Have you ever wondered why some banks have “National Association” after their names and others don’t?

If you look at the bottom of the Bank of America website, it says, “Bank of America, N.A.”

At the bottom of Discover Bank’s website, it just says, “Discover Bank, Member FDIC.”

I was doing research when I noticed something funny – there is an M&T Bank (FDIC #588) and an M&T Bank, National Association (FDIC #34069). M&T Bank, National Association was actively insured since October 1995, but later changed its name to Wilmington Trust, National Association.

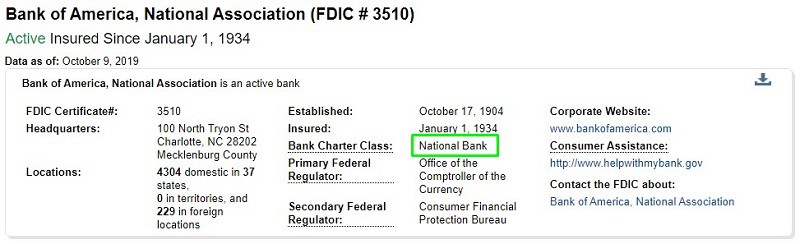

When you dig in further, Wilmington Trust is a National Bank. Its primary federal regulator is the “Office of the Comptroller of the Currency” and its secondary federal regulator is the “Consumer Financial Protection Bureau.”

M&T Bank, without the National Association, is a member of the “Federal Reserve System.” Its primary federal regulator is the “Federal Reserve Board” and its secondary federal regulator is the “Consumer Financial Protection Bureau.”

They are different types of banks!

Table of Contents

What is a Bank?

When it comes to banking, you can’t just rent some office space, collect deposits, offer loans, and call yourself a bank. You have to get a bank charter which authorizes you to commence doing business as a bank. You can only get these charters from a federal or state government.

If you want to start a bank, the Fed has a handy little guide that explains what you need to do. Essentially, you must file a ton of paperwork and get issued a charter. After that, you must get deposit insurance from the Federal Deposit Insurance Corporation (FDIC).

The type of bank depends on who issues you the charter!

What are the Different Bank Types?

When we talk about the different types of banks, we’re really referring to the “Bank Charter Class.”

National Banks

National Banks are “commercial banks that are chartered by the federal government.” They are required to become members of the Federal Reserve System. The Comptroller of the Currency of the Treasury charters the bank, then it becomes a member bank of the Federal Reserve. These banks help facilitate the work of the Federal Reserve such as treasury bond auctions.

These banks are the ones that have “National” in their name or put N.A., which stands for National Association, after their names. The National Banking Acts of 1863 and 1864 established national banks.

State Member Bank

State Member Banks are commercial banks that are similar to the National banks but adhere to state regulations, rather than national guidelines. They are still required to follow Fed regulations, such as reserve requirements, they just aren’t members. State member banks can join the Federal Reserve System but are not required to (and this doesn’t affect FDIC insurance). They are still regulated by the Federal Reserve.

Some of these banks are not members of the Federal Reserve; they are known as “State Nonmember Banks.”

Federal Savings Association

Federal Savings Associations, also called federal thrifts or federal savings banks, are banks chartered by the Office of Thrift Supervision (OTS). The OTS was under the Department of the Treasury and it was responsible for savings banks and savings and loan associations. After the 2008 financial crisis, the OTS was merged into other organizations.

The relevant portions that manage Federal Savings Associations are the Office of the Comptroller of the Currency. When Federal Savings Associations first started, they were restricted to taking deposits and making residential mortgage loans.

Just as you have Federal Savings Associations, you can also have State Savings Associations as well.

Credit Unions

Credit unions are not technically banks. There are a lot of differences between credit unions and banks but from an organizational structure, credit unions are more of a financial cooperative than a profit-seeking financial institution.

They are not FDIC insured but covered by the National Credit Union Administration (NCUA) for up to $250,000. The limits and terms are similar, it’s just a different entity.

Does It Matter?

For most practical purposes, no. All banks are regulated entities and no charter is inherently better than the other.

The FDIC keeps a list of failed banks and of the last twenty-five banks, there were:

- National Banks – 3

- Savings Association – 3

- Member of the Federal Reserve – 3

- Non-member of the Federal Reserve – 16

Larger banks tend to be safer and less likely to fail than smaller banks, but they’re all covered by FDIC insurance. When a bank fails, even one as large as Washington Mutual Bank (with assets of over $300 billion), they close on a Friday and re-open under a new name on Monday.