Many years ago, companies that promised free stock trades were living on borrowed time. High volume traders plus no commissions meant bankruptcy for the likes of Zecco (eventually acquired by TradeKing, which was itself acquired by Ally Bank).

But Robinhood has shown us that a brokerage offering free trades can work. So much so that they’ve been joined by most of the mainstream brokers in offering free trades. They’ve figured out you can earn interest on cash balances, transaction volume rebates, and premium memberships. This has opened the door for new companies and these companies are competing very aggressively.

When companies compete, you win.

The latest entrant into this world of free trading apps is a company called Webull Financial.

Get Your Free Stock from Webull

Table of Contents

| Brokerage | Bonus Promotion | Link |

|---|---|---|

| 🏆 up to $5,000 | Learn more | |

| up to 12 free stocks from the Brokerage+ up to $3,000 from Cash Management | Learn more |

| up to 7 Fractional Shares ($35 value) | Learn more |

| free stock (valued $5 - $200) | Learn more |

| Up to $500 cash | Learn more |

| up to $700 | Learn more |

Who is Webull?

You might be wondering if Webull is legit. You’ve never heard of them (until now). Their name is a little strange… but they are legitimate.

Webull is a brokerage based out of New York City and regulated by FINRA (BrokerCheck). This means your funds are protected by SIPC insurance. You’ll note their age is quite new, having been established in May 2017, but they’re not nearly that young.

Webull is the broker-dealer arm of a Chinese company called Hunan Fumi Information Technology Co, which itself was founded in early 2016 with an angel round of funding led by Xiaomi, a mobile electronics company.

Regardless of its roots, it is regulated by FINRA and does have SIPC insurance so as a broker it’s legit.

Webull Free Stock Offers

If you took advantage of our Robinhood referral, this one will sound very familiar. (here’s a comparison of Robinhood vs. Webull)

When you open an account using this link, you get up to 12 free stocks. The free stock reward is chosen “randomly by algorithm from Webull’s Reward Program Inventory of settled shares.” You’ll get a stock with a minimum market cap of $2.5 billion and listed on the NYSE or NASDAQ, so it’ll be easy for you to sell whenever you want.

But wait there’s more!

Here’s the full bonus schedule:

- Get 12 free fractional shares when you open an account and deposit any amount,

- That’s it!

Get Your Free Stock from Webull

(Offer expires 10/31/2023)

The process is very easy:

- Sign up for a new Webull account using a referral link.

- After registering, download the Webull app for your phone.

- Open the app, click on”Trade” at the bottom of the app to set up an account. This opens an account opening screen where you’ll enter in personal information to actually open an account.

- Go back into the app, then to the menu to see the”My Free Stock” offer.

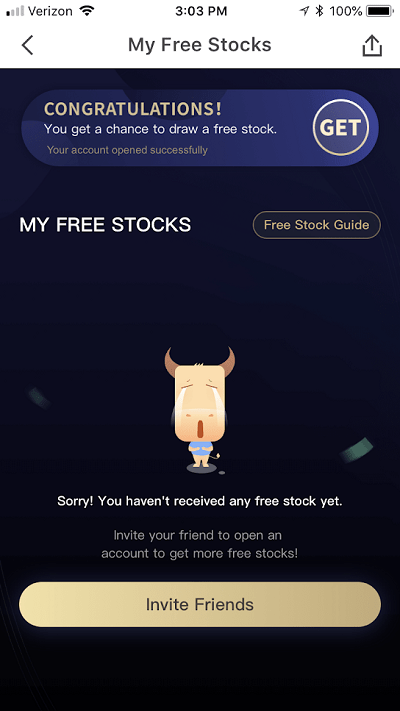

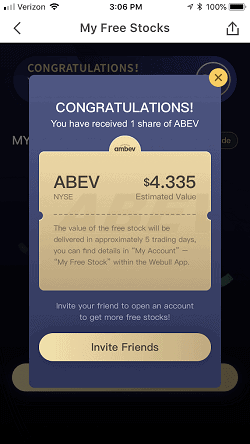

- On the “My Free Stock” page, press”GET” button at the top to see what you get. The screenshot is to the right.

- The stock will be worth up to $300 and credited within 5 trading days.

- Sell the stock! You will be given a tax form indicating the promotional value was given to you.

