When you run your own business, there’s a surprising level of trust involved.

You trust that the customers who enter your store don’t slip a few items into their pocket and walk out. You trust that the person paying you with a credit card didn’t steal it from someone. You trust that the agreements you made with vendors and customers will be honored. From time to time, that trust is broken and people do steal from you… but the idea is that you earn enough profit to overcome those breaks.

That’s where the credit score comes into play. Businesses are constantly trying to identify a good customer from a bad one. If you have a credit score, which is based on their credit history, you can make a better informed decision than if you were to look at the person visually. Looks can be deceiving and prejudices can be very subtle (or not!).

That’s why credit scores are so important.

But what makes a good credit score? For some, it’s to be in that top tier so you get the best rates. For others, it’s just beating the average. It really depends on where you are.

So, what is the average? Let’s find out!

When we say “credit score” in this article, we are referring to the FICO credit score. It was created by Fair Isaac Corporation.

The data was provided by Experian’s annual State of Credit survey.

Table of Contents

🔃 Updated March 2023 with the latest available data from Experian’s State of Credit survey, which was for 2022 data. Personally, I was surprised how credit scores have improved these last few years.

Average Credit Score in America

The average credit score was 714 in 2022.

How does this compare to the past? Here are the last few years:

| Year | FICO Score |

|---|---|

| 2022 | 714 |

| 2021 | 714 |

| 2020 | 711 |

| 2019 | 703 |

| 2018 | 701 |

| 2017 | 699 |

| 2016 | 695 |

| 2015 | 693 |

| 2014 | 691 |

| 2013 | 693 |

The FICO rating tiers are:

- 800 – 850: Exceptional

- 740 – 799: Very Good

- 670 – 739: Good

- 580 – 669: Fair

- 300 – 579: Poor

That means the average credit score in America is Good.

What’s interesting is some of the other data they released along with the average FICO score.

- Average total debt balance – $101,915

- Average personal loan balance – $18,255

- Average student loan balance – $39,032

- Average credit card balance – $5,910

- Average mortgage debt – $236,443

- Average auto loan balance – $22,612

Like anything else, averages can be deceiving especially when you’re looking at the entire nation. With such huge disparities in cost of living, Manhattan vs. rural anywhere USA, the average debt might not even be a useful measure at all!

Average Credit Score by Age

Curious to know which generational cohort had the highest credit scores and which had the lowest?

| Generation | Average FICO Score |

|---|---|

| Silent Generation (77+) | 760 |

| Baby Boomers (58 – 76) | 742 |

| Gen X (42-57) | 706 |

| Millennials (26-41) | 687 |

| Gen Z (18-25) | 679 |

The steady rise in credit scores as you age is not unexpected. Age of accounts is one of the biggest factors in your score so the older you are the older your accounts are likely to be. On time payments and good behavior are also strong indicators.

If you just celebrated your 20th birthday, it’s impossible for you to have an long history of good credit behavior. Your score won’t be as high as someone who has 20 years of on-time payments (and don’t worry, lenders know this).

Average Credit Scores by State

Just as we have different costs of living across the nation, we have different expectations and credit scores across the nation.

A state can be very large, with very different economic and social areas, but it’s very hard to parse data below the state level. That said, it’s still illustrative to review where the states sit and where you, as a resident, stack up.

| State | Average VantageScore |

|---|---|

| Alabama | 691 |

| Alaska | 726 |

| Arizona | 712 |

| Arkansas | 694 |

| California | 721 |

| Colorado | 730 |

| Connecticut | 725 |

| Delaware | 714 |

| District of Columbia | 716 |

| Florida | 707 |

| Georgia | 694 |

| Hawaii | 732 |

| Idaho | 727 |

| Illinois | 719 |

| Indiana | 712 |

| Iowa | 729 |

| Kansas | 721 |

| Kentucky | 702 |

| Louisiana | 689 |

| Maine | 728 |

| Maryland | 716 |

| Massachusetts | 732 |

| Michigan | 718 |

| Minnesota | 742 |

| Missouri | 712 |

| Mississippi | 731 |

| Montana | 689 |

| Nebraska | 695 |

| Nevada | 702 |

| New Hampshire | 734 |

| New Jersey | 724 |

| New Mexico | 659 |

| New York | 721 |

| North Carolina | 707 |

| North Dakota | 733 |

| Ohio | 715 |

| Oklahoma | 693 |

| Oregon | 732 |

| Pennsylvania | 723 |

| Rhode Island | 723 |

| South Carolina | 696 |

| South Dakota | 734 |

| Tennessee | 702 |

| Texas | 693 |

| Utah | 730 |

| Vermont | 736 |

| Virginia | 721 |

| Washington | 735 |

| West Virginia | 700 |

| Wisconsin | 735 |

| Wyoming | 723 |

Minnesota had the highest credit score with an average of 742 while New Mexico had the lowest with an average of 659. It’s not a huge range but that’s no unexpected.

