If you invest in individual stocks, and especially if you’re an active trader, having a good stock screener is one of your most important tools.

There are more than 3,600 stocks of companies trading on US exchanges, and an even larger number of foreign stocks, mutual funds, and exchange-traded funds. A good stock screener will help you filter the companies you want to invest in, based on any criteria you choose. It will also help you to further analyze stocks that have been recommended by investment experts, so you can make your own informed decisions.

Whether you’re a buy-and-hold investor or a day trader, a good stock screener will help you make better investment decisions. To help you find the right one for you, we’ve prepared this list of the best stock screeners. But before we get into the list let’s first take a look at some of the more basic information on stock screeners.

Table of Contents

What is a Stock Screener?

We can probably thank computers for this, but there’s an almost unlimited amount of information available on every security trading on both domestic and international exchanges.

For any security you want to invest in, there are dozens of data points that are significant in helping you to make the right investment decisions. A stock screener will enable you to analyze those data points for any security you are considering investing in. You can whittle a list of 100 potential stocks down to just three or four based on the criteria you consider to be the most important.

Some of the criteria you can use to evaluate potential investments with stock screeners include:

- Specific industry sectors

- Geographic location

- General company information

- Earnings per share (EPS)

- Price Earnings (P/E) ratio

- Forward P/E ratio

- Sales and earnings growth estimates

- Market capitalization

- Trading range

- Trading volume

- Volatility

- Price level -current versus target

- Security versus the market or industry benchmarks

The above list is just a sampling of the criteria you can use. Most stock screeners can be customized to enable you to focus specifically on the categories you consider most important.

Stock screeners are also available in both free and premium versions. You should naturally expect premium versions to come with more features and tools and even to be more user-friendly. Which you choose will largely depend on how much you rely on your own stock analysis, and how frequently you trade.

A free stock screener may get the job done for you if you only make a few trades each year. But if you’re a frequent trader, and especially if you’re a day trader, you’ll almost certainly want a premium stock screener.

The Best Stock Screeners

Rather than ranking the screeners in any specific order, we’re simply listing those we believe to be the best out of a very large group. There’s no one best stock screener for all investors, and the decision will come entirely down to which one will work best for you.

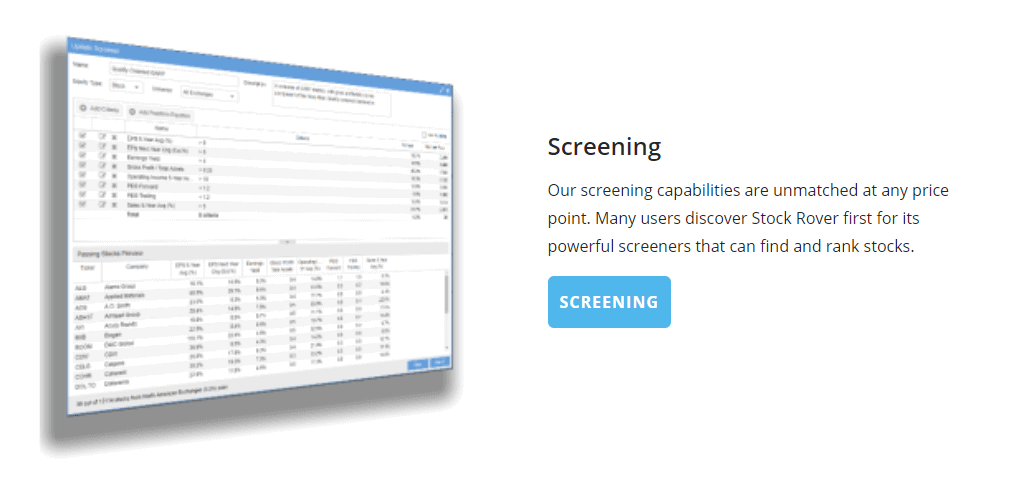

Stock Rover

Stock Rover was launched in 2008 and is both comprehensive and user-friendly. The service is available for desktops, laptops, tablets, and smartphones. What’s more, it offers integration with your brokerage platform. It can be used for exchange-traded funds (ETFs) as well as individual stocks.

Stock Rover offers three different plan levels to fit your investment needs and preferences, as well as your budget:

Essentials – $79.99 per year (22 cents a day)

This plan offers more than 260 financial metrics, five years of detailed historical data, portfolio and watch list tracking, brokerage integration, powerful investment comparison, customizable views and columns, easy, fast and flexible stock screening, real-time text and email alerts, the Stock Rover Investment Library, and guaranteed responsive support.

The plan is available for either $7.99 per month, or $79.99 per year, giving you the equivalent of two free months of service.

Premium – $179.99 per year (49 cents a day)

This version comes with everything in the Essentials plan but has over 350 financial metrics, 10 years of detailed financial history, data export, rank screening, screening with historical data, ETF screening, over 100 charts of all financial metrics, advanced alerting, detailed portfolio analytics, future dividend income projections, correlation analysis, trading planning and rebalancing tools, multi-monitor and support, and integrated comments/notes facilities.

