If you’re thinking about opening a KeyBank account, learn how you can get a few hundred dollars for meeting some very easy criteria.

If you aren’t familiar with KeyBank, they are a “regional” bank with its headquarters in Cleveland, Ohio. They are FDIC insured (FDIC #17534) and are a National Bank regulated by the Office of the Comptroller of the Currency.

I put “regional” in quotes because people confuse regional with small, but they’re not a small bank. They have over a thousand locations spread out across sixteen states. It’s regional but it’s a big region. 🙂

KeyBank current offers one bonus:

Table of Contents

🔃 Updated April 2024 with the new details of the $200 bonus offer, expiring in March.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

KeyBank Checking Account — $200

This is their publicly available offer – get $200 for opening either a Key Smart Checking® or a Key Select Checking® account with the minimum opening deposit of $10 or $50, respectively, plus one qualified direct deposit of at least $500 within the first 60 days of account opening.

Offer code: ADSA0324

Your $200 cash bonus will be deposited into your account within 90 days of meeting requirements. Account must not be closed or restricted during the time of promotional period.

(Only available in AK, CO, CT, ID, IN, MA, ME, MI, NY, OH, OR, PA, UT, VT, and WA.)

👉 Learn more about this KeyBank offer

(Offer expires 7/19/2024)

Previous KeyBank Promotion Codes

We started keeping tracking of the promotion codes based on the date of expiration (deleting those once they’re so far out of date you aren’t likely to need it!), so if you need to know that, here is what we know from previous promotion:

- For the period ending 1/6/2023 – the code was ONAS1222

- For the period ending 2/3/2023 – the code was ONAT0123

- For the period ending 3/3/2023 – the code was ONAS0223

- For the period ending 4/4/2023 – the code was ONAS0323

- For the period ending 5/20/2023 – the code was ONAS0423

- For the period ending 6/16/2023 – the code was ONAS0523

- For the period ending 8/18/2023 – the code was ONAS0723

- For the period ending 10/13/2023 – the code was ONAS0923

- For the period ending 10/20/2023 – the code was ONON1023

- For the period ending 12/8/2023 – the code was ONAF0923

- For the period ending 3/8/2024 – the code was ONAF1223

- For the period ending 7/19/2024 – the code was ADSA0324

For what it’s worth KeyBank tends to stick with a predicable pattern for their codes. 😀

KeyBank Checking Account – $400 Bonus [Targeted] [EXPIRED]

There is also a targeted $400 bonus with the same terms but a promotion code of RETK0123 and expiration date of 3/3/2023.

If you try to use the $400 code instead of the $200 one, they ask you for a “personalized offer/coupon/promotional code” (which is the targeted part).

“You must have received a personalized offer/coupon/promotional code directly from KeyBank via mail or email and enter an offer/reservation code at the time of account opening to qualify.”

(Offer expired 3/31/2023)

KeyBank Referral Program – $100 [EXPIRED]

KeyBank has a referral program where existing customers can refer new customers and earn $100 each as long as the new customer satisfies a few conditions.

The process has to be started by visiting this page and entering the email address of the primary account holder. From there, follow the prompts to send the referral.

For the new customer, you have to “open a new qualifying checking account with minimum opening deposit by December 31, 2022 and makes one direct deposit of at least $500 in the first 60 days.”

The bonus will be deposited within 60 days of meeting the requirements. Both people get $100.

As an existing customer, you can get up to 5 referrals ($500) per year.

(Offer expired 12/31/2022)

Key@Work KeyBank Checking Account — $250 [EXPIRED]

This promotion is a little more limited that you have to be working at a company that offers the Key@Work program. Key@Work is a wellness program that offers financial education, one-on-one advice, and other discounts through employers.

If you do, you’re in luck because KeyBank will give you $250 when you open a Key Advantage Checking, Key Privilege Checking, or Key Privilege Select Checking® account with offer code ONKW0120 and make one direct deposit of $1,000 or more within 60 days. (the $1,000 increases to $2,500 for Key Privilege Checking and $5,000 for Key Privilege Select Checking)

Keep an eye on the monthly fees and what you need to do to get them waived. They differ based on the type of account and the minimum deposit amount is $50. Full details on the promotion page. Also, if you close your account within 180 days of opening it, they will charge a $25 account early closure fee.

