There are many investing apps to choose from to build your portfolio. Each online broker has its unique features that appeal to a specific investment strategy.

Tornado is an investing app that provides a different experience for researching stocks. You can get investing ideas from professional investors without paying a pricey management fee. Tornado’s community-centered approach also offers members the ability to exchange ideas and discuss Pros and Cons of various stocks.

Sound good so far? This Tornado review will help you decide if it’s time to switch brokers as you can improve your investing skills.

Table of Contents

| Brokerage | Bonus Promotion | Link |

|---|---|---|

| 🏆 up to $5,000 | Learn more | |

| up to 12 free stocks from the Brokerage+ up to $3,000 from Cash Management | Learn more |

| up to 7 Fractional Shares ($35 value) | Learn more |

| free stock (valued $5 - $200) | Learn more |

| Up to $500 cash | Learn more |

| up to $700 | Learn more |

What is Tornado?

Tornado is an investing platform founded in 2015 and is available online or on Android and iOS devices. You can invest in individual stocks and ETFs that trade on the US stock exchanges.

On July 22nd, 2021, Nvstr changed their name to Tornado, with a new look and feel and renewed focus on financial wellness and education.

So, what makes Tornado different from your run-of-the-mill online broker?

Tornado founders Bernard George and Patrick Aber both left the hedge fund industry with the mission to help everyone become a more confident investor through personalized content, community insights, and investing education.

With most online brokers, you (the investor) must decide by yourself what to invest in – or use a fully-automated robo-advisor. The lack of guidance makes it challenging to invest by yourself.

But with Tornado, you can manage your own portfolio and Tornado helps by providing customized content and information about stocks and ETFs to buy and sell to keep a balanced portfolio. You’ll discover personalized content tailored to your experience level and community insights that inspire continued learning.

- Earn up to $50 to invest when you participate in Learn & Earn

- One-click portfolio optimization (based on independent, Nobel Prize-winning research)

- Ask professional investors about a specific stock or ETF

- Weighs pros and cons for stock tickers

- See what stocks other Tornado members are investing in

- Stay updated on stock portfolios of famous investors

- Simulate trades

Up to $1,000 Brokerage Promotion

Opening an Tornado brokerage account can be an easy way to earn a funding bonus of up to $1,000. By funding your account and placing a trade within the first month, you get a random cash bonus worth between $10 and $1,000.

Account Options

You can open a taxable individual brokerage account when you’re a US resident at least 18 years old.

Joint brokerage accounts and retirement accounts are not available at this time.

Having a $3,000 trading account balance lets you buy multiple portfolio optimizations with one click.

Fees

A Tornado membership account costs $7.99 per month and you get 40 free trades each month. Each excess trade costs $4.50 to buy or sell stocks and ETFs, and you also pay this fee if you opt out of the membership. You can pay the monthly subscription directly from your linked checking account, savings account, directly from your Tornado account, or with a credit card or debit card.

There are no extra charges to use the other Tornado features, such as asking a professional investor for their insight.

Some of the less-common fees you might encounter include:

- Paper trade confirm: $2

- Paper statement: $5

- Tax statement: $5

- Margin sell out: $25

- Short forced buy in: $25

If you’re not ready to fund your live trading account, Tornado offers a simulated trading account. You get access to most of the platform features to build a sample portfolio.

Investment Options

You can buy or sell individual US stocks, ETFs, and ADRs as long as they are listed on a major exchange.

While you can’t invest in some foreign companies, including commodity producers or Nintendo (NTDOY), you can buy most tickers that trade on the Nasdaq and New York Stock Exchange.

It’s not possible to trade put or call options, but you can own fractional shares of many stocks for as little as $5.

The lack of complex investment options will deter short-term and options traders investors from using Tornado, as the platform was designed with longer term stock and ETF investing in mind.

Key Features

Tornado can be a good fit for both new and experienced investors. offers several engaging features designed to help investors continue improving their skills and make more informed decisions.

Learn and Earn

Tornado offers a Learn and Earn program which serves up educational content aligned with your skill level. You can earn up to $50 to invest when you complete a series of investing lessons. Earning your $50 to invest is an easy way to offset some of the cost of your membership, while sharpening your investing knowledge at the same time.

