If you’re looking to get a new Fifth Third Bank checking account, also known as 5/3 Bank, you might be delighted to learn that you could also get $200 to go along with it.

This promotional offer is great because you can do it completely online, which saves you a trip to a physical branch. Also, the qualifying activities are very accessible so check it out.

Table of Contents

About Fifth Third Bank

Just to cover our bases (every bank listed on the blog is FDIC insured), Fifth Third Bank, National Association, is FDIC insured up to $250,000 (FDIC Cert# 6672) and regulated as a National Bank. They were founded in June of 1858 with headquarters in Cincinnati, Ohio at the aptly named Fifth Third Center.

They have over a thousand locations across eleven states and if you live near one, you could get a bonus from them for opening a checking account.

Here’s how:

Fifth Third $200 Checking Account Bonus Summary

- What you get: $200 cash bonus

- Who qualifies: Ohio, Indiana, Kentucky, Michigan, North Carolina, Florida, Georgia, Tennessee, South Carolina, West Virginia, and Illinois

- Where to open: Online or in-branch

- How to get it:

- Open an eligible checking account with your offer code,

- make direct deposits totaling $500 or more within 90 days of account opening,

- Collect $200! (deposited within 10 days of meeting the requirements)

- When does it expire: 6/30/2024

How to get $200 from Fifth Third Bank

Residents of Ohio, Indiana, Kentucky, Michigan, North Carolina, Florida, Georgia, Tennessee, South Carolina, West Virginia, and Illinois can get $200 from Fifth Third Bank, all you need to do is:

- Open an eligible checking account with your offer code,

- make direct deposits totaling $500 or more within 90 days of account opening,

- Collect $200! (deposited within 10 days of meeting the requirements)

The offer code should be automatically applied but just in case, the code is 3RAJLM.

The Fifth Third Essential, Enhanced, Preferred, Free Checking and Free Checking plus Extra Time all qualify for this promotion. Also, you cannot have closed a checking account within the last year.

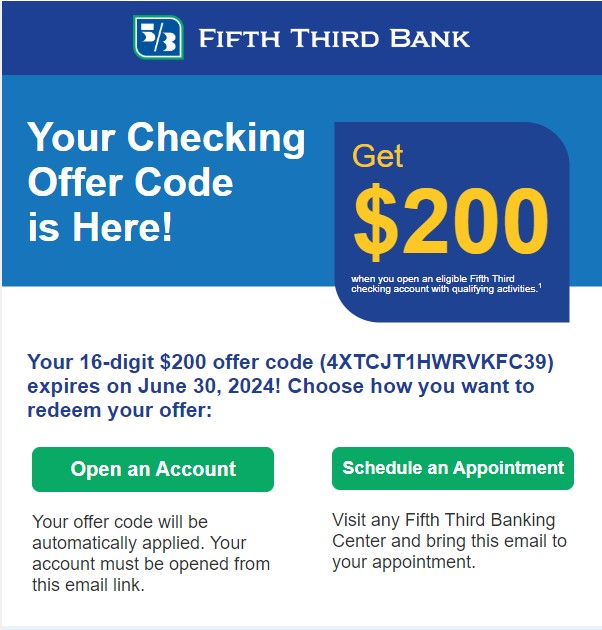

To get your offer code, just go to the promotional page and enter your email address. They will email you your code (it takes a few minutes) and it’ll look something like this:

You can open this account entirely online or you can visit a branch, which is really convenient. If you do it online, your code will be automatically applied. The email explains it all so you don’t have to remember.

You must be a new customer and you can only get one new account-related bonus each calendar year from Fifth Third Bank and you can’t have closed an account within the last 12 months (which is a stricter requirement). You must also be in their service area, which includes Ohio, Indiana, Kentucky, Michigan, North Carolina, Florida, Georgia, Tennessee, South Carolina, West Virginia, and Illinois.

(Offer expired 6/30/2024)

Reader Experiences with the Fifth Third Bank Offer

We’ve had a few readers share their experiences with this offer and they’ve all been positive.

