Are you thinking about opening an account at Citizens Bank and wondering if there are any good promotions going on?

You are in luck – Citizens Bank has two offers running right now.

- up to $400 for a checking account but you will need a direct deposit and use their debit card

- up to $500 for a savings account but you will need to deposit at least $5,000 (for $250) or $10,000 (for $500) for five months

As far as promotions go, both are pretty easy. The direct deposit offer is a pretty easy one with a low direct deposit requirement and using a debit card is pretty easy. The non-direct deposit offer has a low minimum to get either the $250 or $500 (many times banks will require at least twice as much in a deposit).

We’ll discuss the deal, then mention locations and other bank information, and follow it up with how this offer compares with other major banks.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Here’s how to get a new account bonus from Citizens Bank:

Table of Contents

- Citizens Bank Consumer Checking Direct Deposit Offer – up to $400

- Citizens Bank Consumer Savings – up to $500

- Citizens Bank Business Checking – up to $500 [EXPIRED]

- Previous Citizens Bank Promotions

- Citizens Cash Back Plus World Mastercard – $300 Cash

- Who is Citizens Bank?

- Find a Citizens Bank Near You

- Citizens Bank ABA Routing Numbers

- How Does This Compare?

Citizens Bank Consumer Checking Direct Deposit Offer – up to $400

This currently active promotion with Citizens Bank is great – get up to $400 when you open a One Deposit Checking from Citizens™ in-branch and satisfy some simple requirements.

The terms of the deal are straightforward:

- receive one or more direct deposits of $500 or more within 60 days and get $300;

- earn $2 for every debit card purchase you make, up to $100, within 60 days

Must be a resident of Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, and Washington D.C..

In terms of requirements, this offer is pretty good. Review our guide on bank account bonuses to see what other gotchas may be lurking.

Learn more about this offer

(This offer expires 6/6/2024)

Do You Qualify for the Checking Bonus?

This offer is available to those who live in the bank’s geographic footprint, which includes Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, and Washington D.C..

You can choose between four different types of accounts – the Student Checking, One Deposit Checking, Citizens Bank Platinum Checking, and Citizens Bank Platinum PlusChecking. The big difference between the four is their fees.

The Student Checking is only available to people under 25 but has no maintenance fee if you are under 25.

The One Deposit Checking Account has no minimum to open an account. There is also no minimum balance requirement ever. So you could open an account with $1 and never add another penny, you won’t be penalized. There is, however, a monthly maintenance fee of $9.99 each statement period. You can avoid this by making one deposit of any amount each statement period. This deposit or transfer can be done through a branch, ATM, online or mobile banking, telephone banking, or through a direct deposit or wire transfer.

The Citizens Bank Platinum Checking account also lets you open an account with any amount – there is no minimum initial deposit amount. There is a $25 monthly maintenance fee that is waived if you maintain a combined monthly balance of $25,000 or more. This includes deposit and investment accounts.

This account also pays a small percentage of interest, which is better than zero but not much better. If you’re getting a Citizens Bank account because of the promotional offer, I would go with the One Deposit Checking account rather than the Platinum Checking.

Finally, the Citizens Bank Platinum Plus Checking account has a $25 fee that is waived if you have a combined monthly balance of $25,000 and either a deposit of at least $5,000 in your primary checking account each period or you maintain an average daily checking balance of $10,000 or more.

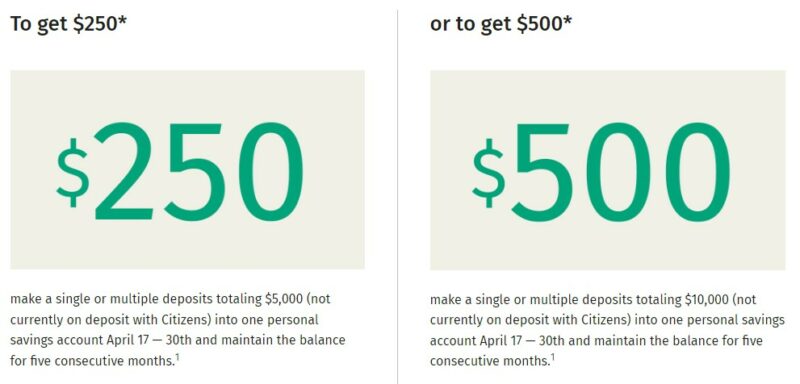

Citizens Bank Consumer Savings – up to $500

Once you do the checking bonus above, you can also give the savings bonus a try too. You can get up to $500 if you open a new savings account and make a deposit. The bonus is based on the deposit:

- To get $250, make a single or multiple deposits totaling $5,000 (not currently on deposit with Citizens) into one personal savings account April 17 — 30th and maintain the balance for five consecutive months.

