SoFi made its name as a modern and more “fun” student loan refinancing company. Why were they fun? Not only did they offer low rates on student loan refinancing, but they also held events throughout the year and even offered career services.

They would hold education events that included networking events, happy hours, and other similar “experiences.” This helped them build one of the largest student loan refinance companies in the United States with over 800,000 members.

It was a different approach to student loans. Up until then, most loan providers competed on price (interest rate on the loan). And while SoFi competed on price too, they also offered these value-added bonuses that helped people fall in love with them.

They have since branched out to several other products including deposit accounts.

Table of Contents

Is SoFi Checking and Savings a Bank?

Yes – they did not start off as a bank but they received regulatory approval to become one.

But they are now officially a bank with their own FDIC insurance offered through SoFi Bank. They have the standard $250,000 of insurance but they also have up to $2,000,000 through the SoFi Deposit Protection program.

Your money is safe there.

SoFi Checking & Savings Account

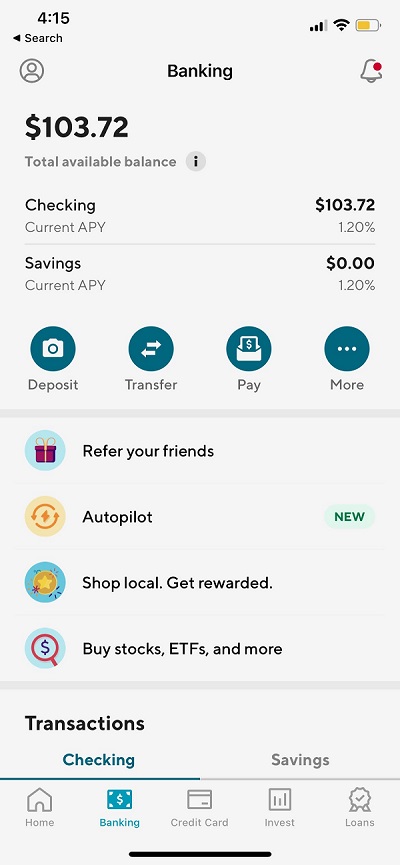

Sofi Checking and Savings is a single “product” but you get a separate checking and savings account. You get a high-interest rate on both accounts plus a debit card that transacts on that checking account.

There are no account fees and no account minimum. There is no monthly maintenance fee, no non-sufficient funds fee, and no overdraft fees. You can get personal checks for free as well as bill pay and transfers. If you use the debit card outside of the United States, they will not charge a foreign transaction fee either (they will pass on the 1% fee that Visa charges).

There are also no ATM fees – they will reimburse you any ATM fees as long you use an ATM with a Visa®, Plus®, or NYCE® logo.

Finally, you get a membership to SoFi which means you can attend those events I talked about in the opening section. While this isn’t an exclusive membership, it is a nice little perk you can take advantage of as long as you live near where they hold these events.

Vaults

Vaults are like sub-accounts in your Sofi account. They’re not separate accounts but ways for you to think about various savings goals.

So you can set a Vault for an emergency fund, to save for your first house, or buy a new car. They all earn the same interest rate.

You can have up to 20 vaults at one time and there are no additional fees or minimums on vaults.

The only thing you can’t do is spend money from a Vault. You can only spend it from your main Sofi account. If you want to spend it, you have to transfer it from the Vault to the main account.

In the event your main account runs out of money, you can set up “reserve spending” so that money in your vault can be used to cover transactions in your main account. If you set this up, it’ll move money so transactions are approved. If you don’t, the transaction won’t be approved.

There are rare cases when they will override reserve spending to move money in the case of:

- Checks and ACHs deposited into your spending balance that are returned or reversed

- Debit card purchases that pre-authorize a lower amount than the final transaction amount (examples include gas station purchases and restaurant tips).

Finally, if you close a vault, that money goes directly into your main spending balance.

Account Opening Walkthrough

Opening an account takes just 7-8 minutes.

The first page is to register for Sofi – name, email, password.

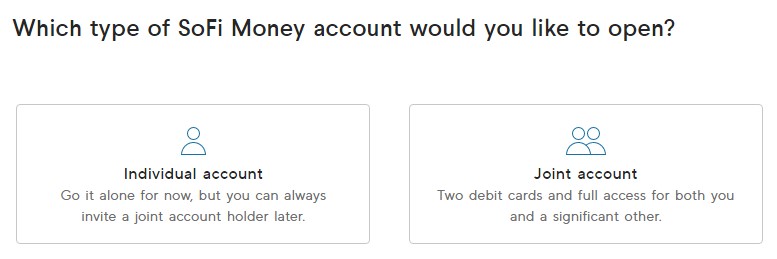

Then, you pick whether to open an individual account or a joint account.

To keep things simple, I opened an individual account.