Offer code ONKW0121 and enter your reservation number if prompted.

(Key@Work seems to only be available in Albany NY, Colorado, Columbus OH, Central IN, Connecticut, Maine, Oregon, Seattle WA and Utah.)

(Offer expired 6/25/2021)

Pros & Cons

The big pro is that they have a large geographic footprint and the bonus is pretty easy to get. It’s not difficult to set up one qualified direct deposit of at least $500 within the first 60 days of account opening.

Your bonus will be reported as taxable interest on Form 1099-INT. This isn’t really a “con” as this happens with every bank but you still want to keep a little aside for the taxman.

Be sure to read over our guide on bank account bonuses so you are aware of all the different things to watch out for whenever you try to cash in one this bonus.

KeyBank Routing Numbers

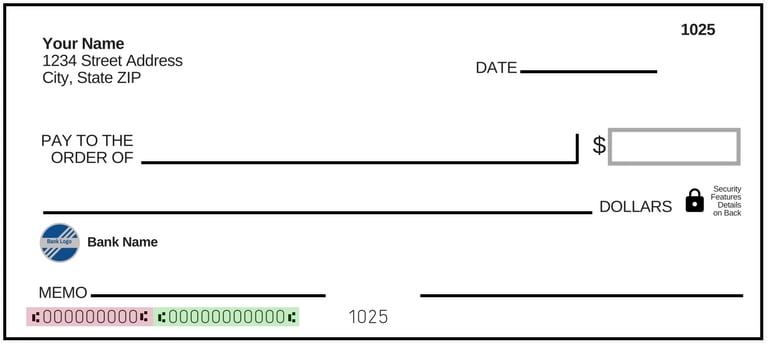

Are you looking for the routing numbers for KeyBank? If so, it’s easy to find.

If you already have an account, the simplest way is to go into the KeyBank app and look it up under account information. You’ll have to click “Show” to reveal the Routing Number for your account.

If you don’t have the app, you can log into your online banking account and find it on the right hand side of the screen under Account Info. Again, you’ll have to click “Show” to show the Routing Number.

Otherwise, you can look it up on your check – it’s the nine digit number at the bottom. The other two numbers down there are your account number (usually longer than 9 digits) and the check number.

Finally, if you don’t have any of those options, you can look it up based on the state in which you opened the account. Look it up on the table below:

| State | ABA Routing Number |

|---|---|

| Alaska | 125200879 |

| Colorado | 307070267 |

| Connecticut | 021300077 |

| Florida | 041001039 |

| Idaho | 124101555 |

| Indiana | 041001039 |

| Maine | 011200608 |

| Massachusetts | 021300077 |

| Michigan | 041001039 |

| New York | 021300077 |

| Ohio | 041001039 |

| Oregon | 123002011 |

| Pennsylvania | 021300077 |

| Utah | 124000737 |

| Vermont | 211672531 |

| Washington | 125000574 |

Why are there different ABA routing codes for one bank? Over the years, Key Bank has acquired other banks. In those cases, it keeps the ABA routing numbers of those banks so those customers don’t have to change everything in the acquisition. It’s a matter of convenience and the system is built for banks to have multiple routing numbers for a single bank.

How Does This Bank Bonus Compare?

How does it compare to other bank bonus offers?

This offer is average. We maintain a list of the best bank promotions and you can see some of the top offers out there.

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.

As you can see, KeyBank’s offer is a fair one if you can meet the requirements and worth getting.

Will you be taking advantage of this key opportunity? 🙂 (sorry, not sorry)

Pete Za says

No no no, you can’t open the account with just the offer code, it’s targeted – when you go in they ask for a reservation code as well. People are wasting their time trying..

Blake says

To the person below, you’re wrong. I just opened a keybank checking account online using their website, and after clicking to open a checking account with them, it asks if you have a promotional code which is where you will enter the code he mentioned on this post (enter the promo code: ONAS1120).

Thank you to the person who published this offer here!