Credit Score Distributions

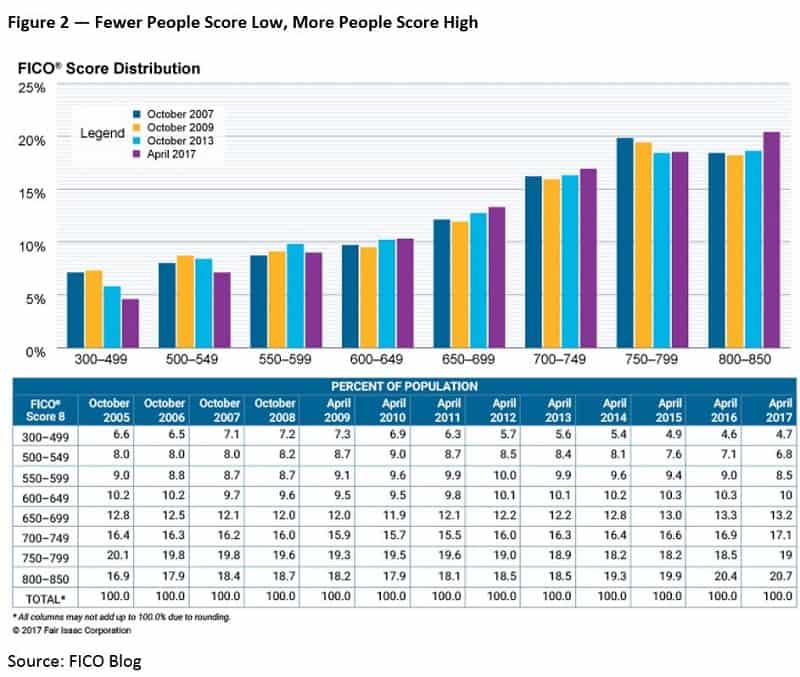

This data is a little dated but the general trends don’t seem to change much.

Here’s something that was fascinating – if you had to guess where the largest concentration of people were in a credit score distribution, would you guess it’s near the top?

The two biggest groups are those in 750-799 and 800-850 according to Experian.

Finding Your Credit Score

There are a lot of free ways to check your credit score and my favorite way is to use CreditWise from Capital One. It’s available to everyone and has the most features. It isn’t a FICO score (VantageScore) but for purposes of monitoring your credit, it’s good enough.

If you want to improve your credit score, our post explains step by step what you can do to find some low hanging fruit (identify and contest any errors or inaccuracies). You don’t need to pay a service (nor should you need to as some can employ some shady tactics).

How do you stack up?

(we will update this in the future if there’s more information about the UltraFICO score that’s coming soon)

Great post. I actually make it a point to check my credit score every week. It’s a bit overkill but I want to ensure that if there is anything wrong with my credit score, that I fix it right away. I use Credit Karma to check my scores but that only gives me TransUnion and Equifax. At the time of this writing, my score with TransUnion is 811 and with Equifax is 816. These both give me my vantage score. I use Chase to get my FICO score with Experian and that is sitting at 817. So, I definitely watch… Read more »

Employers nowadays run credit checks as a vehicle for making an informed pre-employment hiring decision. Though I know that could be used as a reason to filter good people out who have MBA’s and Ph.D’s who have less than perfect credit, having good credit can also be a side hustle blogging topic that has potential to yield any aspiring blogger much affiliate revenue in being a future “side hustle millionaire.” Good thing my credit is above average though employers can’t afford me. L 😛 L

Seems like the FICO score rising on average over the past 12 years is a bit like grade inflation? Are we really better credit risks than we were in 2005?

It’s hard to say why the score has increased and whether the increase isn’t just noise (how much precision is built into the score? given the tiers are so wide, I’d argue probably not much).

That said, employment is up and I’d venture to guess, even though it’s not a factor, an employed person is less risky than an unemployed person.

I used to think that checking your credit score gave you a big ‘ding’ on your credit score. I recently checked it and it’s better than I expected 800 something even though I applied for a credit card recently.

You probably know this now but for those reading and don’t, there are soft and hard inquiries. Hard inquiries are those made by lenders as part of their credit decision process and those lower your score. The logic is that if you are looking for credit, you’re riskier than someone not looking for credit. Soft inquiries are those made by companies for non-lending reasons, like identity confirmation. Another soft inquiries example is when you ask for your own credit report (which is essentially what you’re doing when you look up your score). Someone looking at their own credit score is… Read more »