Acorns

Product Name: Acorns

Product Description: Acorns is a micro-savings platform and a robo-advisor that makes it easy to invest your spare change.

Summary

Acorns is a micro-savings platform and a robo-advisor that makes it easy to invest your spare change. Unfortunately, high monthly fees make the platform less suitable for investors with small portfolios.

Overall

Pros

- No account minimum

- Convenient Round-Up Savings feature

- Intuitive user interface

Cons

- Monthly fees are high for small portfolios

- No tax-loss harvesting feature

- No human advisors

Acorns is a micro-savings platform and a robo-advisor that makes it easy to invest your spare change. It also offers competitive checking and savings APYs, and you can earn rewards when you shop online at thousands of Acorns retail partners.

At A Glance

- Round Up savings feature lets you save and invest seamlessly

- Expert-built ETF portfolios

- Competitive checking and savings APYs

- Acorns Earn rewards you for shopping at thousands of retail partners

Who Should Use Acorns?

Acorns is a useful app if you have difficulty saving and investing money. It automates the entire process, from saving and accumulating investment funds to handling your account’s investment activity.

You set your Round-Ups and connected spending accounts and determine your portfolio, and Acorns handles the rest. That includes investment selection and management, account rebalancing, and even dividend reinvesting.

Acorns offers value but comes at a small cost, though that cost is comparable to similar apps that offer both micro-savings and micro-investing features.

Acorns Alternatives

| |||

| Monthly Fees | $3-$9/month | $4/month or 0.25% AUM | $0-$3/month |

| Min. Investment | $5 | $0 | $100 |

| Robo-Advisor | Yes | Yes | No |

| Learn More | Learn More | Learn More |

Table of Contents

- At A Glance

- Who Should Use Acorns?

- Acorns Alternatives

- What Is Acorns?

- How Acorns Works

- The Acorns Investment Portfolio

- Custom Portfolios

- Acorns Later – Retirement

- Acorns Early – Invest for Kids

- Sustainable ESG Portfolios

- Bits of Bitcoin – Bitcoin ETF

- Mighty Oak Banking

- GoHenry by Acorns (Banking for Kids)

- Acorns Earn

- Acorns Learn

- Acorns Fees

- Signing Up With Acorns

- FAQs

- Summary

What Is Acorns?

Acorns is a micro-savings platform and a robo-advisor that makes it easy to invest your spare change. Each time you make a purchase, the purchase amount is rounded to the next dollar amount, and the difference between the rounded up payment and the actual purchase price of the product or service you are buying goes into your investment account. You can also make lump-sum deposits or set up automatic contributions to your Acorns account.

How Acorns Works

Upon downloading the Acorns app, you will link your spending accounts, including your checking, PayPal, and credit cards. Any time you spend money using any of those accounts, Acorns will create what are known as “Round-Ups.” That’s the difference between a predetermined rounded-up dollar amount and the actual purchase price of the product or service you are buying.

For example, you can round up your purchases to the next dollar or the next $10. If you round up to the next dollar, a purchase of $1.57 will charge your account $2.00, with $0.43 going into your Acorns investment account.

If you set the Round-Up to the nearest $10, a purchase of $8.25 will charge your account $10, with $1.75 going to your Acorns account. You can accumulate Round-Ups by connecting multiple credit and debit cards to the Acorns app.

Each time the Round-Up reaches $5, the money is transferred into your investment account. It is then invested in a group of exchange-traded funds (ETFs). This gives you the benefit of professional, completely automated investment management.

✨ Related: How to Get Free Stock From These 8 Brokerage Companies

The Acorns Investment Portfolio

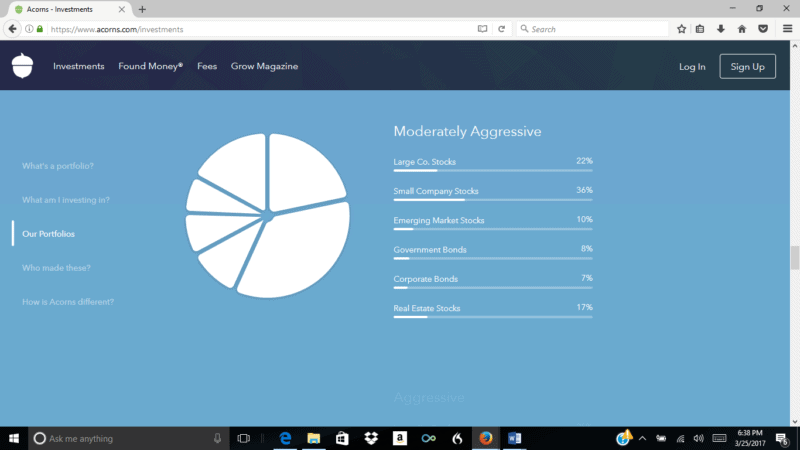

Acorn’s investment portfolio works similarly to other robo-advisors. Your account is invested based on modern portfolio theory, MPT, which favors diversification into different asset classes over individual security selection.

