While index funds and EFTs are great for the bulk of your investments, what if you want something more out of your portfolio?

You can certainly invest in actively managed mutual funds. But those often come with high load fees and there aren’t many that have a long track record of outperforming the market. So that pretty much leaves you with investing in individual stocks.

The biggest dilemma for anyone who wants to invest in individual stocks is choosing which ones to invest in. Picking the right stocks can be something of a part-time job, and most investors don’t have that kind of spare time.

If you want to invest in individual stocks, and you don’t have either the time or the inclination to research which companies to buy, a great place to start your research is a stock-picking newsletter. They’ll tell you exactly which stocks to buy, and the better newsletters can even help you to outperform the general market.

Table of Contents

Motley Fool Stock Advisor

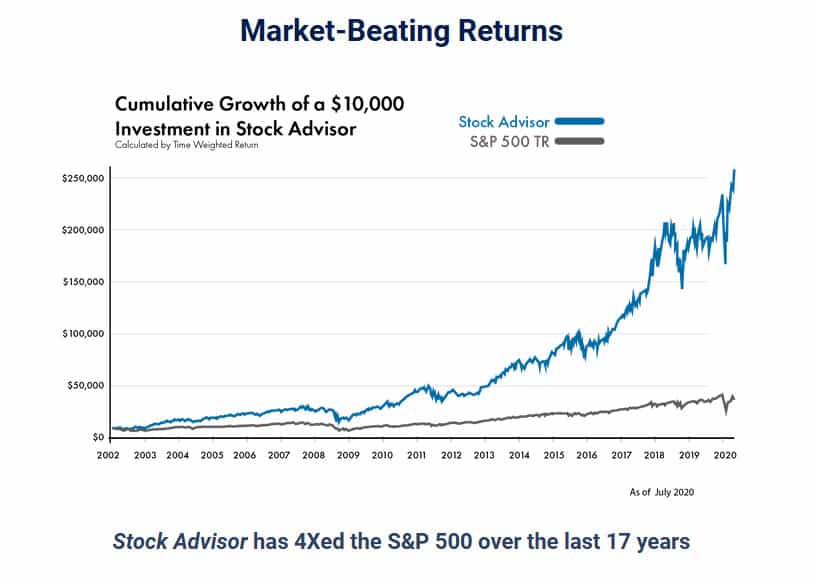

The Motley Fool Stock Advisor may very well be the most comprehensive stock-picking newsletter available. The company claims its Stock Advisor has beaten the S&P 500 by 4-to-1 over the last 17 years. That’s a remarkable claim, and we don’t know specifically how they calculated it. But if it’s even remotely true it makes this one of the very best stock-picking newsletters available.

The company also claims they have made over 100 stock recommendations with returns of over 100%. Some of the companies they recommended in the past include Amazon, Walt Disney, and Netflix, each of which has returned several thousand percent since being recommended in the newsletter.

This newsletter is produced by Motley Fool co-founders (and brothers), Tom and David Gardner. And if you follow the financial news at all you know that Motley Fool is one of the most frequently quoted news and information sources in the field. The newsletter itself claims more than 700,000 subscribers.

Motley Fool provides two new stock picks each month, sent to you by text so that you can act on them immediately. That’s an important feature because the company’s recommendations are so well-regarded that the prices of recommended stocks often increase a few points just on the recommendation.

The Motley Fool Stock Advisor offers a first year deal so it’s only $99. It’s normally $199 per year and you can cancel your subscription at any time. (Here is our full review of Motley Fool Stock Advisor)

*Billed annually. Introductory price for the first year for new members only. First year bills at $99 and renews at $199.

If there is a criticism of the Motley Fool Stock Advisor it’s that, like many subscription services, there’s a constant effort to upsell you into additional services. But if you can deflect the sales pitches, that shouldn’t be a problem at all.

Get started with Motley Fool Stock Advisor

Morningstar

Morningstar is perhaps the single biggest — and most respected — investment source anywhere. Not only is the company constantly being quoted and referenced in the financial media, but their stock and fund analysis is considered top-of-the-line. This is particularly true of their mutual fund analysis, which is generally regarded as the best in the industry.

Morningstar doesn’t provide actual stock recommendations. But they do provide all the tools you’ll need to become a better investor.

