J.P. Morgan Self-Directed Investing

Product Name: J.P. Morgan Self-Directed Investing

Product Description: J.P. Morgan Self-Directed Investing offers commission-free brokerage accounts with minimum investments of just $1.

Summary

J.P. Morgan Self-Directed Investing offers trading in individual stocks, ETFs, mutual funds, and options. Trades are commission-free, and you can begin investing with just $1 — although there are no fractional shares, so you’ll need more cash to get started than with some other brokers.

Overall

Pros

- Commission-free trading of stocks and ETFs

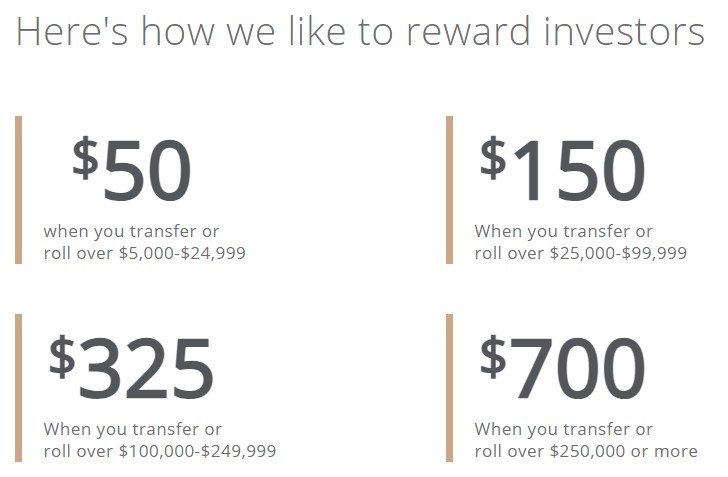

- Sign-up bonus of up to $700

- No account minimum

- Commission-free trading of mutual funds

- Excellent choice for existing Chase Bank customers

Cons

- Not as many investment choices as other brokers

- No fractional shares offered

- More limited customer service hours than other large brokers

- No self-employed retirement plans offered

- No robo-advisor option (J.P. Morgan Automated Investing is being discontinued as of mid-2024)

If you are a Chase Bank customer or plan to be one soon, you may be interested to know that you can invest with the same company where you bank.

But even if you’re not an existing Chase customer, J.P. Morgan Self-Directed Investing is offered to everyone and can be an excellent choice if you’re looking to invest in mutual funds, as it’s one of only a handful of brokers offering commission-free trades in mutual funds.

At a Glance

- Offers commission-free trading of stocks and ETFs.

- Open an account with no minimum deposit required.

- Commission-free trading of mutual funds.

- Opportunity to invest with the largest bank in America.

- Local branches in 48 states.

Who Should Use J.P. Morgan Self-Directed Investing?

J.P. Morgan Self-Directed Investing is available to the general investing public, but it may be of special interest to current Chase Bank customers. Not only will it enable you to engage in self-directed investing at the same institution where you bank, but it will provide a seamless way to transfer funds between accounts.

You may also be interested in J.P. Morgan Self-Directed Investing if you favor investing in mutual funds. The platform offers commission-free trades in nearly 3,000 mutual funds — a serious advantage if you regularly trade these.

J.P. Morgan Self-Directed Investing is probably not a good choice for new and small investors. The platform does not accommodate trading in fractional shares, so you’ll need a larger amount of cash to invest — even though no minimum initial investment deposit is required.

J.P. Morgan Self-Directed Investing Alternatives

| |||

| Fees | $0 commissions for online U.S.-listed stock, ETF, mutual fund, and options trades | $0 commissions for stocks, ETFs, and options | $0 commissions for U.S.-listed and OTC stock, ETF, options and crypto trades |

| Banking services | Savings and checking accounts | None | Cash card |

| Fractional shares | No | Yes, $5 minimum | Yes, $1 minimum |

| Learn more | Learn more | Learn more |

Table of Contents

- At a Glance

- Who Should Use J.P. Morgan Self-Directed Investing?

- J.P. Morgan Self-Directed Investing Alternatives

- What Is J.P. Morgan Self-Directed Investing?

- Investments Offered

- Pricing

- Sign-Up Bonus – up to $700

- Other Features

- J.P. Morgan Self-Directed Investing vs. E*TRADE

- J.P. Morgan Self-Directed Investing vs. Webull

- J.P. Morgan Self-Directed Investing vs. Robinhood

- FAQs

- Summary

What Is J.P. Morgan Self-Directed Investing?

J.P. Morgan Self-Directed Investing offers taxable investment brokerage accounts, traditional IRAs, and Roth IRAs. Each account can be opened with no money, and you can begin trading with his little as $1.