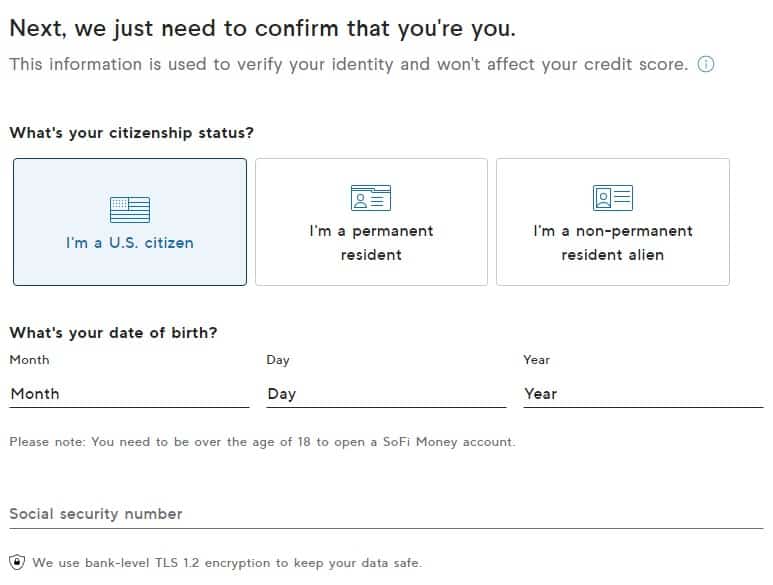

Next, you have to enter your permanent address. They use a tool that helps populate the address, similar to how Google Maps auto-populates as you type, so it’s super fast. Then you enter a phone number that they use for two-factor authentication.

Finally, you have to confirm it’s you with your date of birth and Social Security Number:

(there’s one more regulatory page asking questions like whether you’re an officer of a publicly-traded company, FINRA, etc.)

Then, boom – you’ll probably be confirmed!

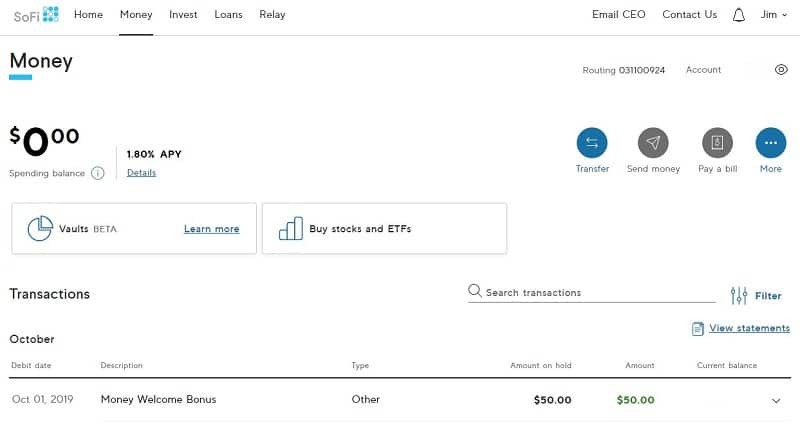

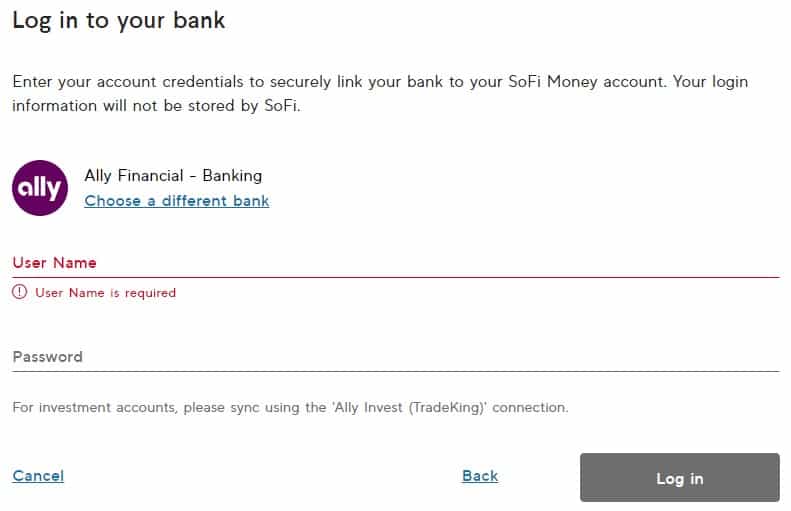

Linking up an account is super easy too, just have to log in with your credentials.

(the image shows Ally Bank but I opted to link up Bank of America)

It takes just a couple days for the transfer to complete, a typical amount of time for an ACH transfer.

And just like that, we’re off and running.

The Money Welcome Bonus of up to $300 is the referral bonus they offer if you open an account using an existing member’s referral link and receive qualifying direct deposits totaling at least $5,000. (here’s our list of all of SoFi’s bonuses)

Any Catches?

SoFi limits you to a certain number of transactions to prevent fraud.

For peer to peer withdrawals, you are limited to $250 per day and $3,000 per month. Bill pay is limited to $10,000 per transaction.

Through ATM or Point of Sale Cash Withdrawal, you are limited to $610 (Ally Bank limits you to $1000 per day). Over-the-counter cash withdrawal is limited to $150 and your Point of Sale spend limit is $3,000. Finally, you’re limited to 12 point-of-sale transactions per day.

These are not onerous limits but there may be times when you will run into them.

Lastly, no wire transfers.

SoFi Checking & Savings Promotions

Want to get up to $300 to open an account? SoFi Money will give you up to $300 if you open your account and satisfy a few other conditions.

It’s just that simple. And once you’re done, you can refer your friends and give them $25 a pop too.

Everyone wins!

Can the two $500 deposits come from another bank?

Also it says the referral code is expired. Is there another one?

The offer gets continually updated and right now, July 2nd, you only have to fund the account with $500 or more. This can be a transfer from another bank.

How long will it take to receive the bonus? Must the $500 Remain in the account till the bonus is posted?

The terms say that they will deposit it once you meet the terms (I’d expect a day few days at most?) and there doesn’t appear to be a requirement for the $500 to remain in the account according to the terms on the page.

What options exist for funding a vault (i.e. “daily”, “weekly”, etc.) ?

It appears there is just a monthly option for recurring transfers or if you decide to save a percentage of each direct deposit, it’s as frequently as you get direct deposits.