When asked what his easiest or best bonus offer was, one reader said:

That’s easy, the 5/3 Fifth Third checking account bonus. I received 375$ for a direct deposit of at least $500. Which for Fifth Third is about any simple ACH push from another account. I opened the account and transferred the money and within 7-10 days it had posted and I received my bonus as well. That coupled with no early account termination fee meant I had completely completed the bonus and made almost 400 in a week or two. Keep up the good work!

In his case, he was able to trigger the direct deposit requirement with an ACH push from is Key Bank account.

Historic Fifth Third Bank Promotion Codes

As the Fifth Third Bank promotion gets refreshed, the “offer code” changes. This offer code situation is a little tricky because you can open the account online or you can enter your email and go to a branch.

If you go into a branch with that code, the code is long and it’s unique to you. No one else has that code. We don’t keep a record of those.

If you open it online, there is an “offer code” embedded in the URL of the button on the promotion page. That’s the offer code we are sharing below:

- For the promotion period ending 3/31/2022, the offer code was 9WC9MJ.

- For the promotion period ending 3/30/2022, the offer code was TH4PCN.

- For the $250 promotion period ending 7/31/2022, the offer code was CWAF7M.

- For the $350 promotion period ending 9/30/2022, the offer code was GRHRT9.

- For the $375 promotion period ending 9/30/2022, the offer code was C39MJP. (they increased the bonus on June 1st)

- For the $250 promotion period ending 12/31/2022, the offer code was FYP79P.

- For the $225 promotion period ending 6/30/2023, the offer code was WWNRG7.

- For the $150 promotion period ending 9/30/2023, the offer code was 3RRG7Y.

- For the $200 promotion period ending 1/7/2024, the offer code was JAP6LF.

- For the $350 promotion period ending 1/7/2024, the offer code was M9Y7GF.

- For the $350 promotion period ending 6/30/2024, the offer code was 3RAJLM.

Fifth Third Bank Fees

Fifth Third Essential, Enhanced, Preferred, Free Checking, and Free Checking plus Extra Time all qualify for this promotion but they have different fee schedules.

The Fifth Third Momentum Checking is an account that has no monthly service charge, no minimum balance required, and no minimum deposit to open the account. They use different terms, like free checking, in the promotional offering but I suspect the Fifth Third Momentum Checking is likely the most fee-friendly account.

By comparison, Fifth Third Preferred Checking requires a combined balance of $100,000 or you pay $25 per month. The benefit of Fifth Third Preferred Checking is that it earns a tiny smidge of interest, which I don’t see as worth it at all.

Fifth Third Bank Routing Numbers

When you are setting up your account, you may want to know your routing number and Fifth Third Bank is one of those banks with a lot of routing numbers.

| Fifth Third Bank Affiliate Routing Numbers | |

|---|---|

| Region | Routing Number |

| FL-Central Florida | 063109935 |

| FL-North Florida | 063113057 |

| FL-South Florida | 067091719 |

| FL-Tampa, Florida | 063103915 |

| GA-Georgia | 263190812 |

| IL-Chicago | 071923909 |

| IN-Central Indiana | 074908594 |

| IN-Southern Indiana | 086300041 |

| KY-Central Kentucky | 042101190 |

| KY-Northern Kentucky | 042100230 |

| KY-Southwestern Kentucky | 083002342 |

| MI-Eastern Michigan | 072405455 |

| MI-Northern Michigan | 072401404 |

| MI-Western Michigan | 072400052 |

| MO-St. Louis, Missouri | 081019104 |

| NC-North Carolina | 053100737 |

| OH-Cincinnati, Ohio | 042000314 |

| OH-Columbus, Ohio | 044002161 |

| OH-Northeastern Ohio | 041002711 |

| OH-Northwestern Ohio | 041200050 |

| OH-Southern Ohio | 042207735 |

| OH-Western Ohio | 042202196 |

| PA-Western Pennsylvania | 043018868 |

| TN-Tennessee | 064103833 |

How Does Bonus This Compare?

It’s a pretty solid bonus for a reasonable direct deposit requirement so if you qualify, I’d take advantage of it.

The offer was just recently increased, from $200, so if you were waiting for that, now’s a good time to snatch it up!

Here are a few comparable deals you should take a peek at too:

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.