Learn and Earn highlights Tornado’s commitment to making financial education accessible to everyone, and sets the platform apart from many of the free brokerages on the market.

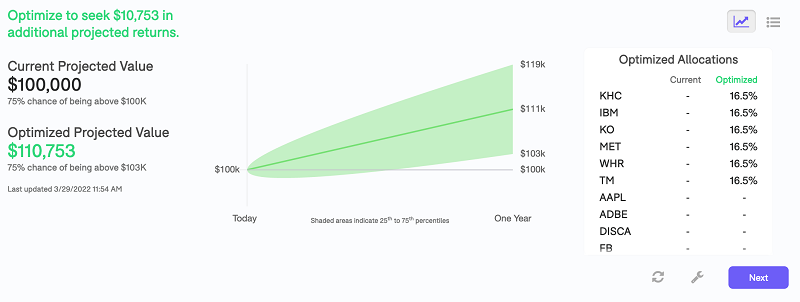

One-Click Portfolio Optimization

The one-click portfolio optimization tool is one of Tornado’s most potent tools. This feature gives Tornado the rigor of a robo-advisor but for individual stocks and ETFs. Tornado is based on the same Nobel Prize-winning Modern Portfolio Theory methodology as the robo-advisors to generate a model portfolio. Except most robo-advisors only invest in index ETFs.

Upon joining, Tornado asks a series of questions to determine your expected annual return and investment preferences. From there, Tornado helps you find stocks that can diversify your portfolio and match your risk tolerance. If you like the model portfolio, you can use Tornado to buy shares of your chosen stocks and funds with one click.

Tornado continually monitors your portfolio performance and can help you decide when it makes sense to buy additional shares or sell shares to rebalance your portfolio. You are fully in control – Tornado does not place trades for you.

Of course, you can adjust your investing goals and open positions of stocks that Tornado doesn’t include in the Optimizer anytime.

Experienced investors can use the advanced investment objectives to fine-tune the portfolio. You can fine tune the algorithm, for example to::

- Prioritize stocks you assign a high conviction rating to

- Buy stocks and ETFs with a minimum dividend income

- Set a maximum portfolio allocation for stocks and ETFs

- Reduce projected portfolio volatility

While the optimization tool isn’t foolproof, it can help you avoid risky stocks or having an imbalanced portfolio. Tornado doesn’t provide personal investment advice, yet this tool can be cheaper than hiring a personal advisor.

This feature is available for all Tornado accounts. However, your brokerage account balance must be at least $3,000 to enable one-click trading.

Ask a Community Thought Leader

Another unique feature to Tornado is asking a Community Thought Leader (“CTL”) their opinion on a specific stock or ETF. Professional Wall Street investors can apply to be a CTL and Tornado pays them to answer your personalized questions.

A direct line to professional investors can be worth the $7.99 monthly cost to use Tornado.

Investment Ideas

Some investing apps, like Robinhood, let you see what other users are buying. Other brokers provide thematic research articles on popular investing topics.

Tornado offers several tools to find new investing ideas as you can connect with other users and see which stocks the most successful professional investors hold.

Investing Ideas Watch List

As you will most likely find more ideas than you can invest in, you can add them to your investing ideas watch list.

From your ideas list, you can rate the stock as a buy or sell. It’s also possible to add a conviction rating, investment horizon, pros and cons, and a reason for adding the symbol to your ideas list.

Exclude specific tickers from the optimization tool if you don’t want to invest in them but only want to monitor their performance.

Keep in mind that anyone you connect with on the Tornado social media platform can see your list, unless you set your account to the “Private” setting.