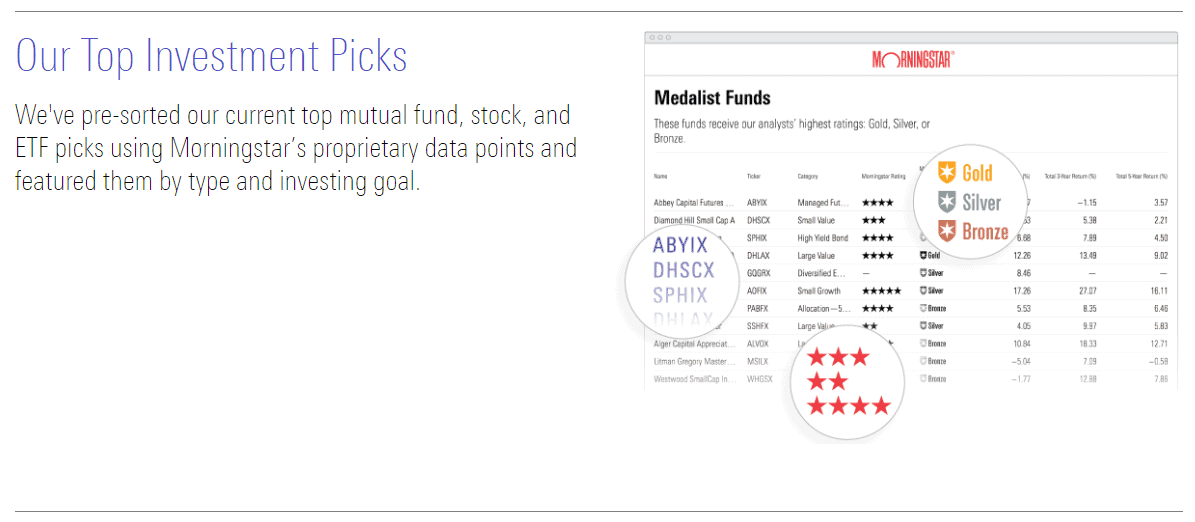

That starts with their Morningstar Investor service. It provides analysis and ratings of stocks, bonds, mutual funds, and ETFs. With some of the most detailed information available on each of those investments, it’s easy to make your own investment decisions.

Morningstar Investor does provide their top investment picks, as well as analyst reports on those picks. They also offer their Portfolio Manager and Portfolio X-Ray tools, and detailed stock screeners. And to help you become a better investor, they offer the Morningstar Investing Classroom. It’s a self-study course to help you learn more about investing as well as the basics of portfolio construction.

Morningstar offers the following fee structure:

- $34.95 per month when paid monthly

- $16.58 per month when paid annually

If you take advantage of our Morningstar Investor Discount, you can receive $50 off an annual subscription.

They also offer a 7-day free trial so you can test the program and see if it works for you.

Check out our full review of Morningstar Investor to learn more. And here’s how Motley Fool and Morningstar compare.

Get a 7-day trial and up to $50 off Morningstar Investor

Seeking Alpha

Seeking Alpha has free and paid memberships that let you read in-depth articles about stocks, funds, and the stock market. Unlike other platforms, your subscription isn’t for a single service as you can read commentary on most publicly-traded stocks and ETFs.

This service can be one of your best options if you don’t want specific guidance like a newsletter that promises one monthly recommendation. Consider this tool if you want an in-depth stock screener that also provides in-depth analysis and ratings.

You will find articles that present a bullish or bearish analysis to gain a better understanding of the potential risks and rewards.

The article library is more extensive than most investment newsletters and can make performing your due diligence and adequately researching a potential investment easier. Numerous articles publish daily and you can see the latest posts and most popular ones on the Seeking Alpha homepage.

Some of the other tools you may not find with most platforms include:

- Financial metrics: Key fundamental metrics for different data like revenue, earnings, valuation, growth, and profitability that you can find on the company balance sheet.

- Quant Ratings: A proprietary scoring system for several factors like valuation, growth, and profitability. These ratings crunch the data so you can quickly see if the stock has bullish or bearish fundamentals.

- Price chart: See the historical price and also perform basic fundamental and technical analysis.

