Current is a neobank that makes it easier to manage your money. They offer up a Basic Checking and Premium Checking account, through Choice Financial Group or Metropolitan Commercial Bank, which means your money is FDIC insured up to $250,000 per account.

It’s just like a regular bank, with full FDIC insurance, except it’s technically a neobank.

That said, did you know that you can get $50 when you open an account and satisfy a few easy conditions?

Yes!

Here are the details:

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Table of Contents

Current.com $50 Welcome Bonus

Current Bank will give you $50 when you join and open a Premium Checking account and:

- Enter the Current Promo Code WELCOME50

- Connect a Payroll Direct Deposit of $200 or more within the first 45 days of opening your account (this must be from an employer or payroll provider by ACH deposit)

That’s it – it takes less than 2 minutes to sign up and the reward is paid 10 business days after the deposit is made to the account.

The only restriction is that you must be a new, first-time Current account holder and you cannot pair it with a referral reward.

The Current Premium Account has quite a few perks that you may like in your main bank including:

- Fee-Free overdraft up to $100 (if you have $500 in qualifying direct deposits each month)

- Get paid up to 2 days faster

- Mobile deposit through your phone

- Up to 15X points and cashback with your card at participating merchants

What Counts as a Direct Deposit?

The terms and conditions state that it must be from an employer or payroll provider by ACH deposit. I was able to accomplish this with a transfer from my Ally Bank account.

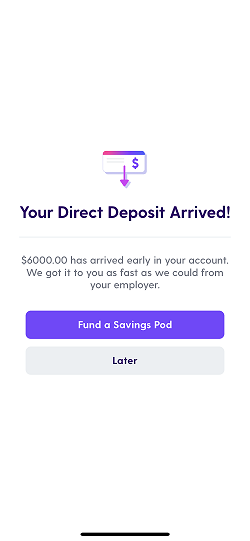

I set up the link from the Ally Bank side, which required the typical “two small deposits confirmation” process, and then initiated a $6,000 transfer from Ally Bank to Current. You only need $200 but because you get 4.00% APY on up to $6,000 in savings (you can set up three “Savings Pods” that each earn 4.00% APY right now, with a maximum of $2,000 in each pod), so I opted to do that.

Within a few days, I saw this in the app:

How Does This Offer Compare?

If you are looking at opening a Current account, this offer is better than no offer. You might as well get fifty bucks if you’re going to be opening the account anyway!

(here’s our Current review to see if you will want this account)

What I find most appealing about Current is that with the savings pods, you can earn 4.00% APY on up to $6,000.

If you’re searching for a bank and want to find the highest cash offer available as a bonus, $50 is not great, especially for an offer the requires a direct deposit. I think a good bonus starts at $100 and many are in the several hundreds of dollars.

Here are some of the better ones:

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.