In that way, Acorns can build a well-diversified portfolio by investing in just six asset classes: large companies, small companies, emerging markets, government bonds, corporate bonds, and real estate stocks.

They do this by investing in a mix of ETFs corresponding with each asset class. ETFs are provided by Vanguard, PIMCO, ProShares, Blackrock, and other well-known fund families. Acorns builds your portfolio from a mix of ETFs from a list of 22 funds.

Your portfolio is determined by your age, your investment goals, your time horizon, your income, and your risk tolerance. Considering all these factors, Acorns then determines your portfolio to fit into one of five different portfolio classes:

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

Each portfolio contains a different mix of ETF allocations. For example, the Conservative portfolio is 60% in bonds and 40% in stocks. The Aggressive portfolio is 100% invested in stocks, with no bond allocation. The other three portfolios contain a mix of asset classes between the two extremes.

Worth noting is that each portfolio also includes a small percentage invested in Bitcoin, which can range between 1% and 5% of the total portfolio (see Bits of Bitcoin section below).

Once your portfolio has been set, you can always change the allocation. For example, if the app determines a Moderate profile, you can always change your allocation to Moderately Aggressive for more growth potential.

As a robo-advisor, Acorns also offers automatic rebalancing of your portfolio whenever it moves outside of the original allocation. It also provides automatic dividend reinvesting as per your recommended allocation.

The use of ETFs enables you to be diversified across thousands of different stocks and bonds, even with a very small portfolio. And you get low-cost professional investment management, the kind that people often pay thousands of dollars per year to have.

✨ Related: Apps Like Acorns

Custom Portfolios

Acorns Custom Portfolios feature is designed to give you more control by allowing you to add individual stocks and ETFs to your existing portfolio. You can allocate a percentage of your portfolio to Custom Portfolios, such as 10%, 20%, or some other percentage. You can then fill that portion of your portfolio with additional securities.

Acorns Later – Retirement

Save for retirement through Acorns Later by opening a traditional, Roth, or SEP IRA investment account.

Acorns Later includes the following:

- The same investment features and methodology as Acorns Invest.

- You can set up recurring contributions in any amount you choose. Acorns Smart Deposit will automatically invest part of each paycheck.

- Income tax deferral on traditional and SEP IRAs and tax-free distributions on a Roth IRA.

You can begin investing with Acorns Later with just $5. There are no fees specific to Acorns Later, apart from a monthly fee based on your Acorns plan.

Acorns Early – Invest for Kids

Acorns Early lets you set up investment plans for your kids. There are no additional fees, but you must subscribe to the Acorns Premium plan, designed for families. There is a monthly fee, which is described under Acorn Fees below.

As with other Acorns accounts, you can begin investing with as little as $5 and set up automatic recurring investments. You can create an Acorns Early account for each of your children at no extra cost. All you need to do is provide the name, birthdate, and Social Security number for each child and you can create an account in minutes.

Acorns Early is set up as a UTMA/UGMA custodial account, which enables you to use the funds for your child’s education or in any way that directly benefits the child. You can fund the account with regular contributions through Smart Deposit, just as you would for your own investment account or IRA. Acorns Early is even set up to receive gifts from anyone who wants to give.

Sustainable ESG Portfolios

Acorns offers its Sustainable ESG Portfolios for socially-conscious investors. These portfolios target companies highly rated for ESG characteristics. Acorns offers no fewer than four different ESG portfolio options.

The portfolios are designed to provide performance similar to standard Acorns portfolios. They comprise sustainable ETFs from iShares BlackRock, rated highly for ESG based on their Morgan Stanley Corporate International (MSCI) ESG ratings. Each will include a similar mix of asset classes to standard portfolios, but with each ETF having a strong ESG rating.

You can choose the Sustainable ESG Portfolios option directly from the Acorns app by tapping “Select.” It’s available for Invest, Early, and/or Later accounts.

Bits of Bitcoin – Bitcoin ETF

Not to be outdone by its competitors, Acorns has joined the ranks of other robo-advisors in offering a cryptocurrency investment option. Bits of Bitcoin is a standard asset allocation, representing up to 5% of your Acorns portfolio. The position is held in a Bitcoin-linked ETF providing an additional diversification into a true alternative asset.

Acorn’s position is that a portfolio should contain a certain amount of uncorrelated asset classes, which Bitcoin certainly is. That’s because the performance of crypto is not directly correlated with the performance of other financial assets, especially stocks and bonds.