- Stock ideas: View curated investment ideas for stocks and funds that are the best fit for a particular investment strategy or Quant Rating factor.

- Stock and ETF screener: Filter potential investments by ratings and fundamental indicators.

- Portfolio tracker: View your long-term investment performance for your existing portfolio and also for investments you find through this service.

Three different pricing plans cater to different investment and research frequencies.

The Basic membership is free and can be good for infrequent researchers. You can only read a limited number of articles each month and have limited access to the ratings and screening tools.

Most subscribers will benefit the most from the mid-level Premium membership. After a 14-day free trial, it costs $29.99 month-to-month, or the monthly fee drops to $19.99 when you pay $239 upfront. You get unlimited access to the articles, ratings, stock lists, and screener.

Frequent and research-intensive investors should consider splurging on the Pro plan to get exclusive access to screens, newsletters, and other rating tools. You pay $299.99 monthly or $2,400 upfront for an annual membership ($199.99 per month).

Our Seeking Alpha review has more details.

💵 Seeking Alpha Premium Spring Sale – 25% Off

Seeking Alpha offers a 7-day free trial for Seeking Alpha Premium so you can see whether it’s right for you. If it is, the regular price is $239 for an entire year and now you can get 25% off – making it just $179 for the year.

If you don’t like it, you can always downgrade to the Basic plan and still use all the portfolios, screeners, and research you’ve done without paying the premium fee.

The trial is a great way to test-drive Seeking Alpha Premium.

👉 Get the Seeking Alpha Premium 7-Day Free Trial

(Offer expires April 3rd, 2024)

Learn more about Seeking Alpha

Moby

Moby is a relative newcomer having been founded in 2021 but they aim to provide investors with their recommendations and analysis in a jargon-free and easy to read format.

They’ve partnered up former hedge fund analysts with reporters to provide three recommendations a week, which is a far higher cadence than many other companies on this list. Each pick comes with a detailed report that follows their goal of avoiding complex financial terms while still being informative.

Moby doesn’t produce a newsletter, per se, but you can access all their reports within the Moby app. You get these picks on top of a variety of premium tools like a stock screener, model portfolios, and more.

Moby costs $16 per month and comes with a 30 day money back guarantee.

Zacks Premium & Zacks Investor Collection

Yet another well-respected investment information source, Zacks website can be accessed free and will provide a wealth of valuable investor information. That includes general information on stocks and funds, as well as securities screening and portfolio management.

They also offer a Zacks Premium service that is $249 per year after a 30-day free trial. It features daily updates of the Zacks Rank, as well as full access to the Zacks #1 Rank List, Equity Research Reports, Focus List portfolio of 50 longer-term stocks, premium screens, and more. It will help you identify which stocks to buy, and even which to sell.

Historically, the Zacks #1 Ranks list has outperformed the S&P 500 when you look back to 1988. Of course, past performance is not indicative of future returns but it’s a good sign.

For a higher level of service, they also offer Zacks Investor Collection. It’s offered at a subscription price of $59 per month, or $495 per year. You can get your first 30 days for only $1 to try it out. It’s considered the preferred newsletter for long-term investors, offering real-time buy and sell signals from Zacks long-term investor portfolios. The plan gives you full access to all other premium research tools and reports to help you find the best stocks and funds for your portfolio. When you subscribe to this service, Zacks Premium is included in the package.

Best of all, Zacks reached out and offered our readers a free Special Report – 5 Stocks Set to Double – absolutely free. Five experts each name a stock and then explain their reasoning as to why they believe the stock will double or more in the near future. This is recently updated and previous editions identified big gains like Chewy (+213%), NVIDIA (243.4%), and Sea Limited (+542.2%).

Get your free report from Zacks

Finimize

Finimize has more than 800,000 subscribers and is available on mobile apps for both iOS and Android devices. The smartphone connection is important too. They provide five-minute daily updates to give you the lowdown on the day’s biggest financial stories and how they impact you. You also get 30-minute expert breakdowns of developing trends, companies, and industries that can impact your investments.

Finimize is free to use and signing up makes you a member of the Finimize community. Though they provide a wealth of general investment information, including up-to-the-minute reports, they don’t provide specific stock recommendations.

You can sign up for the service on the website or by downloading the mobile app.

