If you live in the mid-Atlantic or Northeast United States, you likely live in the geographic region of Santander Bank. Founded in Spain, Santander Bank (Banco Santander) has been in the United States since 2006.

They are FDIC insured (Certificate #29950) with 541 locations sprinkled throughout nine states. If you’re wondering how a bank that entered the US market in 2006 has a certificate that dates back to 1907, it’s because they acquired what was once Sovereign Bank, a savings and loan in Pennsylvania. Sovereign Bank was founded in 1902 and serviced, primarily, textile workers.

The history is a bit long but Banco Santander bought a 20% stake of Sovereign Bank in 2006. There were a few more acquisitions but eventually Banco Santander acquired the rest of the bank in 2009. In 2011, Sovereign Bank officially changed its name to Santander Bank.

This all to say that Santander Bank is a legitimate bank, FDIC insured, and a safe place to put your money.

If you have some direct deposits, you can get a nice juicy new account bonus now – here are the details.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Table of Contents

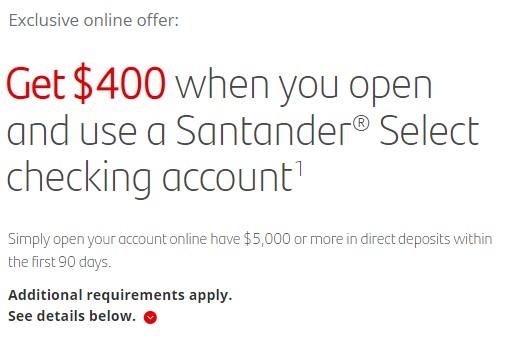

Santander Select Checking — $400

Open a Santander Select Checking account with the promotion code that is shown after you enter your email address (you have to enter your first and last name plus an email address, then it shows a unique code).

Then, just satisfy a few conditions to get $400 from Santander Bank.

The conditions are easy but you have to do this offer in-branch:

- get $400 by having direct deposits totaling $5,000 or more in your account within the first 90 days;,

- keep the account open for at least 90 days,

- get paid!

You can’t be a current checking customer of Santander Bank or had a checking account in the last 12 months.

Available to residents of NH, MA, RI, CT, DE, NY, NJ, PA, or FL.

The account has a $25 monthly fee that is waived when you have a combined balance of $25,000 in bank deposits and/or eligible investments held with Santander Investment Services.

Learn more about this offer

(Offer expires 7/1/2024)

Santander Business Account — up to $500

If you run a business, Santander had a promotion where you could get $500 for opening a new business checking account and maintaining an average daily balance of $2,500 or more in the first 90 days.

Previously, this offer had tiers but it appears those tiers have all gone away.

All that’s required for this promotion, which uses the promotion code BUS500Q124SEA, is to maintain a modest balance. You can open this online or by going into a branch.

(Offer expired 7/30/2024)

How Does This Bonus Compare?

The current promotion has a relatively high direct deposit requirement but not something that’s unreasonable given that you have three months to accomplish it.

That said, here are how some of the other offers compare:

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.

Requan says

Worth mentioning that the Santander Select Checking $400 bonus offer has a $25 monthly maintenance fee, which is waived ONLY if you hold a hefty $25k with them. Still, $300 (net of 4 months of fees) is still worth it on $6k DD.

Excellent point, I’ve updated the post to include this, thanks Requan!