Teachers Federal Credit Union was my first bank account (OK, technically it’s a credit union).

I grew up in Stony Brook on Long Island and my mom worked for the school district, so as wise financially savvy individuals we opted for our local credit union. Teachers Federal Credit Union had a branch near our home and I remember going in to open the account.

It took maybe half an hour and I left with a little green piece of paper that had my name, account number, and the bank’s routing number. I remember thinking that it was odd that I had a “share draft account” and not a “checking account,” but that’s just credit union nomenclature.

Fast forward several decades (👀!) and I get to write about how they have a new checking account promotion – and a pretty sizable one at that.

Teachers Federal Credit Union is NCUA insured (NCUA# 8116) so your money is protected there, as it is in every insured credit union or bank (via FDIC). With that out of the way, here are the details of their promotion:

Editor’s Note: As of October 1st, 2022, Teachers Federal Credit Union is no longer offering this new account bonus. For other bank bonuses, check out our post on the best bank bonuses and promotions or click here to sign up for our email newsletter and get notified of new bank promotions.

Table of Contents

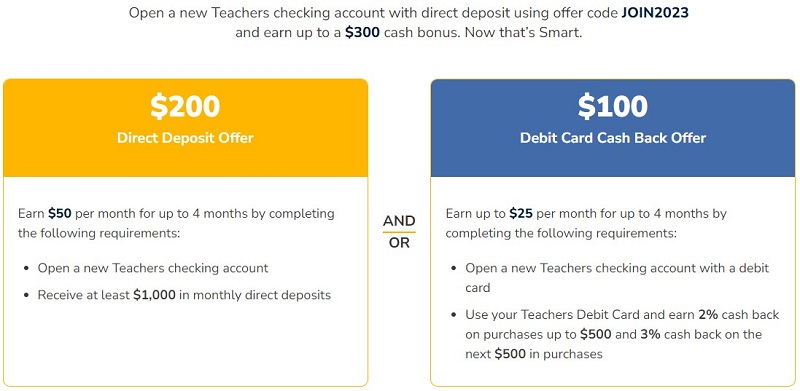

How to get $300 from Teachers Federal Credit Union

The terms of the offer are pretty easy:

- Open a new Teachers Federal Credit Union checking account and have direct deposits totaling at least $1,000 within 60 days – get $50 per month for up to 4 months

- Open a new account with a debit card – get $25 per month for up to 4 months

What’s nice about this offer is that you can do one or the other or both – sometimes banks will require you to get the direct deposit offer before you can get the debit spending one. In this case, you can pick if you so choose.

Lastly, you have to enroll in online banking and eStatements.

Promotion code is JOIN2023.

(Offer expiration is not shown but it’s no longer available)

They have two checking accounts that qualify – Smart Checking and Share Draft Checking.

Smart Checking

The Smart Checking offers a higher APY but you have to meet one of the three following qualifications to get the higher APY:

- Average monthly balance of $5,000 in the Smart Checking account

- $20,000 in combined end of month deposit balances

- Establish direct deposits of $500+ and complete 10 debit card purchases

There is no penalty or fee if you don’t meet these requirements, you just don’t get the higher APY.

Share Draft Checking

Share Draft Checking is their free checking – no fees, no minimum balance, no opening deposit, etc.

What are the Credit Union Qualifications?

If you open this account online, it’s available nationwide. If you want to do it locally, they only have 32 locations on Long Island in New York. I was surprised to see them offer a bonus in part because in my mind, it’s a small credit union!

But, if you open it online, anyone can qualify.

How Does This Bank Offer Compare?

This offer stacks of pretty favorably and considering it’s a nationwide offer, pretty nice. The $300 for opening an account with a direct deposit of $2,500 in 60 days is competitive. The accounts also has no fees and no minimum, a nice bonus, and if you meet the qualifications for Smart Checking, you even get a competitive APY.

The direct spend offer of $500 in purchases to get an extra $100 is a nice bonus, ups everything to $400 for your hard work.

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.