Stansberry Research

Stansberry Research offers several different stock-picking newsletter options. It’s another of the most popular stock-picking newsletters available, with more than 500,000 subscribers worldwide, including 70,000-lifetime subscribers.

They offer strategies for different types of investing, including dividend investing, fixed income, value investing, energy and precious metals investing, alternative assets, and conservative, income-generating options trading strategies. But the site also includes a wealth of investor resources to help you learn more about the process.

The company actually offers several different service packages. For example, they offer three different portfolio types, The Total Portfolio, The Income Portfolio, and The Capital Portfolio. Each involves a specific type of investing, but also offers specific investment recommendations, typically drawn from one of their many newsletter offerings.

In addition, they offer no fewer than seven Macro-Level Services as follows:

- Stansberry Investment Advisory: This is the company’s flagship research advisory, providing a monthly publication showing you how to make money from the most promising emerging trends and influential economic forces affecting the market. It’s available for $199 for one full year.

- True Wealth: A monthly advisory providing safe, alternative investments that are overlooked on Wall Street. Also $199 per year.

- Retirement Millionaire: Shows you how to live a millionaire lifestyle on less money than you think. $199 per year.

- Extreme Value: Monthly newsletter helping you to buy great companies at deep discounts. $1,500 for a one-year subscription. (Note that there is no refund available, but you can get a credit to apply toward other Stansberry purchases.)

- Stansberry Gold & Silver Investor: Newsletter specializing in gold and silver investing. $49 per month, but there is a one-time portfolio fee of $2,500.

- Commodity Supercycles: A newsletter with a focus on investments in energy, metals, and other natural resources. $199 per year.

- Stansberry Innovations Report: Newsletter showing subscribers how to invest safely in the next technology revolutions. $199 per year.

Because of the cost of this newsletter service, Stansberry research is better suited to large, experienced investors. It can cost potentially several thousand dollars per year if you want to subscribe to several of the newsletters at the same time.

Learn more about Stansberry Research here.

Kiplinger Personal Finance Magazine

Kiplinger is another of the most respected names in the investment universe. Not only are they frequently quoted throughout the industry, but they also provide valuable information that’s actionable on a personal level. And in addition to investing, they also provide related information on retirement, taxes, personal finance, wealth creation, and other topics.

Kiplinger’s Personal Finance is issued as a monthly newsletter, and you’ll have a choice as to how you receive it. You can get a printed magazine, digital access, or both print and digital. Each subscription type includes 12 monthly issues and an annual subscription fee of $19.95.

While Kiplinger’s focus is on the bigger investment picture, they do get very specific with recommendations. For example, they publish their favorite list of both mutual funds and ETFs and regularly offer stock recommendations.

Learn more about Kiplinger here.

✨Related: Curzio Research Review: Is it Worth the Cost?

Final Thoughts

As you can see, investment and stop picking newsletters are available in many different flavors and service levels, as well as price points.

If you’re interested in investing in individual stocks or even picking your own ETFs or mutual funds, you should subscribe to a newsletter to help you identify the best candidates. You don’t have to go with a high priced service though, you can start with one of the free or lower-priced services. Then, make sure to do your own research by leveraging tools like TipRanks.

If you’re an advanced investor, and particularly a frequent trader, you’ll want to take full advantage of the more advanced newsletters. Stock picking on an individual level is all about trying to outperform the general market. If that’s a tall order for investment professionals, it’ll be even more difficult for individual investors.

But by subscribing to the right stock-picking newsletter you’ll be leveling the playing field. You’ll be getting access to much the same information that’s available to investment professionals.

But that doesn’t mean you should rely entirely on stocks or funds recommended by newsletters. Virtually all have a fair number of losing picks to go with their winners. With that in mind, use stock-picking newsletters as a starting point. Take their recommendations, but do your own research and make sure you’re comfortable with the companies or funds you’re investing in.

If you want a stock screener, here’s our list of favorites.

Ivan Detlefs says

Can you believe about Gamestop stocks?! I never would have guessed that GME would shoot up like it has. Have you ever profited off a short squeeze like that before? I wonder if it will keep going up?

I’ve never seen anything like this before and I was around when Volkswagon did the same thing in 2008 – I think they’re fun to read but too stressful to participate in.