- To get $500, make a single or multiple deposits totaling $10,000 (not currently on deposit with Citizens) into one personal savings account April 17 — 30th and maintain the balance for five consecutive months.

There are several savings accounts that qualify, including One Deposit Savings and Checking from Citizens, Citizens Quest® Savings and Checking, Citizens Private Client™ Savings and Checking. and Citizens One Deposit Savings and Student Checking.

Learn more about this offer

(This offer expires 4/30/2024)

Citizens Bank Business Checking – up to $500 [EXPIRED]

Citizens Bank has a business checking promotion when you open a new eligible business checking account and complete the qualifying transactions.

This is available on both the Clearly Better Business Checking and Business Advisor Checking accounts but the Clearly Better Business Checking has a lower bonus and no monthly maintenance fee while the Business Advisor Checking account has a higher bonus and a $25 monthly fee.

To get $200, open a Clearly Better Business Checking account with a minimum deposit of $2,000 post to the account by the date stated in the table below then remains on deposit until the date stated in the table below and make five qualifying transactions in the two months stated in the table below.

To get $500, open a Business Advisor Checking Account with a minimum $5,000 post to the account by the date stated in the table below then remains on deposit until the date stated in the table below and make five qualifying transactions in the two months stated in the table below.

| Account opened in month of: | Opening deposit made by: | Opening deposit maintained until: | Five qualifying transactions in the months of: | Bonus will be paid by end of day: |

| January 2023 | February 28, 2023 | April 30, 2023 | March, April | May 31, 2023 |

| February 2023 | March 31, 2023 | May 31, 2023 | April, May | June 30, 2023 |

| March 2023 | April 30, 2023 | June 30, 2023 | May, June | July 31, 2023 |

| April 2023 | May 31, 2023 | July 31, 2023 | June, July | August 31, 2023 |

| May 2023 | June 30, 2023 | August 31, 2023 | July, August | September 30, 2023 |

Learn more about this offer

(This offer expires 5/15/2023)

Previous Citizens Bank Promotions

Citizens Bank will run bank promotions regularly and previously they’d offered up to $600 for a new checking account and new savings account. The previous promotion, which is no longer available, would give you $300 when you opened a new checking account and received a direct deposit of $500 or more within 60 days.

Then, you could get an additional $200 when you opened a new savings account and funded it with a minimum of $15,000 of new funds to the account. You had to maintain that balance for 3 months.

When you satisfied both conditions, you’d get an additional $100. That’s a total of $600.

This offer, though lower, is much easier to achieve because you don’t need to find $15,000 to deposit into the account and leave it there for three months.

Expired Citizens Bank Promotion Codes

As the offers are refreshed every few months, they use a different promotion code for the offer. It’s not publicly displayed but it’s included in the links on the promotion page.

Here are the expired codes for as long as we’ve been tracking them:

- For the period 11/8/21 through 2/17/22 – 61PZC40215385

- For the period 2/18/22 through 4/14/22 – 12KZC92829002

- For the period 4/21/22 through 8/4/22 – 32KSC34672738

Citizens Cash Back Plus World Mastercard – $300 Cash

When you open a Citizens Cash Back Plus World Mastercard by 9/7/2022 then you are eligible for a bonus promotion. Get $300 when you spend just $500 in the first 90 days plus you can earn an additional $100 when you enroll in TSA PreCheck in the first year.

This card has no annual fee plus you even get 1.8% cash back on everything.

Who is Citizens Bank?

There is more than one bank named “Citizens Bank.”

There are quite a few banks with the Citizens in their name. Quite a few are actually named Citizens Bank — such as a Citizens Bank with four locations in Missouri with the FDIC #14488.

