Millions of people have 401(k) plans from previous employers, usually parked with the same old account. Sometimes these plans are forgotten for several years. If that describes one or more plans you have with previous employers, you may want to take a close look at a service called Capitalize.

Capitalize specializes in helping you transfer your old 401(k) plans – with their high fees – to tax-sheltered, low-cost, IRA accounts where you can monitor them more closely.

The best part – they do this for free.

Table of Contents

What is Capitalize?

Capitalize Money, Inc. – Capitalize for short – is a service that makes rolling over a retirement plan held with the previous employer a snap. They can help you with the rollover of either a 401(k) or a 403(b) plan. They can even help convert a traditional plan to a Roth IRA.

Your old plan will be rolled over into an IRA account. Even if you don’t have an IRA to transfer the old plan to, Capitalize will help you set up an account with one of their partner platforms, which includes some of the most popular investment services in the industry.

One of the best features of Capitalize is at the service is completely free to use. In fact, you can use it as often as you like for as many plans as you have.

The company is not rated by the Better Business Bureau, but it does have 4.9 out of five stars with Trustpilot.

How Capitalize Works

Capitalize uses a three-step process to move your old 401(k) or 403(b) plan from where it is now, to where you want it to be.

1. Tell Capital where your old plan is

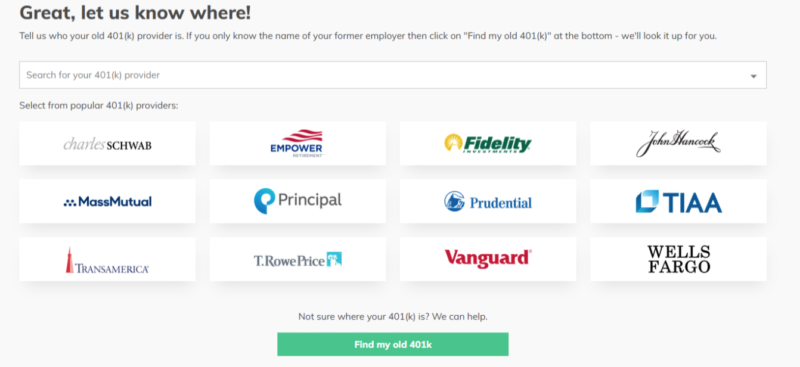

That will mean providing the name of the account trustee where the plan is held. Typically, this is an investment brokerage firm or a mutual fund family. But even if you don’t know where the plan is held, Capitalize can help you find it. Simply by letting them know the name of your previous employer, they’ll likely have the plan administrator information available in their database. If not, they’ll work to find it.

2. Choose your IRA

If you don’t already have your own IRA, Capitalize will take you through the process of setting one up. You’ll be asked a series of questions so they can best determine the options available, including investments, fees, and other features among, several plans. You can then choose the IRA you feel will work best for you.

Capitalize will help you determine which IRA is right for you. For example, if you’re primarily interested in investing in options, they’ll recommend a broker that has a strong emphasis on that type of trading. If you prefer fund investing, they may direct you toward Vanguard or Fidelity, both of which offer a wealth of both no- and low-cost mutual funds and exchange-traded funds.

3. Capitalize connects with your old plan administrator to make the move

You won’t need to contact your previous employer or the administrator for your old plan. Capitalize will do that for you. They’ll contact the provider, handle any administrative details, and make sure the transfer is completed correctly. You’ll also receive updates to keep you in the loop during the process.

Why Move an Old Retirement Plan into an IRA?

What are the benefits to moving an old retirement plan into an IRA?

There are many reasons you might want to rollover your 401(k) but here are some of the most important:

Increased visibility. Once you leave an employer, you may no longer keep track of the retirement plan you have there. As a result, you may be unaware of changes to the plan, such as increased fees or more limited investment options. By moving the account to an IRA you’ll be able to monitor the account on an ongoing basis.

Reduced fees. Employer-sponsored retirement plans tend to be fee-heavy, with many hidden out of sight. For example, the plan may have an annual fee, charge commissions for security transactions, invest in funds with high expense ratios, or even impose load fees on mutual fund options. Those fees will reduce your investment performance and the long-term value of your plan.

