that impacted banking, budgeting, investing, or lifestyle app.

Assuming you don’t want a third party to sync your accounts, you can see if the platform supports manual account linking or other funding methods, such as a credit or debit card. That said, syncing your accounts with Plaid will be the most convenient option.

What Data Does Plaid Collect?

You can expect Plaid to request the following details when syncing financial accounts:

- Account name

- Account number

- Personal details

- Your email address

The app displays which information is being collected during the account connection process.

Does Plaid Sell Your Data?

No, Plaid won’t sell or rent your sensitive data. You also get to decide which information it collects. However, you may not be able to complete the account sync if you disallow certain details.

Is Plaid Legit?

Yes, Plaid is a legit digital service that many well-established companies and fintech startups rely on to connect customer accounts with their platforms. It’s also worth noting that Plaid is owned by the world’s largest card payment company, Visa.

Plaid Lawsuit

Unfortunately, Plaid isn’t trouble-free as they settled a $58 million class action lawsuit in 2022. The findings from the lawsuit included the following:

- Collecting more financial data than necessary

- Obtaining login credentials for linked accounts (username and password)

Impacted users from January 1, 2013, to November 19, 2021, were able to file a claim.

Hopefully, the service will reduce its data-collecting practices. This event is also a good reminder creating accounts and linking accounts isn’t entirely risk-free.

Can You Disconnect Linked Accounts Remotely on Plaid?

Yes, you can easily disconnect synced accounts through the Plaid Portal. This dashboard is also helpful for seeing which apps use Plaid to connect to your financial accounts.

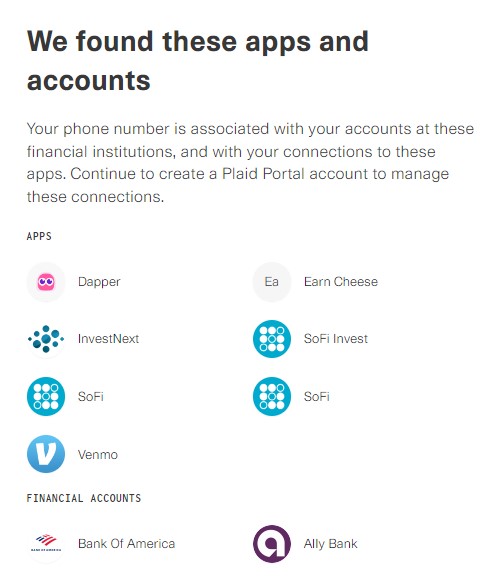

You can create a free Plaid Portal account by entering your phone number. This initial step lets you see which services are currently connected to your bank or PayPal accounts:

To disconnect a particular account, you will need to create a free account with Plaid.

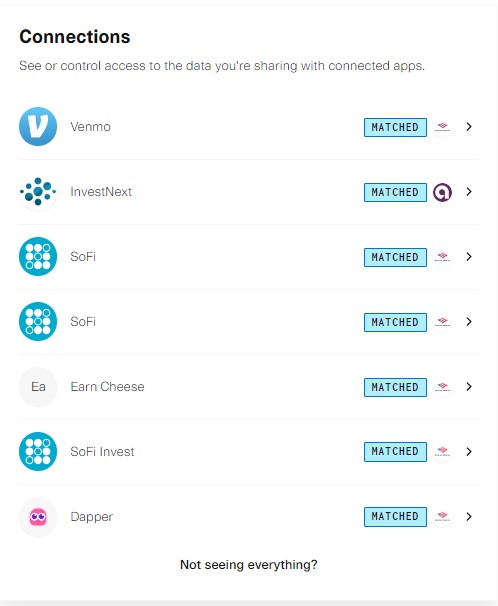

From there, you can manage your accounts:

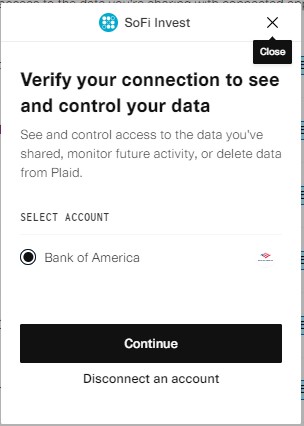

If you want to see the details of the connection, you’ll have to log into the bank again (just as you did when you connected the account). If you just want to disconnect the link, you can click on the > icon and disconnect it.

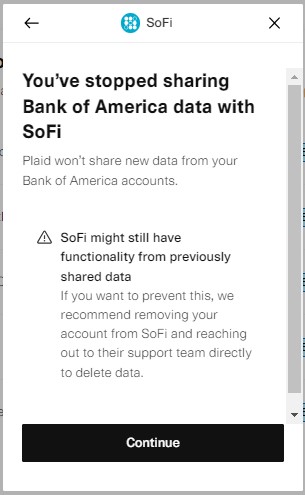

I was surprised to see this connection with SoFi Invest still linked even though I closed my account last year:

It was easy to disconnect, just click “Disconnect an account” on the window and it’s gone. (after another confirmation window pops up)

There is one caveat:

SoFi might still have functionality from previously shared data

If you want to prevent this, we recommend removing your account from SoFi and reaching out to their support team directly to delete data.

Final Thoughts

Plaid is safe and worth using to monitor your financial accounts and transfer money. Services like Plaid allow you to automate your finances and use cloud-based software to help make life easier.

Because Plaid connects with many banks and credit unions, you’re less likely to receive an account connection error that can occur with smaller services.

Plaid is also more secure than manually linking an account, as your banking details are on fewer company servers. Like any online platform, you should use discretion about which accounts you link, as there is an element of risk each time you connect an account, even with third-party apps.

Leave a Comment: