Editor’s Note: M1 Finance has made the decision to close its M1 Plus membership program, effective May 15th, 2024. After that date, M1 Plus features will be available to all M1 customers. This includes additional cash-back rewards, in-depth investing tools, and preferred Margin Loan rates. At the same time, M1s pricing model will also change. All customers will incur a $3 monthly fee to use the platform. However, if you have a balance of $10,000 or more with M1 Finance or an active M1 personal loan, the $3 fee will be waived. Stay tuned as we will update this review and all other M1-related content when the changes take effect.

The world of investing is changing.

In the beginning, you had full price brokerages charging you an arm and a leg to make stock trades. Then came discount brokers who charge a few dollars a trade and mutual fund companies, like Vanguard, who help you invest in mutual funds for very little.

More recently, you have robo-advisors who help you, through technology, invest in the market for a small asset management fee.

Now there’s something new – M1 Finance is unique in the investing world. It’s part brokerage and part build your own investing platform. You determine your asset allocation but then they take care of everything from that point forward. However, what makes it really interesting is that it’s commission free to use and you can even borrow against your balance at reduced interest rates (with M1 Plus).

Let’s take a closer look.

Table of Contents

- About M1 Finance

- How M1 Finance Works

- M1 Finance Features and Benefits

- Minimum initial investment

- Available account types

- M1 Finance Advisory Fee

- M1 Finance Referral Program

- Mobile Access

- Automatic dividend reinvestment

- Account custodian

- Account protection

- Customer service

- Tax information exporting

- M1 Finance Spend and Borrow Accounts

- Basic M1 Account and M1 Plus Account

- M1 Plus Account Unique Features

- How to Open an Account with M1 Finance

- M1 Finance Pros and Cons

- Should You Open an Account with M1 Finance?

About M1 Finance

M1 Finance was launched in 2015 and is headquartered in Chicago, IL. They’re a registered broker regulated by FINRA, licensed to operate in all fifty states and three territories. They’re legit. In fact, they’re so legit that they have over 500,000 funded accounts using the platform.

And not only that, M1 Finance gets high marks from consumers and investors. As of 3/9/2022, the company has a Better Business Bureau rating of “A-”. Meanwhile, M1 is rated 4.6 out of five stars by nearly 18,000 iOS users on The App Store, as well as 4.6 stars out of five by nearly 10,000 Android users on Google Play. Clearly, this is a young company that’s getting it right.

What M1 Finance is doing that seems to be catching on with investors is combining the best elements of self-directed investing with robo-advisors.

The company allows you to select your own investments, or choose pre-built portfolios, which will then be managed robo-advisor-style. That means you can have control over where your money is – which is not typical of robo-advisors – but still have all the benefits of automated investment management.

And perhaps best of all, M1 Finance delivers their investment program to you that’s commission free!