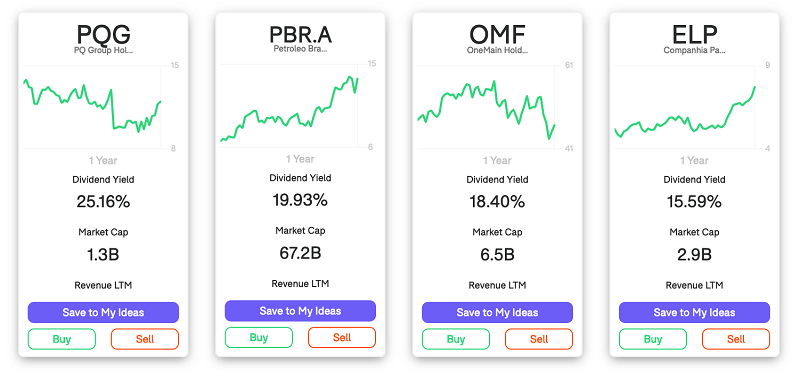

Stock Screener

Tornado has a built-in stock screener that lists stocks and ETFs for certain traits. Some examples include:

- Stocks with a low correlation to your current holdings

- Stocks that investors similar to you are buying

- High dividend yields

- Low price-to-book value

Within these prebuilt screens, you can add additional filters. It’s also possible to make a custom screen. The screener tool is much more advanced than that of other online brokers in terms of capability, especially the filters for low correlation to your current portfolio, and for stocks that investors like you are buying, which is driven by sophisticated machine learning technology not found on other platforms.

If you like a stock pick, you can add the ticker to your Investing Ideas watch list. You can also buy or sell the stock or ETF directly from your screener.

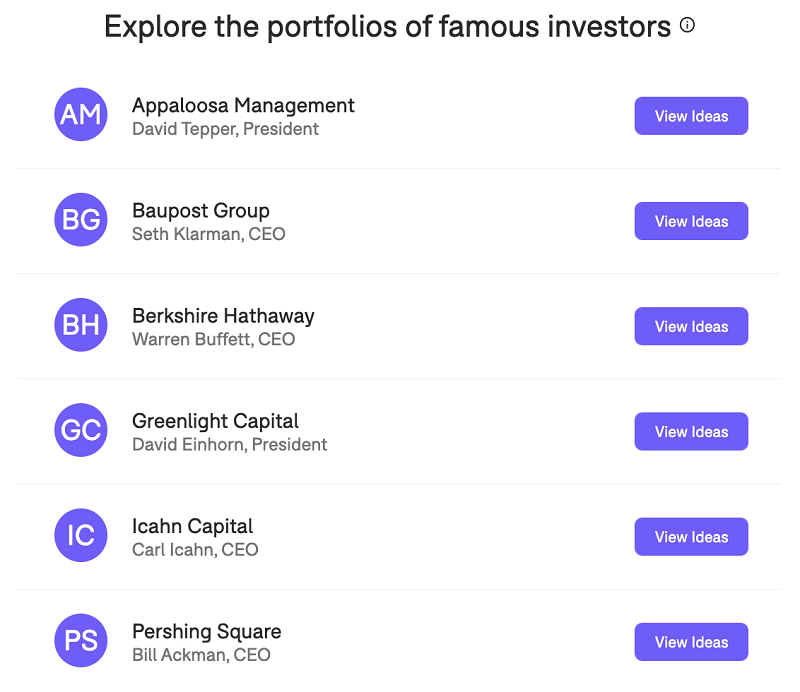

Thought Leaders

Tornado compiles the current publicly-known portfolios of some of the most famous hedge funds and asset managers. Here is the current list of Thought Leader investment firms:

- Appaloosa Management (Jake Tepper)

- Baupost Group (Seth Klerman)

- Berkshire Hathaway (Warren Buffett)

- Greenlight Capital (David Einhorn)

- Ichan Capital (Carl Icahn)

- Pershing Square (Bill Ackman)

You will only see the long-term holdings from each portfolio and not any stocks an investor is shorting. It’s possible to add stocks you like to your ideas list. Clicking on the ticker symbol lets you take an in-depth look at the stock’s recent news, add your personal thoughts, and see the basic stock fundamentals.

Connect with Other Tornado Users

Tornado lets you connect with other users to share investment ideas effortlessly.

It’s possible to see the portfolios of your connections. You can see their portfolio allocation but not the number of shares or portfolio value.