However, J.P. Morgan Self-Directed Investing does not offer several other account types commonly provided by its competitors. These include self-employed retirement accounts, such as SEP and SIMPLE IRAs and Solo 401(k) plans, as well as 529 college savings plans and trust accounts.

Investments Offered

J.P. Morgan Self-Directed Investing offers trading in individual stocks, exchange-traded funds (ETFs), mutual funds, and options.

Fixed-income investments available include:

- U.S. Treasury bills, notes, and bonds, both at auction and on secondary markets.

- Secondary market trading of corporate bonds, municipal bonds, and government agency bonds.

- Brokered certificates of deposit (CDs), both new issue and secondary market trades.

No fractional shares. J.P. Morgan Self-Directed Investing does not offer fractional shares. That’s when you purchase slices of shares (rather than full shares). This may limit the value of this platform for newer and smaller investors.

Investment Research

Investment research is provided by J.P. Morgan Research, as well as by Ideas & Insights, both proprietary services offered by J.P. Morgan Chase. They are designed to help you make informed decisions with strategic analysis and investment advice.

J.P. Morgan Research provides a detailed analysis of more than 1,200 publicly traded U.S. companies.

Pricing

J.P. Morgan Self-Directed Investing provides the following pricing structure for investment trading:

- Stocks and ETFs: $0 per trade, subject to a transaction fee of between $0.01 and $0.03 per $1,000 in principal

- Options: $0 per trade + $0.65 per-contract fee, subject to a transaction fee of between $0.01 and $0.03 per $1,000 in principal

- Mutual funds: $0 per trade

Call-in trades require a fee of $25 per trade for stocks, ETFs, and options, and $20 for mutual funds.

For fixed-income securities, the commission structure is as follows:

- U.S. Treasury bills, notes, and bonds: $0 per trade (includes both auctions and secondary market purchases)

- Newly issued brokered CDs: $0 per trade

- Corporate, municipal, and government agency bonds, and brokered CDs purchased on the secondary market: $10 per trade + $1 per bond over 10 bonds ($250 maximum)

Call-in trades of corporate bonds, municipal bonds, government agency bonds, and brokered CDs purchased on the secondary market require a fee of $30 per trade + $1 per bond over 10 bonds ($270 maximum).

There is no fee premium for call-in trades of U.S. Treasury bills, notes, and bonds, or of newly issued brokered CDs. Margin interest rates are as follows (as of April 25, 2024):

- $0 to $25,000: Prime + 4.75%

- $25,001 to $50,000: Prime + 4.50%

- $50,001 to $100,000: Prime + 4.00%

- $100,001 to $500,000: Prime + 3.75%

- $500,001 to $1,000,000: Prime + 3.00%

- $1,000,001 to $3,000,000: Prime + 2.50%

- $3,000,001 to $10,000,000: SOFR + 2.35%

- $10,000,001 and above: SOFR + 1.85%

The most recent prime rate published by Chase Bank is 8.50%. So if you are making a margin trade under $25,000, the margin rate will be 13.25% (4.75% + 8.50%).

Other Fees

J.P. Morgan Self-Directed Investing also charges the following additional fees:

- Brokerage account transfer and termination: $75 when all assets are transferred out of the account

- Retirement account transfer and termination: $75 when all assets are transferred out of the account

- Wire transfer fee: $25 per wire

- Overnight/express mail: $10 per item

- Stop payments: $30 per item

- Safekeeping: $10 per position, per month

Sign-Up Bonus – up to $700

J.P. Morgan Self-Directed Investing is currently offering a tiered sign-up bonus of up to $700 when you transfer the following amounts into a new account by 7/19/2024:

The bonus is payable on newly opened accounts only. It’s payable when you open a taxable investment account, a traditional IRA, or a Roth IRA. The funds must be transferred within 45 days of enrollment, and cannot be transferred from another account with J.P. Morgan Chase and Co., or its affiliates.

Once the funds are deposited into the account, they must be maintained for a minimum of 90 days from enrollment. The bonus will be credited to the account within 15 days of meeting all requirements.

You are eligible for only one bonus in 12 months from the last enrollment date.

IRS Form 1099-MISC may be sent to you, and filed with the IRS, which means it must be included as income on your tax return.

Get your bonus from J.P. Morgan

INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT – NOT FDIC INSURED – NO BANK GUARANTEE – MAY LOSE VALUE

How Does This Bonus Compare?