The plan is available at $17.99 per month, or $179.99 per year, once again giving you the equivalent of two free months of service.

Premium Plus – $279.99 per year (77 cents a day)

This version offers everything in the Premium plan but has over 650 financial metrics, equation screening, historical data screening, stock ratings, stock fair value and margin of safety, current and historical stock scoring, investor warnings, ratio charts, user-defined custom metrics, much higher data limits, and top priority email support.

The plan is available at $27.99 per month, or $279.99 per year, giving you 12 months of service for the price of 10.

Here’s a video by Ken Leoni, VP of Marketing of Stock Rover, explaining Stock Rover’s screener in a bit over 10 minutes:

Our detailed Stock Rover review has more information.

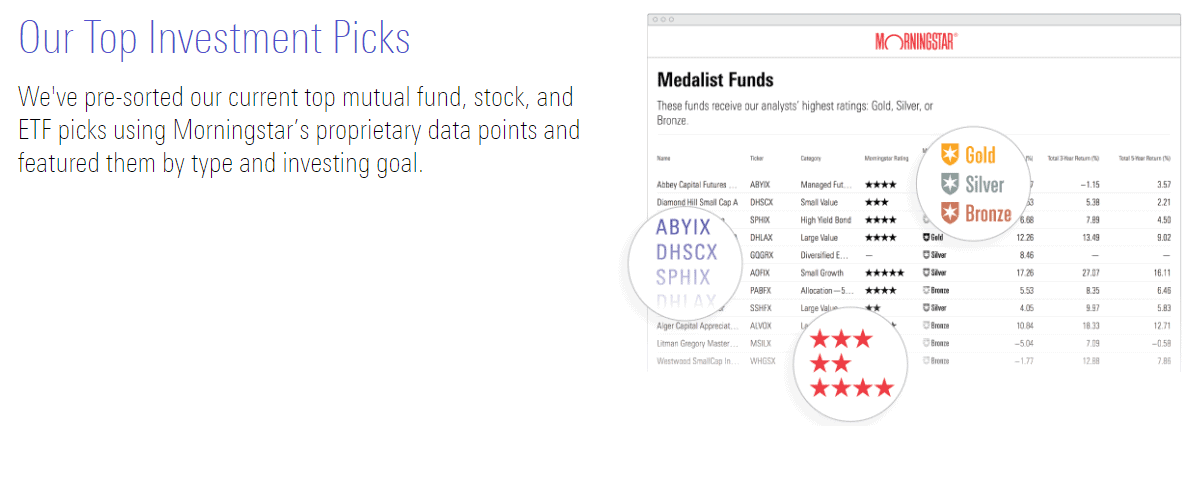

Morningstar

Morningstar has the advantage of being one of the most recognized and respected names in the entire investment universe. Not only does it offer stock screeners for individual investors, but the company is an established source of investment information among many of the largest brokerage firms and financial news agencies in the world.

Morningstar offers two different versions of its stock screener. The first is Morningstar Basic. It’s a free service but it’s extremely limited, offering a greatly reduced number of screening tools, as well as reduced Portfolio X-Ray and Portfolio Manager capabilities.

However, Morningstar Premium provides the complete package. It provides analysis and ratings of stocks, bonds and funds. And while it can be used for both ETFs and mutual funds, it’s traditional emphasis has been on mutual funds.

It has analyst reports, top investment picks, the Morningstar Portfolio Manager and Portfolio X-Ray, as well as the full lineup of stock screeners. It also comes with tools and worksheets, including a budget worksheet, goal planning worksheet, net worth worksheet, and personal cash flow statement.

Meanwhile, the Morningstar Investment Classroom offers a self-study course to help you learn more about investing as well as the basics of portfolio construction.

Morningstar offers the following fee structure:

- $29.95 per month, or $199 if you pay annually (54 cents a day)

- $349 if you commit to two years (47 cents a day)

- $449 if you commit to three years (41 cents a day)

If you take advantage of our Morningstar Premium discount promotional code, you can receive the following discounts:

- $30 off a one-year membership

- $70 off a two-year membership

- $100 off a three-year membership

In either case, you’ll get the benefit of a 7-day free trial to test that the program and see if it works for you.

Here’s our full review of Morningstar Premium.

For a limited time, Morningstar Investor is discounted by $50!

It comes with a 7-day free trial so you can lock in your savings, try the service, and cancel if you don’t think it’s for you.

Get a 7-day trial and up to $50 off Morningstar Premium

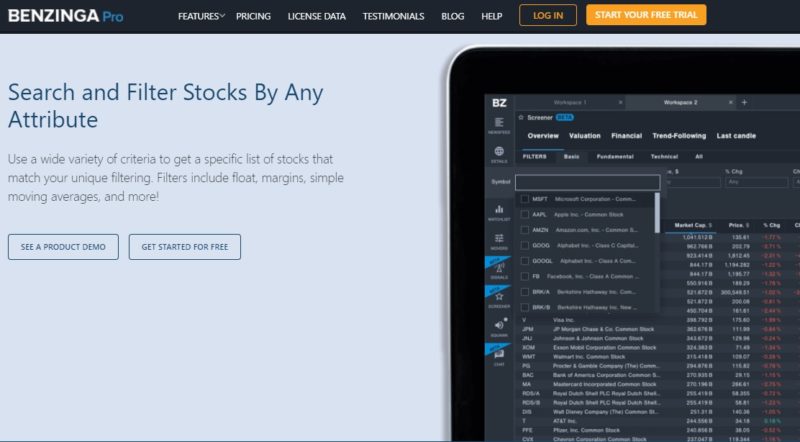

Benzinga Pro

Benzinga is a well-known investing news site that covers everything from the public markets to crypto. They have a variety of free newsletters including a premarket activity update, a “market in 5 minutes,” and even one on SPACs, which have been popular recently.