But in an IRA account, you’ll be able to choose low- and no-fee options. Not only will you know exactly what these are, but you’ll also be able to improve your investment returns by keeping them to a minimum.

Retirement account consolidation. It makes little sense to have your retirement nest egg spread out across several different plans. Not only is it more cost-effective to consolidate your accounts, but it’s also easier to manage and track your portfolio, and develop a comprehensive asset allocation plan.

Roth IRA conversion. This strategy has become popular in recent years, as investors look to create tax-free income for their retirement years. One of the best ways to do this is by converting old retirement plans into a Roth IRA. This is often called a “backdoor Roth”. You can read more about backdoor Roth’s here.

Capitalize Features and Benefits

Customer service: email contact only.

Mobile app: not offered.

Fees: None. Capitalize will earn a fee if you choose to move your plan to an IRA trustee recommended on the platform. But there will be no cost to you for using the selected account.

Direct assistance: A rollover concierge will be available if you have any questions about the process.

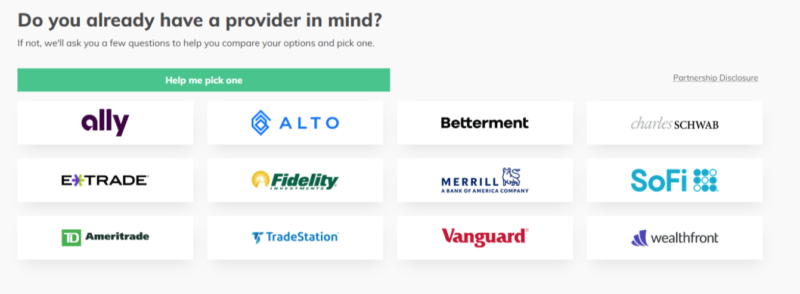

IRA Custodians used: Charles Schwab, Vanguard, Betterment, Wealthfront, Fidelity, TD Ameritrade, ALTO, SoFi, Personal Capital, E*TRADE, Ally Invest, Merrill Edge, TradeStation, and other popular investment services.

Account security: They are not covered by FDIC or SIPC, since Capitalize isn’t a broker, and doesn’t take custody of your assets. To protect your information, Capitalize implements and maintains reasonable administrative, physical, and technical security safeguards to protect your information from loss, theft, misuse, and unauthorized access. However, they do not disclose exactly what those safeguards are.

How Capitalize Makes Money

Capitalize keeps this service free by earning commissions when you open a new account. Some, not all, of the brokerages they work with pay commissions for referrals to their service.

Their affiliate partnerships don’t seem to greatly influence who they work with considering they offer with most of the major brokerages, including Vanguard and Fidelity. Your choices are not limited to only those who have a relationship with Capitalize.

How to Sign Up with Capitalize

The sign-up process with Capitalize is surprisingly easy. It’s accomplished with a series of easy-to-understand input screens. In addition to the information that will be requested on those input screens, you should also be prepared to provide some personal information, including your date of birth and home address.

The sign-up process looks like this:

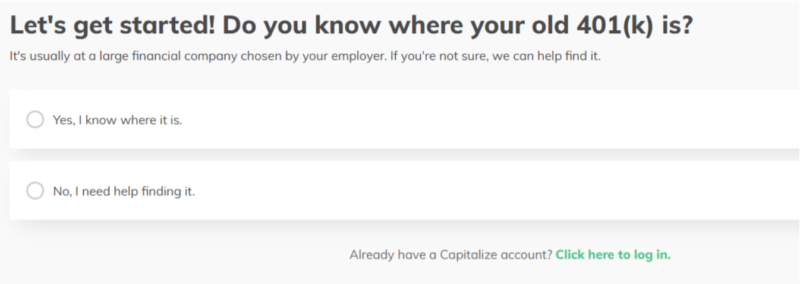

You’ll first be asked if you know where your old 401(k) is located. But don’t worry if you don’t, since you are given an option to get help finding it. Capitalize has a database of employer pension plans and where they’re located. But even if an employer or a plan isn’t in the database, they can still help you locate where yours is being held.