The offer from J.P. Morgan is similar to your typical brokerage bonus and as far as brokerage bonuses go, it’s on par with others:

| Brokerage | Bonus Promotion | Link |

|---|---|---|

| 🏆 up to $5,000 | Learn more | |

| up to 12 free stocks from the Brokerage+ up to $3,000 from Cash Management | Learn more |

| up to 7 Fractional Shares ($35 value) | Learn more |

| free stock (valued $5 - $200) | Learn more |

| Up to $500 cash | Learn more |

| up to $700 | Learn more |

Other Features

Chase Mobile App

J.P. Morgan Self-Directed Investing can be accessed from the J.P. Morgan Mobile app, available for both Android and iOS devices.

With the app, you can see intraday investment account balances, position details, and transaction history, and access J.P. Morgan Research and Ideas & Insights.

In addition, you can manage other Chase accounts on the mobile app, and make transfers between accounts.

The Chase Mobile App has a rating of 4.8 among iOS users, and 4.4 among Android users as of publishing.

Customer Service

Customer service is available by phone and by email, Monday through Friday, from 8:00 AM to 9:00 PM, and Saturdays from 9:00 AM to 5:00 PM.

Customer service may also be available at one of more than 4,800 Chase Bank branches located in 48 states.

Account Security

Investments held with J.P. Morgan Self-Directed Investing are covered by the SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash.

This coverage is designed to protect against broker failure, and will not apply if losses are attributable to market conditions.

J.P. Morgan Self-Directed Investing vs. E*TRADE

E*TRADE is a well-established online brokerage offering many of the same investment features as the biggest brokers, including commission-free trades of stocks, ETFs, and options.

Much like J.P. Morgan Self-Directed Investing, E*TRADE does not offer fractional share purchases. But they do offer a few more investment choices, including futures and participation in initial public offerings (IPOs).

E*TRADE also offers more account options, including Coverdell ESAs, custodial accounts for minors, and beneficiary IRAs. And if you prefer a managed investment option, E*TRADE offers their Core Portfolios.

E*TRADE also offers a better selection of investment tools, especially regarding options trading. They even offer a paper trading account to help you test investing strategies without risking your own money.

While E*TRADE does offer a premium savings account as well as a checking account, they do not provide the full range of banking services available through Chase Bank. That can be especially important if you prefer to invest where you bank.

J.P. Morgan Self-Directed Investing vs. Webull

Webull does not offer a cash sign-on bonus but regularly provides promotions of free stocks or fractional shares when you open a new account. They also sometimes offer incentives for transferring from a competing broker.

Similar to J.P. Morgan Self-Directed Investing, they do offer commission-free trading in stocks, options, and ETFs — but not mutual funds.

Webull is a more limited trading platform than J.P. Morgan Self-Directed Investing, but it is designed primarily for fast-paced trading, like day trading. And as a standalone broker, there is no bank tie-in.

Read our full review of Webull.

J.P. Morgan Self-Directed Investing vs. Robinhood

Robinhood works much the same way as Webull, but it’s an investment broker that also offers trading in cryptocurrencies — which is an investment option J.P. Morgan Self-Directed Investing does not offer.

Robinhood does offer trading in fractional shares and charges no commission for trading in stocks, ETFs, or cryptocurrencies. Robinhood also offers participation in a limited number of pre-IPO stocks.

In a feature sure to please IRA investors, Robinhood is currently providing a matching contribution of between 1% and 3% of the investor contribution to an IRA account. Though Robinhood is not a bank, it provides interest on uninvested cash of up to 5.00% APY. They also offer a cash card providing many of the same benefits as a rewards checking account.

Read our full review of the Robinhood app.

FAQs

A J.P. Morgan Self-Directed Investing account is a brokerage account designed specifically for self-directed investing. That means you choose the investments, how long you will hold them, and in what portfolio configuration. No broker assistance is provided with this type of account.

Options trades are available commission-free, with a $0.65 per contract fee. However, there is a commission of $25 per trade with broker assistance.

You can open an account with no money at all and begin investing with as little as $1. However, since J.P. Morgan Self-Directed Investing does not accommodate fractional shares investing, you’ll need at least enough funds to purchase an entire share of stock in either an individual company or an ETF.

Though the service is expected to be withdrawn in 2024, the current annual advisory fee is 0.35% of assets under management. All existing accounts as of that date will be converted to a J.P. Morgan Self-Directed Investing account.

Summary

As part of the largest bank in America, J.P. Morgan Self-Directed Investing can be an excellent choice for existing Chase customers who want to invest with the same institution where they bank. You can take advantage of face-to-face customer service at more than 4,800 branches across the country.

While J.P. Morgan Self-Directed Investing probably isn’t a good choice for advanced investors, it can be a good choice for mutual fund investors since there are no commissions charged on these types of funds.

good to invest with

Are you using them now?