Like a social media network, you can send messages to your connections and ask why they hold a specific stock. As your connections buy or sell shares, you can receive real-time notifications.

While this feature can give you investing ideas, avoid the herd mentality effect, and perform your due diligence before placing a trade.

Trading Simulator

A free simulated trading account can be useful for improving your investing skills and testing investing ideas. The trading simulator lets you use the one-click portfolio optimizer and adjust your investment strategy – and this is 100% free.

Research Tools

Tornado offers some research tools that are better than many free investing apps. But these community-focused tools are not as extensive as a full-service broker like Ally Invest or Fidelity.

For example, Tornado offers minimal charting tools for technical analysis. You will see a basic stock price chart and related news articles. This is because Tornado is built with the long term stock investor in mind, therefore technical analysis is not a prominent feature.

Pros and Cons

Probably the best research tool for most investors is the Pros and Cons feature. For each stock and ETF symbol, you will see a collection of 250-character pro or con opinions.

Any Tornado user can add a tidbit and you can agree or disagree.

These pros and cons can be an easy way to understand how a particular stock can make money and its potential risks. Even if you’re quite familiar with a stock, these community insights can present arguments that you might overlook, and help members connect and exchange ideas in a productive way.

S&P Capital IQ

Tornado uses S&P Capital IQ to provide fundamental data for stocks and ETFs. Professional investors use the same data source to compare potential investments. While you won’t get full access to the Capital IQ research reports, you can compare these metrics:

- Price/Earnings

- Price/Sales

- Projected revenue growth

- Dividend yield

- Market cap

- Net Debt

- Forward EPS (current quarter)

- Forward EPS (current year)

- Revenue LTM

- Price/Tangible Book ratio

- Price/Sales ratio

- Total Debt/EBITDA

- and more…

These metrics can vary widely when using a free research tool. Seeing the same numbers as the pros lets you make educated investing decisions.

Tornado Mobile App

The Tornado mobile app is available for Android and Apple devices. It has the same research and trading features as the Tornado web platform.

Positives and Negatives

Pros

- Earn up to $50 to invest via Learn and Earn program

- One-click portfolio optimization for individual stocks and ETFs

- Can ask stock-specific questions to professional investors

- Connect with other investors to exchange investing ideas

- 40 free trades each month

- $5 account minimum

Cons

- $7.99 monthly subscription fee

- Lacks technical analysis tools for short-term traders

- Cannot buy or sell non-US stocks or mutual funds

- No fractional investing

Who Should Use Tornado?

As you can see in this Tornado review, this platform is best for investors that want to invest in individual stocks and ETFs, connect and engage with other investors, and continue their financial education along the way. The portfolio optimization tool makes it easy to build a diversified portfolio.From there, you can add stock picks from stock picking newsletters and your Tornado social network connections.

Alternatives to Tornado

You should avoid Tornado if you prefer to invest in index funds only. Short-term traders relying on powerful technical analysis tools and low trade fees will find Tornado constraining. You might consider these alternative brokers instead that can cater to your investment strategy.

Tip: Check out the best brokerage account promotions and bonuses worth up to $3,500

Webull

Webull is a popular free investing app for buying stocks and ETFs. You can also trade options and short-term traders can benefit from the technical analysis tools. New members can also get three free stocks worth up to $1,600.

Read our Webull review and learn about their free stock offer.

M1 Finance

You can buy fractional shares of stocks and ETFs with M1 Finance without trade fees. For instance, M1 Finance offers premade portfolios that copy famous investors lists and other investing themes.

Read our M1 Finance review to learn about this free robo-advisor.

Betterment

Index fund investors that want a fully-automated robo-advisor should consider Betterment. While you won’t invest in individual stocks, you can invest in cost-efficient index funds. These funds give you instant diversification to US and global assets with a $0 account minimum.

Read our Betterment review to hear more about the oldest robo-advisor.

Summary

Tornado makes it easy to start investing in individual stocks and ETFs with the one-click portfolio optimization tool. Being able to ask investing questions to professional investors, connect with the community, and continue sharpening your skills with Learn and Earn are compelling reasons to use Tornado.