How M1 Finance Works

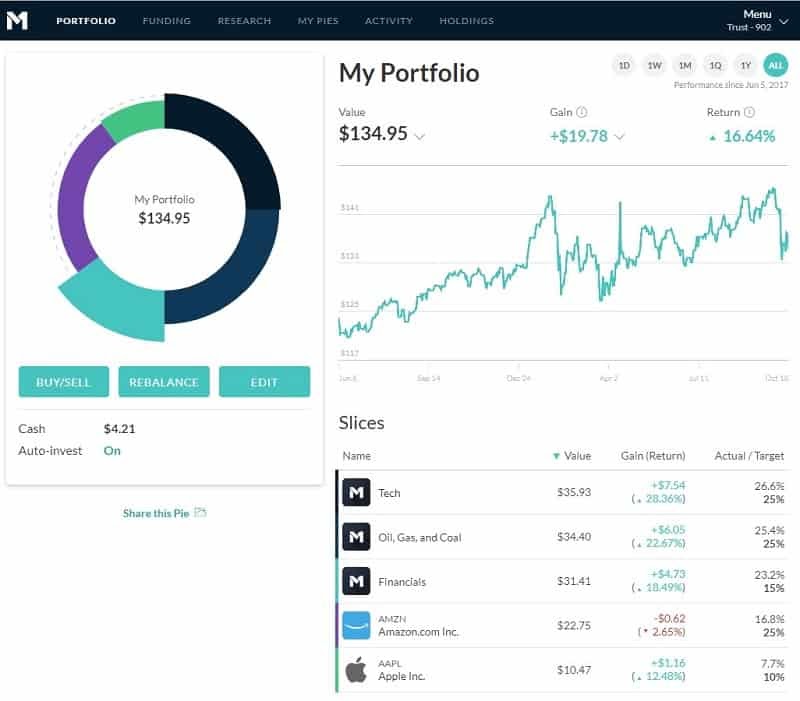

Once you sign up for the service, a pie with predetermined investment categories – referred to as “Expert Pies” – will be recommended for you. The referral will align with your risk tolerance and is designed to meet a particular investment goal. Each pie will have as many as 100 different components, or “slices”. Each slice can be an ETF, a stock, or even another pie.

M1 Finance has more than 66 Expert Pies that you can choose as a basis for your portfolio. You can then customize each pie, by including your own choice of stocks or exchange-traded funds.

Stocks you select for a pie must come from either the New York Stock Exchange, NASDAQ, or BATS. Alternatively, you can even create your own pie portfolio, referred to as “Custom Pies”. Note that M1 Finance does not offer mutual funds in the construction of pies.

In creating custom pies, you can select the securities in the pie. For example, you can set the target rate for each pie slice, which will be filled with a single stock or ETF. The percentage of the slice will determine how much stock or ETF shares will occupy that slice.

As you add money to a pie, M1 Finance will not maintain the desired target allocations for that portfolio – you have to manually rebalance to keep your allocation in line.

You are able to purchase both individual stocks and exchange-traded funds (ETFs) in your account pies so you are in total control of your allocation. You can adjust it to match your risk profile. You can change your investment lineup at any time too. This is very different from many competitors who determine a portfolio for you and don’t allow you to make changes.

Creating, Building, and Maintaining Pies

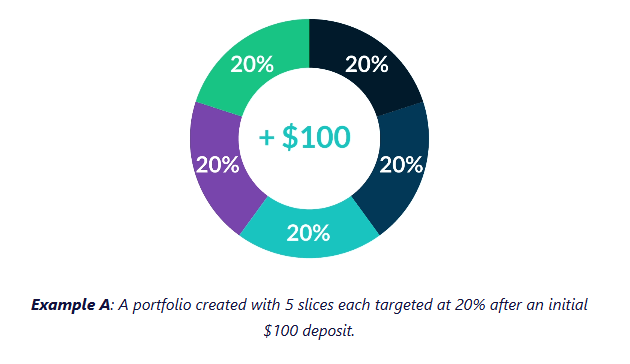

You choose your portfolio by determining the stocks, funds, and pies you will include in a given pie. Once you do, you’ll set percentage allocations for each slice of the pie.

For example, let’s say you want to build a pie based on the FAANG stocks. You choose to invest in Facebook, Apple, Amazon, Netflix, and Google. You can simply allocate 20% to each stock in the pie. Alternatively, you can come up with a different mix, say 40% in Amazon, and 15% in each of the other four stocks.

You can establish pies based on certain market sectors, such as technology, energy, or socially responsible investing. Those pies can either be Expert (predesigned) or Custom (self-built). You can create an unlimited number of pies.

Once you establish a pie, you can fund it periodically or even establish recurring deposits, such as $100 per week. M1 Finance allocates the incoming money according to your intial pie allocation.

M1 Finance uses a tax lot strategy when selling securities. This helps to reduce the amount of taxes you’ll pay as a result of capital gains.

When you make a withdrawal from your account, the M1 Finance algorithm determines which securities to sell. They’ll be prioritized based on the following sequence (but you can always pick what you want to sell yourself):

- Losses that offset future gains.

- Lots that result in long-term capital gains (to get lower tax rates on long-term capital gains).

- Lots that result in short-term capital gains (done as a last resort, since these gains are taxable at ordinary tax rates).

When you open your account, you can determine in advance how much money will be held in the cash portion. Any amounts in excess of the limit you set will automatically be invested. This is to minimize the cash drag of having on investment funds.