The one we’re referencing today is Citizens Bank, National Association (FDIC #57957). It’s a National Bank insured since May 2005 with 1,085 locations across 13 states.

Find a Citizens Bank Near You

Citizens Bank has locations in thirteen states including Connecticut, Delaware, Illinois, Indiana, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, and Vermont.

You can use their branch and ATM locator to find the closest location to you. This offer is available online so you don’t really need to visit a branch to open it.

In fact, it’s only available online.

Citizens Bank ABA Routing Numbers

Citizens Bank has several ABA routing numbers as a result of mergers and acquisitions, so finding your ABA number depends on where you opened your account. You can look it up on the list below:

| State | Routing Number |

|---|---|

| Connecticut | 211170114 |

| Delaware | 031101143 |

| Illinois | 241070417 |

| Indiana | 241070417 |

| Massachusetts | 211070175 |

| Michigan | 241070417 |

| New Hampshire | 011401533 |

| New Jersey | 036076150 |

| New York | 021313103 |

| Ohio | 241070417 |

| Pennsylvania | 036076150 |

| Rhode Island | 011500120 |

| Vermont | 021313103 |

How Does This Compare?

Citizens Bank is a sizable regional bank given all its locations and the bonus is a nice one. Being able to get $300 for a checking account with an easy $500 direct deposit requirement puts it as one of the better ones. Layer on the $200 (it’s really $300 with the $100 bonus for both accounts) for a savings account with a $15,000 new-to-Citizens funds and you have yourself a decent bonus structure.

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.

As you can see, the Citizens Bank offer is pretty good. If you only want a checking account, Wells Fargo will give you more cash but when it comes to the combination of the two, Citizens will be a higher dollar amount.

Hi Jim,

Do you know if you need to deposit the 15K into citizens at the time of opening the account or you can deposit over the month?

I don’t know for certain but my reading of the terms seems to indicate you have to open the account with $15,000 and keep it there for several months.

This is a scam, i didn’t get my money and i did exactly what was noted on the postcard i received in the mail.

What did Citizens Bank say when you asked about it?

Jim,

This is not as easy as it looks.

They asked me to deposit the 15K when I opened it (same date).

And, they asked me to open the checking and the savings at the same time (same date).

It seems that they are eager to find the way not to give me the bonus.

It is not like other banks’ promotion.

They asked the very strict requirements (fine prints).

It is not a plain language.

It did not make any sense to me.

Finally, they did not give me a bonus.

It is so frustrating.

Opened both checking and savings accounts. Had so much trouble with the transfer of funds ($10K and $15K) which Citizens had initiated but never reflected in my accounts. After 3 weeks of trying to find out what happened (including 2 hour visits to the branches) to my money, I decide to make a claim to return amount of bank transfers to my original bank. Citizens finally said they cannot help me after almost a month of going back and forth! Terrible bank!

Personally I think Citizens Bank is a scam. To receive their $600 bonus offer, I opened both accounts on the same day, deposited the full $15,000 into the savings, made a checking deposit and set up direct deposit. A couple days later, I noticed the savings account wasn’t showing online when I logged in. I called them and was told there was some sort of glitch on their end. They would look into it and assured me that the accounts would both show the same opening date. Six months later I was told I didn’t qualify for the $200 savings… Read more »

The Citizens bank offers appear clear and simple but having chased several of these offers and chased them for the bonus payout after far exceeding the requirements they dodge the payout.

I experienced 3 bonus mailers which were denied even after providing documented proof of meeting the full requirement.

Save your time and use the Citibank- Huntington and others to avoid the wasted time. Citizen bonuses are a scam.

Citizens Bank had this promotion back in 2020, where they offered $300 for opening a checking account and $200 for keeping something like $20,000 in their savings account for 3 month, plus another $100 if you did both. I did both and got my bonus. Now that the offer is back, I opened just the checking account, which I had issues seeing in Online Banking due to previously having an account with them. Hopefully the bonus hits my account again this summer.

Keep us updated on what happens but that seems like it was long enough ago that it should be a problem?

Also sounds like this current offer is a vast improvement over 2020!