If you’ve wanted to invest but are having trouble getting started, Stash may be just what you need. Not only do they provide access to investment accounts, but they also can help you learn to begin investing.

Millions of Americans have no investments at all. A primary culprit is the lack of savings to get started. But since Stash can help you learn to budget and start to invest, there’s no reason to delay any longer.

Stash may be the perfect platform for a new investor to begin their investment journey.

Table of Contents

- What Is Stash?

- How Does Stash Work?

- Auto-Stash

- Banking Account

- Stock-Back1®

- Investing – Stash’s Smart Portfolio

- Advice

- Investing Access

- Banking Access

- Insurance Access

- Stash Features

- Stash Plans

- Stash Pricing

- How to Sign Up with Stash

- Who Is Stash Best Suited For?

- Stash Pros & Cons

- Stash Alternatives

- FAQs

- Final Thoughts on Stash

What Is Stash?

Founded in 2015, Stash is a micro-savings and micro-investments app company based in New York City. The app is used by more than 6 million people, referred to as “Stashers.”

The company’s founders, Brandon Krieg and Ed Robinson, are Wall Street veterans on a mission to change the investment status quo that they feel is stacked against ordinary investors. In the process, they created a savings and investment app designed to make investing both affordable and straightforward.

How Does Stash Work?

Stash is primarily an investment service, but it’s also a micro-savings app that gives you the ability to accumulate the money to invest without thinking about it. The feature is known as Auto-Stash.

Auto-Stash

Auto-Stash allows you to save money to invest. It works by investing your spare change from purchase activity.

You can use the Set Schedule feature to make automatic transfers into your investment account from your bank account. You choose the amount and frequency of the transfer.

Banking Account

This is a digital banking service powered by Stride Bank, N.A., Member FDIC1. You can load money into your Stash banking account through your linked bank account or at any one of tens of thousands of retail locations around the country. You’ll also get a Stock-Back® Card1, which you can use to access your cash and make purchases, just as you would with any debit card.

You can also use your Stock-Back® Card1 to access cash at more than 55,000 ATMs within the Allpoint ATM network. There is no fee for accessing money at one of these ATMs.2

You can sign up for the banking account either from the Stash website or mobile app.

Once you have the app up and running, you’ll be able to deposit checks using mobile deposit, or even set up transfers from other accounts, or set up direct deposits into your account.

Stock-Back1®

When you use your Stock-Back® Card to make purchases, you can earn pieces of stock back3. This is similar to cash back rewards or points offered by credit cards, except you’ll earn investments instead of cash or points. Stock-Back® can be earned with every purchase.4

When you spend money at a publicly traded company, you’ll earn with stock in that company. Of course, the merchant will need to be available on the Stash platform.

If a merchant isn’t available on the Stash platform, you’ll be rewarded with an investment that you choose as your custom stock reward.

You can earn Stock-Back® with the following merchants: Amazon, Apple, AT&T, Chevron, Coca-Cola, Comcast, CVS pharmacy, Disney, Dollar Tree and Dollar General, General Motors, Hilton Hotels, and many other popular publicly traded merchants.

Investing – Stash’s Smart Portfolio

Stash’s Smart Portfolio is a robo-advisor platform. Features include portfolio creation, investing new funds as they arrive, and portfolio rebalancing. Since it’s a fully managed account, you won’t have the ability to change specific investments within your Smart Portfolio.

That said, Stash distinguishes itself from other robo-advisors in that you also have the option to manage your own Personal Portfolio, in which you can choose your investments and allocations.

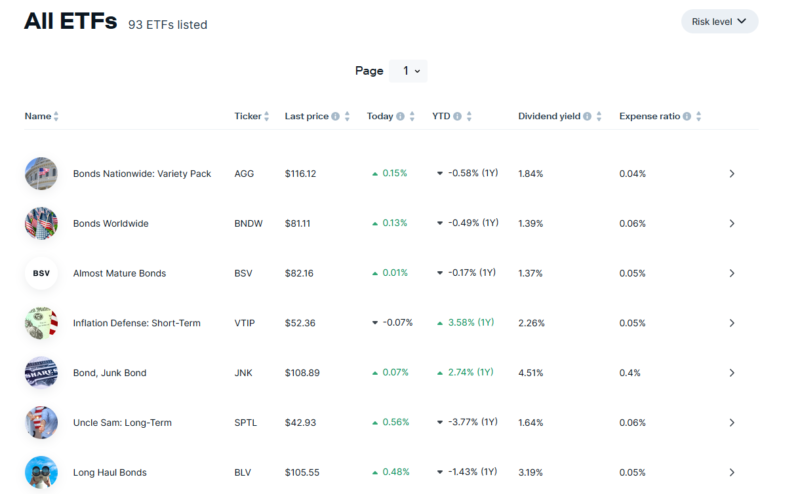

In still another departure, Stash isn’t primarily or entirely dependent on the use of exchange-traded funds (ETFs) in the construction of your portfolio. They provide access to more than 400 ETFs that have unique names like “Women Who Lead,” “Social Media Mania,” and “Robots Rising” that describe what the ETF does.

