Pentagon Federal (PenFed) Credit Union is one of the largest federal credit unions in the nation and they were founded in 1935 and now boast nearly 3 million members across the world. (in assets, they are behind Navy Federal Credit Union and State Employees’ Credit Union)

Before we get to the bonus, you may be wondering if you’re eligible to join PenFed Credit Union – the answer is yes (membership requirements were dropped in 2018). You are not required to be a member of the military, you can open an account as long as you are an adult age 18 and older and have at least $5 to deposit.

If you’d like to earn a bonus for opening an account, read on for the details:

Table of Contents

PenFed Premium Online Savings Bonus – up to $750 [EXPIRED]

🔴 This may be a targeted offer as the terms and conditions state: “This exclusive Bonus Offer is only available for the original recipient and cannot be shared or made eligible beyond the original recipient.”

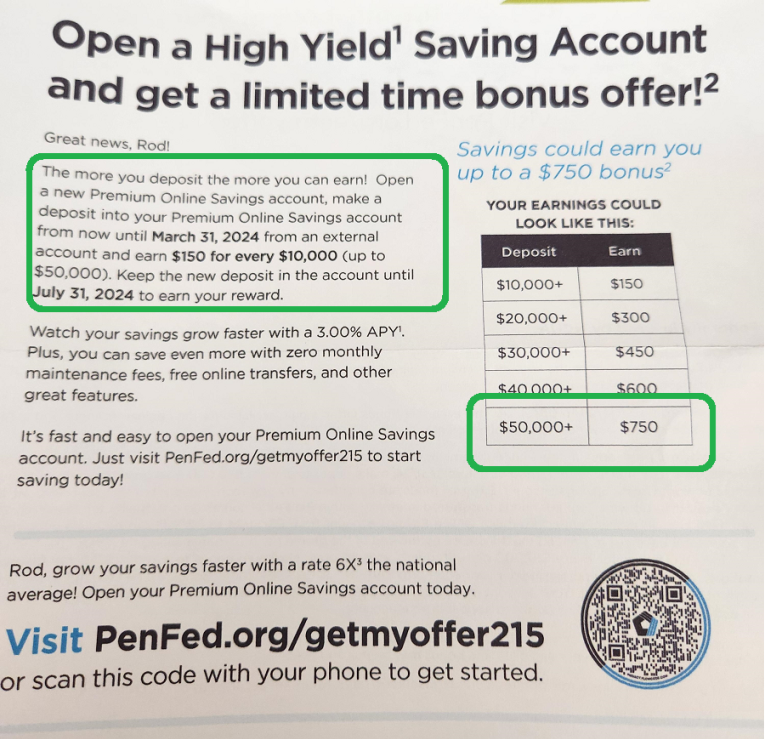

PenFed Credit Union is offering a bonus to new customers who open a new PenFed Premium Online Savings and deposit at least $10,000 or more into the account by 3/31/2024.

Then, the amount of the bonus is based on the amount of new money you deposit into your account before 7/31/2024. New money is defined as funds new to PenFed.

You get $150 for every $10,000 up to $50,000:

| Deposit Amount | Bonus Amount |

|---|---|

| $10,000 – $19,999 | $150 |

| $20,000 – $29,999 | $300 |

| $30,000 – $39,999 | $450 |

| $40,000 – $49,999 | $600 |

| $50,000 or more | $750 |

Then, keep the cash in the account until around 9/30/2024 (60 days) to get your bonus.

(Offer expires 3/31/2024)

How does this offer compare?

PenFed Credit Union consistently gets high marks from his customers and is well-regarded in the industry. Their products stack up against any commercial bank so that’s a strong positive signal.

As for the bonus, the bonus schedule is very strong but the only knock is that the APY on the account is modest – just 3.00% APY as of this writing. Your cash will sit in the account until April, or approximately 5-6 months, and earn 200 basis points less than the prevailing rates for a high yield savings account.

Doing simple math (so this will not be exactly correct but directionally so), if you make 5.30% APY on $10,000 for five months, it’s approximately $221 in interest. With PenFed, you make 3% for 5 months or approximately $125 plus you get the $150 bonus – total of $275.

You do make more with PenFed but you will have to decide if the dollar amount is worth the effort (which will largely be based on how much cash you have to deposit).

Here are some competing offers:

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.