Bluevine

Product Name: Bluevine

Product Description: Online bank offering interest-bearing checking accounts, financing, and billpay capabilities for small businesses.

Summary

Bluevine is an online bank that has some great offerings for small businesses, such as the ability to earn interest on your deposits, get cash back on credit card purchases, and access financing through a line of credit. It also offers bill pay through its accounts payable platform, which can connect with QuickBooks.

Overall

Pros

- 2.00% APY interest on balances up to $100,000

- No minimum balance, no minimum deposit

- Very few fees (up to $4.95 to deposit cash)

- Unlimited transactions

Cons

- Up to $4.95 to deposit cash

- No physical locations

- No merchant processing services

- Low daily and monthly maximums for cash deposits

When I opened my business, I did what most people do: I went to a bank and set up a business bank account. And back then, in 2005, my choices were limited to the banks that were in my neighborhood. But in the years since, there has been a slew of neobanks offering banking services for businesses.

One of these online banks is Bluevine, which has now been around for over a decade. They offer two business checking accounts, financing options such as a credit card and line of credit, and accounts payable services. In this Bluevine Business Checking review, we’ll see how it stacks up against other online banks.

At a Glance

- Offers two interest-bearing checking accounts for businesses.

- Lines of credit available for up to $250,000.

- 1.5% cash back credit card for existing and eligible Bluevine customers.

- Syncs with QuickBooks for managing your accounts payable.

Who Should Use Bluevine?

Bluevine’s products are suited to small business owners who don’t require access to in-person banking services and are comfortable with totally online banking and bill paying.

They’re also a great option for earning interest — something that few business checking accounts offer. And if you can manage the $95 monthly fee, the Premier account could have you earning even more interest while paying lower service fees. (Just be sure to do the math first and ensure what you’re saving in fees and earning in interest outweighs the monthly fee.)

To be able to access Bluevine’s lending products, you’ll need a credit score of at least 625 and your business needs to have been in operation for at least two years. While you can still open a Bluevine Business Checking Account without meeting these criteria, you won’t be able to borrow any money from Bluevine until you’re more established.

Note that businesses based in Nevada, North Dakota, and South Dakota are only eligible for some of Bluevine’s products and features.

Bluevine Alternatives

| |||

| Monthly Fees | $10 (waived if account balance is $500+) | $0 to $55 | $0; $19.99 for Found Plus |

| Minimum Balance | $0 | $0 | $0 |

| APY | 1.50% APY on balances up to $100,000 | 4.15% APY on balances up to $100,000 with Lili Pro, Smart, and Premium | 1.5% APY on balances up to $20,000 with Found Plus |

| Learn More | Learn More | Learn More |

Table of Contents

- At a Glance

- Who Should Use Bluevine?

- Bluevine Alternatives

- What Is Bluevine?

- Bluevine Checking Accounts

- Bluevine Financing Options

- Bluevine Accounts Payable

- How To Open a Bluevine Account

- Bluevine vs. Lending Club Tailored Checking for Business

- Bluevine vs. Lili Business Checking Accounts

- Bluevine vs. Found Business Banking

- Summary

What Is Bluevine?

Bluevine is a financial technology company based out of Redwood City, CA, and was founded by Eyal Lifshitz, Moti Shatner, and Nir Klar. Lifshitz was a venture capitalist who used to work at Greylock Partners and started Bluevine in 2013.

Bluevine offers online business banking services and their primary product is a business checking account, Bluevine Business Checking. Bluevine uses Coastal Community Bank for their banking service and is FDIC-insured for up to $3 million, which is significantly higher than the usual $250,000. This means you can keep more money within one institution. BlueVine has an A+ rating with the Better Business Bureau.

They also offer financing options such as a line of credit and credit card.

Bluevine Checking Accounts

Bluevine offers two checking account options for small business owners: a standard checking account that comes with minimal fees and the ability to earn interest on your deposits, and a premium version that offers a higher APY and a reduced rate on the few fees Bluevine does charge.

Bluevine Business Checking Account

The Bluevine Business Checking account is their flagship product and it’s everything you would expect from a business checking account — plus it even pays interest.

There are no monthly maintenance fees, and you get unlimited transactions, live support, and 2.00% APY interest on your balances of up to $250,000 (if you meet a monthly activity goal). There is no minimum deposit, no minimum balance, no monthly service fees, and no overdraft fees.

You also get ATM access through the MoneyPass network, which has roughly 40,000 locations nationwide. Plus, two free checkbooks.

One common problem with online banks is cash — many online banks don’t offer the ability to deposit cash. Bluevine has gotten around this by partnering with Green Dot and Allpoint+ ATMs — although this does come with a fee of up to $4.95 per deposit.

Deposits at one of Green Dot’s 90,000+ retail locations have a daily limit of $2,000. The Allpoint daily limit is $5,500. Both have a 30-day rolling limit of $7,500.