In addition to ETFs, they include a large number of individual stocks. They offer thousands of stocks in various sectors, like consumer staples, energy, finance, healthcare, media, real estate, and technology.

Stash allows you to invest with as little as $5 because they provide fractional shares. These give you the ability to purchase slivers of stock rather than total shares. For example, instead of buying a stock for $50, you can purchase 1/50th of one share for just $1. That enables you to build a diversified portfolio with a small amount of money.

Depending on the Stash plan you choose to use, you’ll have access to some or all of the following features:

Advice

Stash will provide advice based on the plan you select.4 This can range between advice for beginning investors, to complete family finances, and market insights.

Investing Access

Provides investing strategies for a personal portfolio or even portfolios for your children if you have custodial accounts. The availability of retirement accounts and custodial accounts will depend on the specific plan you sign up for.5

Banking Access

All plan levels come with access to the banking feature, allowing you to get paid up to two days early through direct deposits into your account.5 You’ll also have your Stock-Back® Card and, depending on your plan, get 1% Stock-Back® Rewards6.

Insurance Access

You’ll have access to $1,000 or $10,000 in life insurance, depending on the plan you choose.7

Life insurance is provided by Avibra, which is a partner of Stash. Its group life insurance coverage is available to US residents between the ages of 18 and 54.

Stash Features

Minimum initial investment: $0 to open a Personal Portfolio and Smart Portfolio.

Available accounts: Individual taxable brokerage accounts, traditional and Roth IRAs, and custodial accounts.

Availability: All 50 US states, plus the District of Columbia.

Investments included in your portfolio: The current makeup of investments offered includes over 400 ETFs and over 3,000 individual stocks.

Mobile app: Available on The App Store for iOS devices, 11.0 or later, and on Google Play for Android devices, 7.0 and up.

Customer service: By phone and live chat, Monday through Friday, from 9:00 AM to 5:00 PM, Eastern time.

Account custodian/clearing agent: Apex Clearing Corporation.

Account security: Investments are held by Stash’s partner and custodian Apex Clearing Corporation, a third-party SEC registered broker-dealer, and member FINRA/SIPC. Your investments in your account are protected up to $500,000 total (including $250,000 for claims for cash). For details please see www.sipc.org. For uninvested funds, your Stash account is enrolled in the Apex FDIC-insured Sweep Program. Deposits to the Sweep Program are covered by FDIC insurance up to $250,000 limit per customer at each FDIC-insured bank that participates in the Program. Once your cash is deposited with the participating banks under the Sweep Program, such cash will no longer be covered by SIPC.

Meanwhile, Stash is a registered investment advisor with the US Securities and Exchange Commission (SEC).

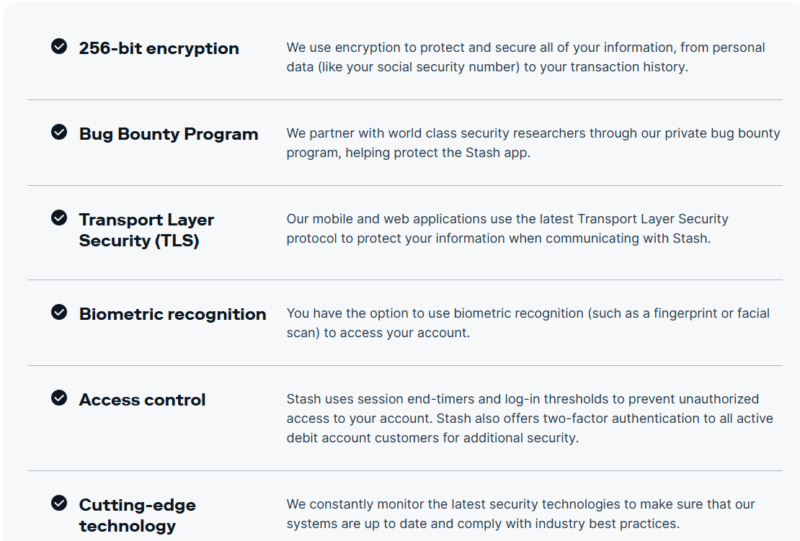

Other security measures employed by Stash include the following:

Stash Plans

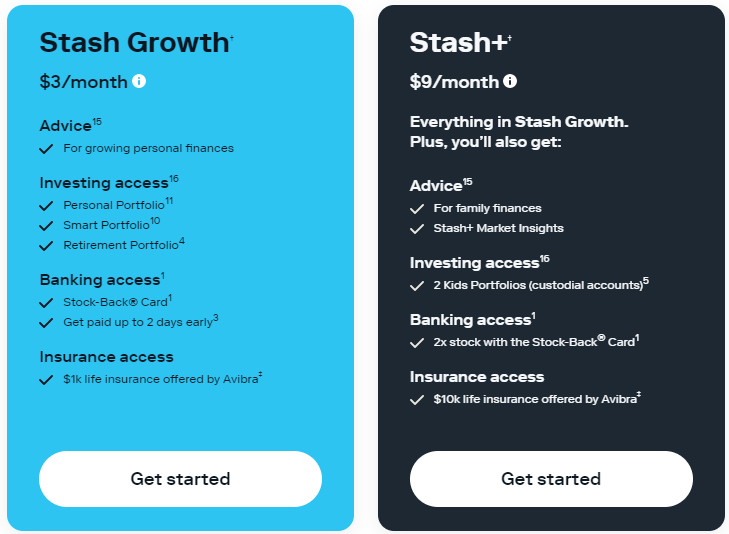

Stash currently offers two different plans.

Descriptions are below, with pricing details in the next section.

Stash Growth

This is the basic Stash account. It comes with Auto-Stash to help you accumulate the funds needed for investing, as well as banking access1. The latter provides you with a Stock-Back® Card that allows you to earn stock through regular spending activity at participating merchants. The plan also comes with savings tools, personalized advice, and access to $1,000 life insurance coverage from Avibra7.

It’s designed for investors who want to expand their long-term wealth building. It also comes with a Personal Portfolio and access to a Smart Portfolio and either a traditional or Roth IRA account.

Stash Plus

This plan includes all the same features as Stash Growth. But it gives you 1% Stock-Back® Rewards6 stock on the Stock-Back® Card1, as well as access to a Smart Portfolio; investment accounts for children, an exclusive monthly market insights report, and $10,000 of life insurance coverage from Avibra7.

Stash Pricing

Stash has a separate fee schedule for each of its two plans.

The fee schedule is as follows:

Other Stash Banking Fees:

- Out-of-network ATM withdrawal fee: $2.50

- Mastercard® Debit Card Foreign Currency Conversion Rate fee 3%

How to Sign Up with Stash

You can open an account with Stash from the website or the mobile app. You can complete the sign-up process in just two minutes.

Once you’ve entered your email address and created a unique password, you’ll click Create account and move to the next screen.

There you’ll be asked to provide your full name, date of birth (you must be at least 18 years old and a US citizen), as well as your Social Security number. As is the case with most financial accounts, you’ll need to verify your identity, consistent with federal law.

Next, you’ll choose one of the three plans for your account. You’ll be asked a series of questions designed to establish your investor profile, including your risk tolerance and investment goals. This will help Stash determine your portfolio allocation and recommended investments.

Finally, if you plan to fund your account through your bank account, you’ll need to connect that bank account to your Stash Account. You will verify the link to your bank account by entering your login credentials to your bank account or after two small test deposits have been performed and confirmed.

You’ll then be able to transfer funds through ACH transfers. Expect transfers to reach your Stash account in two to four business days.

Who Is Stash Best Suited For?

While it’s certainly possible for investors of all levels of experience and wealth to take advantage of Stash services, Stash targets their product toward new and small investors.

Stash assumes you have little or no investment knowledge or experience when you sign up for the service. Stash will provide the needed guidance.

If you’ve been having difficulty starting to put money aside to invest, that’s where Stash shines. Through the Round-Ups feature on Auto-Stash, you can begin building the funds for your investment portfolio through regular spending activity.

That said, the fee structure offered by Stash can prove to be a significant benefit to more prominent investors.

For example, the fee for Stash Growth is just $3 per month. That means you can get investment advice or management provided for a portfolio of $100,000 – or even $1 million – for just $36 per year. It’s doubtful there are any investment services available anywhere that can come close to matching a fee that low.

Stash Pros & Cons

Pros:

- Open an account with no investing minimum.

- Stash helps you to accumulate the money to invest through their Auto-Stash tool, which lets you build savings passively.

- Engage in self-directed investing using recommendations from Stash in a Personal Portfolio, or get comprehensive portfolio management through Stash’s Smart Portfolio.

- Offers thousands of individual stocks, in addition to ETFs, for your portfolio.

- Fractional shares enable you to diversify a very small amount of money across a large number of funds and stocks.

Cons:

- Because Stash works on a flat monthly fee, the fee may be relatively high on small balance accounts.

- No tax-loss harvesting feature on taxable brokerage accounts.