If you check the box indicating you know where the plan is held, you can choose from one of the dozens of investment services listed in the drop-down menu.

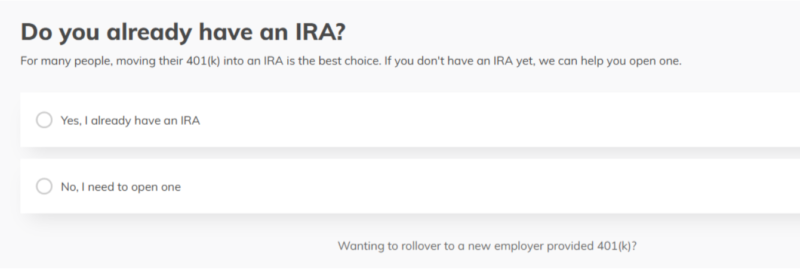

Once you’ve selected the current plan trustee, you’ll next be asked if you either already have an IRA to transfer the employer plan into, or if you need to open one.

I indicated having an IRA plan in existence, with Fidelity. But if you don’t have an IRA already set up, and need to choose one, Capitalize helps you to make that choice. We’ll cover that process in more detail at the end of this section.

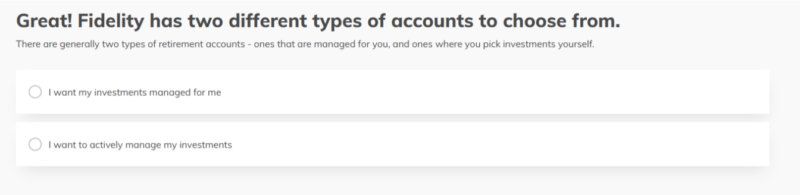

Once I selected Fidelity, I was presented with a choice of either a managed investment option or actively managing my own investments. I chose self-directed investing.

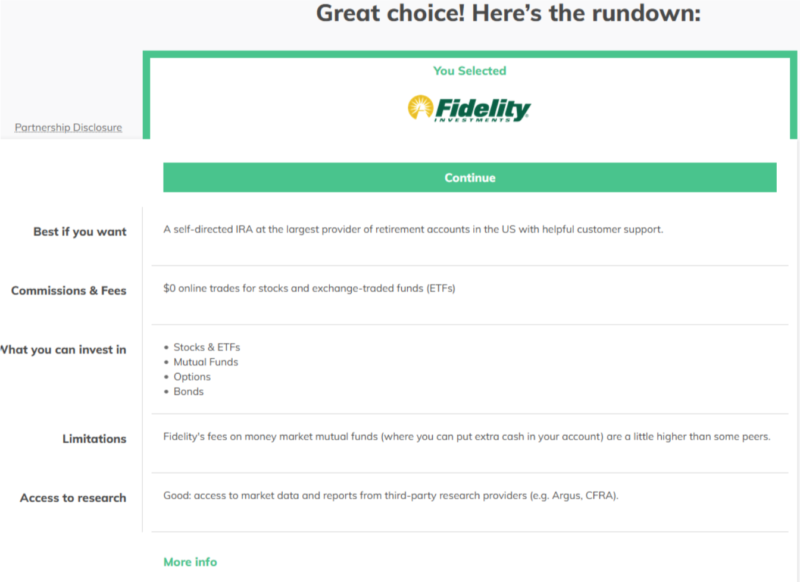

On the next screen, I was presented with the general services Fidelity offers. You can click “More Info” at the bottom of the screen to open up much greater detail about the broker you’ve chosen.