Benzinga Pro is their suite of investing tools that includes a powerful stock screener that you can use to help filter out the universe of stocks into a smaller basket for further analysis. The big question is whether a news site that has developed a suite of tools is worth using.

At the moment, their stock screener is in “beta” so I’d expect them to add more functionality as time passes. There are a variety of filters you can use but the two major “categories” are a technical screener and a fundamental screener.

On its own, I think the screener itself is about the middle of the pack (remember, it’s still in beta) but worth mentioning as part of their suite of tools. For example, one of the more interesting other features is their “Why Is It Moving?” indicator on a stock – it’s a simple one sentence description that aims to explain why a particular stock is moving the way it is (such as an analyst upgrade or downgrade).

Benzinga is offering a big 25% off discount on their Benzinga Pro subscription.

It’s normally $49 a month but for a limited time they’re dropping it to just $37 a month.

Get a 14-day trial and discount off Benzinga Pro

Finbox

Finbox bills itself as “the most complete toolbox for investors”, and it’s not hard to see why. It’s one of the most comprehensive stock screeners available. It offers more than 800 financial metrics and even allows you to export data to Excel, Google Sheets, and CSV file formats. It also provides watch lists, charts, hedge fund portfolio trackers, and preset screens.

Not only can you get information on US stocks, but also on virtually any publicly traded company around the globe. That takes in more than 100,000 stocks on over 135 exchanges. They’ve even partnered with S&P Market Intelligence for fundamentals and forecast data. The stock screener can support more than 1,000 metrics, including price-to-book ratios, free cash flow yield, and EV/EBITDA.

Finbox offers three different plan levels:

Free

This plan provides access to whitelisted metrics, unlimited watch lists, whitelisted screener filters, view and edit financial models, and the ability to import 5,000 spreadsheet data points.

Starter – $15 per month, billed annually

Thie starter plan includes everything in the free version and adds data for US stocks and premium metrics, premium screener filters, and the ability to import 250,000 spreadsheet data points. However, there is an extra charge for non-US stocks with this version.

Professional – $58 per month, billed annually

This plan includes everything in the Starter plan, as well as data on all global regions, premium metrics, and premium screen filters. You’ll also have unlimited website exports and the ability to import 1 million spreadsheet data points.

FINVIZ*Elite

FINVIZ*Elite, short for Financial Visualizations, is one of the top stock screeners available. It offers real-time quotes, charts, premarket data and provides email alerts. It works with both technical analysis and fundamental data. Perhaps one of the more interesting features is the ability to backtest your trading activity against historical data (and includes 16 years of historical data).

You’ll be able to use the screener for up to 100 portfolios, up to 100 tickers per portfolio, and 100 screener presets.

Elite is available for $39.50 per month however you can pay on an annual basis at $299.50. Using the yearly subscription, the monthly breaks down to $24.96.

The one disadvantage with FINVIZ*Elite is that it is a very technical stock screener. Designed primarily for advanced investors, it’s not recommended for new or even intermediate investors.

However, they also have a free version in FINVIZ. It’s not as powerful as the Elite version because it’s not real time quotes but has the capability to filter on nearly 70 factors. It’s an excellent alternative for new and intermediate investors to learn how to up their games.

Our FINVIZ review has more details.

Yahoo! Finance

Yahoo! Finance isn’t one of the more comprehensive stock screeners on this list, but it does have the advantage of being free to use. And it’s one of the most popular stock screeners at that, particularly among new and more casual investors.

The screener offers just 19 preset screens and does come with built-in mutual fund and bond screener capabilities. You can use the screener at any time however you will need to become a registered user to save any custom information.

Final Thoughts on the Best Stock Screeners

If you are or plan to invest in individual stocks, even on a casual basis, it’s best to become familiar with a good stock screener. You may even want access to one if you invest strictly in funds.

As a new investor, it will likely be better to start with a free stock screener, like Yahoo!Finance. Many large brokerage firms offer some kind of stock screening capability, at least on a limited basis.

But as you become more advanced in your investing activities, and especially if you become a more active trader, you’ll certainly need to seriously investigate and consider a premium stock screener. The free screeners, while better than nothing, won’t cut it for advanced trading, at least not if you want to be profitable.

Select one of the premium stock screeners above, become familiar with it and you’ll find yourself making better and more profitable investment decisions going forward.

If you are also looking for a stock broker here is our list of stock brokers that offer free trades.