Stash Alternatives

If Stash isn’t the right choice for you, there are plenty of other alternatives from which to choose. Three of the best include the following:

Acorns

Acorns is the investment app that most closely resembles Stash. That’s because it functions as both a micro-savings and micro-investment app. Similar to Stash, Acorns uses spending roundups to enable you to accumulate funds to invest passively. And, of course, you can add lump sum contributions to your account regularly or on a one-time basis. Acorns offers complete investment management. That is, all you need to do is fund your account.

Read our complete review of Acorns.

Betterment

Betterment may be the better choice if saving money to invest isn’t a requirement. Betterment is a pure robo-advisor; in fact, it’s the first robo-advisor in the space. All you need to do is fund your account regularly, and Betterment will provide complete investment management, including portfolio selection, periodic rebalancing, automatic dividend reinvestment, and even strategies to minimize capital gains taxes.

You can open an account with no money, and Betterment charges a single, low flat percentage fee to manage your account. And if you’re looking for high interest on your savings, Betterment Cash Reserve pays one of the highest interest rates in the industry, currently at 0.30% APY.

Read our complete review of Betterment.

M1 Finance

M1 Finance is a perfect choice if you like the robo-advisor concept, but you prefer to choose your investments. M1 Finance uses a strategy they refer to as “pies.” These are small portfolios that can hold up to 100 individual stocks or ETFs. You can choose from one of the dozens of prebuilt pies provided by M1 Finance or create your own. And you can have as many pies in your account as you like.

There is no minimum amount required to open an account, but you will need at least $100 to begin investing. And there’s more good news on the pricing front: M1 Finance charges no fees, either to manage your account or for the purchase of the stocks and ETFs that will go into your pies.

Read our complete review of M1 Finance.

FAQs

Yes. The company has more than 6 million participating users and receives high marks among mobile users on The App Store and Google Play. And despite being only seven years old, the company is well recognized as a legitimate service provider within the investment community.

While there’s never a guarantee of investment success on Stash or any other investment platform, the company does use time-honored investment strategies that can teach you to stack the deck in your favor.

For new investors, in particular, investment returns are likely to be more generous than if you try to implement an investment strategy of your own.

Stash is a privately owned company funded by venture capital. The company is owned by Brandon Krieg, Ed Robinson, and David Ronick.

Final Thoughts on Stash

If you’ve been avoiding investing because you don’t have the money to get started, there’s no need to wait any longer. Stash can not only help you to manage your investments but also to set aside the money to begin investing.

That’s not a slight advantage, either. Millions of people have no money saved and invested for the future because they never got started. Stash will provide you with an opportunity to get started right here, right now, even if you know nothing about investing and have no money at all.

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value.

1 Stash Banking services provided by Stride Bank, N.A., Member FDIC. The Stash Stock-Back® Debit Mastercard® is issued by Stride Bank pursuant to license from Mastercard International. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Any earned stock rewards will be held in your Stash Invest account. Investment products and services provided by Stash Investments LLC and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

2 Get fee-free transactions at any Allpoint ATM, see the app for location details, otherwise out-of-network ATM fees may apply. For a complete list of fees please see the Deposit Account Agreement for details.

3 All rewards earned through use of the Stash Stock-Back® Debit Mastercard® will be fulfilled by Stash Investments LLC and are subject to Terms and Conditions. You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash. In order to earn stock in the program, the Stash Stock-Back® Debit Mastercard must be used to make a qualifying purchase. Stock rewards that are paid to participating customers via the Stash Stock Back program, are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

4 What doesn’t count: Cash withdrawals, money orders, prepaid cards, and P2P payment. If you make a qualifying purchase at a merchant that is not publicly traded or otherwise available on Stash, you will receive a stock reward in an ETF or other investment of your choice from a list of companies available on Stash. See Terms and Conditions for more details.

5 Early access to direct deposit funds depends on when the payor sends the payment file. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

6 1% Stock-Back® rewards available only on Stash+ ($9/mo) and only for client’s first $1,000 of Qualifying Purchases in each calendar month program. See Terms and Conditions for details.

7 Group life insurance coverage provided through Avibra, Inc. Stash is a paid partner of Avibra. Only individuals who opened Stash accounts after 11/6/20, aged 18-54 and who are residents of one of the 50 U.S. states or DC are eligible for group life insurance coverage, subject to availability. Individuals with certain pre-existing medical conditions may not be eligible for the full coverage above, but may instead receive less coverage. All insurance products are subject to state availability, issue limitations and contractual terms and conditions, any of which may change at any time and without notice. Please see Terms and Conditions for full details. Stash may receive compensation from business partners in connection with certain promotions in which Stash refers clients to such partners for the purchase of non-investment consumer products or services. Clients are, however, not required to purchase the products and services Stash promotes.

Stash has full authority to manage a “Smart Portfolio,” a discretionary managed account. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in their account.