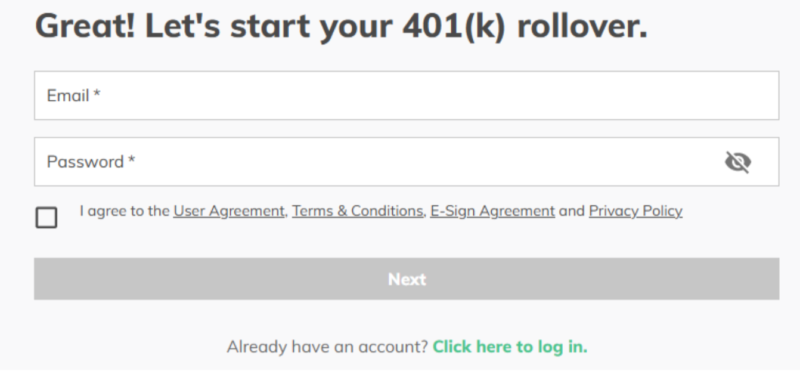

Once you’ve selected an IRA trustee, you’ll enter your email address and choose a unique password. That will establish your account, and begin the process of transferring your old retirement plan into the IRA account you’ve selected.

Choosing a New IRA

What happens if you don’t have an existing IRA to transfer your plan into, and are not sure which custodian will be best for you?

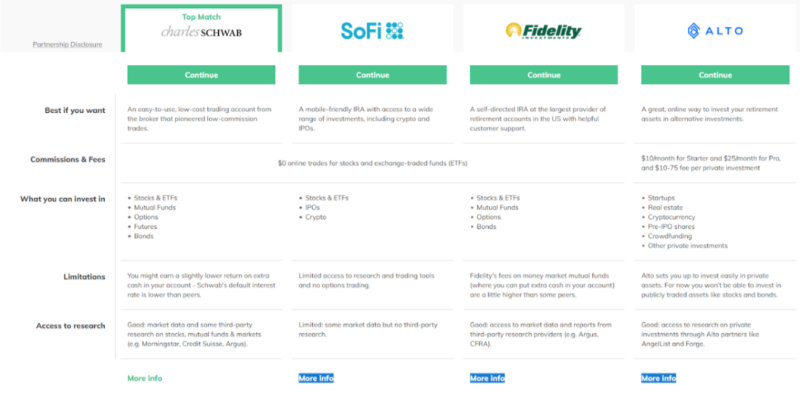

Under the screenshot above that asks “Do you already have an IRA?” you’ll have the option to investigate several investment platforms. Capitalize will present you with a side-by-side comparison of the trustees that provide the investment services you’re looking for in your IRA account.

The comparison information above is in summary form, but you can get greater detail by clicking “More Info” under each broker.

Capitalize Pros and Cons

Pros

- The service is free to use.

- Capitalize handles all the details of transferring your old retirement plan to a new or existing IRA account.

- If you don’t have an IRA, they’ll help you open one with some of the top IRA custodians in the industry.

- Choose a self-directed broker or a robo-advisor for a managed investment option.

- You can use Capitalize to transfer multiple old retirement plans.

Cons

- No mobile app available.

- Customer service is limited to email.

- While Capitalize does facilitate the transfer of your old retirement plan to a new IRA, they don’t provide financial or tax advice.

Capitalize Alternatives

Capitalize is virtually a unique service for transferring old retirement plans into IRAs. It’s a relatively new service, and for that reason, it has no direct competitors.

Moving an old retirement plan to an IRA is a multistep process, and you can find instructions on how to do it yourself in various web articles, and even through investment services that offer retirement plan rollovers.

But if you don’t want to go through all that’s involved in making the transfer, you can sign up for Capitalize – free of charge – and they’ll handle the entire process for you.

Should You Sign Up with Capitalize?

Moving an old retirement account to an IRA isn’t the most pleasant of tasks, particularly if the old plan is really old. It may be difficult to track down and have quirky procedures that are not meant for the average human being to understand. Capitalize can help you navigate that process with a minimum of effort on your part.

Given all the reasons for closing out an old retirement plan and moving it to an IRA, you owe it to yourself to take advantage of this service as soon as possible. This is especially true if you have several plans with previous employers. Not only will those plans involve multiple fee structures, but it’s very difficult to develop a comprehensive investment portfolio across different plans, some of which may have very limited investment options.