Your credit score is one of the most important numbers in your financial life.

So much so, people try to get a “perfect” credit score of 850.

Here’s the thing… a perfect score and an almost perfect score are the same.

Someone with a 800 and an 850 will get very nearly the same interest rate (you never know when some bank will give some special rate for an 850 to get some press), but the person with the 850 had to do a lot more to get their score that high.

The better question is – what’s a “good” credit score? A minimum score that gets you approved for loans and the best interest rate.

(wondering what the average credit score is in the US? It’s higher than you think!)

Table of Contents

Why Your Credit is Important

Before discuss what makes a score good or bad, let’s consider how it is used. A luxury sports car is good unless there’s 24″ of snow on the ground… then it’s bad and a sled is better. 🙂

Context matters.

Your credit score is often used for two things – credit decisions (yes or no) and interest rates. You can find out your credit score for free nowadays.

Your credit score may be used in some surprising situations – whether you get a cell phone, whether you can rent an apartment, and sometimes whether you get a job. Fairly or unfairly, those are all in some way a credit decision. For a cell phone, you get a device worth hundreds of dollars and you agree to pay a monthly fee. For an apartment, you borrow a place to live and you agree to pay them a monthly fee.

In those instances, “good” means yes.

But we don’t care about those situations.

We care about loans and how much a lending institution will charge you to borrow money. Banks love to lend money. If you can’t get a bank to lend you money, someone will be willing to take the risk and step in.

How much you pay in interest will be decided by your creditworthiness – that’s how we will calculate how much your credit score is worth and truly know how good it is.

For our estimates, we used myFICO’s loan calculator, using interest rates from December 16, 2022.

30 Year Fixed Mortgage

| FICO Score Range | Interest Rate (APR) |

|---|---|

| 760-850 | 5.829% |

| 700-759 | 6.051% |

| 680-699 | 6.228% |

| 660-679 | 6.442% |

| 640-659 | 6.872% |

| 620-639: | 7.418% |

On a $150,000 30-year fixed loan, here’s how much interest each credit range pays over the life of the loan:

- 760-850: $167,845

- 700-759: $175,530

- 680-699: $181,715

- 660-679: $189,260

- 640-659: $204,633

- 620-639: $224,548

A borrower with a credit score of 639 will pay $56,703 in interest more compared to someone with a 760 credit score. $1,890 in extra interest expenses every single year for thirty years.

15 Year Fixed Mortgage

As is the case whenever comparing 15-year fixed and 30-year fixed rates, the 15-year fixed rates are much lower because the term is halved.

| FICO Score | Interest Rate (APR) |

|---|---|

| 760-850 | 5.26% |

| 700-759 | 5.482% |

| 680-699 | 5.659% |

| 660-679 | 5.873% |

| 640-659 | 6.303% |

| 620-639: | 6.849% |

On a $150,000 15-year fixed loan, here’s how much interest each credit range pays over the life of the loan:

- 760-850: $67,189

- 700-759: $70,355

- 680-699: $72,897

- 660-679: $75,993

- 640-659: $82,285

- 620-639: $90,410

A borrower with a credit score of 639 will pay $23,221in interest more compared to someone with a 760 credit score. $1,548 in extra interest expenses every single year for fifteen years.

60 Month New Auto

Note that the FICO credit score range widens but the interest rate goes up considerably.

| FICO Score | Interest Rate (APR) |

|---|---|

| 720-850 | 6.334% |

| 690-719 | 7.496% |

| 660-689 | 9.871% |

| 620-659 | 12.44% |

| 590-619 | 16.58% |

| 500-589: | 18.251% |

On a $10,000 60-month new auto loan, here’s how much interest each credit range pays over the life of the loan:

- 720-850: $1,693

- 690-719: $2,022

- 660-689: $2,710

- 620-659: $3,480

- 590-619: $4,776

- 500-589: $5,318

The same FICO Score 639 borrower from the mortgage examples would pay $3,480 in total interest over 5 years whereas the 720 would pay a mere $1,693, a difference of $1,787. That’s an extra $357.40 a year for the same vehicle.

48 Month Used Auto

| FICO Score | Interest Rate (APR) |

|---|---|

| 720-850 | 6.837% |

| 690-719 | 8.076% |

| 660-689 | 9.965% |

| 620-659 | 11.157% |

| 590-619 | 15.393% |

| 500-589: | 16.828% |

On a $10,000 48-month used auto loan, here’s how much interest each credit range pays over the life of the loan:

- 720-850: $1,458

- 690-719: $1,735

- 660-689: $2,166

- 620-659: $2,442

- 590-619: $3,455

- 500-589: $3,808

The same FICO Score 639 borrower on a used car would pay $2,442 in total interest over 5 years whereas the 720 would pay $1,458, a difference of $1,003.

What is a good credit score?

One that gives you the lowest interest rate for all possible products.

When you review all the rates and scores from the MyFICO tool, the products are mortgage loans or auto loans.

For the mortgage loans, the highest tier is 760 – 850.

For the auto loans, the highest tier is 720 – 850.

If your score is above a 760, you’re set. You get the best possible rates for both home and auto.

A good credit score is one that is 760 or higher.

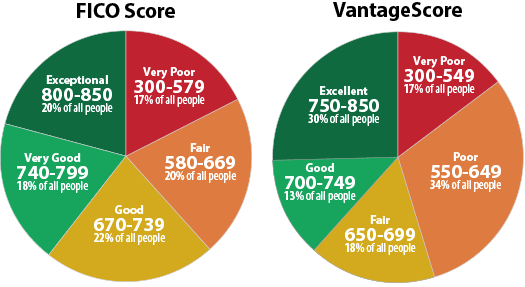

Experian has shared this image on their blog showing credit score ranges and labels:

It seems to indicate that 670-739 is “good”, 740-799 is “very good,” and anything higher is “exceptional.”

I suppose 670 is a good credit score if you don’t mind paying higher interest rates. 🙂

How to get a good credit score

Do no harm.

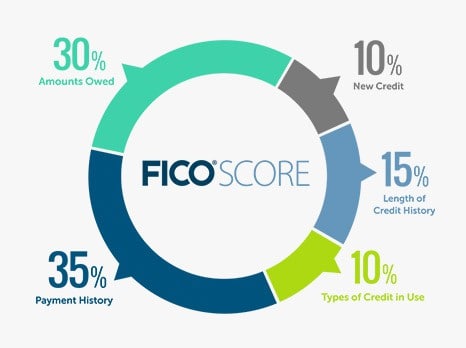

The keys to increasing your credit score are so simple:

Always avoid the massively negative items that stay on your report for 7 years – collections, bankruptcy, civil judgments, etc.

If you are about to get a loan, in the next year or two, avoid committing any of the shorter term actions that reduce credit scores – hard inquiries, late payments, etc. Don’t go chasing credit card promotions if your score is important.

If you’re going to get a 30 year fixed home loan, it would be disastrous to go from a FICO 760 to a FICO 759 because that would mean paying an extra $6,713. Those credit card promotions worth hundreds of dollars are great… unless you have to pay thousands more in interest down the road.

One little tweak you can do is to sign up for Experian Boost, which pulls in some of your bills and can improve your score.

✨ Related: How to Check Your Business Credit Score

What about the new UltraFICO score?

It remains to be seen what the quality ranges will be with the new UltraFICO score as it gets released. Perhaps the score ranges will be the same, perhaps they’ll slide a little higher as there’s more information, but it will be some time before creditors know.