For the last few years, Robinhood has been the darling of brokerage apps. What started as a mobile-only trading app with a waitlist has grown into a publicly traded company that is often mentioned in discussions about trading of any kind.

Do you remember the Reddit-fueled trading frenzy in GameStop and AMC a while back? If you were caught up in that and saw Robinhood pause trading on some names, you might have been shocked to learn that it was even possible.

I don’t want to get into some of the conspiracy theories as to why this happened (I think they’re mostly unfounded) but shortly thereafter, a lot of other brokerages did the same at the direction of their clearinghouse, Apex Clearing Corporation.

Did this leave you a bit miffed at Robinhood? Are you looking to move to another brokerage?

Here are the best Robinhood alternatives:

Table of Contents

What We Looked For In Alternatives

This isn’t a list of any old brokerages, we looked at brokerages that are true alternatives to Robinhood:

- They must offer free trades

- No minimums, no account maintenance fees

- Preferably a nice little sign-on bonus

- Did not restrict the trading of any stocks (before being required to by their clearinghouse)

Webull

Webull is similar to Robinhood in that it’s a brokerage that offers you free stock for signing up as well as free trades. In fact, you get up to 12 free stocks.

- Get 12 free fractional shares when you open an account and deposit any amount,

- That’s it!

Again, no maintenance fees, no ways to ding you, and you are their target market. The only knock is that their app, while completely functional, doesn’t look as pretty as Robinhood.

SoFi Invest

SoFi Invest is the brokerage arm of the well-known fintech darling SoFi, whose core offering started with student loan refinancing. In offering banking services, SoFi now has SoFi Invest – a no commission brokerage service with no minimums and no account fees.

Best of all? They will give you $50 if you sign up through a referral link and deposit at least $1,000. There are no trading requirements to get this bonus.

With SoFi Invest, you can also invest in cryptocurrencies, much like Robinhood, so this one is the most similar to Robinhood (though the bonus offer is not as generous as some others.

Public

Public is one of the newer brokerages (at least to me) and their claim to fame is the ability to buy partial shares (as little as $5), something that isn’t offered elsewhere. These are partial shares with real-time settlement (if you remember Sharebuilder, they used to batch them). Public also offers a social component where you can see other people’s trades (when they make them public).

Public also as a bonus where you can get $10 worht of stock from one of 9 companies (Alphabet (Google), J&J, Facebook, Apple, Visa, Chase, Microsoft, Amazon, or Alibaba).

Obviously, no commission trades, minimums, or account fees.

Tornado

Tornado is a modern brokerage designed to help everyone become a more confident investor through personalized content, community insights, and investing education. The platform marries trading with engaging social features that allow you to follow other members’ portfolios and exchange ideas.

They offer free trades with a subscription and there are no minimums.

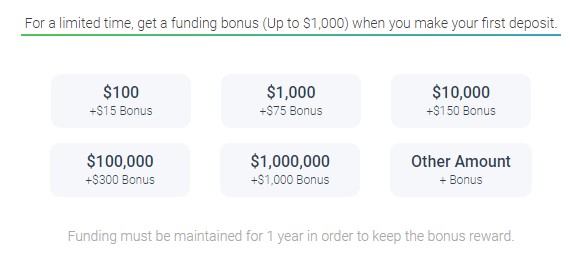

They also offer a referral bonus in which you get cash based on how much you deposit.

Ally Invest

Ally Invest offers free trades, no minimums, no account fees, and they pair nicely with Ally Bank – an online bank that offers a full suite of banking products and higher yields than a traditional brick and mortar bank.

Sometimes, Ally Invest may offer a bonus based on the amount you transfer into your account.

If you are doing a full account transfer (ACAT), they will reimburse up to $75 in transfer fees.

Final Thoughts

The saga around GameStop and how the markets reacted is unprecedented – I’m not making any judgments as to what was appropriate or not but I suspect there will be investigations and inquiries as to what happened. We will learn a lot more in a few months once everything shakes out.