Are you in the market for a new checking account?

TD Bank has several promotions going on right now:

- They have two cash bonus offers when opening a new checking account,

- A savings account bonus of $200, plus,

- a TD Bank Cash Card promotion worth $150 cash back

The terms are fairly simple for the checking account – open an account and receive direct deposits. The Premier Checking account has a higher bonus but much higher minimum balance (to avoid fees) and direct deposit totals. If the tiers are too high on the Premier, you can still get cash by going with the Convenience checking option too. At the very least, you’ll walk away with $200 and a solid checking account to go with it.

Layer on one of their savings accounts (which require fairly large deposits) and you get another $200.

TD Bank N.A. is FDIC insured (FDIC # 33947) and they have branches in Connecticut, Washington D.C., Delaware, Florida, Massachusetts, Maryland, Maine, North Carolina, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, South Carolina, Virginia, and Vermont. Here’s our guide to finding your TD Bank routing number.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Table of Contents

🔃 Updated April 2024 with the details of their brokerage account offer, which is up to $750 when you open a TD Automated Investing account.

TD Automated Investing – up to $750

TD Bank is offering a tiered bonus of up to $750 when you open a TD Automated Investing account before . You just need to fund your account within 30 calendar days of opening your account and then keep that balance in there for 90 days.

The cash bonus will be deposited within 15 days of meeting those requirements.

The bonus schedule is:

| Deposit Amount | Bonus Amount |

|---|---|

| $1,000 – $4,999 | $50 |

| $5,000 – $24,999 | $150 |

| $25,000 – $49,999 | $250 |

| $50,000 – $74,999 | $450 |

| $75,000 – $99,999 | $750 |

It’s important to know that since this is an automated investment account, there are fees. There’s an annual wrap fee of 0.30% for all account balances (including cash) with a minimum of $15.

👉 Learn more about this promotion

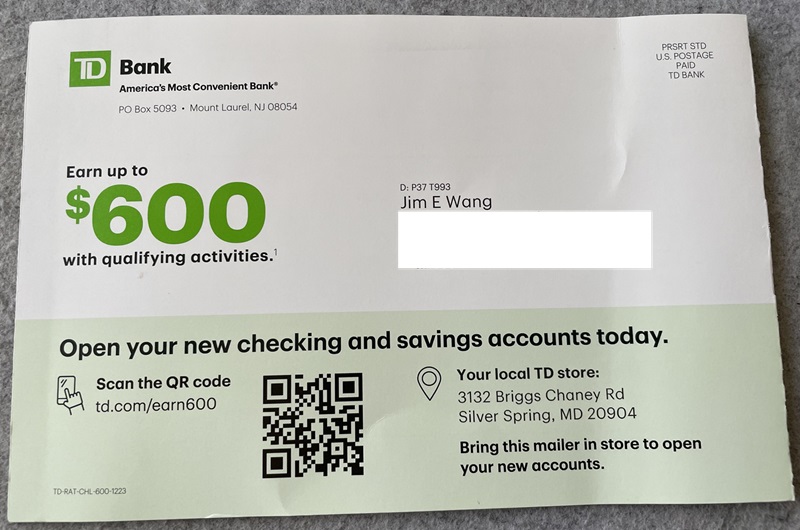

TD Bank sent out a mailer that you can bring into a branch. They say the offer is available only to those who received a mailer, though I’m unsure how they can confirm who received one or not. I was sent one, but the middle name was wrong.

Either way, here are the terms.

TD Bank offers bonuses on these two checking accounts:

- TD Beyond Checking – $300 bonus (details below), $2500 minimum balance to avoid fee, no ATM fees, free first order of check

- TD Convenience Checking – $200 bonus (details below), $100 minimum balance to avoid fee, discount on first order of checks

Both of these offers are for new customers who do not have an existing or prior checking account at TD Bank. You will need to open the account online and the direct deposits need to be recurring deposits of your paycheck, pension, or benefits from the government (like Social Security) or your employer. You can’t transfer funds from another account and have it count. The bonus is deposited within 95 days of satisfying the criteria.

