Fidelity Investments is one of the biggest investment companies in the world in terms of the number of customers and also total assets under management.

For the longest time, they’ve been competing head-to-head with The Vanguard Group in the mutual fund space. Personally, I’ve been a Vanguard customer for decades but I’ve heard plenty of great things about Fidelity. If I were picking today, either would make a good choice.

With trillions under management, Fidelity mutual funds and ETFs have some of the lowest expense ratios. Even though they are extremely popular, like many companies, they always want more customers. So they will offer different promotions throughout the year to entice people to switch their accounts or simply open a new one with them.

On this page, we will share the best Fidelity Investments promotions they have available.

One note, Fidelity Investments frequently changes their promotions so always check back to see which ones are available right now.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Table of Contents

| Brokerage | Bonus Promotion | Link |

|---|---|---|

| 🏆 up to $5,000 | Learn more | |

| up to 12 free stocks from the Brokerage+ up to $3,000 from Cash Management | Learn more |

| up to 7 Fractional Shares ($35 value) | Learn more |

| free stock (valued $5 - $200) | Learn more |

| Up to $500 cash | Learn more |

| up to $700 | Learn more |

Fidelity Bloom – 10% Savings Match

Fidelity Bloom is Fidelity’s fintech app that aims to help you build better financial habits through cash rewards, savings, and a little cash bonus.

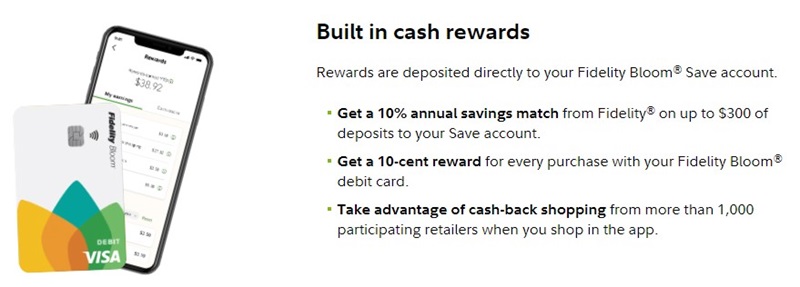

You have to scroll down the product page to see the bonus, as it’s listed under “Built in cash rewards.” Here’s a screenshot:

There is an annual savings match program where you get a 10% match on the first $300 in deposits into the account. That’s a maximum of $30 each year.

You also can get a 10-cent rewards into your Fidelity Bloom Save account every time you use the debit card plus up to 25% cash back when you shop in-app.

Plynk Invest – $10

Plynk Invest is an investment app that seeks to compete with a lot of the no-commission trades app like Robinhood. It’s meant for beginner investors who are still learning and there are creative ways to contribute to your account, including exchanging old gift cards.

When you convert gift cards, there’s a small fee but it’s better than keeping the card unused in your desk!

For a limited time, there is only the one sign up bonus:

- $10 sign up bonus – sign up and get $10

$75 deposit bonus – they double your deposit, minimum of $25 and up to $75(this has been removed)

The basic app is free, there is no account minimums, but some features may require a $2 monthly fee in the future.

Fidelity Cash Management – $100 Cash [EXPIRED]

Fidelity had a limited time promotion where you can get $100 for opening a Fidelity Cash Management Account from within Goal Booster. They currently state this is now “Under Construction” but we will update this when that changes.

All you have to do is deposit $50 or more within 45 days and you’ll get the $100.

Fidelity Youth Account – $50 [EXPIRED]

Open a Fidelity Youth Account, designed for teens 13 through 17, and you get a $50 reward. The parent (or guardian) must have a Fidelity account first but the teen just needs to download the Fidelity mobile App, activate a new account, and they get the $50 bonus. No other requirements to get the bonus.

The account has no minimum and no account fees and the bonus is limited to one per customer.

Fidelity Starter Pack- $100 Cash [EXPIRED]

This $100 cash offer from Fidelity Starter Pack has expired, we are keeping this section here in case they bring it back.

Fidelity has a limited time promotion where you can get $100 for opening a Fidelity Account, Cash Management Account, Roth or Traditional IRA. You can open what they call a “Starter Pack,” which is The Fidelity Account® + Fidelity® Cash Management Account or you can just open an individual account – which includes those two plus a Roth IRA or a Traditional IRA.

All you have to do is deposit $50 or more within 15 days and you’ll get the $150 within 25 days of opening your account.

The promo code is FIDELITY100 and the offer has no published expiration date. It is limited to one offer per customer and US residents.

You must keep the $100 cash reward in the account for a minimum of 90 days.

👉 Learn how to get $100 cash from Fidelity Starter Pack

Fidelity Brokerage – Up to $2,500 Cash Bonus [EXPIRED]

Fidelity Investments once offered a cash bonus if you opened an account and transferred new funds. The amount of the bonus was based on the amount you deposited:

- Deposit $50,000 – $99,999 and get $200

- Deposit $100,000 – $249,999 and get $300

- Deposit $250,000 – $499,999 and get $600

- Deposit $500,000 – $999,999 and get $1,200

- Deposit $1,000,000 or more and get $2,500

While this offer is no longer available, it’s comparable to Ally Invest’s new account offer which has this schedule:

| Deposit or Transfer Amount | Your Bonus |

|---|---|

| $10,000 – $24,999 | $100 |

| $25,000 – $99,999 | $250 |

| $100,000 – $249,999 | $300 |

| $250,000 – $499,999 | $600 |

| $500,000 – $999,999 | $1,200 |

| $1,000,000 – $1,999,999 | $2,000 |

| $2,000,000 or more | $3,000 |

Ally Invest offers more for higher balances and they offer cash for lower balances – something Fidelity didn’t. If this offer comes back, I’d take advantage of it if Fidelity is the brokerage you want to work with because Vanguard doesn’t offer any new account bonuses.

Hi Jim,

We are retired this year and have been researching brokerages for retirement(living in not prep).

We did not know bonuses even existed as we were looking deeply into products they carry specific to our needs. We just missed this Fidelity offer and it hurts to see. We are not in a rush but have decided on Fidelity just yesterday.

Do you know if there has been traditional months they offer such generous bonus promotions? Your reply would really be appreciated and a great help in our next step.

Mahalo

Liz

Hi Liz – They change up their offers from time to time but it doesn’t seem to match any kind of season or monthly schedule.