In another life, I wrote process management software for large organizations in the government. These organizations had processes that “evolved” out of years of personal relationships and massive three-ring binders. (It wasn’t until that job that I learned Excel spreadsheets had limits to the rows and columns in a sheet!)

The processes had become extremely difficult to manage, with frequent mistakes, because it was too complicated. It relied on memory and relationships. The leaders of the organizations realized this and tasked us with solving this problem.

Whenever we worked with a new organization, our first task was to document their processes. Then we simplified it. Then we built a process management package that helped them get greater visibility into their process.

When I looked at my own personal finances, I realized I had a similar challenge.

I opened accounts whenever I needed them. I haphazard connected them. I signed up for bank promotions at every turn. I got credit cards and threw old ones in a drawer so they wouldn’t hurt my credit score. It was a mess.

Today, my financial foundation looks well-designed. But it didn’t start out that way.

Like Michaelangelo famously said about the statue of David, you simply chip away everything that isn’t the statue of David. Duh.

So that’s what I did!

Here’s how you can do the same.

Table of Contents

Draw Your Financial Map

Before you can improve anything, you need to understand it.

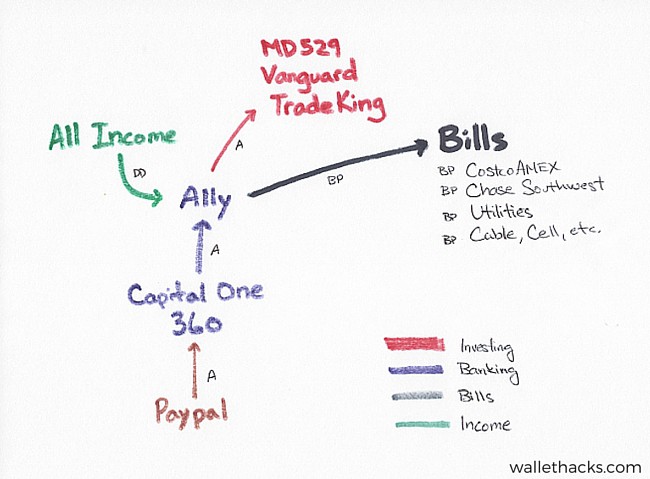

(this map is from years ago – Tradeking was acquired by Ally in 2016 – thus helping me simplify without me having to do anything!)

The first step is to draw your financial map. A financial map is a drawing of all your financial accounts and their relationships with one another. It shows you which accounts are connected, through online links that allow you to initiate transfers, the roles of each, and helps get that model out of your head.

It also identifies areas where you have accounts you don’t need and could even help you remember accounts you’ve forgotten. So many instances of Missing Money are bank accounts people forget after they’ve moved.

Reshape Your Financial Map

Your map may look like a mess of arrows and circles. That’s OK.

Before you simplify, you want to set up your system within the existing mess. It sounds counterintuitive but you’ll be cutting away accounts. You don’t want to cut and reconnect accounts at the same time.

You want to shape your map into what you want it to end up being. You do this so that when you start closing accounts, you don’t run into any issues with people paying you or you paying other people, etc.

You want to select a checking account as your hub and start getting into the habit of using it as a hub. Our paychecks go into this hub and all of our bill payments are paid out of this account. I like designating a single account as the hub so I can see everything in one place. You can opt for whatever you’d like, but the result is that these accounts are keepers.

Start Closing & Consolidating Accounts

Once your hub is set, and you can wait a few months or even a year just to be sure, you can start closing accounts. There is no cost or penalty to close a bank account.

With brokerage accounts, there may be a cost for an account transfer. The system is called ACATS, which stands for Automated Customer Account Transfer Service, and some brokers charge a small fee to transfer accounts. This allows you to transfer assets as assets, rather than liquidating them and transferring cash. This may be better since a transfer has no tax implications while liquidation does. (many brokers will offer a new account bonus to help offset this cost)

If you have 401(k) plans at previous employers, you may wish to roll them over into a Rollover IRA. They’re just like a 401(k) from a tax perspective, you just get a lot of options if your previous 401(k) was limited. Here are what you should consider when rolling over a 401(k). And if you are intimidated by the process, a service like Capitalize can help you.

You don’t have to cancel or transfer everything at once. You can opt to do the easy stuff first, like bank accounts, and push off the more involved ones, like brokerages, until later. Or you can get lucky like me and have Ally Bank acquire TradeKing and never deal with it at all. 🙂

As for credit cards, you have a few options if you’re concerned about your credit score. If you intend to need your score (buy a house, car, etc.), don’t do anything with it just yet. If you own a car and own a house, with no near term loan needs, you can take a small hit by closing a credit card. Opt for the newer ones first, so you keep the average history as high as possible, or the smaller credit limits, so you keep your utilization down.

I recommend using only one or two credit cards. Keep your life simple. The added benefit of a third, fourth, or fifth card is rarely worth it. You can stick the rest in a desk drawer if you’re concerned about a lower score from canceling.

Lastly, if you do cancel cards, make sure you increase the credit limits of the others to limit the minor damage.

Redraw & Improve Your Financial Map

Once you’ve pared away some of the fat, redraw your map and think about how you might improve it.

I don’t like trying to improve a process while I’m simplifying it because you can get stuck in the weeds. It may be tempting to try to tweak things here and there but all that time you spend researching may slow down the simplifying process.

The only exception to this is if you decide to select a new checking account hub. If you’ve been using a brick-and-mortar bank with a ridiculously low-interest rate (they all do), it makes sense to switch to an online bank that might offer you more. Since you’ll be updating your other accounts, this is an improvement I can get behind.