Then, layer on either a TD Beyond Savings or a TD Simple Savings and deposit $10,000 or more in new money within 20 days of account opening, then maintain a balance of at least $10,000 for 90 additional days from the 20th day after account opening. Then you earn an additional $200.

More details on each of the deals below:

TD Bank Beyond Checking Promotion – $300

TD Bank has a Beyond Checking promotion of $300 with very reasonable requirements for an account of this type. Just open a TD Beyond Checking account and receive direct deposits of $2,500 or more within 60 days of opening your account.

To qualify for this offer, you must be a U.S. resident and apply for the offer online.

There is a $25 monthly maintenance fee that is waived when you maintain a $2,500 minimum daily balance. They also offer overdraft service as well as free money orders, bank checks, stop payments, paper statements with check images, as well as incoming wire transfers.

Remember, this bonus will be reported as taxable income on Form 1099-MISC.

This offer is available in these states: CT, DE, DC, FL, ME, MD, MA, NH, NJ, NY, NC, PA, RI, SC, VT, and VA..

👉 Learn more about this promotion

The information for this product or card has been collected independently by WalletHacks.com. The card details on this page have not been reviewed or provided by the card issuer.

TD Bank Convenience Checking Promotion – $200

If the balance requirements or the direct deposit requirement was too high, you can get $200 by opening a TD Convenience Checking account and receive direct deposits of more than $500 within 60 days of opening the account. $2,500 in direct deposits within 60 days can be high, $500 might be easier to reach.

To qualify for this offer, you must be a U.S. resident and apply for the offer online.

There is a $15 monthly maintenance fee that is waived if you maintain a minimum daily balance of just $100. This checking account does not earn interest.

This offer is available in these states: CT, DE, DC, FL, ME, MD, MA, NH, NJ, NY, NC, PA, RI, SC, VT, or VA.

👉 Learn more about this promotion

The information for this product or card has been collected independently by WalletHacks.com. The card details on this page have not been reviewed or provided by the card issuer.

TD Beyond Savings or TD Simple Savings – $200

For the savings component, you can open either a TD Beyond Savings or a TD Simple Savings – the requirements are the same for both. Just deposit $10,000 or more in new money within 20 days of account opening, then maintain a balance of at least $10,000 for 90 additional days from the 20th day after account opening. It’s a relatively high amount but if you can reach it, the terms are simple.

What’s the difference between TD Beyond Savings vs TD Simple Savings? The TD Beyond Savings account offers a tiered interest rate and the TD Simple Savings offers a flat rate. Both rates are quite low.

The TD Simple Savings accounts has a $5 monthly fee that is easily avoided (maintaining a $300 daily balance is one way, so is linking to a TD Beyond Checking account). The TD Beyond Savings has a $15 monthly fee that you can void by also linking a TD Beyond Checking account (or maintaining a $20k balance!).

👉 Learn more about this promotion

The information for this product or card has been collected independently by WalletHacks.com. The card details on this page have not been reviewed or provided by the card issuer.

TD Bank Cash Card – $150 cash back

The card offers 3% cashback on dining, 2% cash back at grocery stores, and 1% on everything else[ – so it’s a very good daily spending card too.

Lastly, it has a $0 annual fee and no foreign transaction fee, so very useful if you’re traveling internationally.

Learn more about TD Bank Cash Card

How does bonus offer this compare?

We maintain a comprehensive list of bank bonuses (a good place to look if you don’t think you can satisfy this bonus’s requirements) so we know a good bonus when we see one.

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.

In the end, eligibility is important too and this one is open to a broad geographic area.

Final Verdict

This is an above-average bonus offer that is generous enough to be enticing. If you don’t have an account and don’t mind redirecting your direct deposit, it’s a good one to take advantage of if you are in the market.

The requirements are standard and the account itself is good too – it’s an all around good offer.