M1 Finance Retirement Accounts

M1 Finance offers traditional, Roth, rollover, and SEP IRAs. IRAs require a minimum initial investment of $500. If you need to do a rollover, either from a 401(k) plan or 403(b) plan or from an external IRA, M1 Finance does have a Customer Success team that can help you with the process.

SEP IRAs are commonly used by small businesses to provide for retirement plans both for the business owner and employees of the business. However, SEP IRAs with M1 Finance are only for the business owner. The platform cannot accommodate participation by employees of the business.

M1 Finance Features and Benefits

Minimum initial investment

You can open an account with M1 Finance with no money whatsoever, but you will need at least $100 in the account to begin investing.

Available account types

M1 Finance is available for individual and joint taxable accounts, traditional, Roth, rollover, and SEP IRAs, as well as trust accounts. M1 Plus members get access to custodial accounts too.

M1 Finance Advisory Fee

Most robo-advisors charge an annual fee of between 0.25% and 0.50% per year to manage your account. But one of the biggest advantages of M1 Finance is that they do not charge an advisory fee. Your portfolio management, including rebalancing, is provided free of charge.

They don’t even charge commissions on trades made within your investment pies.

M1 Finance Referral Program

M1 Finance will give you $30 to invest for each friend you refer who signs up for the service. You can do this by generating a unique link on the M1 Mobile App that you can share with friends by email, text, or social post. Your friend will also get $30 to invest.

Mobile Access

M1 Finance is available on The App Store for iOS devices 12.0 or later, and is compatible with iPad, iPhone, and iPad touch. It’s also available on Google Play for Android devices, 5.0 and up.

Automatic dividend reinvestment

Automatic dividend reinvestment takes place when dividend income to the account reaches $10. The funds are held in cash until the $10 threshold is met, then the funds are invested in your pies based on the allocations you’ve set.

Account custodian

Funds held with M1 Finance are held by Apex Clearing Corporation, which acts as the clearing firm and custodial agent for M1 and a variety of other brokers.

Account protection

Funds held with M1 Finance are covered by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. This coverage protects against broker failure, not losses due to declines in market value. This coverage is provided through Apex Clearing as custodian for M1 Finance accounts.

Customer service

Available Monday through Friday, 9:30 AM to 4:00 PM, Eastern time. However, contact is available only by in-app email, not by phone or live chat. You must submit a support request for assistance.

Tax information exporting

M1 Finance integrates directly with both TurboTax and H&R Block. That will simplify your tax preparation efforts if you use either service, particularly if you are an active trader with multiple taxable transactions.

M1 Finance Spend and Borrow Accounts

M1 Finance is joining other robo-advisors – like Betterment and Wealthfront – in offering a cash account (“Spend”) as well as a borrowing capability (“Borrow”).

This will give you an opportunity to hold uninvested cash in your account, as well as to access part of your investment accounts through a credit line. That will eliminate the need to sell securities to access funds from your account.

M1 Finance Spend Account

This account feature enables you to both access your cash and spend through an M1 checking account.

The account comes with a Visa debit card for both online and in-store purchases and can also be used to access cash at ATM machines. However, only between one and four ATM fees will be reimbursed per month, based on whether you have a Basic M1 Account or an M1 Plus Account (see descriptions of each below).

M1 Finance Borrow Account

M1 Finance Borrrow will give you the ability to borrow against your account through a flexible portfolio line of credit. You must have a minimum account value of $2,000 to take advantage of this feature. But if you can, you can borrow against your account at rates ranging between 2% and 3.5%, based on the account type you have.

With the Borrow feature, you’ll be able to access up to 40% of the value of your account and receive the funds in as little as 10 seconds (but may take longer for withdrawals). And since you’re borrowing the funds from your own account, you won’t need to get credit approval. Funds can be taken for any purpose.

By definition, M1 Borrow is a margin loan since it is secured by the value of your investments. The interest rate will be determined based on the Federal Funds Rate, which is subject to change. And since it is a margin loan, the credit line is also subject to maintenance calls. That means if your portfolio declines in value, you’ll need to add additional funds to your account to ensure the credit line does not exceed 40% of your account value. (they offer a monitoring tool so you know how close you are to the limit)

Basic M1 Account and M1 Plus Account

There are two account types, the Basic M1 Account and the M1 Plus Account. Both offer cash accounts and credit lines, but with unique terms for each.