If you need to send money internationally, you can also do this with Bluevine’s Business Checking account (except for businesses based in Nevada). Payments can be made to 32 countries and in 15 currencies, with funds received in as quick as 24 hours. There’s a flat fee of $25 per international payment and a minimum 1.5% charge for funds sent in non-U.S. currencies.

Bluevine Premier Business Checking Account

In addition to their standard Business Checking account, Bluevine also offers a Premier Business Checking account, with a higher rate of 4.25% APY as of publishing, on balances up to $3 million. It also includes priority customer support — meaning whenever you call Bluevine, you’re routed to a priority queue.

With Premier, you also get discounted fees on same-day ACH and domestic and international wire transfers.

However, you do have to pay for all these extra features. Bluevine Premier has a $95 monthly fee — although you can avoid the fee by maintaining an average daily balance of at least $100,000 and spending at least $5,000 with Bluevine’s credit card.

Bluevine Financing Options

If you need to borrow funds for your business, you have two options through Bluevine: a revolving line of credit or a cash back credit card.

Bluevine Line of Credit

Bluevine’s line of credit lets you borrow up to $250,000 as revolving credit. This means that you can tap into the funds as needed and only pay interest on the amounts you withdraw.

You can request funding from your Bluevine dashboard and approval can be as quick as within five minutes, with funds deposited within a few hours. Repayment can be weekly or monthly, for a term of 26 weeks or 12 months.

To qualify, you must have:

- Been in business for 24+ months

- A FICO score of at least 625

- At least $40,000 in monthly revenue

You’ll also need to supply basic information about you and your business, including bank statements for the last three months and proof that your business is in good standing. Note that businesses in Nevada, North Dakota, and South Dakota are ineligible.

While Bluevine itself doesn’t offer term loans, some lenders within its network do. Term loans are available for up to $250,000 with repayment terms of up to two years.

Bluevine Credit Card

The Bluevine Business Cashback Mastercard offers unlimited 1.5% cash back on business purchases. It also comes with no annual fee.

Because the card is issued by Mastercard, it comes with various Mastercard perks, including theft protection, car rental insurance, and rebates at selected hotels, restaurants, and gas stations through the Mastercard Easy Savings program.

Other perks that come with the Bluevine Business Cashback Mastercard at the time of publishing include:

- 30% off QuickBooks Online

- Up to 20% off Intuit TurboTax

- $125 advertising credit with Microsoft Advertising

- Discounted 13-month subscription for McAfee Total Protection

- 2 free months of Adobe Creative Cloud

- 50% off a subscription to Zoho Social

- 30-day free trial of My Medical Champion telehealth

To get the card, you must already have an active Bluevine business checking account — for existing customers, you’ll receive an offer through your Bluevine dashboard if you’re eligible or, if you’re a new customer just signing up, you can opt in to be notified once you’re eligible for the card. You must also have a 700+ personal credit score and your business must be operating or incorporated in the U.S.

Note that if you open a Bluevine credit card, you’re ineligible for a Bluevine line of credit, and vice versa.

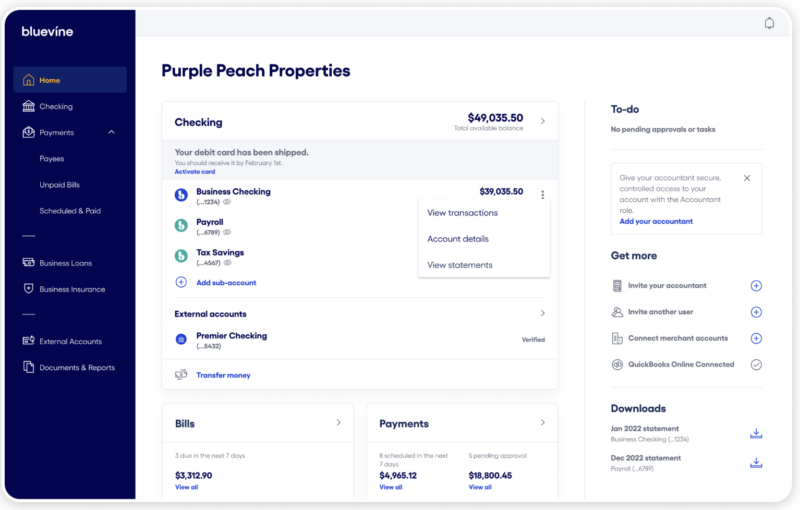

Bluevine Accounts Payable

Bluevine also offers an accounts payable platform, which enables you to send payments via wire, ACH, or check. It’s essentially bill pay and they offer the ability to electronically pay 40,000 companies (if your vendor isn’t one of the 40,000 then you can simply add your own).

You can also set up automated approval workflows and automatically route payments to team members. And the system can sync with QuickBooks Online, so you won’t lose track of your payments. You can also set up various permission levels, to control what different team members can do with their specific access:

- Authorized users can add and pay bills, plus approve payments.