Keep in mind that by investing in ProShares Bitcoin Strategy (BITO), you’ll be investing in Bitcoin futures, and not in the crypto itself. Exactly how much of your portfolio will be invested in BITO depends on your investor profile. If you are a conservative investor, no more than 1% of your portfolio will be held in this fund. 5% will be the allocation for an aggressive portfolio.

Mighty Oak Banking

In a way, this is now the centerpiece of the Acorns system. It’s available with the Acorns Personal Plus plan (see Acorns Fees section below). It provides banking services, including a checking account and emergency fund, and acts as the control center of the Acorns product menu.

Mighty Oak Banking offers the following:

- 3.00% APY on your Checking Account balance

- 5.00% APY on your Emergency Fund balance

- Paycheck split – you can automatically invest part of your paycheck each pay period

- Comes with the Mighty Oak Visa Debit Card, with access to more than 55,000 fee-free AllPoint ATMs

- Get paid up to two days early

- Real-time Round-Ups, with spare change going into your investment account

- Online and mobile banking, including mobile check deposit and digital checks

- Account balances are covered by FDIC insurance for up to $250,000 per depositor

GoHenry by Acorns (Banking for Kids)

GoHenry by Acorns is a banking service for kids under the Acorns Premium (family) plan.

It offers the following:

- A debit card and learning app

- Choice of more than 45 debit card designs

- Chores tracker and automated allowance for kids

- Parental controls with real-time spending notifications

- Award-winning videos and quizzes to teach kids and teens money skills

Acorns Earn

Acorns Earn allows holders of the Mighty Oak Debit Card to earn bonus investments from thousands of top merchants. Examples include Groupon, Chevron, Kohl’s, Hotels.com, Apple, Walmart, Nike, and Expedia.

By installing the Acorns extension, you’ll get bonuses automatically. However, most rewards are earned when you shop through the offers that appear in the Earn section of the app. The bonuses will be invested in stock in your investment portfolio. Once you receive notification of your rewards, which should take three to seven days after making your purchases, the rewards will be invested in 60 to 120 days. The extended investment cycle allows time for returns, adjustments, and cancellations.

Acorns Earn also helps you to earn extra income from side hustles. You can use the Acorns app to locate full-time, part-time, and remote jobs, enabling you to save and invest the income you earn from those gigs. Acorns claims to make over 9 million job opportunities available from the Earn feature.

It’s also possible to earn rewards by inviting friends to sign up for Acorns. Both you and your referral will earn a $5 investment for each completed sign-up..

Acorns Learn

Acorns Lean is a library of financial resources, including videos, articles, and tips on categories such as investing, retirement, savings, borrowing, earning extra money, and financial planning. These resources are designed to help Acorns users become more educated about all things finance and how to use the Acorns app to achieve financial goals.

Acorns Fees

Unlike most robo-advisors, which charge a percentage fee based on the assets under management held with that advisor, Acorns instead uses a subscription fee pricing structure.

There are three different plans:

Acorns Personal ($3 per month) – designed for individuals. It comes with the following:

- An investment account.

- An IRA.

- Spare change investing through Round-Ups.

- A checking account that includes the Acorns Visa Debit Card.

- Acorns Earning.

- Acorns Learning.

Acorns Personal Plus ($5 per month) – provides enhanced features and benefits. It comes with everything in Acorns Personal but adds the following:

- Mighty Oak Banking with an emergency fund earning 5.00% APY and 3.00% APY on checking.

- Bonus investments matched by Acorns up to 25%.

- Live question-and-answer sessions with investing experts.

Acorns Premium ($9 per month) – designed for families, this version includes all the features and benefits of Acorns Personal Plus but adds the following:

- Investment accounts for kids.

- The ability to customize your portfolio by adding individual stocks.

- Bonus investments matched by Acorns up to 50%.

- Banking for kids with GoHenry by Acorns.

- $10,000 life insurance policy for eligible customers.

- No-cost Will to help plan for your family’s future (valued at $259).

Signing Up With Acorns

You can sign up for the Acorns app through the Apple App Store or Google Play, and once again, it’s free to install.

Sign-up will involve providing the following information:

- A valid email address

- Your online banking login information to link your accounts to Round-Up spare change and to fund your investments.

- If you don’t bank with Bank of America, Chase, Citibank, PNC Bank, USAA, US Bank, US Navy Federal Credit Union, or Wells Fargo, you’ll also need your checking account and routing numbers.

- Your physical address-this should be your most permanent address since they can’t accept PO Boxes or business addresses.

- Your Social Security Number.

- General Profile Information like your financial goals, occupation, and earnings. This will help in recommending the right portfolio for you.

- Upload a photo of your government-issued ID or other documentation that helps them verify your identity.