Both accounts enable you to invest with M1 Finance completely free, and each comes with both the Spend and Borrow features, though each account has different benefits. They also offer the Visa debit card and will allow you to accept direct deposits and transfer funds between your investment account as well as your Borrow and Spend accounts.

Basic M1 Account Unique Features

As you can see from the screenshot above, you’ll be able to access your credit line at a rate currently set at 3.5%. And while you will have the basic checking account and debit card, you won’t earn interest on cash balance, nor will you earn 1% cash back when you spend using the debit card. The account will provide one reimbursed ATM fee per month.

However, the good news with the Basic M1 Account is that it has no annual fee.

M1 Plus Account Unique Features

This account level enables you to borrow against your assets at a current rate of just 2.0%. That’s a full 1.5 percentage points lower than the rate on the Basic M1 Account.

With the Spend account, you’ll earn 1% APY* on cash balances in your account, as well as 1% cash back on purchases made with the Visa(R) debit card. The account also provides for reimbursement of up to four ATM fees per month.

M1 Plus does come with an annual fee. It is $3 a month or $36 a year. It can be offset by interest earned on your cash balances and cashback received on your purchases, particularly if you use the debit card actively.

*No minimum balance to open account or to obtain APY (annual percentage yield). APY valid from account opening. Fees may reduce earnings. Rates may vary. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc. M1 is not a bank. M1 Spend checking accounts furnished by Lincoln Savings Bank, Member FDIC.

M1 Plus is a paid annual membership that confers benefits for products and services offered by M1 Finance LLC, M1 Spend LLC and M1 Digital LLC, each a separate, affiliated, and wholly-owned operating subsidiary of M1 Holdings Inc. “M1” refers to M1 Holdings Inc., and its affiliates.

How to Open an Account with M1 Finance

To open an account, you must be either a US citizen or a permanent US resident (green card holder). You must also be over the age of 18, with a current US mailing address.

You begin the process by entering your email address and creating a password. You’ll then be asked to provide the typical information requested in establishing any type of financial account. This will include personal information, like your name, address, and phone number.

Once your account has been established, and you’ve chosen your pies, you can link an external financial account to your M1 Finance account. This will enable you to move money into the account, or withdraw it electronically. A large number of financial institutions are included in the application process. But you can add any that are not, by including the name of the institution, the type of account, and your account number (or bank routing number, if applicable).

M1 Finance Pros and Cons

Pros:

- M1 Finance charges no advisory fee and no commissions for trading.

- The platform combines automated investment management with individual security selection.

- You can open an account with no money, and begin investing once you have at least $100 ($500 for IRA accounts).

- Fractional shares – since you will include individual stocks in a pie, M1 Finance enables you to purchase fractions of shares, rather than whole shares. This enables you to fully diversify a pie even with a small amount of money.

- You can earn interest on your uninvested cash as well as 1% cash back on purchases made with the Visa debit card if you open an M1 Plus account.

- The ability to borrow money against your account at interest rates that are well below market rates.

Cons:

- There is no ability to invest in mutual funds.

- Though you can hold individual stocks in your pies, you cannot trade them the way you would with a traditional brokerage account.

- M1 Finance does not offer tax-loss harvesting, which is becoming a common feature on many robo-advisors.

- M1 Finance is not a trading account (but it’s not meant to be).

Should You Open an Account with M1 Finance?

If you’ve been fascinated by the idea of robo-advisors, and their ability to manage your investments for you – but you don’t like giving up the idea of choosing your own investments – M1 Finance is the investment platform for you. You choose the investments you will make, consistent with self-directed investing, and the platform handles the mechanics of managing your portfolio. It’s the perfect blend between robo-advisor and self-directed investing.

You can open an account with no money at all, and fund it with payroll deposits. And best of all, it will cost you absolutely nothing to start investing with the app.

However, if your primary interest is in trading individual stocks, or even day trading, M1 Finance is not a platform for you.

If you’d like more information, or you’d like to sign up for the investment service, visit the M1 Finance website.