- Contributors can set up payments and approve, but don’t have access to view account balances and details.

- Accountants can sync to QuickBooks Online, download statements, and pay bills.

Bluevine offers reasonable fees for making payments to vendors and employees. Payment fees are as follows:

- Standard ACH: Free

- Same-day ACH: $10

- Wire transfer: $15

- Check: $1.50

- Credit card payments: 2.9%

- International payments: $25 plus 1.5% of the payment amount

Note that several of these fees are reduced if you have a Premier account.

✨ Related: Best Business Savings Accounts

How To Open a Bluevine Account

To access any of Bluevine’s products, you’ll first need to sign up for a Bluevine Business Checking account.

To do this, you’ll need to supply some basic information about yourself and your business, including its annual revenue, entity type, and industry. From there, the required documents vary, depending on your entity type (sole proprietorship, corporation, or partnership).

If there is anyone who owns more than 25% of your business, you’ll also have to provide their personal information.

Bluevine vs. Lending Club Tailored Checking for Business

Like Bluevine, Lending Club is one of the few financial institutions that offers interest on its business checking account. However, its APY is only 1.5%, versus Bluevine’s 2.00% APY (or 4.25% if you go for the Premier account). Also, Lending Club’s interest rate only applies on balances up to $100,000, whereas Bluevine pays interest on balances up to $250,000.

Lending Club also offers 1% cash back on purchases made with its debit card — Bluevine offers 1.5% cash back, but only with its credit card.

There is a monthly fee with Lending Club, but it’s only $10, and this can be waived if you keep a minimum of $500 in the account.

Bluevine vs. Lili Business Checking Accounts

Lili is another online financial company that’s geared toward small businesses. It offers four tiers of business checking accounts, each with no or very low fees — a Basic account has no monthly service fees and Lili Premium only charges $55 per month.

Each tier offers additional features, such as cash back rewards on your Visa debit card, free overdraft, and bookkeeping tools. Like Bluevine, you also get unlimited transactions and pay no fees at MoneyPass ATM locations. Lili also shines for its 4.15% APY on checking accounts of up to $100,000 (only available for Pro, Smart, and Premium account holders).

However, where Lili falls short of Bluevine is that you can’t send wire transfers or write checks with a Lili account. There are also low daily ($1,000) and monthly ($9,000) cash deposit maximums that may make it difficult if your business is bringing in more than that in cash — although Bluevine also has comparable limits of $2,000 daily and $7,500 monthly with Green Dot.

Bluevine vs. Found Business Banking

Found is another fintech that offers a no-monthly-fee business checking account and bill pay features. It also has no minimum balance requirement and allows for unlimited transactions. Found connects to bookkeeping and payment apps such as QuickBooks and Stripe.

Like Bluevine, Found also has a premium account option, Found Plus, which has a monthly fee of $19.99. In exchange for the fee, you’ll get priority customer service and the ability to earn interest on your deposits — although as of publishing, Found is only offering 1.5% APY on balances up to $20,000, versus Bluevine’s starting 2.00% APY. (Plus, with Bluevine, you can also earn interest at the basic account level.)

While Found offers unlimited transactions, check deposits are limited to a total of $3,000 per week. Cash deposits are limited to a total of $2,000 per week and $4,000 every 30 days.

Found currently doesn’t offer any financing products like loans, lines of credit, or credit cards.

Read our full review of Found Business Banking.

Summary

If I were opening a business checking account today, I’d give Bluevine serious consideration because it offers everything I could possibly need out of a business checking account plus it offers interest on your cash balances up to $250,000 — something that is extremely uncommon in business checking.

The only limitation is if you want all your business services consolidated with one bank and you need a merchant payment processing provider. With the rise of payment services like Square, this might be a non-issue for many businesses that need POS capability. With unlimited transactions, Bluevine can easily support that.

Mark says

This bank fails to do the basic stuff. They have extremely rigid requirements for endorsing checks you deposit and often reject them, but they don’t tell you at the time of deposit that it is rejected, they simply never post the deposit to your account. They don’t post it and then reject it in your account activity, so you can see what is going on. They simply never post it; it is like it never existed. Also, they won’t post a held check in your account activity until it clears, so it makes it again appear like they did not receive the deposit for several days. I tried to send a wire transfer twice this week. The first time they rejected it the next day for an unknown reason. The second time they rejected it the next day because my description was not descriptive enough. Seriously, my description was not descriptive enough! Take about nonsense. My description on a wire transfer is none of the bank’s business. Any real bank would get this. Wire transfers are also urgent. Now I am loosing credibility with my supplier because this amateur bank did not like my wire transfer description. This bank must be run by a bunch of kids that have never had checking accounts before, never used a business checking account as part of running a business. Steer far clear of this bank.