Once you’re signed up with the app, you can add as many spending accounts as you like and you’ll be ready to go.

Acorns vs. Stash

Stash is perhaps the closest competitor to Acorns because it also functions as a micro-savings app with an investment capability. It provides its Stock Back debit card offering up to 3% in stock as you use the card to make purchases, though most purchases will accumulate only 1% in stock.

You’ll have access to a personal brokerage account, a retirement account, and a Smart Portfolio that provides automated investment management.

You can accumulate funds in your investment accounts through a debit card or one-time or periodic contributions. Stash offers two plans: Stash Growth at $3 per month and Stash+ at $9 monthly. Growth is for individuals, while + is for families.

For more details, check out our full Stash review.

Acorns vs. Betterment

If you are looking for a robo-advisor with more comprehensive financial services, Betterment is an excellent choice. It provides fully automated investing and offers a high-yield cash account, currently paying 4.75% APY on balances as high as $2 million.

Betterment also offers a no-fee checking account with a Visa debit card that pays cash-back rewards of up to 5% on purchases. This combination gives you the opportunity to bank with the same company you invest with.

Betterment charges an AUM fee of 0.25% per year on most account balances and offers IRAs, socially responsible investing, and cryptocurrencies. It also offers at least a dozen portfolio options and allows you to customize your portfolio.

To learn more, check out our Betterment review.

Acorns vs. M1 Finance

Unlike Betterment, M1 Finance is not a robo-advisor. While they share some of the advantages of automated investing, it’s a fully self-directed investment platform with no advice component.

If you want more control over your investments, M1 Finance may be the way to go. The platform allows you to create your own portfolios, called “pies.” Each pie can be filled with up to 100 ETFs and/or individual stocks.

Specialized pies can invest in cryptocurrencies. You can create your own pie based on any investment theme, but M1 Finance offers at least 60 prebuilt pies if you’d rather not create your own. Once your pies have been created, M1 Finance provides automated investment management, including periodic rebalancing.

There are no commissions to add ETFs and stocks to your pies and no annual advisory fee for the management of your account. However, effective May 15, 2024, M1 Finance will begin charging $3 monthly for all accounts unless you have $10,000 or more in M1 assets or an active Personal Loan.

M1 Finance also offers a high-yield savings option – currently paying up to 5.00% APY – and a rewards credit card with up to 10% cash back.

For full details, read our M1 Finance review.

FAQs

Acorns can make sense if you are a new investor looking to accumulate savings and begin investing. You can open an account and begin investing with only $5. Acorns provides automated investment management, so you don’t need investing knowledge. All you’ll need to do is fund your account, and Acorns will handle all the details for you, from portfolio creation to rebalancing.

Yes, you can make money with Acorns. It invests as a robo-advisor, building a customized portfolio based on your risk tolerance, investment goals, and time horizon. Your account will be invested in ETFs, each representing a pool of hundreds or thousands of individual securities.

Acorns can diversify your portfolio across different asset classes and companies. The investment strategy is based on buy-and-hold, which has proven to be a moneymaking strategy for generations.

That said, it is possible to lose money investing through Acorns or any other investment service available. Investing carries a certain amount of risk, especially in equity-type investments like stocks.

Yes. Acorns reports that over $20 billion has been invested through the service. It uses 256-bit encryption to provide secure information transfer and up to $250,000 FDIC insurance on checking account balances. Securities are protected by SIPC coverage for up to $500,000 per investor.

Summary

Acorns is an excellent choice if you’re struggling to build a consistent savings habit and want to start investing. In addition to its clever Round Ups savings feature and automated investing platform, you can earn a competitive yield on your checking and savings balances.

The downside of Acorns is the monthly fees ranging from $3 to $9. While not terrible, they will eat into your returns if you only have a few hundred or a few thousand dollars invested.

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value.

*Offer is subject to T&Cs

Good advice. I’ll give it a try. Thanks for offering.

One other thing worth mentioning is they sporadically increase their referral bonus. They did +$500 if you refer 10, I believe in November, and this month they actually have $1000 if you refer 10! On top of the normal $5 for you and for the person being referred.

I closed my Acorns account after less than two years. It was up 23% which was excellent, but my deal breaker was their timeliness of sending my tax info. Last year it was the middle of March and that is what they aim for.

DO NOT INVEST YOUR SPARE CHANGE WITH THESE THIEVES, ACORNS…BETTER TO PUT YOUR MONEY IN YOUR SAVING ACCOUMT, BUY BITCOIN OR SIMPLY BUY TAX LIEN CERTIFICATES, BUT DON’T WASTE YOUR MONEY HERE: AFTER A YEAR, AND DESPITE THE LOW FEDERAL APR, YOUR MOMEY WILL NOT GROW BUT DISAPPEAR.