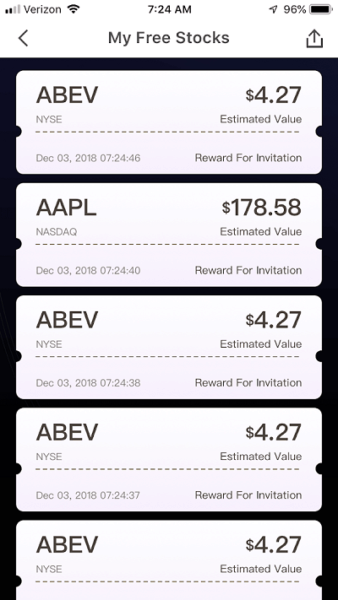

I did this earlier and I got a stock that a lot of folks seem to have gotten, ABEV (parent company to Anheuser-Busch), valued at $4.335 a share. Not bad… it’s not a thousand bucks but who am I to complain about an extra $5 I didn’t have before. 🙂

Get Your Free Stock from Webull

Every so often you get lucky… 🙂

Webull Cash Management Promotion – up to $3,000

Webull also has a cash management account as part of their offering. Much like other brokerages, which keep your cash in a sweep account, Webull offers a cash management account that earns a competitive 5.00% APY.

It also offers a deposit bonus based on the following schedule:

| Net Deposit | Cash Bonus |

|---|---|

| $2,000 – $9,999 | $10 |

| $10,000 – $24,999 | $100 |

| $25,000 – $99,999 | $300 |

| $100,000 – $499,999 | $1,200 |

| $500,000+ | $3,000 |

This is on top of any other bonus you get for opening a brokerage account, so you’re able to double dip!

(Offer expires 10/31/2023)

Webull Signup Process

The signup process is fast – you just sign up with a phone number or email address. You download their app, available on iOS as well as Android, and then provide all the typical brokerage account information – name, address, social security, employment, and investing experience. You will have to provide your address too including a way to identify you – like a passport or driver’s license (plus you’ll need to take a photo of it).

After entering my information, my account was available in a few minutes.

What’s remarkable about the process is that you don’t need to deposit money, complete a trade, or link up an account to get the free share of stock. You simply need to open an account and once it is approved, you can get your free share.

There is no minimum account balance requirement for a regular cash account. If you opt for a margin trading account, you’ll have to maintain at least a $2,000 balance.

What Stock Can I Get?

The free stock odds of the value you get in stock is implied as follows (from their promotional page in the black section, #6):

For the shares you get for opening an account:

- stock in the $3 – $10 per share range, approximately 1:1.02

- stock in the $10 – $50 per share range, approximately 1:52.63

- stock in the $80 – $100 per range, approximately 1:1111.11

- stock in the $100 – $300 per range, approximately 1:10000

For the 1 share you get for depositing at least $100 (you have 30 days from opening your account to deposit):

- stock in the $8 – $30 per range, approximately 1:1.02

- stock in the $30 – $100 per range, approximately 1:52.63

- stock in the $100 – $200 per range, approximately 1:1111.11

- stock in the $1000 – $2000 per range, approximately 1:10000

How is Webull as a Brokerage?

As a brokerage account, Webull is a perfectly good brokerage – it has some limitations but these are not uncommon. They are one of our favorite Robinhood alternatives.

First, there are no commissions on trades but there still are fees. The SEC and FINRA both charge a small fee and Webull passes those on. The SEC charges $23.10 per $1,000,000 of principal on a sale with a minimum of a penny. FINRA charges a Trading Activity Fee (TAF) and the TAF is $0.000119 per share on sells with a penny minimum and $5.95 maximum. So on each transaction, you will still have to pay a minimum of a penny each – one to the SEC and to FINRA.

You can trade over 5,000 stocks and ETFs but you can’t trade options, over-the-counter stocks, mutual funds, or bonds. You are also limited to market, limit, stop and stop-limit orders with a “good for today” deadline (so no “good-til-canceled” GTC orders). There are extended hours trading, both pre-market (4 AM-9:30 AM) and after-hours (4 PM-8 PM).

Customer service is good too with a live chat feature as well as a phone call if you prefer talking over typing.

For a free trade brokerage, it’s a fairly comprehensive feature set if you want more than the free share of stock. It’s comparable but not nearly as robust as Robinhood, likely because they’re newer, but they do have the functionality if not the polish.

Get Your Free Stock from Webull

Do you like getting free shares of stock? We have this list of financial startups that give you shares for signing up for their service. Companies like Robinhood, Tornado, and Stash Invest!

Yes, you get 2 shares of stock when you sign up and then another 2 shares when you deposit at least $100. The total value can get as high as $3,700 if you are very lucky.

The stock will be from companies with a minimum market capitalization of $2.5 billion – you won’t get some shares from a tiny company you’ve never heard about. There is a 1 in 100 chance you’ll get a share of Facebook, Proctor & Gamble, Starbucks or Snap. There is a 1 in 50 chance you’ll get a share of Google, Facebook, Proctor & Gamble, Starbucks, Kraft Heinz, or Snap.

Thanks for the review just downloaded it last week and actually got the free stock. Seems like they have GTC and bracket orders now too so was really happy don’t have to worry about reentering every time after market hours. Overall a great app so far better than Robinhood who I can never reach for sure.