Keep Simplifying

From time to time, go back to your map, update it, and simplify in areas where you don’t see a benefit for that complexity.

When you draw your financial map – send it to us! We’d love to see it!

Automate As Much As You Can

After your financial map has been decluttered, you need to automate as much as you can. A simple system is great. A simple system where you’ve automated as much as you can is even better.

I automate my saving, by setting up automatic transfers wherever they need to go, and I automate my bill pay. I do this for monthly bills, like my utilities, as well as my credit card payments. We don’t carry a balance and our monthly balance is roughly the same (I monitor transactions so I don’t get surprised by the statement), so this is fairly routine for us. There’s no reason for me to have to log into my bank account and pay a utility bill or a credit card. That’s just another thing to potentially forget.

The only bills I pay manually are those that I only see annually, like a heating oil delivery or propane delivery. Everything else is automatic.

Digitize Your Records (Especially Paper)

My post on how to organize your financial documents gives a step by step guide to how to organize the mass of paper you may be getting from your financial institutions, but the key rules are simple.

- Digitize everything.

- Keep the original if it government issued, notarized, personal property, tax or loan related. Shred the rest.

99.9% of the paper you get is useless. And that’s after you sign up for paperless/electronic statements.

I scan it if I can’t download it and I keep the original if the original is really hard to get.

Cut Services You Don’t Need

As you drew your financial map or automated your bill pay, you probably saw some services you were paying for. Consider simplifying your life by cutting those away.

By reducing those expenses, you reduce one other thing to worry about, you save a little extra money, and your finances are just a little more streamlined to what you want.

It can seem like a never-ending process, that’s OK, just keep at it and your life will get easier and easier.

And one day you’ll look back and see a statue. 🙂

What will you do next to simplify your finances?

Great Post Jim – I recently went through a similar process. It took over a year to do the basic bank account and credit card changes (ie. stop using, run off balances and wait time) with another year to restructure the investments. After we retire we’ll reduce again. (Move 401k’s to IRA, combine the investments as a couple to reduce number of funds) Well worth the time and effort to simplify! Much easier to manage. As a side note, it really didn’t affect our credit scores. We did increase the limits so that may have reduced the impact on the… Read more »

It took me a long time too because I was afraid closing an account would inevitably mean some random charge would go on it from something I forgot… but that never happened.

Closing an account but increasing the limits on others definitely mitigates any negative effects. History vs. credit utilization, I suppose. If you don’t need your score for something, like a major loan, then your score isn’t that significant. It’s only right before a loan and if you are on the border of different ranges (average vs. good vs. excellent), that’s when you should avoid major changes.

Just realize that requesting a credit limit increase can lead to a ‘hit’ on your credit score as it often is considered a “hard inquiry” as the creditor needs to reevaluate. Probably shorter-term hit though and not a heavy hit either.

If you request one and it’s approved instantly, it’s a soft inquiry. If they need more information, that may be a hard one and you should decline to avoid the hit.

I’m curious. Did you really cancel all old cards you don’t use and only have 1 or 2 open credit cards presently? I have been reluctant to shut down older cards that I don’t use for the reason you cite above (credit score hit). But I probably will do this as it is annoying having extra cards around.

Great article. Yours is some of the best personal financial writing I know of.

Sincerely,

Tom

I did not cancel all the old cards but my oldest recently cancelled me! Discover told me that since I hadn’t used the card in a few years, it was gonezo unfortunately. I missed that card, I used to buy all my ebay side hustle stuff with that card… so much so that I memorized the number.

Thanks for the compliment Tom!

I had a feeling that, like me, you just can’t bear to unnecessarily ding your credit score–even if it is hovering well north of 800. 😉

I may slowly cancel them, to spread out the dings, but a card in the drawer doesn’t really hurt my system. 🙂

I actually cancelled them. I had 5 different cards, my wife had 8. The department store or specialty cards sucked us in over many years. We now have one joint card that we use for all online activity, vacations and gas. (No real logic on the gas except it helps us compile the expense data.) Changing to one joint card for online took time, but oh so worth it. We now only need to watch one card closely and if something happens we would just change any online account to a new card. We each have one other card that… Read more »

Cool post Jim. Never thought about simplifying in this way. This is something I’m going to do since I just transitioned into self employment and have a 401k to rollover and other accounts to clean up.

Have you been watching Marie Kondo???

Ha I haven’t – I did get her book many years ago but didn’t read it through!

Love this post. I’ve been on a bit of a simplification / minimalist kick lately and this post definitely hit the spot. I love the automating idea. I’ve automated all the bills I could automate (to pay from credit cars preferably). One thing that I find VERY useful is Personal Capital! I know you mention that with your link at the bottom in the “about me” section. But it deserves a spot above the fold! Even after simplifying, I still have quite a few accounts with various companies. Personal Capital gives it all at a glance on the phone app.… Read more »

The Notes app has been great for us because I can quickly scan documents and email them to myself, which is far easier than putting them in a scanner at home. This also means that I deal with it now, rather than in a pile next to the scanner.

Personal Capital is a very useful tool but I didn’t think it fit in the article – still great though!

Thank you, Jim for confirming that my actions are so far so good. When my Husband died 4 yrs ago I had already put everything you mentioned on autopay. As bills were finished I had to remember to quit paying them. This took some focusing, and rewarding.

I have been pretty loopy about other money and have wasted quite abit. I am really getting it together now and your article couldnt have come at a better time…oh, yes, it could have curbed my “giving money away” spell I went through. Thank you for sending this one..and more.